Wowww. What about that drop in gold.

The largest single day fall in just under THREE YEARS!

The drop has been today attributed to the Richmond Fed President Jeffrey Lacker’s urging of the central bank to hike interest rates again, even if the current data doesn’t warrant the move on the surface.

“While inflation pressures may seem a distant and theoretical concern right now, prudent preemptive action can help us avoid the hard-to-predict emergence of a situation that requires more drastic action after the fact.”

Lacker’s argument revolves around the fact that in early 1994, former Fed Chairman Alan Greenspan hiked interest rates even though core inflation was only running at a 2.2% annual rate and had been drifting lower. This preemptive move saw inflation capped and was argued as the reason for price stability that the economy has experienced since.

After sitting at major resistance into Jackson Hole, on the blog, we have been talking about playing for a breakout higher.

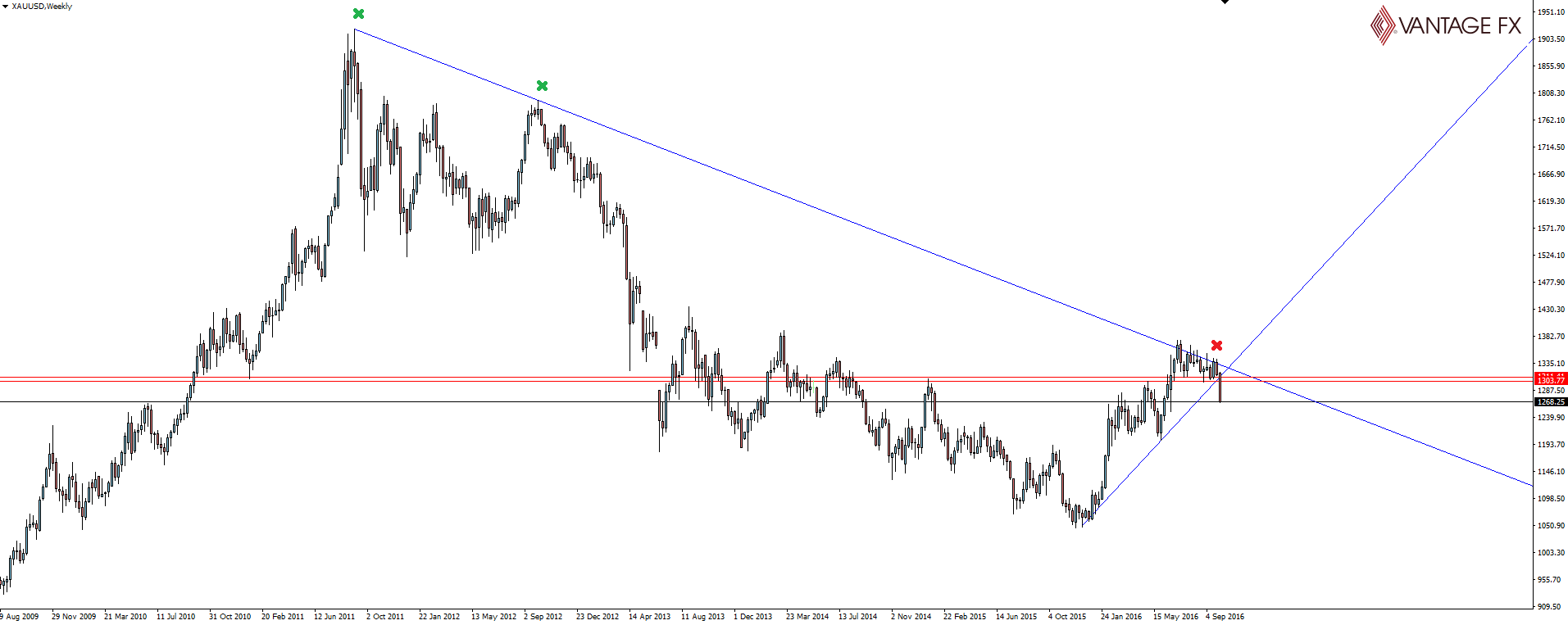

XAU/USD Weekly:

