Technically Speaking For November 6

Dallas Fed President Kaplan is pleased that the yield curve's inversion is improving (emphasis added):

“I feel better with a more normally shaped yield curve,” Kaplan told Bloomberg News on Tuesday after speaking at an event in Dallas. Kaplan had voiced concern in the past that having the Fed’s benchmark policy rate above the entire Treasury yield curve was a warning that it had set rates too high...

“So now that we’ve got a 10-year in the 180s and a 2-year in the 160s -- much more in line with the fed funds rate -- I think it again reinforces to me that we’ve probably got an appropriate setting of the Fed funds rate now,” he said.

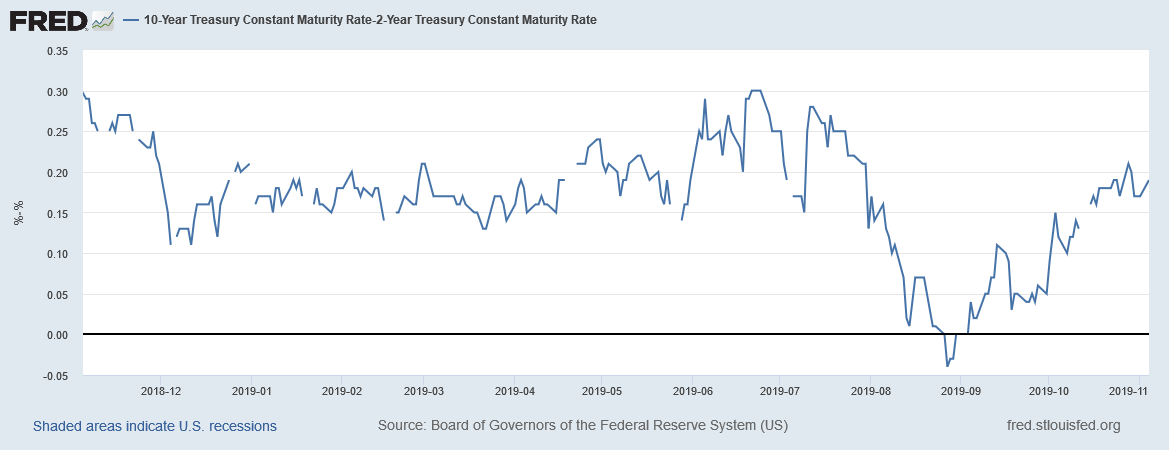

Various measures of the yield curve have been improving. The 10-2 spread -- cited above -- is widening:

Other measures of the yield curve's belly have widened recently and are a prime reason I lowered my recession probability in the next 6-12 months to 15%.

The latest round of Markit Economic Service Sector Indexes are mostly positive:

