Key Points:

- The EUR has potentially found a temporary bottom.

- Currently deep in oversold territory.

- Completing an ABCD wave could lead to a reversal.

The often neglected side of the Brexit equation, the Eurozone, has been feeling the pressure over the past number of weeks and this has taken its toll on the union’s currency. Specifically, the EURUSD has been effectively in free fall recently as concerns continue to mount over the triggering of article 50 by the UK. However, some of the market’s gloomy outlook might be about to be reined in as the pair looks to have found a temporary bottom.

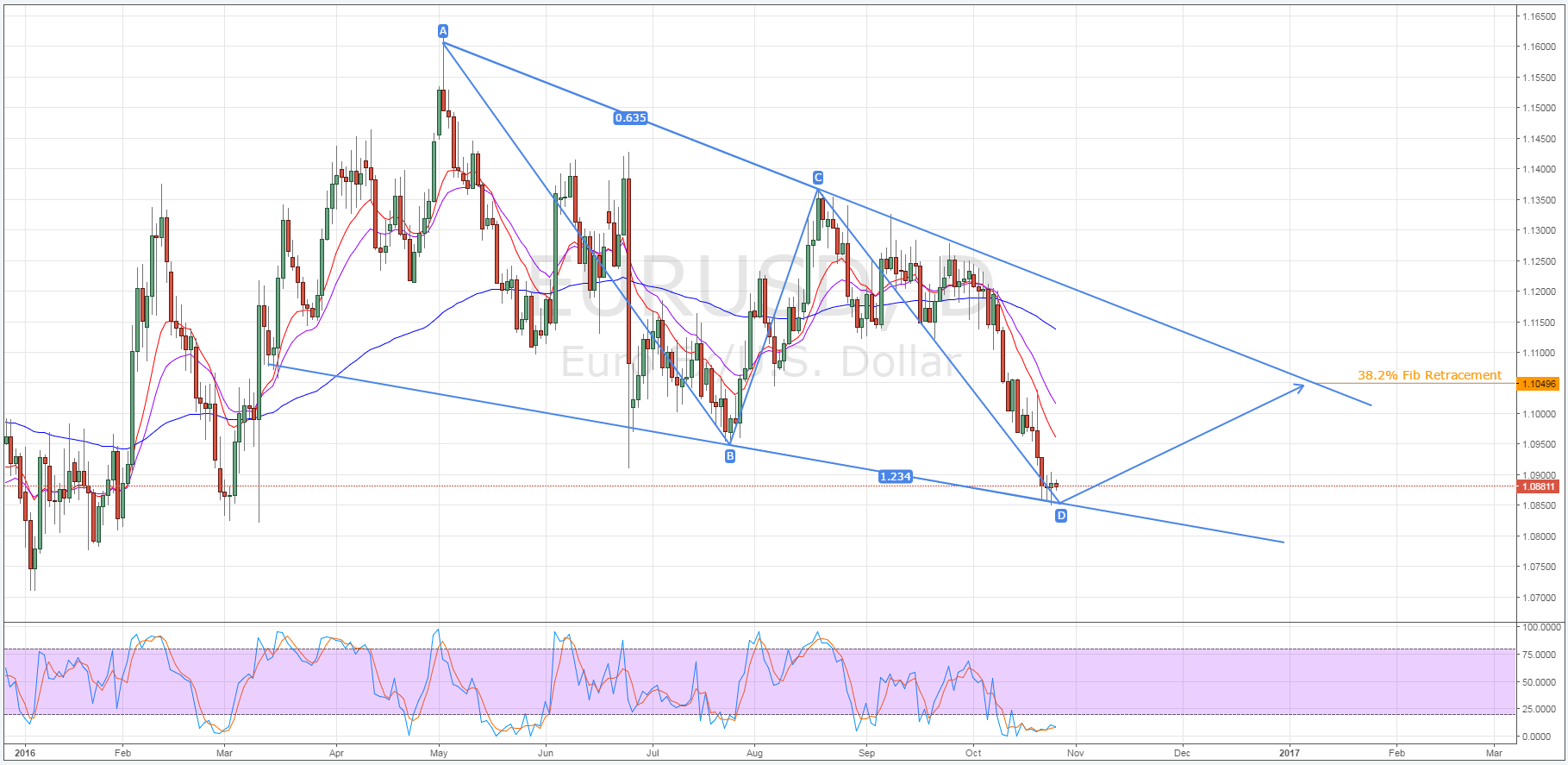

Firstly, the presence of a fresh bottom around the 1.0886 mark seems rather likely given the presence of the lower constraint of the long-term falling wedge structure. As illustrated below, the EUR’s overall bearish phase seems to be taking the form of a bearish wedge and, as a result, we should see some bullishness in the coming sessions.

Moreover, the pair’s stochastics have been firmly trapped in oversold territory for a rather extended period of time. As a consequence of this, the EUR is long overdue for even a brief spell of buying activity in the near- to medium-term. However, any rallies currently in the wings for the pair could be just as voracious as the tumbles which have dominated the charts for the majority of October.

The evidence for a potentially sharp reversal and a spell of subsequent gains comes largely as a result of the recently completed ABCD wave, shown above. Notably, the retracements made by the EURUSD since the beginning the A leg have proven to be in line with what would be expected of a textbook ABCD pattern. As a result of this, we could see the pair move back to test the upside over the coming weeks.

In the event that we do see a shift in momentum from bearish to bullish, the EUR will likely move as high as the 1.1049 mark prior to resuming its long-term downtrend. This price represents the intersection of both the upside of the wedge and the 38.2% Fibonacci level which, as a result, should cap upsides at this price. Furthermore, the impending reversal is forecasted to be somewhat muted relative to the one seen during the B leg as traders are continuing to price in Brexit risk.

Ultimately, even if the pair has encountered a turning point, the long-term bias remains firmly bearish for the EUR whilst it remains confined by the falling wedge. Consequently, this recent low may not be the last bottom we see tested before the UK triggers article 50 to formalise its split from the EU. However, for the bulls out there it could be worth taking a look at the EURUSD once again, at least in the near-term.