But with the major weekly resistance level holding…

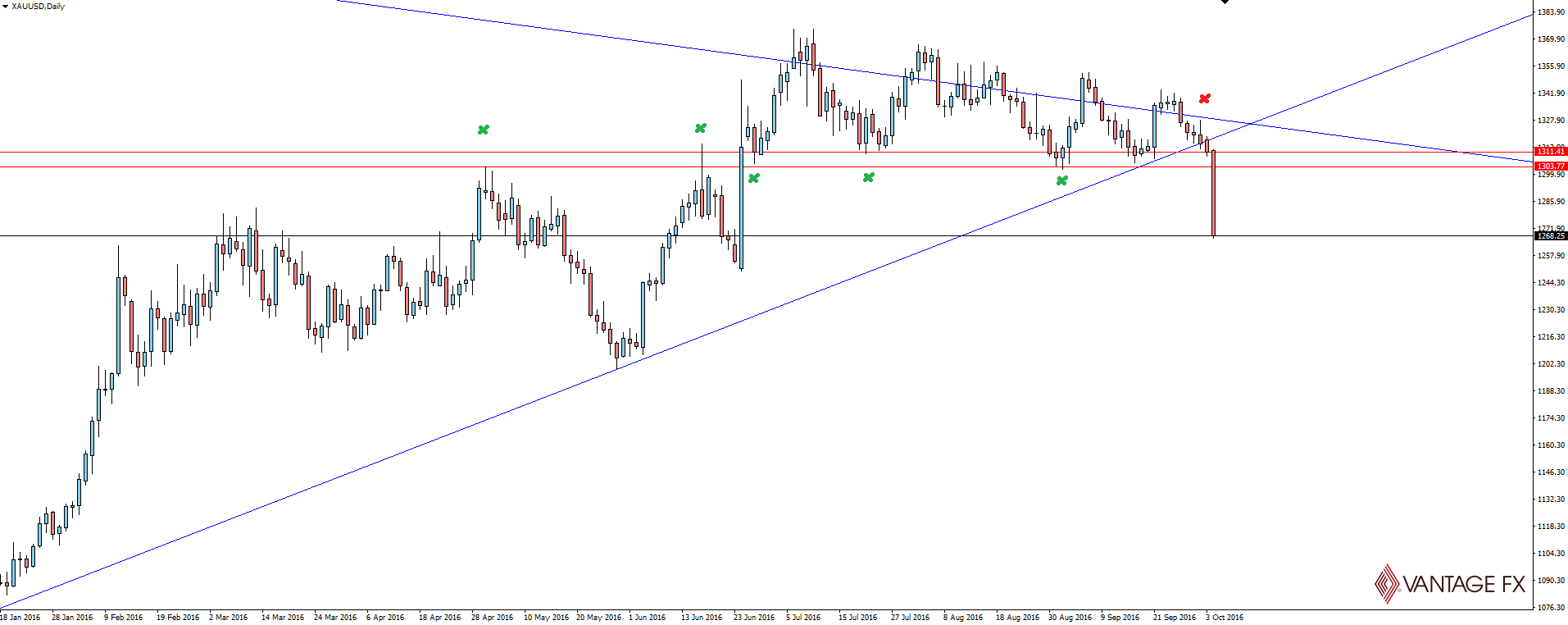

XAU/USD Daily:

And with the counter-trend, daily trend line giving way, the technicals have overtaken as the overriding reason why price was hammered in the way it was.

Now we’ve compared the US Dollar and Gold before and know that our SmartTrader Tools package shows the inverse correlation between the two markets.

If gold is getting smashed, then the USD is most likely going to bounce, right?