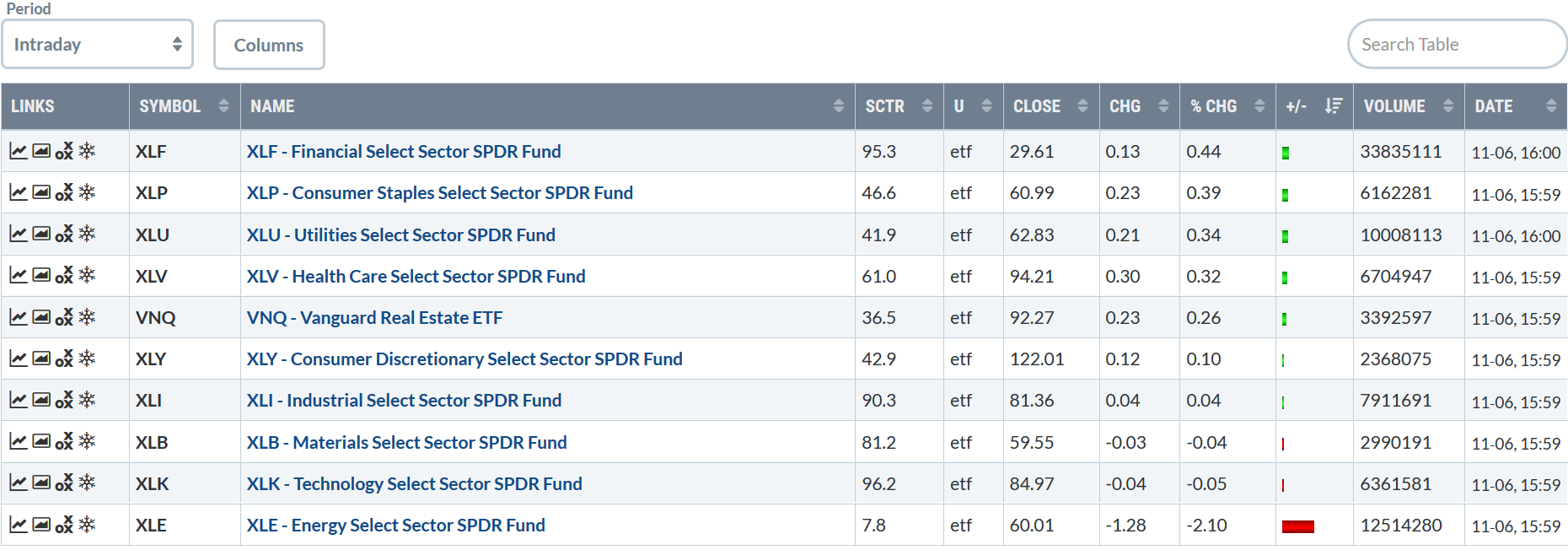

Sector performance is turning more bullish.

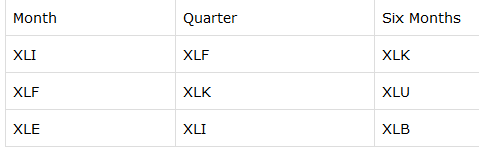

The following table shows the top three industry performers for the last month, quarter, six months:

Technology appears twice, as do financials and industrials. Energy and basic materials are also in the table. Utilities are the only defensive sector, and they only appear in the six-month time, meaning more aggressive sectors are rising in importance over shorter time spans. Overall, this is bullish, indicating that traders have more confidence in the underlying economy.

