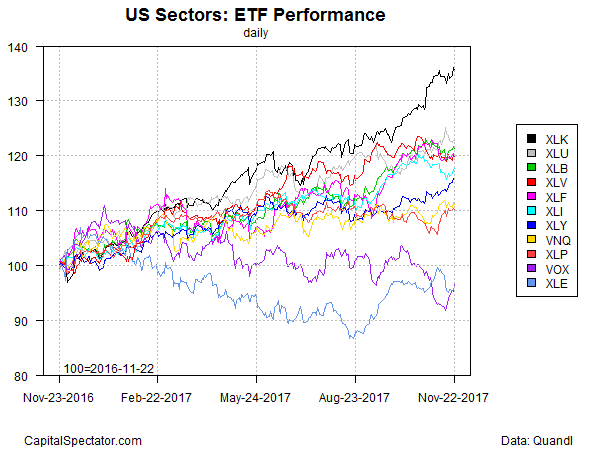

Technology shares have surged recently, leaving the rest of US equity sectors in the dust, based on a set of ETFs. Sector leadership appeared to be shifting to tech from financials at the end of last month. Nearly four weeks later, the transition is complete and there’s no doubt which sector dominates the upside momentum rankings for one-year performances.

For one-year return, for instance, Technology Select Sector SPDR (NYSE:XLK) is up a red-hot 36.3% for the year through Nov. 22. The second-strongest performer, utilities, is currently posting a solid 24.0% total return for the trailing one-year window. Impressive, but that pales next to tech’s performance of late.

Meantime, weakness in relative terms continues to weigh on most of the other sectors as the trading year heads into its final run for 2017. Seven of 11 sectors are trailing the broad market (based on the SPDR S&P 500 (MX:SPY) (NYSE:SPY) ETF in year-over-year terms, including two instances of red ink.

Telecom and energy have lost ground as of Wednesday’s close vs. the year-earlier price. By contrast, all the sectors were posting annual gains at the end of October.

Tech’s strong performance is conspicuous in the performance chart below. As horse races go, XLK’s recent run (black line at top of chart) is far and away the field’s strongest.

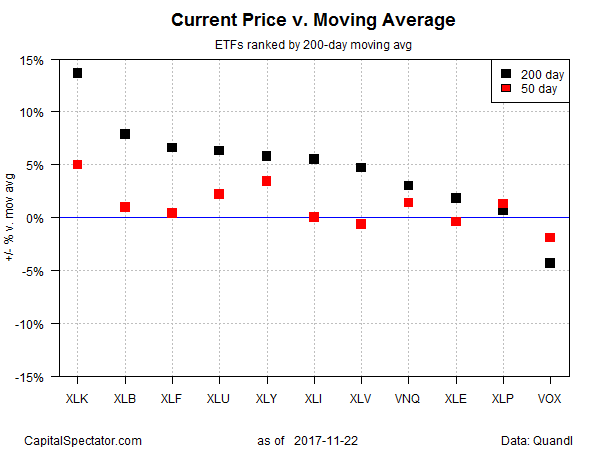

Ranking the sector ETFs by current price relative to 200-day moving average also shows tech’s outsized leadership. As of Nov. 22, XLK’s price is trading close to a 15% premium over its 200-day average – substantially above the equivalent numbers for the rest of the sectors.

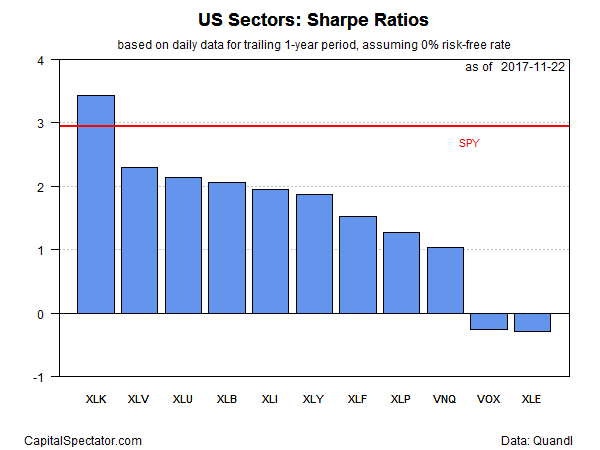

It’s no different for risk-adjusted results. Ranking the sector ETFs based on one-year Sharpe ratio (SR) also lifts tech stocks to a strong leadership position. Indeed, XLK’s 3.4 SR for the past 12 months is in nose-bleed territory relative to the other sectors. Technology Select Sector SPDR’s SR, for example, is nearly 50% higher than the second-highest Sharpe ratio for sector funds (Health Care Select Sector SPDR (NYSE:XLV)).