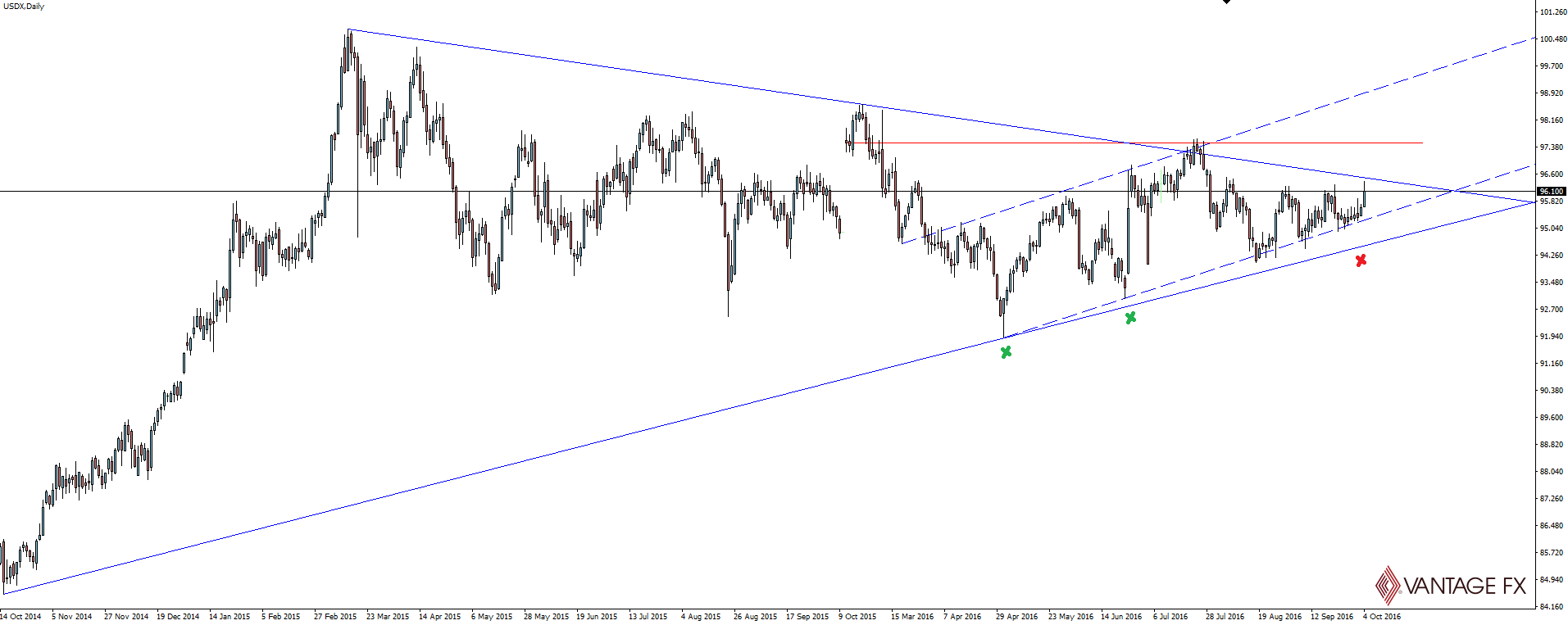

US Dollar Index Daily:

As you can see on the USDX daily chart, higher time frame support held and price has bounced up nicely. Exactly the same as Gold, but inverted. Beautifully illustrating how tied together global markets are even across the commodities/currencies asset class divide.

But… Yes, there’s always a but! As we know, comments from a regional Fed Presidents come and go within the weekly news cycle almost as often as we have hot dinners.

There is always trading opportunity in these moves and cycles. Just beware.

On the Calendar Wednesday:

CNY Bank Holiday

AUD Retail Sales m/m

GBP Services PMI

USD ADP Non-Farm Employment Change

CAD Trade Balance

USD ISM Non-Manufacturing PMI

USD Crude Oil Inventories

Dane Williams – @VantageFX

Risk Disclosure: In addition to the website disclaimer below, the material on this page prepared by Forex broker Vantage FX Pty Ltd does not contain a record of our prices or solicitation to trade. All opinions, forex news, research, tools, prices or other information is provided as general market commentary and marketing communication – not as investment advice. Consequently, any person acting on it does so entirely at their own risk. The expert writers express their personal opinions and will not assume any responsibility whatsoever for the Forex account of the reader. We always aim for maximum accuracy and timeliness, and FX broker Vantage FX shall not be liable for any loss or damage, consequential or otherwise, which may arise from the use or reliance on this service and its content, inaccurate information or typos. No representation is being made that any results discussed within the report will be achieved, and past performance is not indicative of future performance.