Over the month, Tesla (NASDAQ:TSLA) stock is down over 10%. At their current price level of $263.55, TSLA shares are still in the pre-Trump-Musk hype zone of early November. At the height of this wave of bullishness, TSLA stock reached its all-time high of $479.86 on December 17th.

On April 22nd, Tesla is scheduled to report its Q1 2025 earnings. Per Zacks Investment Research forecasting, the consensus earnings per share (EPS) for that quarter is $0.49, which would be an improvement from the reported EPS of $0.35 in the year-ago quarter.

In the last reported earnings for Q4 2024, Tesla beat the estimated EPS of $0.62 by a slight margin of 6.4% at $0.66. Will this be the case again, or will the TSLA stock see new yearly lows?

Let’s examine the forces working in either direction.

Elon Musk’s Political Exposure Risks

By becoming a prominent figure in the new Trump administration, Elon Musk transferred public’s sentiment towards him onto his only publicly traded company – Tesla. In turn, Tesla has become the target of a coordinated political-media machine in the hands of people who lost the elections.

Although DOGE-powered revelations revealed much fraud, waste, and corruption within USAID, this is likely the tip of the patronage network iceberg. Being that public opinion is a function of mainstream media programming, Tesla shareholders have to examine the following new dynamic:

- If negative media coverage spurs hostility towards Tesla cars and owners, will that suppress Tesla sales?

- If oppositional sentiment against Elon Musk is heightened, will that spur street-level action against Tesla cars and owners, further degrading Tesla sales?

There is good data to approximate answers to both questions. According to the latest Edelman Trust Barometer report, the average percent of trust in business, government, media, and “NGOs” is in the red zone in the United States, at 47%. For comparison, China has a trust rating of 77%.

This is good news for Tesla, as even coordinated influence machinery has less traction within the majority of the populace, which is why the Trump-Musk alliance won the elections in the first place. Unfortunately, the suppressive potential to hinder Tesla sales may come from the streets.

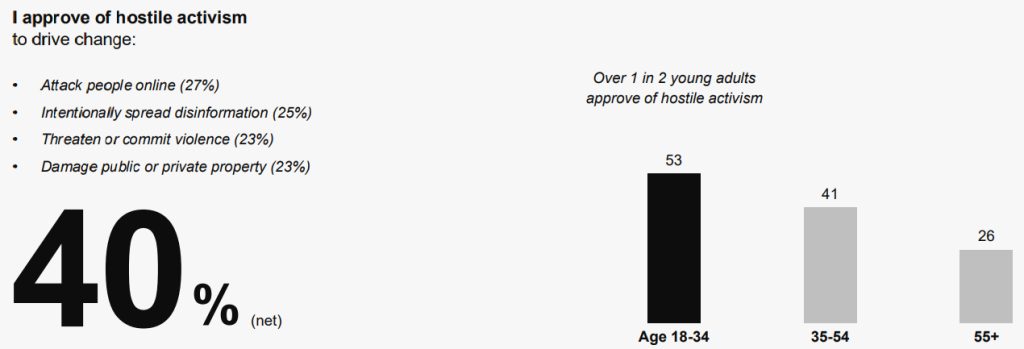

The same report revealed that most young people support hostile activism.

Image credit: 2025 Edelman Trust Barometer

This is quite important because even though instances of defacement/destruction of Tesla vehicles may be few in number, their reporting paints a picture of risk. Prospective Tesla buyers then have to calculate is their Tesla purchase worth the risk of a random attack?

This is a matter of moral fortitude, which could be approximated. Namely, during the pandemic narrative, the average mask adherence was around 70%. This is a proxy for both confrontation avoidance and susceptibility to mainstream media.

In turn, this puts moral fortitude for risk-taking in short supply. The consideration to buy Tesla EVs is then further affected by relatively high prices against China’s BYD, expected lower oil prices under the Trump admin, and the lower resale value problem of EVs owing to battery degradation.

Altogether, even though President Trump painted Tesla attacks as “nothing short of domestic terrorism”, it is likely that Tesla sales will be suppressed this year. It is also uncertain if President Trump has control of institutions, given that most of his executive orders (EOs) have been blocked/nullified by the judiciary.

