- Elon Musk's Tesla is set to announce earnings after market closes today

- Investors are eager to see how the EV maker's price cuts have affected company's earnings

- Based on how the stock has reacted to earnings so far this year, post-earnings volatility remains in the offing

Electric vehicle manufacturer Tesla Inc (NASDAQ:TSLA) is set to release its Q3 earnings report today. The Austin Texas-based giant's stock has been trading sideways recently, and investors are hoping this report will provide the stock the spark it needs to resume the uptrend.

Throughout the year, Tesla has slashed its prices on numerous occasions, raising concerns that these moves have eaten into the company's margins and earnings per share. Moreover, key data on production and deliveries, disclosed just before the earnings report in early October, revealed a 6% drop in the 3rd quarter compared to the previous quarter.

Although the Elon-Musk led company has attributed some of the delivery declines to production issues, the company seems undeterred by these figures. Tesla's CEO, Elon Musk, previously announced a decrease in production for the 3rd quarter due to planned factory maintenance work.

However, the market's general expectation was for deliveries to exceed 455K units, significantly higher than the 430K range. Yet, the company fell short of this mark. These production and delivery numbers that fell below expectations have also led to weaker earnings forecasts for the 3rd quarter.

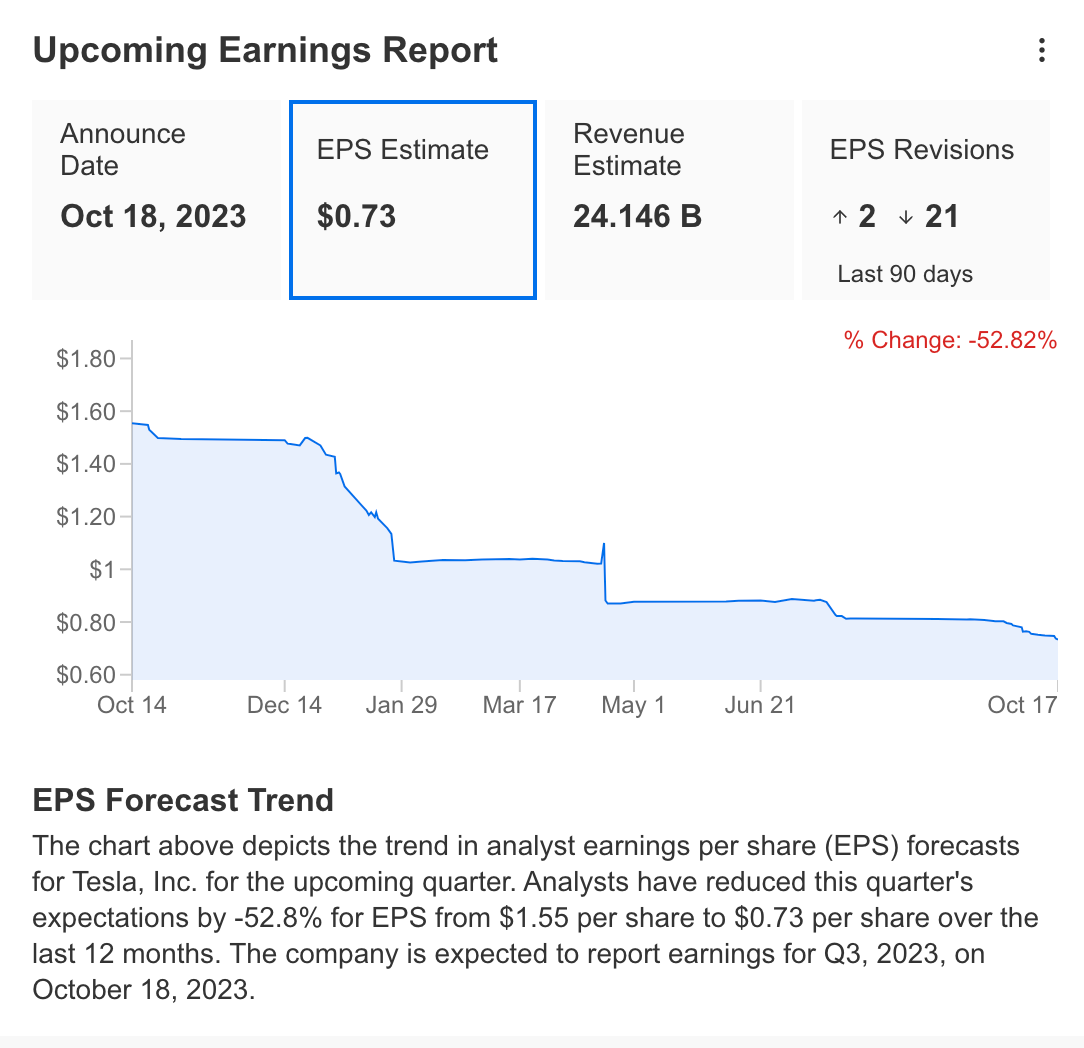

Putting the previous quarter's performance into context, Tesla reported an EPS of $0.91, surpassing InvestingPro's expectations by 10%. The quarter's revenue reached almost $24.92 billion, aligning closely with expectations. Source: InvestingPro

Source: InvestingPro

For the Q3 results to be announced today, it is seen that the EPS expectation has been reduced by 50% as it is estimated to be announced as $0.73. With 21 analysts revising their views downwards, it is estimated that the company's earnings could come in at $ 24.14 billion.

The quarterly results announced this year have created serious volatility in TSLA stock. So much so that the first reaction after the results were announced in the first half of the year was reflected in the form of a decline in the share price exceeding 10%. Source: InvestingPro

Source: InvestingPro

Especially after the 2nd quarter results announced in July, it was noteworthy that the downward momentum in TSLA shares continued for a while. Depending on the volatile price movement this year, it seems likely that volatile movements will once again follow the report to be announced at the end of the session today.

