Summary

- A group of state AGs are investigating Google for anti-trust violations.

States Attorney's General are banding together to investigate Google (emphasis added):

Fifty U.S. states and territories, led by Texas, announced an investigation into Google’s “potential monopolistic behavior.”

The Monday announcement closely followed one from a separate group of states Friday that disclosed an investigation into Facebook’s market dominance. The two probes widen the antitrust scrutiny of big tech companies beyond sweeping federal and congressional investigations and enforcement action by European regulators.

Two of the FANG stocks (Facebook (NASDAQ:FB) and Google (NASDAQ:GOOGL) are now firmly in the regulatory cross hairs. While it will be a long time until these investigations produce anything, the end result could be a break-up of Google -- the story specifically mentions that a possible solution could be to strip out the search function and turn it into a separate company.

Brexit is between a rock and a hard place. Boris Johnson has suspended Parliament. But Parliament has fought back aggressively: they have passed a bill that prevents a no-deal Brexit and voted to not have a snap election. Overall, Johnson is in a very difficult place. The EU Brexit deadline is quickly approaching. Johnson's stated goal of Brexit at all costs has been legislatively eliminated. He can't call a snap election to finish the purge of his party, and according to recent news reports, the EU isn't in a negotiating mood. I have no idea what happens next but the messy road to Brexit continues.

Does trade policy uncertainty hurt economic growth? A recent Federal Reserve study argues yes (emphasis added):

In sum, both the aggregate time-series analysis and the cross-sectional evidence suggest that higher trade policy uncertainty has adverse effects on GDP and investment, with these effects estimated to be protracted through time. This evidence is consistent with a large body of recent academic literature that documents the negative effects of other kinds of economic and policy uncertainty on economic activity. That said, the unprecedented size of the recent increases in trade policy uncertainty points to some degree of "uncertainty" around these estimates.

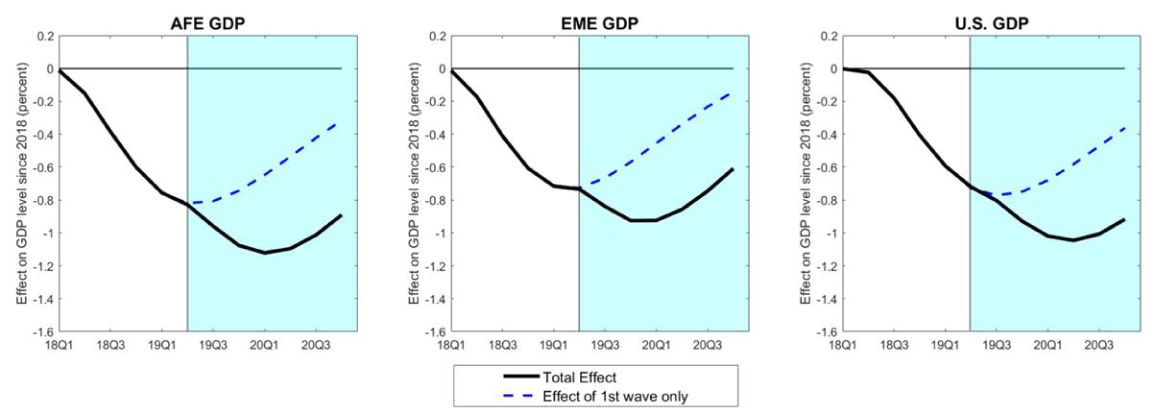

Here are the charts referenced above:

This shouldn't be a surprising outcome. We're already seeing some of this weakness in other reports -- low capital investment from business, which is leading to weaker industrial production.