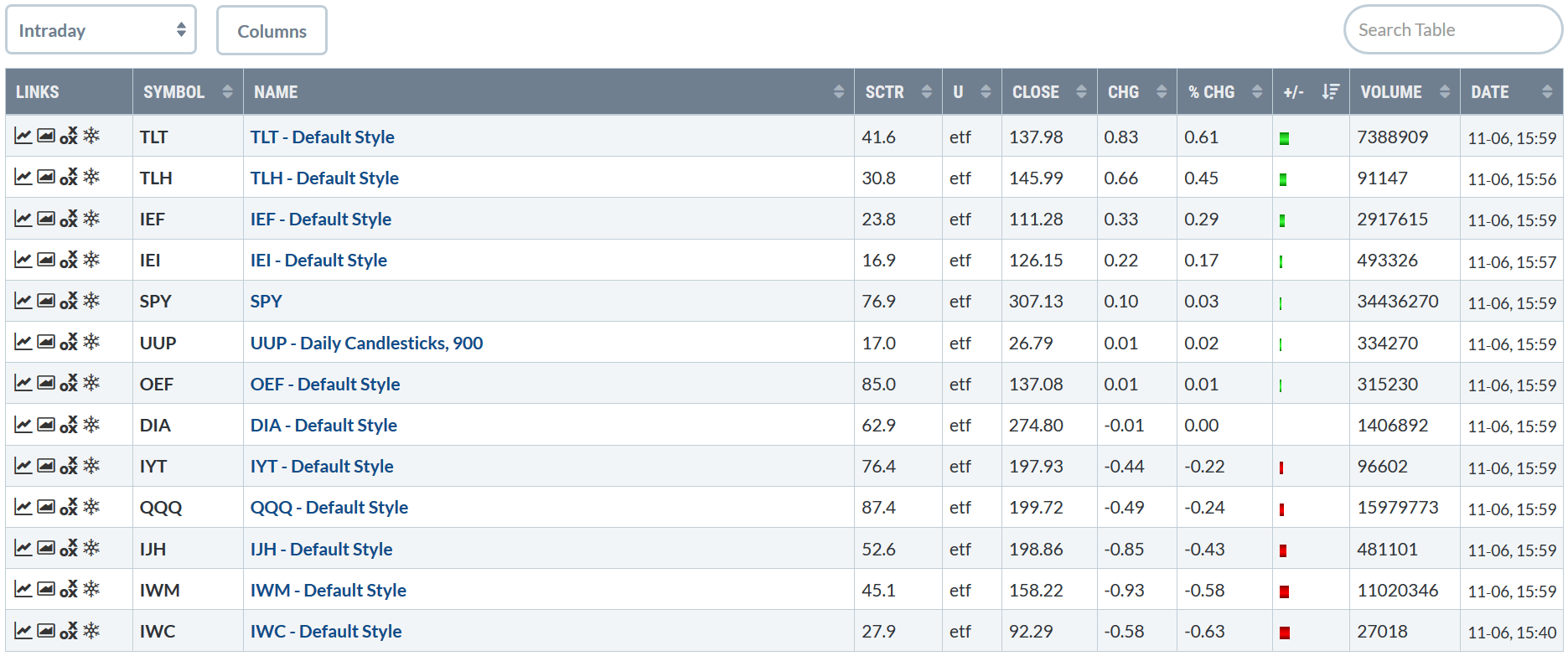

Let's turn to the performance tables:

Ultimately, this is more of a nothing day than anything else. The strongest gain was .61%; larger-caps were either unchanged or off modestly; smaller caps were down. Since the market is in a rally, this is more of a brief consolidation than anything else.

With the exception of the energy sector, the sector performance was the same as the index's -- up or down modestly. But the movement isn't anything to write home about.

