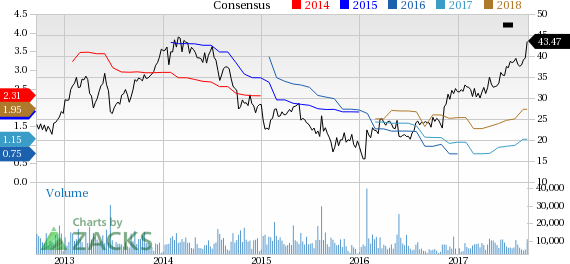

Shares of Terex Corporation (NYSE:TEX) hit a 52-week high of $43.67 on Sep 15. However, the stock closed the day’s trading a trifle lower at $43.47. The company has gained 37.9% year to date, much higher than the S&P 500’s gain of 11.7% over the same frame.

Terex has a market cap of $3.9 billion. Average volume of shares traded over the last three months is approximately 1.4 million. We note that the company has beaten the Zacks Consensus Estimate in three out of the trailing four quarters, the average positive earnings surprise being 122.8%.

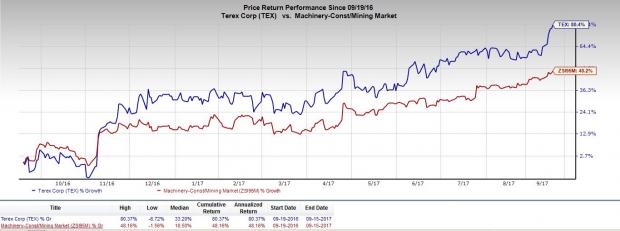

Notably, Terex’s shares have vastly outperformed the industry in the last year. While the stock rallied 80.4%, the industry recorded only 48.2% growth in the same time period.

What's Driving Terex?

Terex’s share price has considerably gained around 14% over the last week. Investors favorably view the company’s plans of disciplined capital-allocation strategy and return of capital to shareholders.

On Sep 6, Terex announced a new share repurchase program of up to $225 million. The company had earlier committed to pursuing a disciplined capital-allocation strategy that included the efficient returns of capital to shareholders through share repurchases of $1-$1.5 billion through 2020.

Notably, Terex will benefit from progress on its transformation program. The Cranes segment returned to profitability in the second quarter, led by benefits from restructuring actions, and the company expects this trend to continue. Its Materials Processing segment is also progressing well.

Further, Terex’s commercial excellence initiative continues to make progress. The company remains focused on enhancing performance management tools and improving process discipline in sales pipeline and account management.

Moreover, positive estimate revisions reflect optimism in the company’s potential as earnings growth is often an indication of robust prospects (and stock price gains) ahead. Estimates for Terex have moved up in the past 60 days, reflecting analysts’ optimistic outlook. The earnings estimate for 2017 has gone up 17%, while that of 2018 has moved up 15%. Further, the company’s positive long-term earnings growth rate of 19.7% holds promise.

Zacks Rank & Other Key Picks

At present, Terex sports a Zacks Rank #1 (Strong Buy).

Other similarly-ranked companies in the same sector are Caterpillar Inc. (NYSE:CAT) , China National Materials Company Limited (OTC:CASDY) and Komatsu Ltd. (OTC:KMTUY) . You can see the complete list of today’s Zacks #1 Rank stocks here.

Caterpillar has an expected long-term earnings growth rate of 9.5%.

China National Materials has an expected long-term earnings growth rate of 20%.

Komatsu has an expected long-term earnings growth rate of 12.7%.

New Report: An Investor’s Guide to Cybersecurity

Cyberattacks have become more frequent and destructive than ever. In fact, they’re expected to cause $6 trillion per year in damage by 2020.

The cybersecurity industry is expanding quickly in response to these threats. In fact, a projected $170 billion per year will be spent to protect consumer and corporate assets. Zacks has just released Cybersecurity: An Investor’s Guide to Locking Down Profits which reveals 4 promising investment candidates.

Download the new report now>>

Terex Corporation (TEX): Free Stock Analysis Report

Caterpillar, Inc. (CAT): Free Stock Analysis Report

Komatsu Ltd. (KMTUY): Free Stock Analysis Report

China National Materials Group Corp. (CASDY): Free Stock Analysis Report

Original post

Zacks Investment Research