This backs the data we saw yesterday from railroads as the Temp Help Index rose to levels not seen since 2007 and has been in a steady uptrend all year. This is a highly bullish reading and very positive for employment for the remainder of the year. For those inclined to blame Obamacare for this, please read this post where I address that fallacy.

The bottom line here is the economy continues to grind forward. It is doing so in the face of significant headwinds from the shrinkage of government employment around the nation on both a Federal and State level. As that downsizing eases and eventually stops, the underlying strength of the private economy will become more apparent to people. There is some interesting data on this.

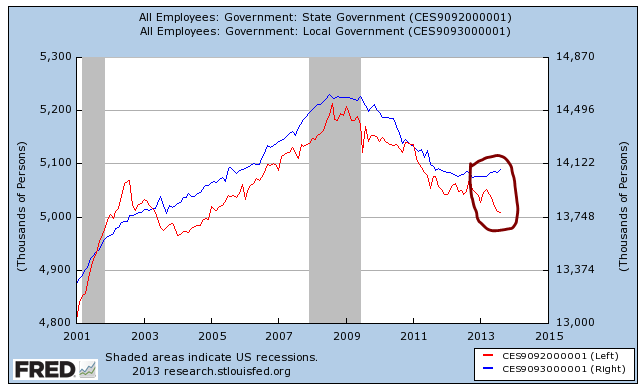

We see here that State government employment seems to have taken a leg down after briefly stabilizing while Local government employment has risen. My bet would be this is simply due to States shifting certain tasks to localities meaning the net here is that State/Local employment is now simply stabilized. If we look at the chart below it would seem as though that is what is happening.

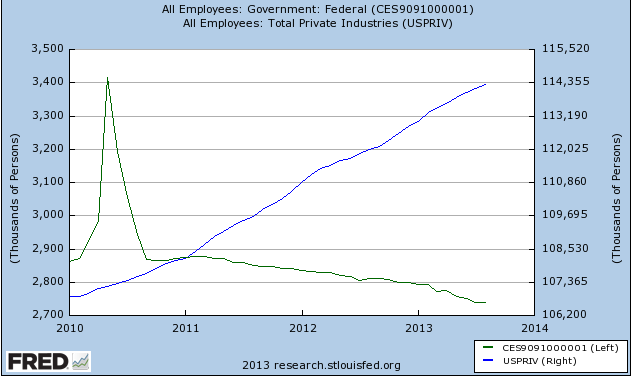

Now the Federal government is still shedding jobs while the private sector continues to add to them. Now, this is the proverbial “double edged sword” for many people. Most would agree that government is too large and payrolls and redundancies need to be reduced. If that is true, then what we are seeing is a healthy dynamic. It also means we cannot simply compare “this recovery to past ones” in terms of aggregate job growth because the reduction in Federal jobs will be both a drag on overall employment numbers and then economic demand in the overall economy (fewer gov’t workers purchase fewer goods/services).

The good news is that this dynamic appears to be running its course and even just a flat lining of the number will allow the private sector strength to become more apparent.

Now, before those who are skeptical try to mischaracterize everything i just said let me say this: I do think the economy could be much stronger. there are many reasons for its current “un-robustness”, Obamacare creating uncertainty, tax policy (or lack thereof) creating uncertainty, gov’ts fiscal status creating uncertainty etc etc etc…..

But I would argue that the private economy, despite all the above headwinds is actually doing pretty well. Solving any of the above issues could cause it to really take off.

Of course, after nearly 6 years years of the same arguments, I guess one ought not be overly optimistic. Either way, the private economy is chugging along at a healthier pace than I think most would give it credit for.

Disclaimer: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Temp Employment Index Rises To 5 Year High

Published 09/22/2013, 01:28 AM

Temp Employment Index Rises To 5 Year High

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.