Tesla's Profit Margins in Focus Ahead of Key Earnings Report

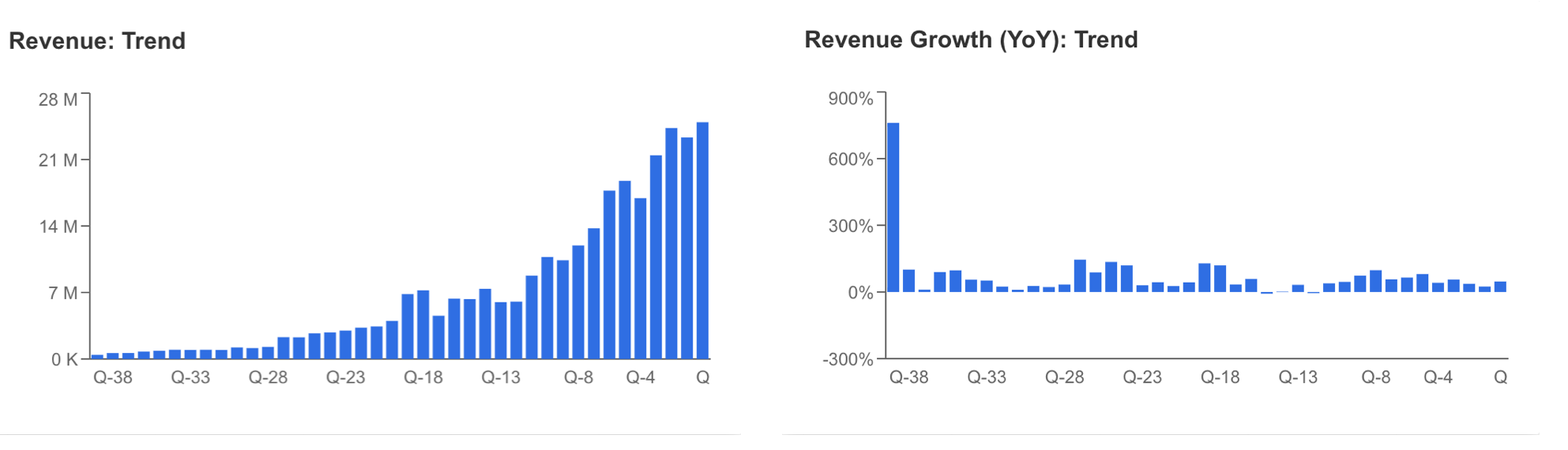

In the upcoming Q3 results, the spotlight for Tesla, a company known for its growth-oriented approach, will be on revenue margins. Analyzing historical data, it becomes evident that the company has sustained revenue growth since the third quarter of 2020.

Notably, the second quarter demonstrated a rebound after marking the lowest revenue growth in the past three years at 21% in the first quarter. Forecasts have been shaped in alignment with the last quarter's figures due to the lower deliveries experienced in the third quarter.

Source: InvestingPro

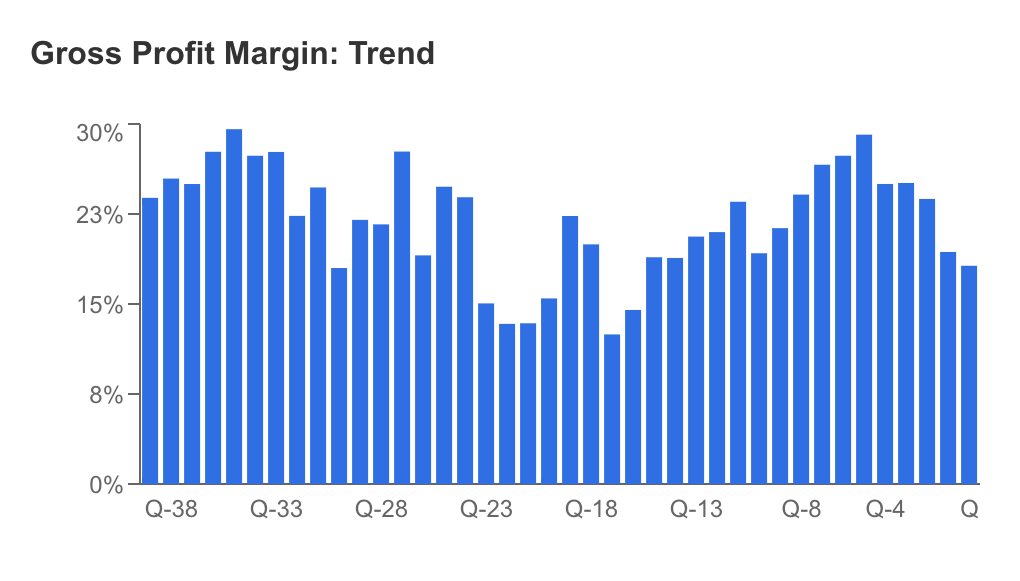

Tesla's change in sales policy this year also seems to have led to some deterioration in margins. In particular, the price cuts applied throughout the year led to a downward trend in gross profit margin.

Source: InvestingPro

Tesla has a high market capitalization and market share dominance compared to peer companies. While the price cuts applied this year are seen as a decision taken to protect market share, the company's gross profit margin will continue to be closely monitored. Tesla's improvement in margins while maintaining its market share will be extremely important for the company to maintain its leading position and reassure investors.

Source: InvestingPro

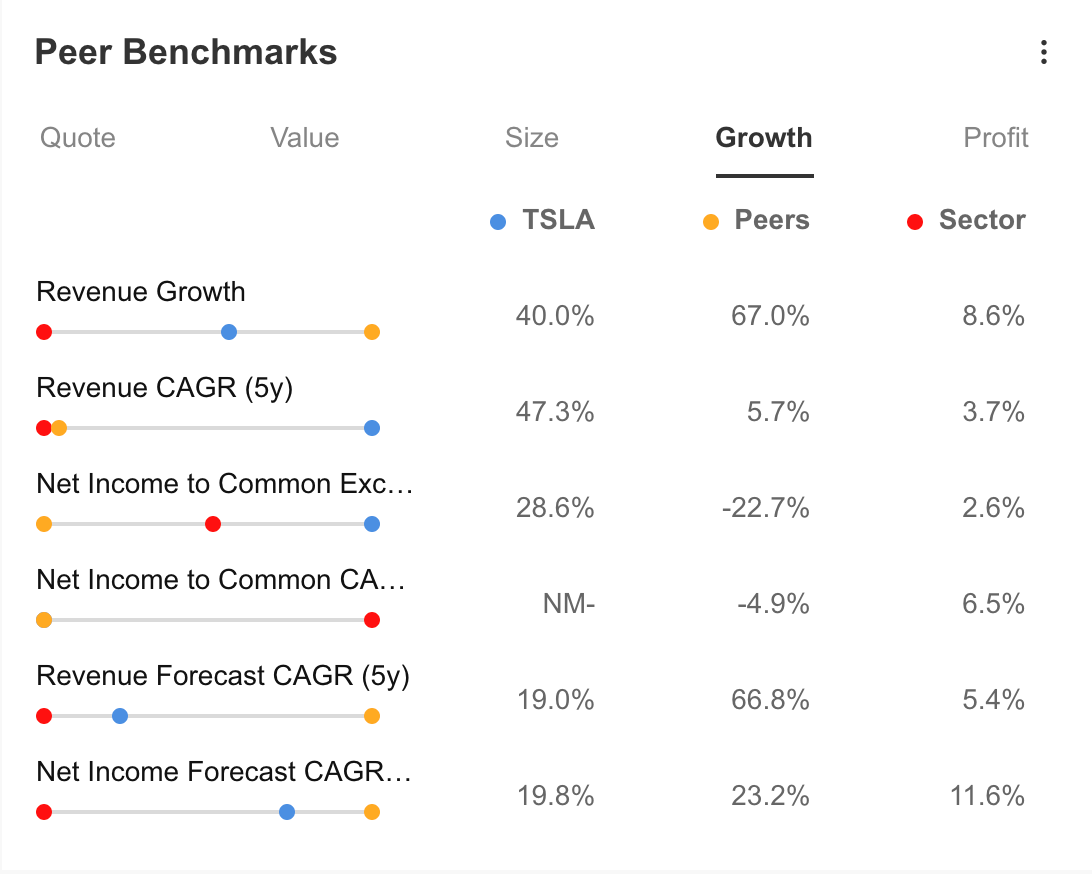

When the company's growth items are compared with peer companies; it can be seen that revenue growth is 40% on an annual basis, below the peer average of 67%. The fact that the 5-year revenue and net profit forecasts are also below peer companies can be seen as a warning in the long-term projection.