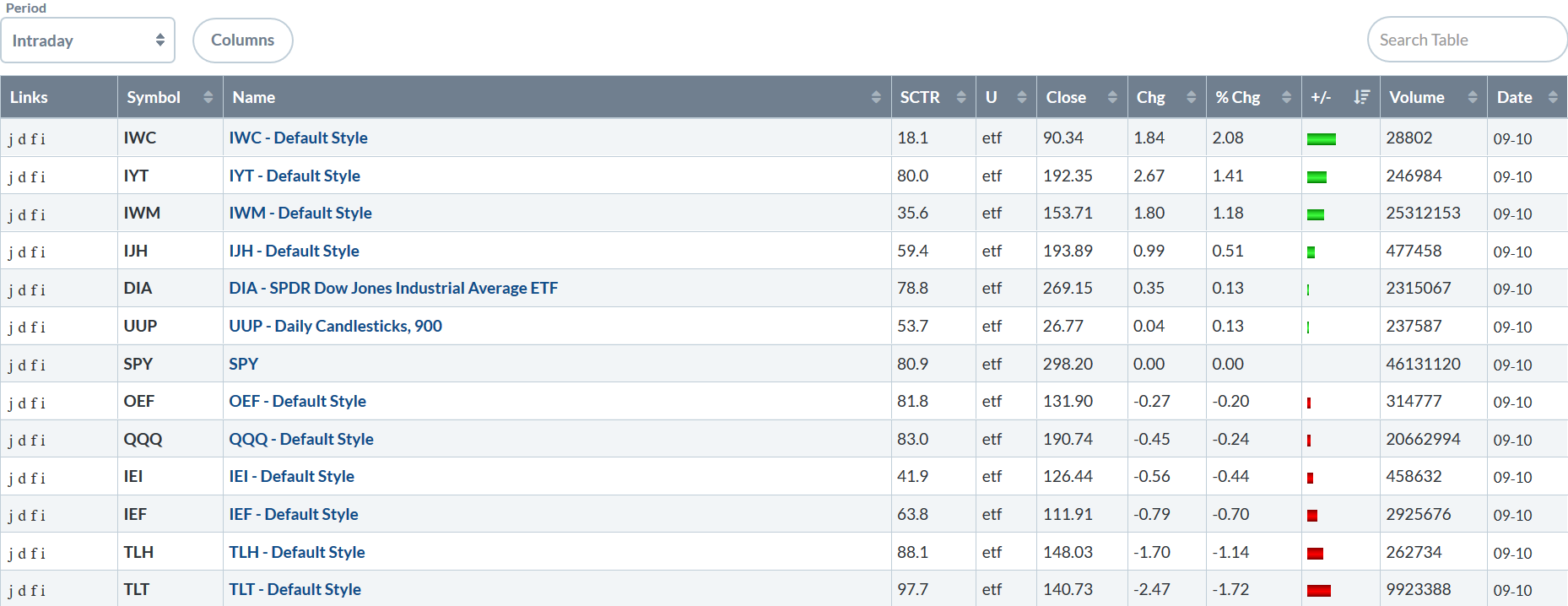

Let's look at today's performance table:

This is a really interesting table. The micro-caps led the market higher, gaining 2.08%. That was followed by the transports and small-caps. This is the first table in some time where the riskier equity averages have led the way higher by such a large margin. The larger-cap indexes were all lower. The Treasury market was the big loser, with the long-end of the curve dropping over 1%.