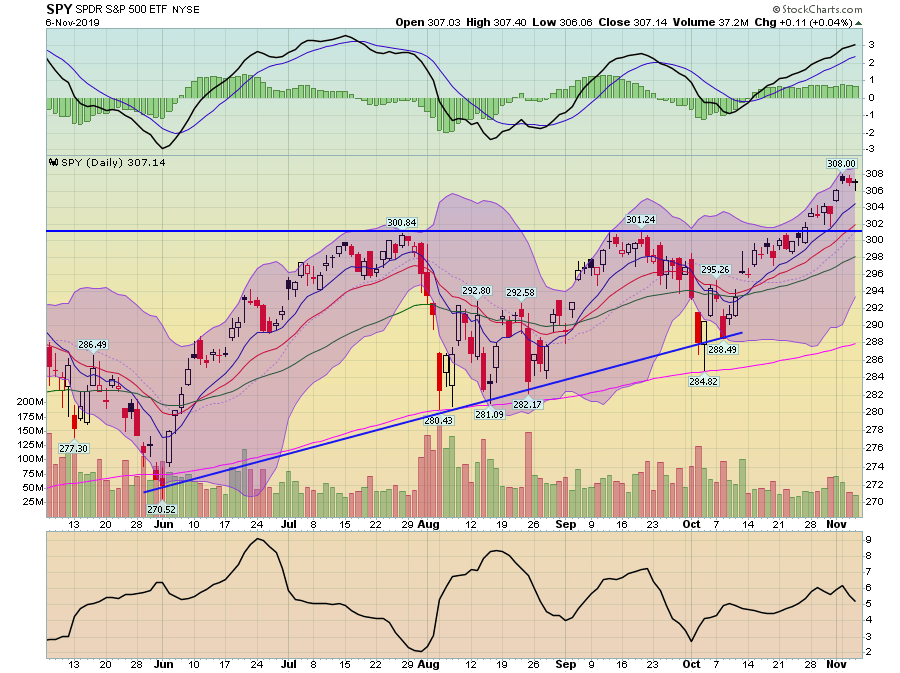

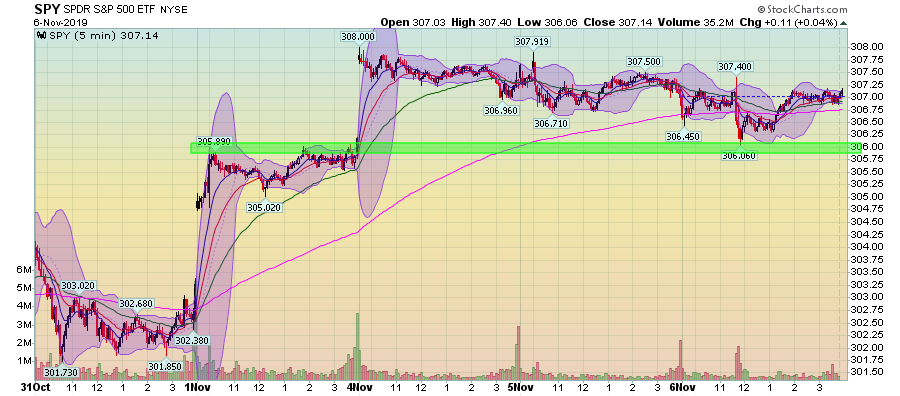

The charts show the consolidation pretty clearly.

SPY daily chart shows the break-out nine days ago and the consolidation that's occurred over the last three days. Momentum is still positive and the EMA picture is still very bullish (shorter EMAs are higher than the longer EMAs and all are rising).

Over the last three days, the SPY has trended modestly lower but remains above highs from November 1.

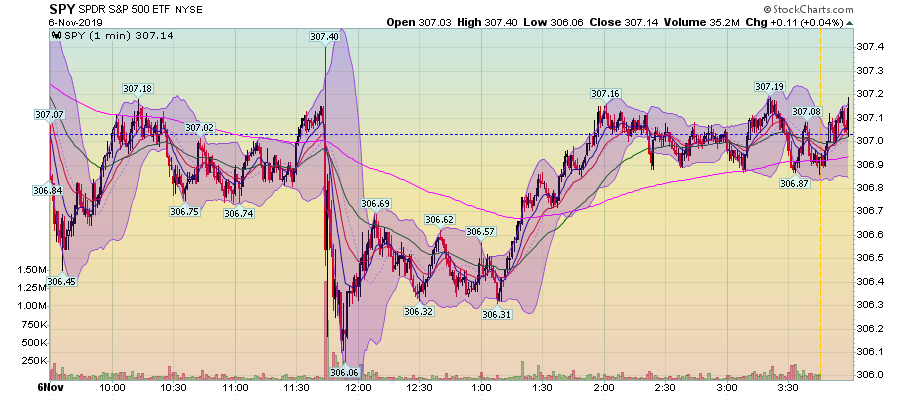

Finally, for the SPY, today's chart shows the "nothingness;" prices used yesterday's close (the dashed line) as a center of gravity for trading.