Source: InvestingPro

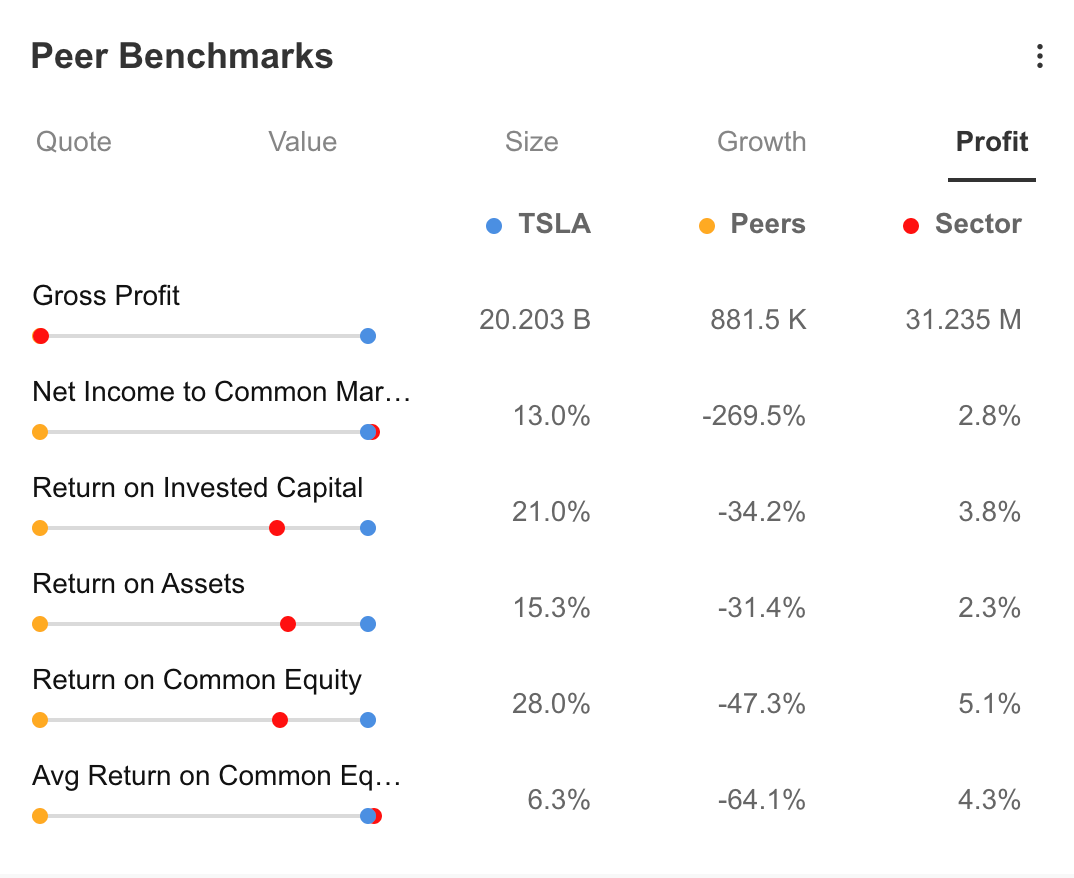

When compared in terms of profit margins, it can be said that Tesla has maintained its dominance over peer companies in the last one-year period. While the gross profit margin stands out as the item that strengthens the company's hand, ratios such as the ratio of net profit to share margin, return on capital investment, return on assets, ROE, and ROCE remain negative in peer companies, while Tesla draws a positive picture at this point.