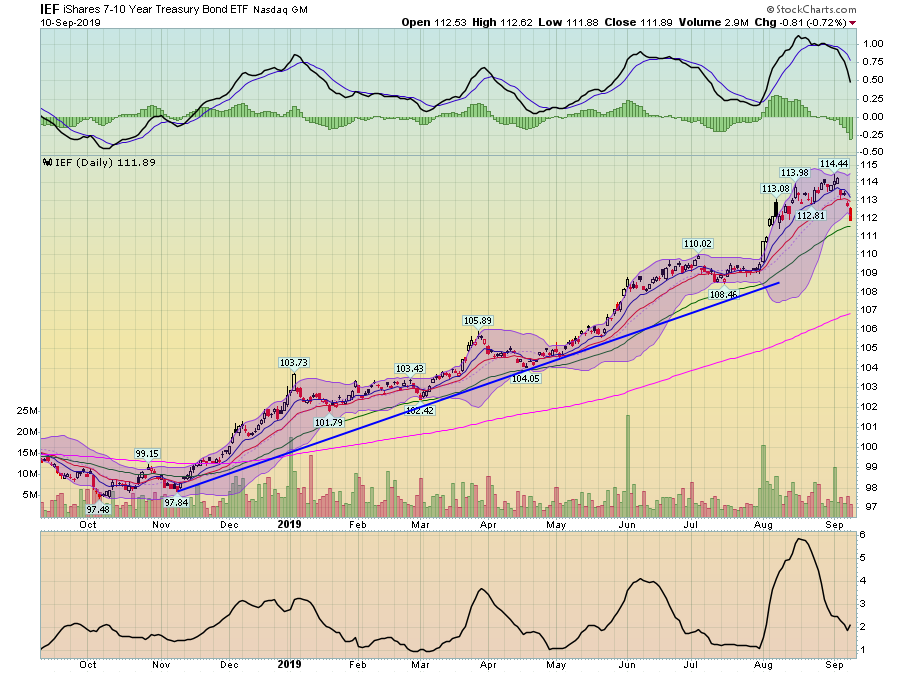

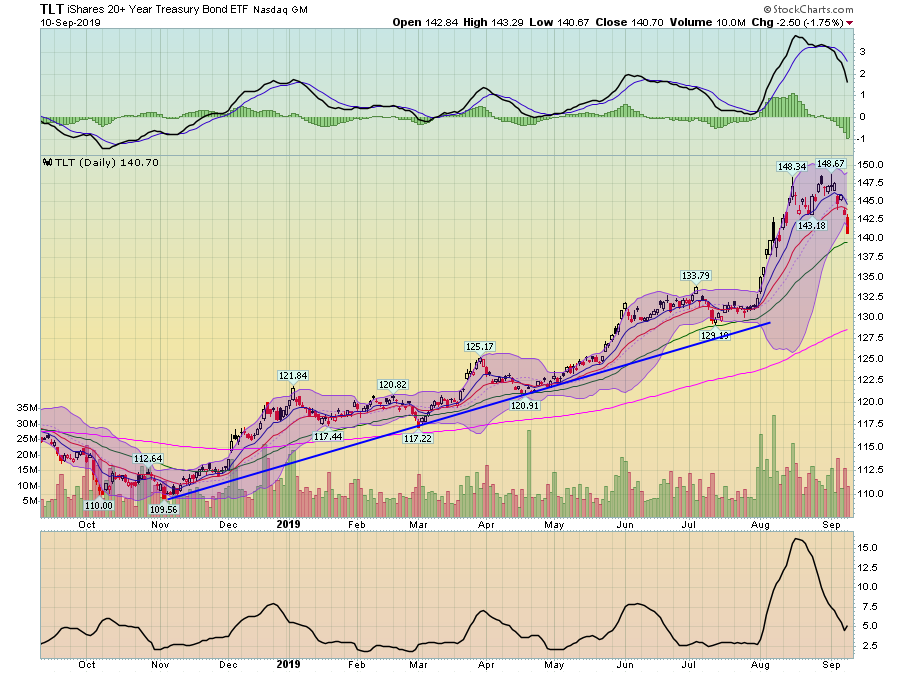

The big development right now is the selloff in the Treasury market:

The IEF peaked at 114.44 and has since been heading lower. Prices have moved through the 10 and 20-day EMA with declining momentum. There hasn't yet been an increase in volume.

The pace of decline on the TLT's is a bit faster.

