Investing.com’s stocks of the week

Good afternoon, dear friends!

This week was quite productive. If you follow our trading recommendations, then about 10 trades should have been closed with profit. Go on reading to learn more about what signals worked out this week.Signals mentioned within our market reviews

As of Friday morning, three forecasts were executed with different efficiency degree:

- AUDNZD - bearish forecast was executed. One should have entered the market when rebound from global imbalance took place; both take profits worked out, profit made up 18 and 54 points;

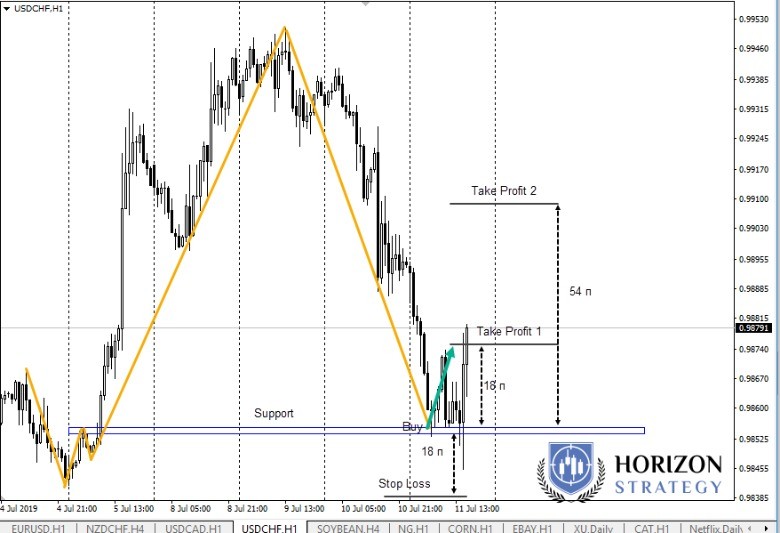

- USDCHF - buy signal was generated on July 11. The first target has been reached (+18 pips), the chart is moving towards the second take profit; the trade is still in the market;

- Dow Jones - here, the movements were sharp, but the imbalance has worked out. It took less than an hour to reach the both targets. As a result, 40 and 120 points were gained.

- EURUSD - scenario implying a false breakout of the round level 1,1200 was executed perfectly. Consolidation above the imbalance was followed by the entry that provided profit of 23 and 69 points for two take profits. Reversal pattern is present; its maximum breakout and testing provided grounds for performing purchases;

- GBPUSD - the situation is similar to EURUSD. The movement was caused by the news, but despite the increased volatility, the scenario was executed perfectly. Both take profits were reached, which provided 25 and 75 points of profit;

- GBPJPY - we've exited the trading zone, price rounding was formed and both take profits were reached. One could earn 16 and 48 points on this movement. The second take profit was reached the next day;

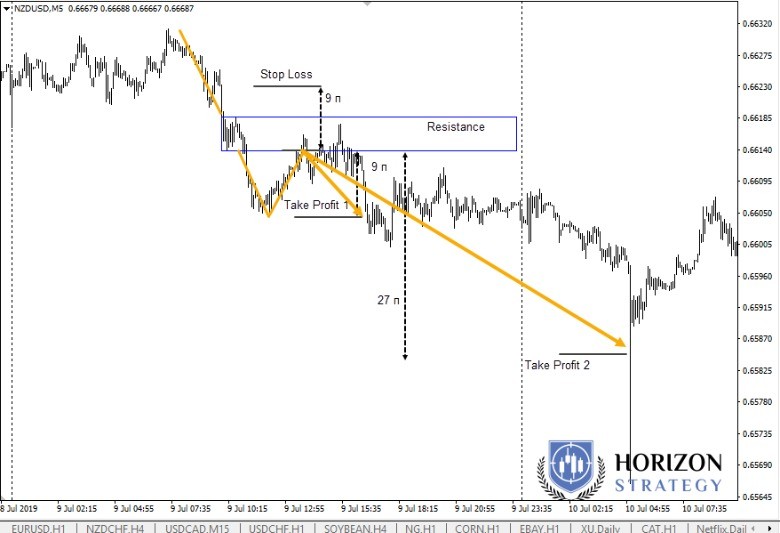

- NZDUSD - the same scenario; trading zone was formed on a strong movement. We've exited it downwards, tested the lower border and opened trade to sell. Potential profit - 9 and 27 points on two take profits;

- USDCAD - rather aggressive trade, but it worked out well. The level of stop was tested (9-10 points), but in case it had been placed with a margin of several points, it should not have worked out. Profit on the trade - 28 points;

- WT - just the first take profit was executed, which provided profit of 35 points. The signal wasn't particularly strong, so one could have closed the entire volume when this level was reached. The signal was standard - reaction to the imbalance after it was broken out downwards sharply;

Conclusion

Conclusion

These entry points could have provided about 600 points of profit. We've entered the market with smaller volume as most signals were aggressive. Provided the lot were standard, the weekly profit would make up ≈150 points.

Such a profit could be gained when following our recommendations and copying our trades.