A wave of economic data had its affect on the currency market during Friday’s trading session, increasing volatility across the board. The economy that took center stage was the U.S, releasing it’s overly watched Non-Farm Payrolls. Even though the result continued to linger in negative territory it exceeded analyst’s expectations, showing that fewer jobs were lost during the month of April. In addition factory orders blasted through the roof, coming out at 1.4%, helping to give additional strength to the Dollar.

The U.S stock markets gapped up during pre-market hours sending positive sentiment throughout equity traders. Even though the major indices retraced throughout the session they still managed to close up by an average of 0.3%. The Fed also announced that it intends to increase its term Auction Facility to $150 billion from $100 billion.

Commodities managed to strengthen during the session due to overall momentum, sending Crude oil up to close the session at $116.32 per barrel. Gold managed to erase previous losses closing the session up at $858 per ounce.

Looking forward, currencies will continue to act on Friday’s market reactions. In addition, trader’s eyes will focus on Service PMI from the U.S as other markets are going to be closed.

Euro | Japanese Yen | British Pound

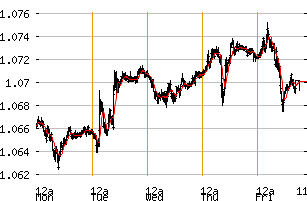

Euro

After opening the session in Asia at $1.5468, the Euro lacked volatility during the first few hours of the session. Economic data from the U.S sparked Euro selling, sending this pair down to a low of $1.5371. Despite numerous efforts by the Euro to regain strength, this pair closed the session just off its intraday low at $1.5410.

Support: 1.5340, 1.5300, 1.5250

Resistance: 1.5480, 1.5600, 1.5750

Euro | Japanese Yen | British Pound

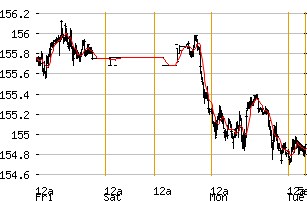

Japanese Yen

This carry traded currency experienced choppy trading throughout yesterday’s intraday session. After consolidating for the first few hours of the session, the Dollar received a boost prior to the opening of the U.S equity session. The USD/JPY managed to hold onto its gains closing the session at 105.40

Support: 104.50, 103.60, 103.20

Resistance: 105.50, 105.70, 106.00

Euro | Japanese Yen | British Pound

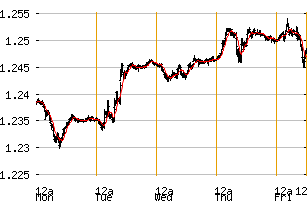

British Pound

After opening the session at $1.9740 and trading barely unchanged, the pound received intraday strength sending this pair to a high of $1.983. Similar to the Euro the Pound lost all its strength following the release of the economic data sending it down into negative territory. The GBP/USD closed the session just off its intraday low at $1.9730.

Support: 1.9700, 1.9660, 1.9600

Resistance: 1.9900, 1.9950, 2.0000

Euro | Japanese Yen | British Pound