It is that time of year at colleges around the country. Students are taking final exams, packing to go home for the summer. Professors are frantically grading exams to meet deadlines. And inevitably when the grades get posted there will be some students that are shocked that they did not ace the final and get an A. Next comes the request for a regrade or even a retest. Usually tough conversations ensue.

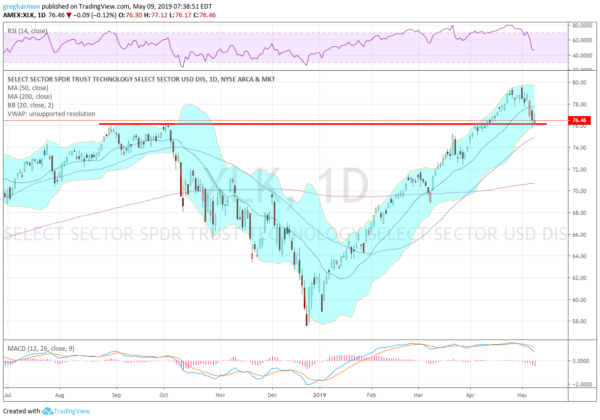

It is like that in markets as well. A good example of this is in the Technology Sector ETF, Technology Select Sector SPDR (NYSE:XLK). After topping in September of last year the ETF pulled back to a December low. Since then it moved nearly straight up. In early April it reached the prior high and barely paused before a break out to the upside. The move higher continued to late in the month and a new all-time high.

Whether it was an overbought market or tariff talks, the ETF has pulled back recently. And as of Wednesday’s close it was back to retest the break out level. True to form there are also ugly conversations occurring about further downside, and the recession debate is back. But will that play out?

While the easier path seems lower with both the current narratives and price action, it is notable to observe that there are many indications that this could be just a healthy digestive move in an uptrend. The RSI has retreated from overbought territory, and remains in the bullish zone as it starts to level out. The MACD is pulling back but remains positive. And the price has now touched the lower Bollinger Band®.

These combine to suggest if the drop stops this would be a good place for it to happen. No guarantees. No certainties.

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.