Tesla Inc. (NASDAQ:TSLA) plans to raise $1.5 billion, through the offering of senior notes due 2025. The company intends to use the proceeds of this notes offering to support the production of its latest Model 3 sedan and other corporate objectives.

In the second quarter, Tesla made total cash investment of $1.16 billion for development of Model 3’s capacity and to amplify its battery output. Launched in Jul 2017, the price of the new sedan vehicle starts at $35,000.

The company aims to steadily speed up Model 3 sedan’s production to 1,500 vehicles in third-quarter 2017 and achieve a run rate of 5,000 units per week in 2017 and 10,000 vehicles per week in 2018. Also, Tesla expects a positive gross margin in fourth quarter and sets a target margin of 25% in 2018 from the newly-launched model.

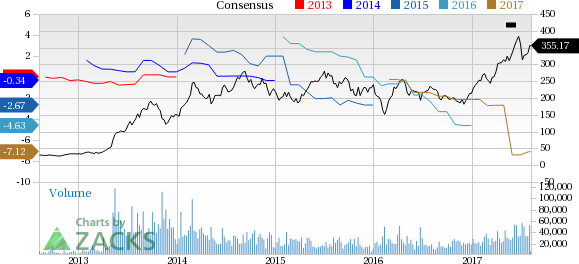

Tesla Inc. Price and Consensus

Til now, the company has been raising funds through a combination of equity and convertible bonds offering, which in due course, gets converted into shares. In March, it raised $1.4 billion through convertible notes.

Tesla is aggressively working toward expanding its product portfolio to boost sales. Prior to the Model 3 launch, the company unveiled a series of new Model S and Model X versions with 100 kWh batteries last August.

However, Tesla’s heavy investments to increase production capacity, develop Model X and Model 3, construct Gigafactory and expand sales volume, plus enhance services and the Supercharger infrastructure are all escalating its capital expenditure. For second-half 2017, Tesla estimates capital expenditure of around $2 billion.

Price Performance

Tesla’s shares have surged 31.9% in the last six months, substantially outperforming the 4.8% increase of the industry it belongs to.

Zacks Rank & Key Picks

Tesla currently carries a Zacks Rank #3 (Hold).

Some better-ranked automobile stocks are Fox Factory Holding Corp. (NASDAQ:FOXF) , Cummins Inc. (NYSE:CMI) and Ferrari N.V. (NYSE:RACE) , all currently carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Fox Factory has a long-term growth rate of 15.9%.

Cummins has an expected long-term earnings growth rate of 12.1%.

Ferrari has an expected earnings growth rate of 14.1% over the long term.

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look. See the pot trades we're targeting>>

Tesla Inc. (TSLA): Free Stock Analysis Report

Fox Factory Holding Corp. (FOXF): Free Stock Analysis Report

Ferrari N.V. (RACE): Free Stock Analysis Report

Cummins Inc. (CMI): Free Stock Analysis Report

Original post

Zacks Investment Research