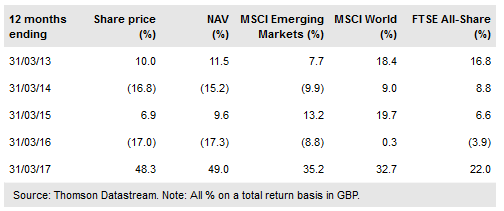

Templeton Emerg Mark Investm Trust (LON:TEM, TEMIT) aims to generate long-term capital growth from a diversified portfolio of emerging market equities. Since the change in manager in October 2015, there has been a notable improvement in TEMIT’s relative performance – over the last 12 months, its NAV total return has outperformed its MSCI Emerging Markets index benchmark by 10.2%. TEMIT has historically run a small cash balance, but in January 2017 announced it had entered into a new £150m credit facility; if fully drawn down, it would take gross gearing to c 7.0% of net assets.

Market outlook: EM valuations relatively attractive

Despite outperforming world equities in 2016 (a period of outsized returns for shareholders across the globe), emerging market equities remain at relatively attractive valuations. The MSCI Emerging Markets index has c 30% lower forward earnings and price-to-book multiples and a modestly higher dividend yield than the MSCI World index.

In addition, relative economic growth forecasts favour emerging markets. For investors seeking exposure to emerging market equities, a fund with a disciplined, long-term, value-orientated approach may hold some appeal.

To read the entire report Please click on the pdf File Below