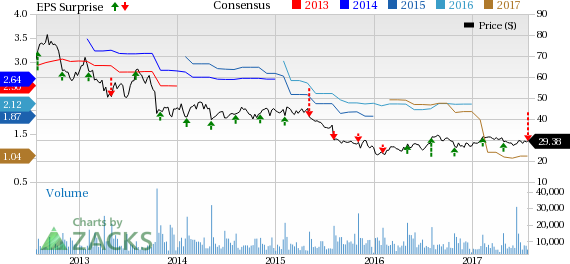

Teradata Corporation (NYSE:TDC) reported dismal results for the second quarter of 2017, wherein its top and bottom lines not only fell short of the respective Zacks Consensus Estimate but also marked significant year over year decline.

The company reported adjusted earnings (excluding all one-time items but including stock-based compensation expenses) of 13 cents, plunging 80% from the year-ago quarter’s earnings of 65 cents. Adjusted earnings also came below the Zacks Consensus Estimate of 22 cents.

On non-GAAP basis, Teradata’s earnings tumbled 69% year over year to 22 cents per share, mainly due to decline in revenues.

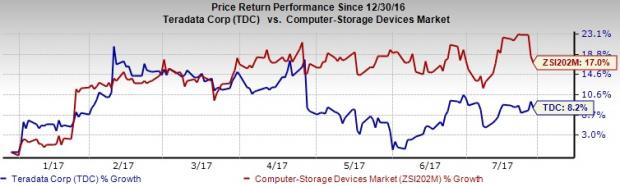

Notably, Teradata has underperformed the industry it belongs to in the year-to-date period. During the said period, the stock has returned merely 8.2% while the industry gained 17%.

Revenue Details

Total revenue of $513 million missed the Zacks Consensus Estimate of $513.35 million. Moreover, it plunged 14% on a year-over-year basis. This was mainly due to the company’s ongoing business transformation activity, under which its large customers have begun shifting to subscription pricing offerings.

Products and Cloud revenues decreased 32% year over year to $166 million. Services revenues fell 3% on a year-over-year basis to $347 million. Revenues from Americas Data and Analytics decreased 17% year over year while that from International Data and Analytics grew 1% from the prior-year quarter.

Margin

Non-GAAP gross margin contracted 420 basis points (bps) from the year-ago quarter to 51.7% mainly due to “a higher mix of services versus product revenue”. Also, services had much lower margins which more than offsets the higher margins from product sales.

The company reported non-GAAP operating income of $47 million, down from $130 million reported in the prior-year quarter. Non-GAAP operating margin shrunk to 9.2% from 23% reported year over year mainly due to lower revenue, shrink in gross margin and increased operating expenses to support the company’s strategic initiatives.

Balance Sheet & Share Repurchase

Teradata exited the quarter with $1.085 billion in cash and cash equivalents, compared with $1.164 billion at the end of the previous quarter. Teradata had long-term debt (excluding current portion) of $508 million at the end of the second quarter compared with $523 million at the end of first-quarter 2017.

In the second quarter, Teradata generated cash flow from operations of $61 million and free cash flow of $45 million. Year-to-date, the company generated $309 million of cash flow from operational activities and $275 million of free cash flow.

Teradata repurchased 3.7 million shares for $108 million during the second quarter, while 5.1 million shares for $151 million in the first half of 2017. Concurrent to its second quarter earnings release, the company announced that it intends to buyback $300 million worth of its common stock in the second half of this year. The company will use available cash from U.S. operations and its totally unused $400 million of revolving credit facility.

Guidance

The company is finding it difficult to estimate the actual impact of its ongoing business transformation initiatives on its full-year revenue. Teradata expects 2017 revenues to come in the range of $2.095 billion to $2.140 billion, representing a decline of 10% to 8%. Excluding the revenues of Marketing Applications business, which it had divested last year, the company projects revenues to decline between 5% and 7%, which is narrower than its earlier projected range of 5% to 10%.

Teradata also provided earnings outlook for the full year. The company projects to report GAAP earnings in the range of $0.26 to $0.31 while non-GAAP earnings are estimated to come between $1.22 and $1.27.

The company did not provide any guidance for the third quarter but projects that fourth quarter to be better than the current quarter.

To Conclude

Teradata revenues are getting impacted by the company’s ongoing business transformation. Also, restructuring related costs, a sluggish spending environment in the domestic market and increasing competition from the likes of International Business Machines (NYSE:IBM) and Oracle Corp (NYSE:ORCL) and others will continue to weigh on its financials.

However, over the long run, the company is expected to benefit from transition to a subscription-based revenue model. Plus, strategic partnerships with the other big tech giants and acquisitions should bode well for long-term growth.

Currently, Teradata has a Zacks Rank #3 (Hold).

Stock to Consider

A better-ranked stock in the broader technology sector is Applied Optoelectronics Inc. (NASDAQ:AAOI) , which sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The company has delivered an average positive earnings surprise of 118.33% in the trailing four quarters and has a long-term expected EPS growth rate of 18.8%.

More Stock News: Tech Opportunity Worth $386 Billion in 2017

From driverless cars to artificial intelligence, we've seen an unsurpassed growth of high-tech products in recent months. Yesterday's science-fiction is becoming today's reality. Despite all the innovation, there is a single component no tech company can survive without. Demand for this critical device will reach $387 billion this year alone, and it's likely to grow even faster in the future.

Zacks has released a brand-new Special Report to help you take advantage of this exciting investment opportunity. Most importantly, it reveals 4 stocks with massive profit potential. See these stocks now>>

Teradata Corporation (TDC): Free Stock Analysis Report

International Business Machines Corporation (IBM): Free Stock Analysis Report

Oracle Corporation (ORCL): Free Stock Analysis Report

Applied Optoelectronics, Inc. (AAOI): Free Stock Analysis Report

Original post