Source: InvestingPro

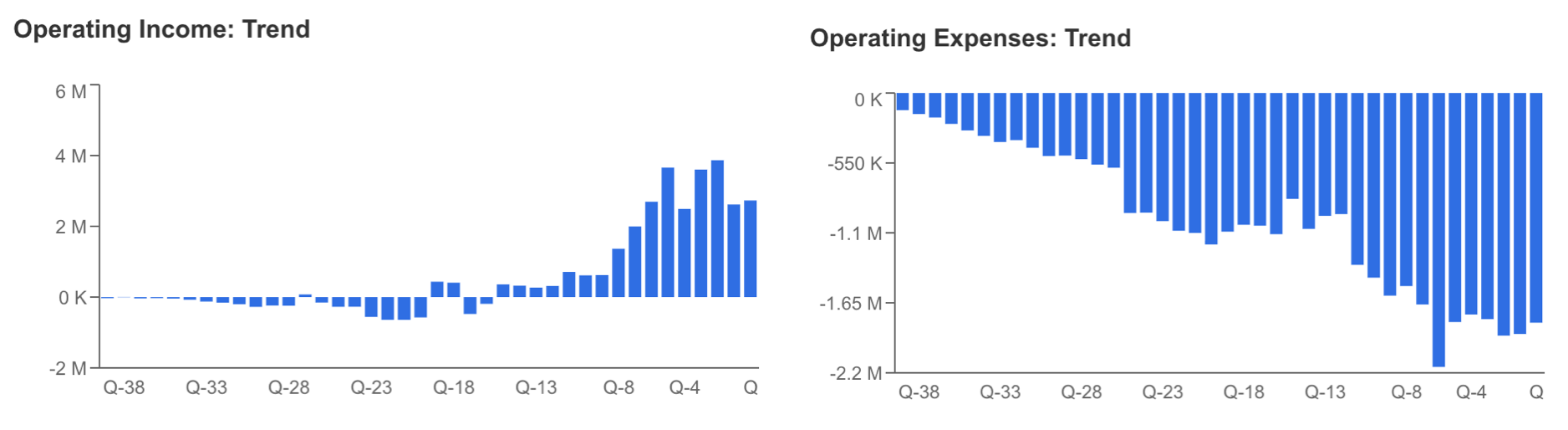

Tesla's operating margins are also among the factors that stand out, especially in the period when the company continues to cut prices. In this approach that reduces sales revenues, managing production expenses and other costs well stands as a critical activity.

Looking at the charts, it is seen that Tesla has managed its operating margin well so far. In addition, Musk made a commitment to further reduce costs in his statements on this issue. Therefore, Tesla's operating margin will be an item to be closely monitored in the earnings report to be announced today.

Tesla: Fundamentals Have Remained Intact

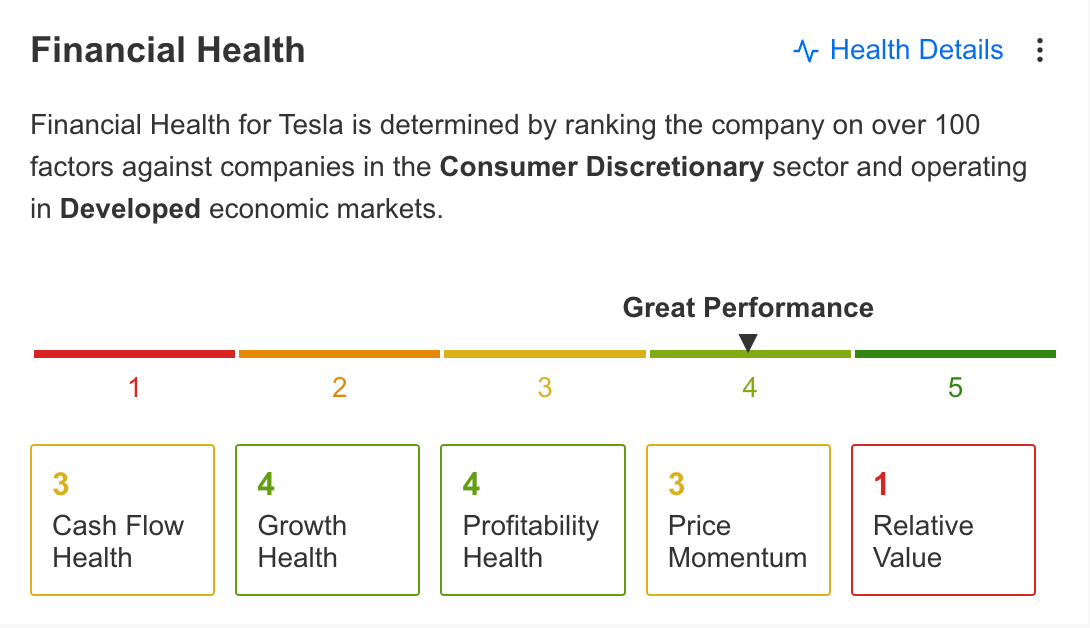

Ahead of Q3 earnings, Tesla's overall outlook is shaped as shown in the table below on the InvestingPro platform.

While the company is labeled as having very good performance in general, it is seen that the growth and profit situation remains healthy. Cash flow and price momentum have also performed well, while the relative value of the company stands as the factor that negatively affects performance.