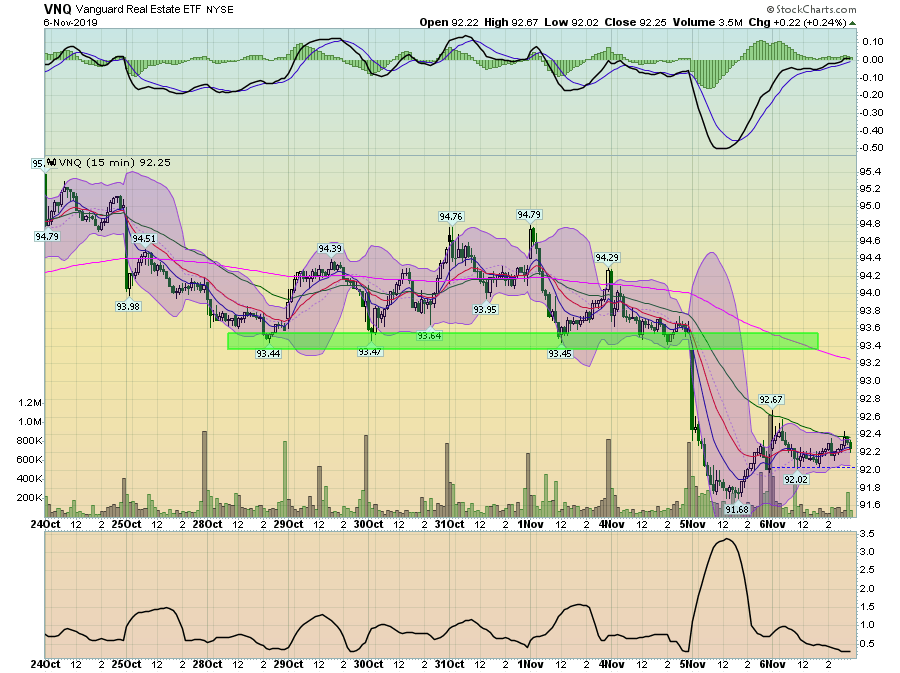

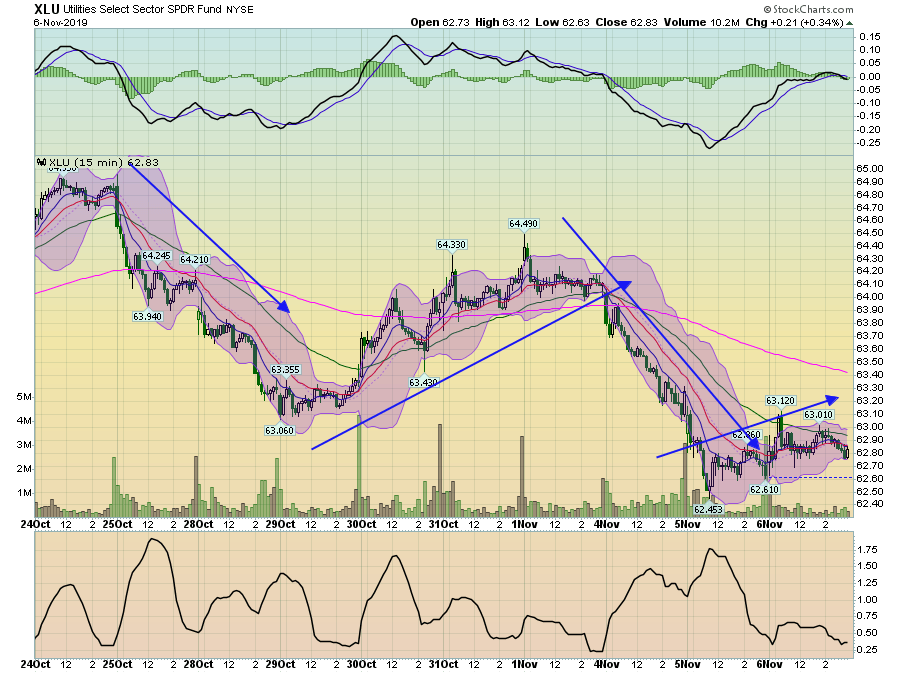

There is, however, an interesting trend occurring underneath the broader market: two defensive industries are in a 2-week downtrend.

The real estate ETF used the 93 level for technical support between October 28 and November 4. On Tuesday, prices dropped sharply and consolidated losses.

Utilities are in a clear move lower; they're printing a series of lower lows and lower highs.

While the bars on the daily chart are still a bit weak, the underlying trend is clear: the move higher is still intact and the market is solidifying gains.