To answer the question from the title: Nothing is wrong with Tesla (NASDAQ:TSLA), and I think it can still fly higher. It is simply digesting some of its recent astronomical gains. Allow me to explain using Elliott waves.

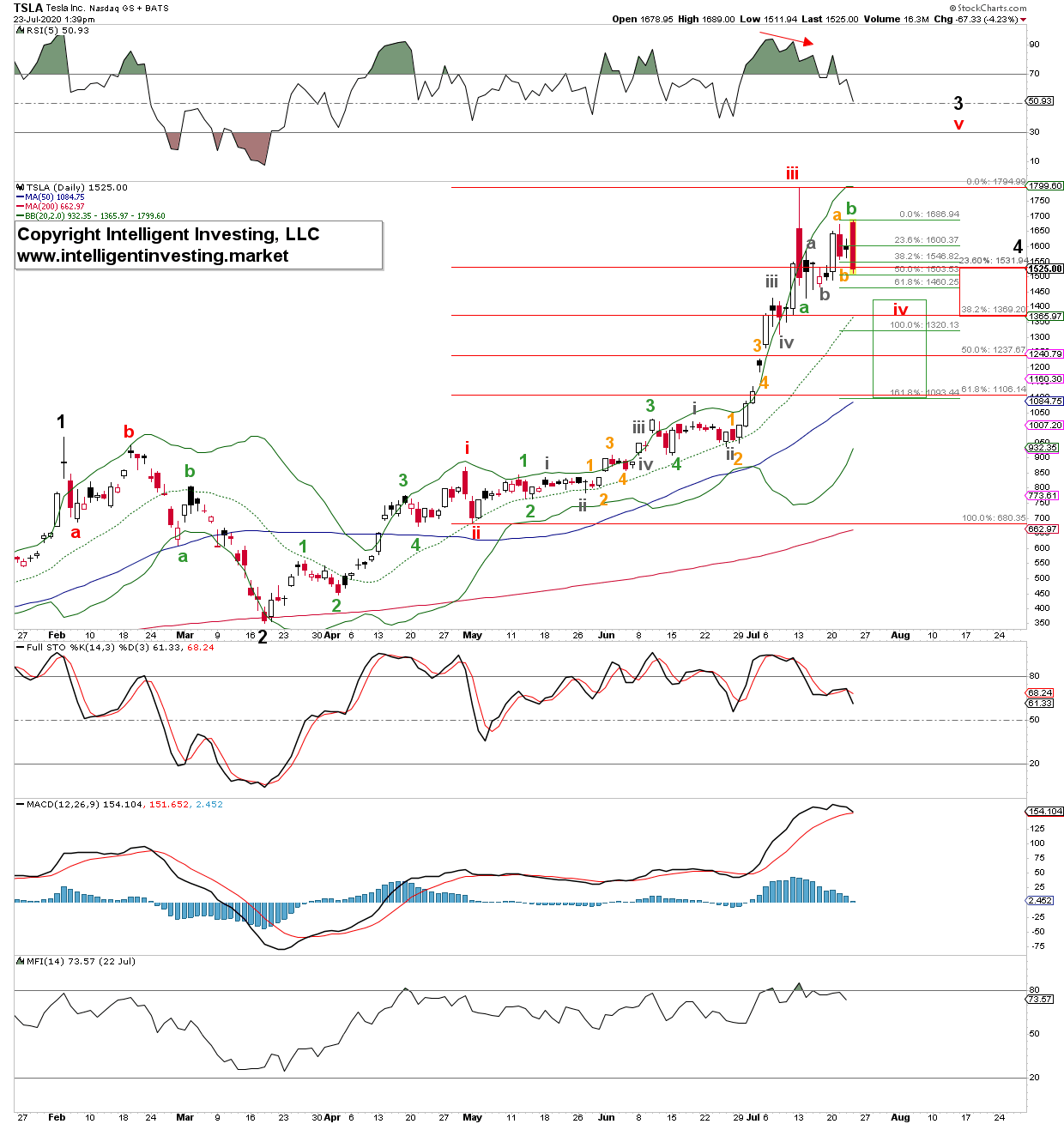

Figure 1 below shows the weekly chart of Tesla. I know it is a busy chart, but there are several key takeaways from it. Let me start with the technical indicators.

1) four out of five prior times Tesla was this overbought on the weekly RSI5, Money Flow Index, and Stochastic oscillator it corrected (vertical lines). Tesla is now as overbought and correcting.

2) The Elliott wave count I have for Tesla is that it is now in (red) intermediate-iii of (black) major-3 of (blue) Primary III/C of (purple) Cycle-3/C.

Why do I label the more significant degrees as numbers (five waves up) and letters (three waves up)? I must remain intellectually honest because I cannot know beforehand if Tesla will move higher in five or three larger waves. This unknown is the blessing and the curse of Elliott wave. The blessing, because if price at some point drops below a specific price level, we know it will only do three waves up. If it does not fall below it, and moves higher, then it will be five waves. One can use that certain price level as a stop. The curse, because from a buy-and-hold perspective, you do not know beforehand when the music will stop playing. But that is why one must always use stops anyway.

