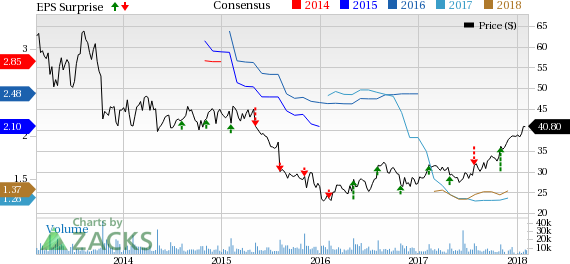

Shares of Teradata Corporation (NYSE:TDC) plunged almost 6.2% to close at $35 on Feb 9, following dismal fourth-quarter 2017 results. Adjusted earnings of 58 cents per share declined 17.1% year over year. However, the figure beat the Zacks Consensus Estimate of 50 cents.

Total revenues of $626 million beat the Zacks Consensus Estimate of $610 million. However, the figure was flat on a year-over-year basis. Revenues were adversely impacted by the company’s ongoing business transformation.

Products and Cloud revenues decreased 7.3% year over year to $243 million. Services revenues increased 5.2% on a year-over-year basis to $383 million.

Revenues from Americas Data and Analytics decreased 8.1% year over year (8% at constant currency), while that from International Data and Analytics increased 14% (8% at constant currency) from the year-ago quarter.

Moreover, recurring revenues increased 7% on a constant currency (cc) basis. Consulting services also rose 2% at cc. However, perpetual software licenses and hardware revenues declined 17% at cc.

Operating Details

Non-GAAP gross margin contracted 190 basis points (bps) from the year-ago quarter to 51.8%. Total product & cloud gross margin contracted 160 bps, which was partially offset by 20 bps expansion in services gross margin.

As a percentage of revenues, selling, general & administrative (SG&A) expenses increased 190 bps to 27.3%. Moreover, research & development (R&D) expenses jumped 290 bps from the year-ago quarter to 12.1%.

Non-GAAP operating margin contracted 640 bps on a year-over-year basis to 14.5%, primarily due to lower revenues, shrinking gross margin and higher operating expenses to support the company’s strategic initiatives.

Balance Sheet & Share Repurchase

As of Dec 31, 2017, Teradata had cash and cash equivalents of $1.089 billion, compared with $1.025 billion as of Sep 30, 2017. The company exited the quarter with total debt (including current portion) of $538 million compared with $546 million at the end of the previous quarter.

On Feb 5, 2018, Teradata's board of directors authorized an additional $310 million to repurchase shares. The company has approximately $500 million authorized for share repurchases.

Guidance

For 2018, Teradata expects revenues between $2.15 billion and $2.20 billion. The Zacks Consensus Estimate for revenues is currently pegged at $2.18 billion. Non-GAAP earnings are projected between 67 cents and 77 cents. The Zacks Consensus Estimate for earnings is currently pegged at $1.39.

For first-quarter of 2018, revenues are projected in the range of $490-$500 million. The Zacks Consensus Estimate for revenues is currently pegged at $499.2 million. Non-GAAP earnings are estimated between 13 cents and 16 cents per share. The Zacks Consensus Estimate for earnings is currently pegged at 27 cents.

Zacks Rank & Stocks to Consider

Teradata carries a Zacks Rank #4 (Sell).

A few better-ranked stocks in the broader technology sector are Micron Technology (NASDAQ:MU) , Super Micro Computer (NASDAQ:SMCI) and Seagate (NASDAQ:STX) . While Micron and Super Micro sport a Zacks Rank #1 (Strong Buy), Seagate has a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Long-term earnings growth rate for Micron, Super Micro and Seagate is projected at 10%, 14% and 15.6%, respectively.

Wall Street’s Next Amazon (NASDAQ:AMZN)

Zacks EVP Kevin Matras believes this familiar stock has only just begun its climb to become one of the greatest investments of all time. It’s a once-in-a-generation opportunity to invest in pure genius.

Seagate Technology PLC (STX): Free Stock Analysis Report

Teradata Corporation (TDC): Free Stock Analysis Report

Super Micro Computer, Inc. (SMCI): Free Stock Analysis Report

Micron Technology, Inc. (MU): Free Stock Analysis Report

Original post