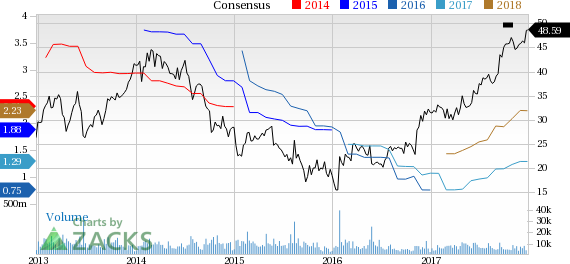

On Dec 27, Terex Corporation (NYSE:TEX) crafted a fresh 52-week high of $48.87 during intra-day trading, finally closing lower at $48.59.

Terex has a market cap of around $4.1 billion. The average volume of shares traded over the last three months is around 1,143.7K. Also, the company surpassed the Zacks Consensus Estimate in each of the trailing four quarters, with an outstanding average positive earnings surprise of 135.9%.

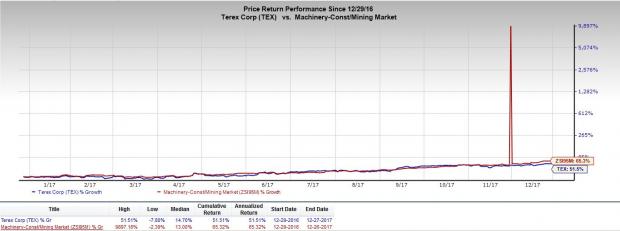

The stock has rallied 51.5% in a year’s time, higher than the S&P 500’s gain of 19.5%. However, Terex’s shares underperformed the industry’s gain of 65.3% during the same timeframe.

What's Driving Terex?

In the third-quarter conference call, Terex raised its full-year adjusted EPS guidance to $1.20-$1.30, driven by upbeat market dynamics and improved operational expectations for fourth-quarter 2017. The company also increased its full-year sales outlook. It continues to implement the strategy to focus and build capabilities in key commercial and operational areas.

Notably, Terex made excellent progress on strategic priorities in the third quarter. During the quarter, it completed the sale of its crane facility in Jinan, China. In Germany, it sold the manufacturing site at Bierbach. Terex also remains focused on implementing its Execute to Win business system. On strategic sourcing, Terex’s Wave 1 teams have started to assess supplier proposals.

Further, Terex will continue to execute its disciplined capital-allocation strategy and return capital to shareholders. In September, the company monetized its remaining holdings of Konecranes shares for $221 million. Further, the company has completed the repricing of its term loan in August, which will reduce interest costs.

In addition, Terex repurchased around 22.3 million shares for about $770 million in the first nine months of 2017. Its board authorized a new share repurchase program of up to $225 million in the recently-reported quarter, of which $154 million was remaining as of Sep 30. Its diligent capital-allocation strategy, including the efficient return of capital to shareholders through share repurchases, will stoke growth.

For the third quarter in a row, Terex’s backlog grew year over year in every segment. Its total segment backlog rose 44% and bookings were up 18% in the quarter. Backlog will further grow on the back of continued focus on product development.

Upward Estimate Revisions

In addition to the above, Terex’s positive estimate revisions reflect optimism in the company’s potential, as earnings growth is often an indication of robust prospects (and stock price gains) ahead. Estimates for Terex moved up over the past 60 days, reflecting analysts’ bullish sentiments. The earnings estimate for 2017 has gone up 11%, while that of 2018 increased 8%.

The above-mentioned tailwinds have raised investors’ optimism on the stock and are anticipated to boost the company’s share price in the days ahead.

Zacks Rank & Stocks to Consider

Terex currently carries a Zacks Rank #3 (Hold). Some better-ranked stocks in the same space include H&E Equipment Services, Inc. (NASDAQ:HEES) , Caterpillar Inc. (NYSE:CAT) and Komatsu Ltd. (OTC:KMTUY) . All three stocks sport a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

H&E Equipment has a long-term earnings growth rate of 18.6%. Its shares have appreciated 71.5%, year to date.

Caterpillar has a long-term earnings growth rate of 10.3%. Its shares have rallied 69.9% in the year so far.

Komatsu has a long-term earnings growth rate of 16.2%. So far this year, its shares have gained 59.5%.

Today's Stocks from Zacks' Hottest Strategies

It's hard to believe, even for us at Zacks. But while the market gained +18.8% from 2016 - Q1 2017, our top stock-picking screens have returned +157.0%, +128.0%, +97.8%, +94.7%, and +90.2% respectively.

And this outperformance has not just been a recent phenomenon. Over the years it has been remarkably consistent. From 2000 - Q1 2017, the composite yearly average gain for these strategies has beaten the market more than 11X over. Maybe even more remarkable is the fact that we're willing to share their latest stocks with you without cost or obligation.

See Them Free>>

Terex Corporation (TEX): Free Stock Analysis Report

Caterpillar, Inc. (CAT): Free Stock Analysis Report

Komatsu Ltd. (KMTUY): Free Stock Analysis Report

H&E Equipment Services, Inc. (HEES): Free Stock Analysis Report

Original post

Zacks Investment Research