Energy services company TechnipFMC plc (NYSE:FTI) reported second-quarter diluted earnings per share (excluding one-time items) of 45 cents, beating the Zacks Consensus Estimate of 38 cents. The improved results were driven by steady project executions, achievement of key milestones, efficiencies from its industry-leading solutions and cost reduction efforts.

First-quarter revenues of $3,845 million decreased from $4,959.3 million a year but were above the Zacks Consensus Estimate of $3,815 million.

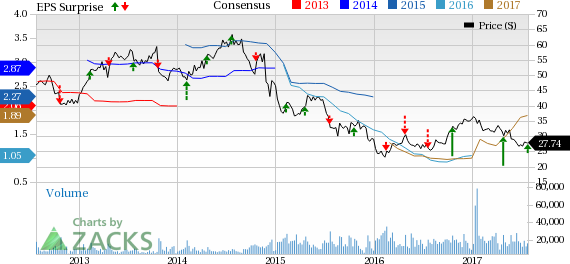

TechnipFMC plc Price, Consensus and EPS Surprise

Segmental Analysis

Subsea: The segment’s revenues for the second quarter were $1,730.3 million, reflecting a decrease of 28% from first-quarter 2016. Reduced project activities within Europe and Africa led to lower revenues. Operating profit came in at $236.1 million, down 9.8% year over year.

Onshore/Offshore: Segment’s revenues, at $1,812.9 million, were down 19.8% year over year. Revenues declined due to the completion of several projects in the prior-year period, notably in the Middle East and America. However, operating income jumped 227.2% to $204.5 million on improved profitability on the back of achievement of key construction milestones.

Surface Technologies: The segment’s revenues for the second quarter were $300 million, 1.3% below first-quarter 2016 sales of $303.8 million. However, a favorable product mix and a leaner cost structure helped the company to reduce its losses to $1 million against $24.2 million incurred a year ago.

Backlog

As of Jun 30, 2017, TechnipFMC’s total backlog was $15,182.9 million compared with $15,076 million a year ago. Of this, backlog for ‘Onshore/Offshore’ was $8,582 million, while ‘Subsea’ and ‘Surface Technologies’ backlogs were $6,186.8 million and $414.1 million, respectively.

Capex & Balance Sheet

In the reported quarter, TechnipFMC spent $56.3 million on capital programs. As of Jun 30, the company had cash and cash equivalents of $7,179.1 million and long-term debt of $3,301.3 million, with a debt-to-capitalization ratio of 19.5%.

Guidance for 2017

TechnipFMC projects its revenue for Onshore/ Offshore segment to be at least $7.3 billion in 2017. Subsea and Surface Technologies are expected to generate revenues of $6.1 and $1.4 billion respectively for the year. Estimated capex budget for 2017 is $300 million.

Zacks Rank and Key Picks

London-based TechnipFMC is a leading manufacturer and supplier of technology solutions for the energy industry. The company currently carries a Zacks Rank #3 (Hold).

Some better-ranked players from the broader energy space include Braskem S.A. (NYSE:BAK) , Petróleo Brasileiro S.A. or Petrobras (NYSE:PBR) and SeaDrill Limited (NYSE:SDRL) . While Braskem and Petrobras sport a Zacks Rank #1 (Strong Buy), SeaDrill carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Braskem posted an average positive earnings surprise of 107.79% in the trailing four quarters.

Petrobras delivered an average positive earnings surprise of 59.58% in the last four quarters.

SeaDrill reported an average positive earnings surprise of 97.13% in the last four quarters.

More Stock News: Tech Opportunity Worth $386 Billion in 2017

From driverless cars to artificial intelligence, we've seen an unsurpassed growth of high-tech products in recent months. Yesterday's science-fiction is becoming today's reality. Despite all the innovation, there is a single component no tech company can survive without. Demand for this critical device will reach $387 billion this year alone, and it's likely to grow even faster in the future.

Zacks has released a brand-new Special Report to help you take advantage of this exciting investment opportunity. Most importantly, it reveals 4 stocks with massive profit potential. See these stocks now>>

Petroleo Brasileiro S.A.- Petrobras (PBR): Free Stock Analysis Report

FMC Technologies, Inc. (FTI): Free Stock Analysis Report

Braskem S.A. (BAK): Free Stock Analysis Report

Seadrill Limited (SDRL): Free Stock Analysis Report

Original post