Europe’s Backlash Against Tesla

Unlike the US, the EU has no approximation of a First Amendment. This makes it easier to deliver media narratives uniformly. Not only did the entire EU adopt the Digital Services Act (DSA) in October 2022, which opened the floodgates for mass censorship, but each country has extra layers of narrative control.

This puts Elon Musk in a difficult spot, as his disagreements with respective EU governments can be transferred to Tesla’s public reception, making it a toxic brand. It appears this has already transpired.

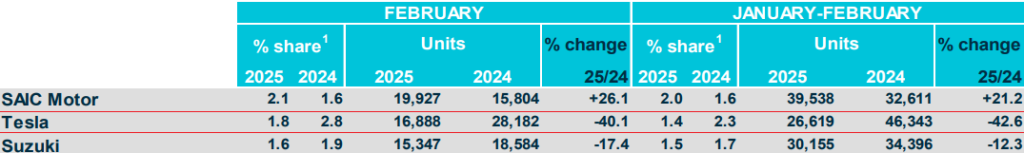

According to the latest European Automobile Manufacturers Association report on March 25th, new Tesla car registrations in February dropped by 40.1% from a year ago.

BEV sales increased by 26% in Europe, painting Tesla’s decline in an even dire light. Image credit: ACEA (BIT:ACE)

Overall, Tesla’s total market share in Europe dropped from 2.8% to 1.8% year-over-year. In the BEV market, Tesla’s share declined to 9.6%, the lowest February level in five years. Given that Europe has a historically stronger tradition of protests than the US, it is likely that street-level actions could be weaponized to further suppress Tesla sales.

At the same time, there could be a rebound of Tesla sales when Model Y receives an update. If March and April registration reports show the same decline trajectory, it will be clearer that Tesla has indeed become a toxic brand in Europe. Or at least, that consumers don’t want to tackle street action risk against Tesla EVs.

BYD’s Bid

Chinese BYD (SZ:002594) will likely be the beneficiary of Europe’s sentiment shift. BYD’s Atto 3 is so far the biggest seller in Europe, priced at around €37k in Germany. Much is expected of BYD’s cheapest offering, Seagull, which goes for under $10k in China.

In Europe, it will launch as Dolphin Surf at under $26k due to high tariffs against China’s EVs. In total, BYD aims to deliver 5.5 million cars this year. For comparison, Tesla delivered 1.78 million in 2024.

US Tariffs: Tesla’s Saving Grace?

With uncertainty broiling in Europe and stiff competition from BYD, Tesla is looking to scale down from global EV presence to becoming a US-centric company. In addition to already quadrupled tariffs against Chinese EVs during the Biden admin, President Trump recently announced 25% import tariffs on foreign cars.

These tariffs will cover US-assembled vehicles if they use foreign-made components, taking effect on April 2nd. This should impact around 40% of all new cars in the US that are imported. Elon Musk noted that the “tariff impact on Tesla is still significant.”

Thursday’s Bernstein analysis pointed out that 22% of Tesla’s components come from Mexico, 7% from Canada, and 3% from China. Although this doesn’t constitute 100% US-made, it is still more than other competitors, allowing Tesla to “gain margin as competitors raise prices.”

The Bottom Line

Becoming the main character on the political stage is a risky move when one heads a publicly traded company. This vulnerability is all too easily exploited as public opinion is engineered. Nonetheless, political winds are fickle and the public’s memory is short.

By the end of the year, Musk’s political exposure could be in the rearview mirror. But even if that is the case, Tesla still needs to scale up in the realm of affordability with Model 2, rumored to be around $25k.

If this is combined with a robust full-self-driving (FSD) capability, Tesla will secure its future, and current concerns will fizzle out. But with so much uncertainty, TSLA stock price targets are in a wider range.

Per WSJ forecasting data, the average TSLA price target is $360.48 against the current price of $263. The low estimate is $120, while the ceiling (Robotaxi revolution) is at $1000 per share.

***

Neither the author, Tim Fries, nor this website, The Tokenist, provide financial advice. Please consult our website policy prior to making financial decisions.

This article was originally published on The Tokenist. Check out The Tokenist’s free newsletter, Five Minute Finance, for weekly analysis of the biggest trends in finance and technology.