If you want to invest in a green future, this merger should get your attention. The leading manufacturers of electric cars and home solar panels are trying to become one company.

Two months ago, SolarCity Corporation (NASDAQ:SCTY) agreed to a $2.5 billion to $3 billion buyout from Tesla Motors (Nasdaq: NASDAQ:TSLA). Together, Tesla and SolarCity could create the next big thing in greentech. Electric cars may soon be charged by solar-powered batteries.

Both companies are tech-industry darlings that have seen tremendous growth in their first few years. And the possibilities of what a combined company could produce are staggering. But at this point, the deal isn’t a sure thing.

Tesla and SolarCity Skeptics

For one thing, SolarCity founders Peter and Lyndon Rive are cousins of Tesla CEO Elon Musk. That’s not necessarily a financial concern. But it has raised some eyebrows from a PR perspective.

More importantly, both companies have been burning through cash. They’ve been spending at potentially unsustainable rates in the lead-up to the proposed merger. And that’s brought a slew of lawsuits from concerned Tesla and SolarCity investors.

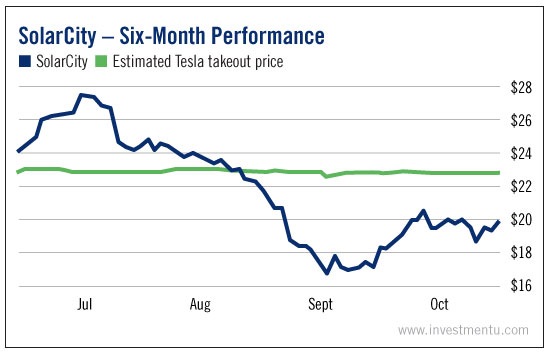

Amidst all this uncertainty, SolarCity stock has been trading below the estimated Tesla purchase price. Investors seem skeptical that this greentech merger will really happen.

The uneasiness among Tesla and SolarCity investors would be concerning in any case. But it’s especially problematic given that the merger is being put to a vote. On November 17, both companies will allow their shareholders to weigh in on the plan to combine the companies.

Based on the shareholder lawsuits and price discrepancies, the odds don’t look good.

A New Greentech Giant?

But there are also causes for optimism about the merger. For one thing, Tesla and SolarCity don’t have to worry about antitrust regulators, who approved the deal in late August. That gives them a leg up on a few other high-profile mergers in progress right now like Bayer-Monsanto.

A combined company could also unlock tremendous synergies. According to analysts, a SolarCity installation produces enough power every day to charge a Tesla car. And Tesla’s batteries facilitate this process. All a SolarCity-Tesla customer would need to do to “fill up” their car is to plug their solar panels into their battery in the morning. Then they’d just plug the battery into their Tesla in the evening.

If it pans out, this merger could take us to 100% carbon-free driving in a matter of years.

There’s also a strong counterargument to the notion that SolarCity is getting “bailed out” by Tesla. Yes, it’s true that SolarCity is losing a decent amount of money now. But it didn’t accept the first lifeline that was thrown to it. Or even the first seven.

Tesla is the eighth buyout offer that the Rive brothers have heard. Unless this is a case of sheer nepotism, there’s a method to Musk’s madness.

Every environmentally conscious investor dreams of the day when they can drive to work in their electric car. Or the day when their lights and computers are powered by clean energy from the sun. But few greentech enthusiasts thought that both goals would be attainable so soon... much less that they’d be interlinked.

The Tesla and Solar City merger has quite a few hurdles to clear. But if it succeeds, it could create a greener future for our planet... and greener wallets for investors.