Source: InvestingPro

In this context, InvestingPro summarizes the positive and negative aspects of the company as follows:

Positives:

- High return on capital

- Excess of cash over debt

- Significant increase in the last 6 months

Negative aspects:

- Analysts revised their expectations for the 3rd quarter downwards

- High price/earnings ratio

- Volatility of the share price

However, the fact that Tesla does not distribute dividends can also be considered a handicap for long-term investors.

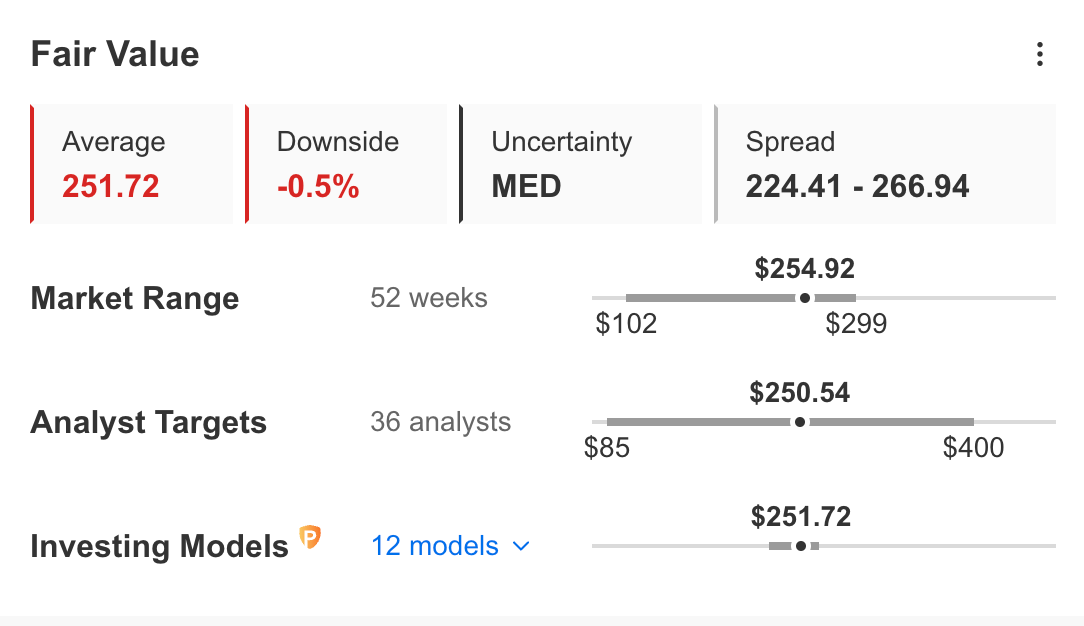

Source: InvestingPro

Forecasts for the performance of TSLA shares also show that the share price is currently at the fair value level. Based on 12 financial models, the estimated fair value is $251, while the consensus forecast of 36 analysts is shaped at similar levels.

Technical View

A technical analysis of TSLA's stock price shows that investors continue to protect the share at the $250 band, despite the declining delivery figures in October and the negative revision of analysts.

A noteworthy observation on Tesla's weekly chart is its lower volatility throughout 2023. Although the upward trend for 2023 appears intact, it's crucial to acknowledge the price congestion that emerged in September following the peaks and troughs in July and August.

The earnings report set to be released today adds an element of anticipation. It's conceivable that this report might serve as a catalyst, potentially leading to a significant move after its publication.

In terms of the price outlook, which is expected to align with the prevailing trend, a drop below $245 could trigger a downward breakout, potentially sending Tesla's stock to the $185 - $200 range.

On the upside, the $255 level is recognized as the nearest resistance. An upward breakout might materialize with a daily closing above this price, raising the possibility that the stock could extend its upward trajectory to around $350.

Considering past data, it's evident that investors swiftly react to developments related to Tesla. With today's earnings report expected, it's likely that volatility will surge again in response to the forthcoming data.

***

Disclaimer: The author does not own any of these shares. This content, which is prepared for purely educational purposes, cannot be considered investment advice.