In simpler investing times, an investor purchased Treasury bonds for their reliable income stream. Today, the only reason to buy iShares 7-10 Year Treasury (IEF) is for the potential that worldwide demand can push yields lower and prices higher.

Similarly, there once was a time when dividends in technology stocks were a mere afterthought. You bought Apple (APPL) because it might go from $50 per share to $100; you accumulated shares of Microsoft (MSFT) because you believed that it would travel from $15 to $30.

However, the technology stock landscape is changing rapidly. Many large-cap tech mainstays that did not offer dividends for decades are now serving up 2%+ yields. And in an environment where a 10-year note produces a meager 1.75%, this “freebie” is fast becoming a critical component for total return.

For those who are less inclined to pick individual standouts, First Trust NASDAQ Technology Dividend (TDIV) may combine the best of stable tech brands and impressive dividend growth. What’s more, TDIV may have a compelling argument for equity income enthusiasts.

Traditional dividend funds and dividend ETFs typically rely on defensive economic sectors like utilities and consumer staples. Unfortunately, in an ultra-low rate environment, these segments may trade at an expensive premium; non-cyclicals can easily fall out of favor. It follows that equity income investors with traditional holdings should consider bolstering dividend-oriented tech in their portfolios to hedge against “yield myopia” and/or sharp sector rotations.

The idea has been catching on quickly. In roughly 4 1/2 months, TDIV has accumulated nearly $50 million in assets under management. And why not? Cash-rich behomoths from Microsoft (MSFT) to Intel (INTC) to Oracle (ORCL) to Cisco (CSCO) are undoubtedly capable of paying up.

First Trust NASDAQ Technology Dividend (TDIV) tracks an index that yields roughly 3%, though it carries an expense ratio of 0.5%. The probability of uneven distributions makes it difficult to gauge the exact payout across a 12-month span, though the 30-day SEC yield of 2.19% and the December payment suggest 2.25%-2.5% annually.

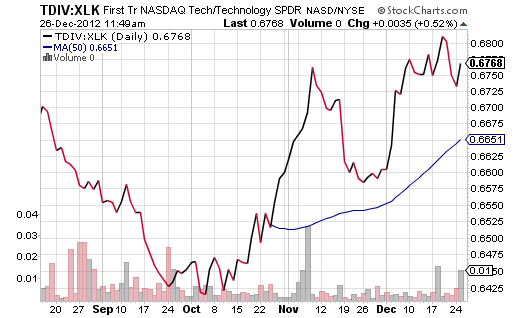

TDIV’s relative strength is evident when one compares the new exchange-traded vehicle with the grand-daddy of tech ETFs, SPDR Select Technology (XLK). The current price on the TDIV:XLK price ratio is at the top of its range and it is well above a 50-day trendline.

Investors may wish to keep in mind that this outperformance is in large part due to TDIV’s exclusion of Apple (APPL). The “i-everything” mega-cap first initiated dividends in 2012, meaning that it may not yet meet longevity requirements or dividend growth requirements for inclusion in the index that TDIV tracks. For the last 3 months of tax gain harvesting, then, ex-AAPL ETFs have succeeded.

Disclosure: Gary Gordon, MS, CFP is the president of Pacific Park Financial, Inc., a Registered Investment Adviser with the SEC. Gary Gordon, Pacific Park Financial, Inc, and/or its clients may hold positions in the ETFs, mutual funds, and/or any investment asset mentioned above. The commentary does not constitute individualized investment advice. The opinions offered herein are not personalized recommendations to buy, sell or hold securities. At times, issuers of exchange-traded products compensate Pacific Park Financial, Inc. or its subsidiaries for advertising at the ETF Expert web site. ETF Expert content is created independently of any advertising relationships.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Technology ETFs: Not Just For Capital Appreciation Anymore

Published 12/27/2012, 01:21 AM

Updated 03/09/2019, 08:30 AM

Technology ETFs: Not Just For Capital Appreciation Anymore

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.