Tech has been a strong performer for most of the year, but in recent weeks its outperformance has accelerated over the rest of the major US equity sectors, based on a set of exchange traded funds.

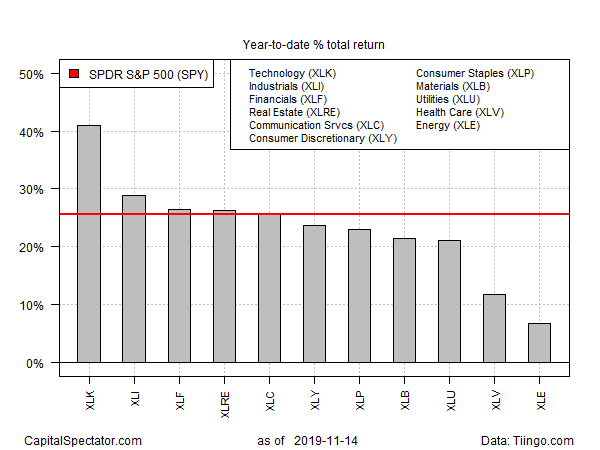

Technology Select Sector SPDR (Technology Select Sector SPDR (NYSE:XLK)) is riding high at the moment with a sizzling 40.1% total return year to date as of yesterday’s close (Nov. 14). The ETF was already posting a solid gain in 2019 at this point a month ago, but in recent weeks the bull market for XLK went into overdrive.

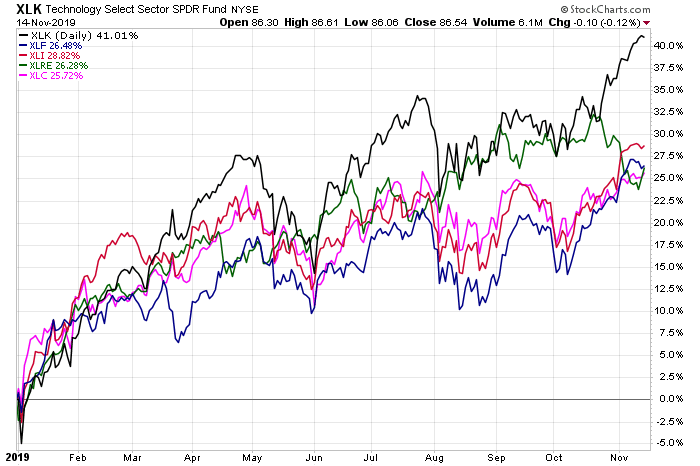

Consider, for instance, how the top-five sector ETF performances stack up this year. As the chart below shows, XLK’s lead (black line at top) has decisively widened lately.

Tech’s expanding lead is all the more impressive when you consider that all the US equity sectors are posting year-to-date gains.

Some analysts are concerned by tech’s strength and, by some measures, high valuation. “I do think technology is close to peaking out in the short run,” Mark Newton, president of Newton Advisors, told CNBC last week.

Nonetheless, XLK has continued to rally. The fund ticked lower in yesterday’s trading, but remains just a hair below a record high reached the day before (Nov. 13).

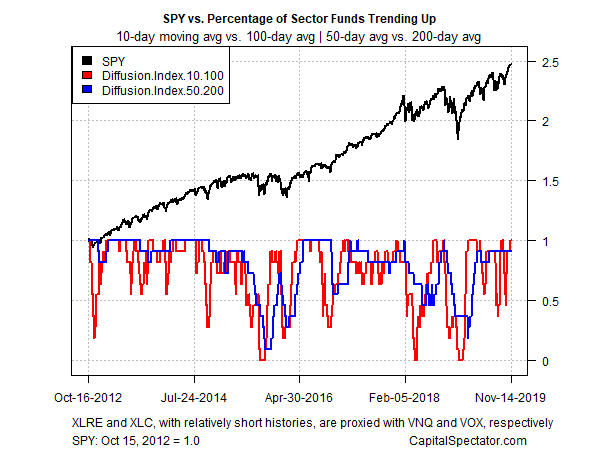

In fact, bullish momentum continues to inhabit most of the sector ETFs listed above, based on two sets of moving averages for the ETFs listed above. The first compares the 10-day moving average with its 100-day counterpart — a proxy for short-term trending behavior (red line in chart below). A second set of moving averages (50 and 200 days) represents an intermediate measure of the trend (blue line). As of yesterday’s close, the two indicators continue to reflect positive momentum generally. Indeed, all the funds are reflecting an upside bias via the short-term profile and all but one ETF is trending higher for the intermediate profile.