Figure 1, weekly chart.

That said, Tesla should now be in (red) wave-iv before moving higher for (red) wave-v to complete the anticipated “wave-3?”

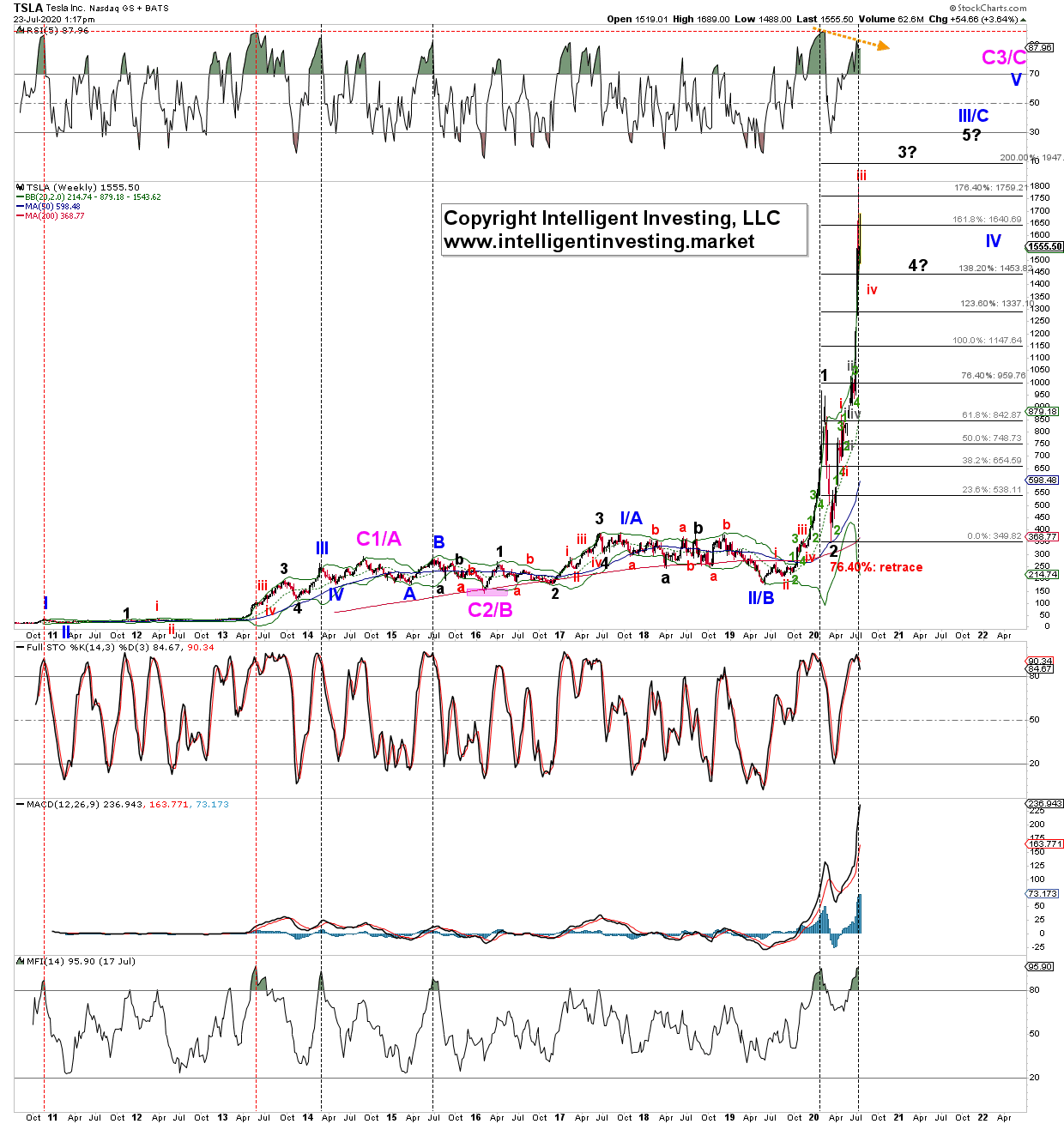

The daily chart, with price action over the last six months, in Figure 2 below shows more detail.

The Elliott wave count since the mid-March low took a while to crack, but in the end, it aligned perfectly with the wave count shown on the weekly chart. I, therefore, prefer to see Tesla target ideally between $1,369-$1,320 for wave-iv before moving higher to new All-time Highs (ATH) for wave-v of 3. The rally over the past seven trading days was overlapping and, therefore, counts best as a (green) b-wave. Now, wave-c of wave-iv should be underway. Note Tesla could even drop as low as $1,106-$1,093 for wave-iv without any issues. This drop would fil the early-July gap.

Bottom line: There is nothing wrong with Tesla and its stock. In my humble opinion, based on technical analyses and Elliott wave, it is correcting before moving higher again. The correction should ideally stall around

$1,370+/-50 but could drop as low as $1,100+/-5. A move below that lower level will be a serious warning for the bulls that the odds for more upside are getting very slim. Thus, as usual: know your trading time frame, know your pain level, and never assume anything. Hope is not a profitable strategy.

Figure 2, daily chart