Tesla (NASDAQ:TSLA) (TSLA) just wowed investors in one of its biggest share price rallies to date, surging the stock over 30% since its Q3 report Thursday (October 23rd). This surge lost short-sellers over $1 billion, which initiated a "short burn" that lifted this stock back into the $300 range, but there is more to the story that could take this stock to new highs.

Analysts are increasingly optimistic about this stock and have continued to raise expectations and propelled TSLA into a Zacks Rank #2 (Buy). It is reasonable to assume that these estimates will continue to rise as analysts adjust their models for the most recent company optimism.

Earnings Review

Tesla has a history of either misguiding analysts or leaving them in the dark regarding future quarterly results. This most recent quarter was no exception.

I sit here and think to myself, what are the possible reasons that an investor relations team would want such significant surprises in their earnings reports? The conclusion that I came to is that they want to keep TSLA relevant, and with huge swings in share prices from big headlines and big earnings surprises keeps TSLA at the forefront of traders' minds.

I know that traders looking for short term gains are only a small subset of the investor community. Still, it makes up a large portion of daily volume, and volatility increases volume, which in turn increases liquidity.

Regardless, this most recent earnings report proved to be a significant surprise on the EPS side of the equation. Analysts were expecting a sizable loss this quarter, but instead, they demonstrated sizable profits. Some of this can be attributed to the hampered expectations from a disappointing Q2, and some could be attributed to an investor relations team that likes surprises, up or down.

The biggest news coming out of Q3 earnings, from my perspective, is the ahead of schedule Shanghai Gigafactory. Ahead of schedule is something you rarely hear from Tesla, who has had a history of overpromising and under-delivering. This year may be the year that they finally hit their targets and keep their promises.

The overzealous and eccentric CEO Elon Musk promised to have 360,000-400,000 vehicles delivered by the end of fiscal 2019. This was something quickly shrugged off by investors, as this visionary's grandiose expectations are often unattainable.

Tesla has been able to deliver over 95,000 cars in Q2 and 97,000 in Q3, which were both record delivery figures for the company. If the company can deliver 105,000 cars in Q4, then it will have hit Musk's seeming unattainable guidance.

Shanghai Gigafactory

China is the largest electric vehicle market in the world by a substantial amount, almost doubling that of the US. Tesla's new Shanghai plant will give the company direct access to this market and allow them to cut costs substantially. In a letter to shareholders, Elon said that this factory was 65% cheaper than any Model 3 factory built in the United State's

The cost to the Chinese consumer will fall due to expect cost reductions and also allow the firm to bypass the tariffs associated with the US-China trade conflict.

The Gigafactory is currently in trial production and plans to have the plant fully operational this quarter. In phase 1, Tesla expects to be producing 250,000 cars for China annually and to reach its capacity of 500,000 units in the years moving forward.

The firm also said it would announce the location of its highly anticipated European factory by the end of the year — this one more step for Tesla in its takeover of the automotive world.

Some investors are still concerned about the steep competition in China, as well as signs of a global economic slowdown that would undoubtedly impact Tesla's sales.

Every major automotive company is working on some form of an electric vehicle, including companies like Toyota (TM), Ford (F), and General Motors (GM). These firms still have a long way to go before they are at the same level as Tesla, and by then, Tesla will be miles ahead.

Recent performance

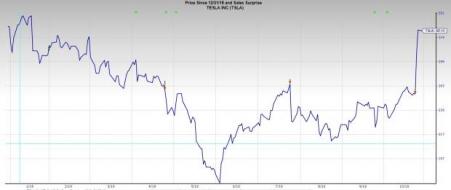

Tesla has been trading all over the board since the stock was introduced to the public markets in 2010. This trend of volatility has not faltered in recent years. From mid-December of last into early June, TSLA fell over 50%, to its lowest in over 3 years, due to liquidity concerns.

The stock bounced back on a $3 billion resurgence of capital from debt and equity sources, as well as record-breaking delivery figures. TSLA stumbled a little from a miss in its Q2 earnings report but quickly regained its moment with another set record-breaker in quarterly deliveries. This propelled the stock into earnings, with gains of roughly 40% since the beginning of October.

Take Away

Tesla's surge from its Q3 report was more than just a short squeeze as the stock has continued to rally in the days following the report. As it stands, Tesla is now America's largest automaker. Many are rooting for this underdog story, with the values of innovation, and a greener planet being the catalysts. But, many are also betting against TSLA because of the overly positive narrative they believe has blinded investors and risen the stock beyond its intrinsic value.

Today, the reality is that Tesla is creating a brand for itself. It has become a very desirable good with quality distinguishing it from the inside out. The recent run-up does cause me some short-term share price concerns, but as a long-term play, TSLA is the automotive stock for your portfolio of the future.

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look.

See the pot trades we're targeting>>

Tesla, Inc. (TSLA): Free Stock Analysis Report

Toyota Motor Corporation (TM): Free Stock Analysis Report

General Motors Company (NYSE:GM): Free Stock Analysis Report

Ford Motor Company (NYSE:F): Free Stock Analysis Report

Original post

Zacks Investment Research