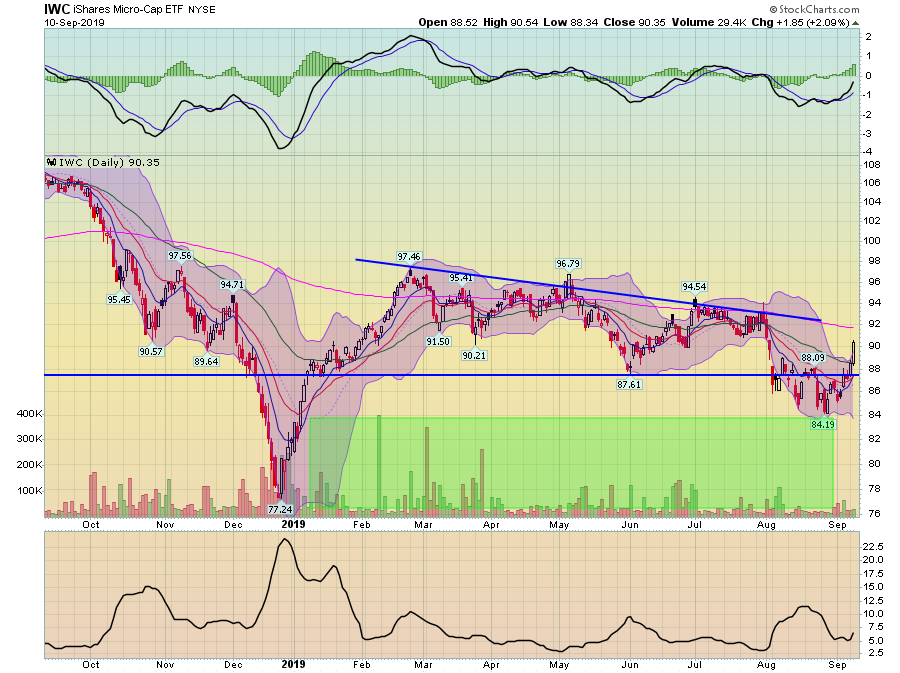

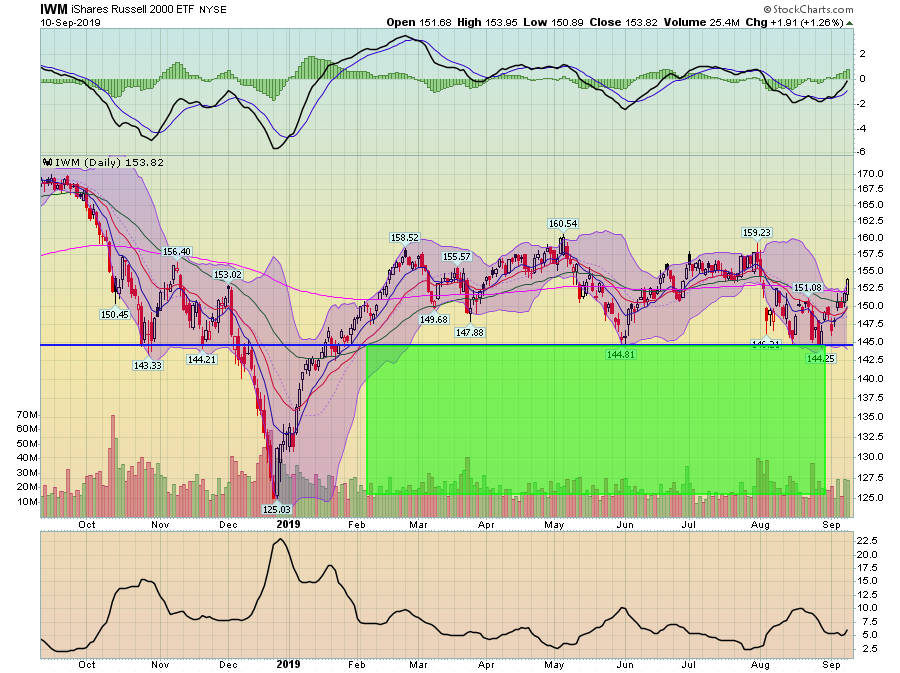

Then we have some solid movement in the smaller-cap indexes:

Micro-caps printed a very strong bar today. Prices are now firmly through the 10, 20, and 50-day EMAs.

Small-caps have moved through the 200-day EMA on fairly strong volume.

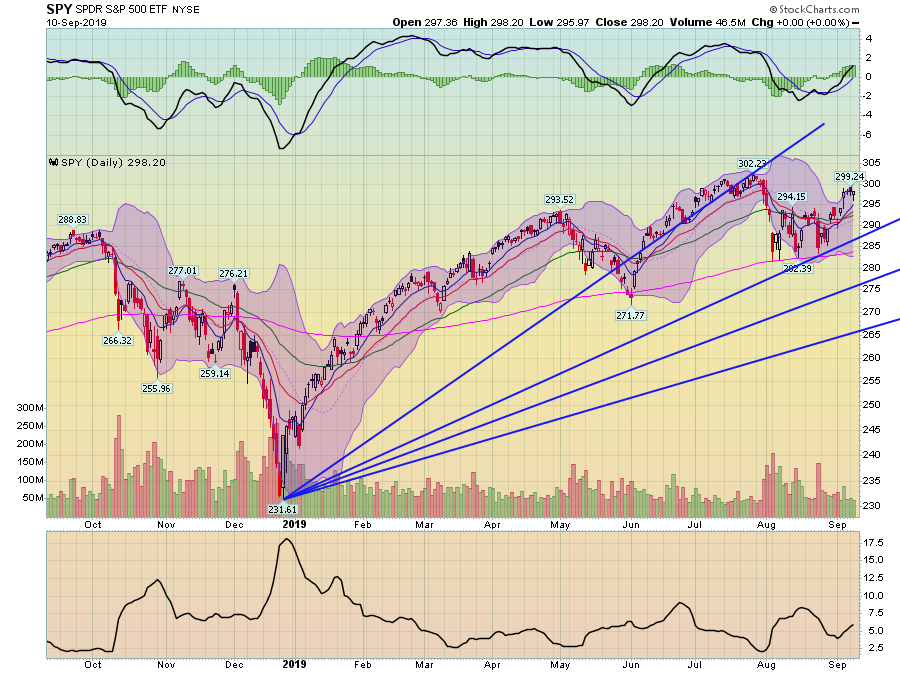

However, large-caps are lagging a bit:

The SPY has trended sideways for the last few days, not following the movement of the small-caps.

Despite the underperformance of the larger-cap indexes, things are moving in the right direction for the bulls. The best news is the Treasury market selloff, which indicates bond traders are taking some profits. And with small-caps making out-sized gains, it's reasonable to assume we'll see at least a few more gains for this part of the run.