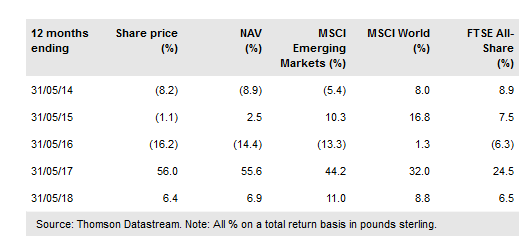

Templeton Emerg Mark Investment Trust (LON:TEM) has been managed by Chetan Sehgal since the beginning of February 2018, when he took over from prior lead manager Carlos Hardenberg. The two managers had worked closely together for a number of years and there will be no change to the investment process. Sehgal will continue to follow Franklin Templeton’s value-based, bottom-up stock selection approach, aiming to generate long-term capital growth. The manager is optimistic on the outlook for emerging market equities, citing above-average earnings growth with below-average valuations versus global equities. TEMIT has recently announced its FY18 results (ending 31 March); its NAV and share price total returns of 12.4% and 13.7% respectively were ahead of the 11.8% total return of the benchmark MSCI Emerging Markets index.

Investment strategy: Bottom-up stock selection

Lead manager Sehgal follows Franklin Templeton’s value-based, five-step investment process: identification of undervalued companies; in-depth fundamental analysis; team peer review; portfolio construction; and portfolio evaluation and attribution analysis. The bottom-up approach means that TEMIT’s portfolio can vary markedly from the benchmark in terms of sector and geographic allocations. Gearing of up to 10% of NAV is permitted (net gearing of 4.1% at end May 2018).

To read the entire report Please click on the pdf File Below: