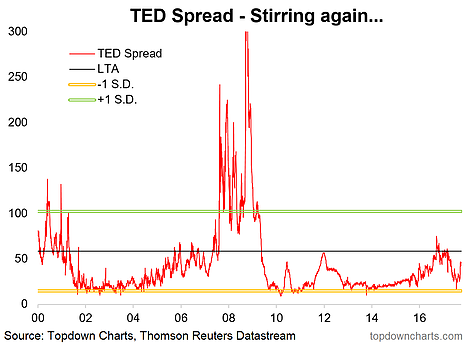

Going through the various charts on credit strategy and risk pricing I noticed a couple of interesting and related charts that I thought would be worth sharing. The first one is the "dreaded TED spread" - I wrote a piece on this back in July where I remarked on the fall in the TED spread; it stood in contrast to the steady rise earlier which had triggered some commentators to start getting (even more) bearish given the parallels to the 2008 period. One thing I noted was that indicators like this often work in reverse... that is, similar to the VIX, "risk" is generally higher when the indicator is low and paradoxically, for equity markets risk is typically lower when the indicator is at extremes.

While the signal from the TED spread has been distorted by a tightening up of regulations and reporting around LIBOR and changes in money market funds, there probably is still some residual signal left in there, so when it starts to stir it's worth noting at least in passing.

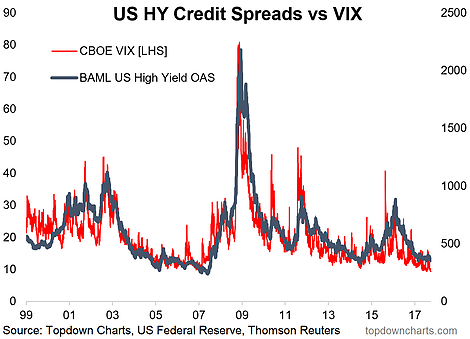

What makes the stirring in the TED spread a little more interesting is how it stands in contrast to the very calm/complacent/confident readings of the CBOE VIX and US High Yield credit spreads. The mid-2000's period showed us just how long such complacency can last, and as long as the economy is doing fine and no risk events materialize, it can stay that way. I track a number of leading indicators for HY credit spreads and while a couple are showing some minor signs of divergence, the cyclical economic indicators are saying that the current levels are justified (given the current stage of the cycle).

To wrap up though, I keep coming back to that notion that low levels of the VIX/HY credit are generally more risky times than high levels - whether it's confidence or complacency, a few things need to continue to go right for the current levels to continue to be justified. As we get later in the economic/market cycle this will be put to the test - it will also be put to the test as the Fed commences quantitative tightening...

After a false alarm and subsequent calming, the TED spread is starting to stir again. Interestingly, it stands in contrast to the VIX and HY credit spreads (see the second graph).

Both the VIX and US High Yield Credit Spreads are trading around the lows - call it complacency or confidence, it is what it is. I looked at US HY Credit spreads in the latest weekly report, and while there are a couple of divergences vs credit conditions, the economics/cyclical picture justify current levels.