Summary

- It's official: I've upped my recession chances for the next 18-24 months.

- A hard Brexit is looking more and more likely.

- There is a notable split in the performances of the major averages.

Well, I've formally gone on the record as arguing the possibility of a recession is now increasing. The reasons? Global equity markets - with the exception of the U.S. - are all lower. In addition, commercial paper remains elevated relative to the Fed funds rate, the Fed is hiking rates which is flattening the yield curve and, as of this week, building permits continue to weaken. I caution this simply means the possibility of a recession has increased. While I don't have a model that assigns hard percentages (or even odds), I'd currently place the probability at about 25-30% right now. As a commenter to the piece aptly noted, we're now seeing an increasing number of cracks.

Remember that economic shocks cause recessions. These can be oil price spikes (hello, OPEC), financial catastrophes (like when lenders extend a ton of credit to unworthy borrowers who then buy houses, assuming they will always increase in value), and the Fed "taking the punch bowl away" (like when your parents got home a day early to discover a massive party at your house). Let's add to that the possibility of a hard Brexit, which is kind of like the second category of risks and which is looking more and more like a real possibility. Here's the basic problem. The UK wants all of the benefits of EU membership without being a member of the EU. This is basically the "Chequers" plan the Prime Minister May recently floated. The EU simply won't allow that to happen. Why? Because then everyone would leave the friggin union, that's why. So, May was "humiliated" in her latest attempt to negotiate a Brexit deal. The result is that a hard-Brexit - where the UK is a member of the EU one day and not a member the next - is a growing possibility. And that, dear reader, would be a really bad situation for the global economy.

The OECD has slightly downgraded its growth projections for three reasons:

Economic growth prospects are now slightly weaker across the board than anticipated in May, when the OECD released its latest Economic Outlook. Escalating trade tensions, tightening financial conditions in emerging markets and political risks could further undermine strong and sustainable medium-term growth worldwide.

So far, problems that would be caused by trade tensions have been contained. You have to wonder how long that can continue with Trump continuing to increase the total amount of tariffs on imports. The rising dollar is clearly hurting some emerging markets. And then we have issues like the rising right-wing political movements across the EU, which, paradoxically, haven't led to an increase in calls to leave the EU. They have, however, increased the political stress.

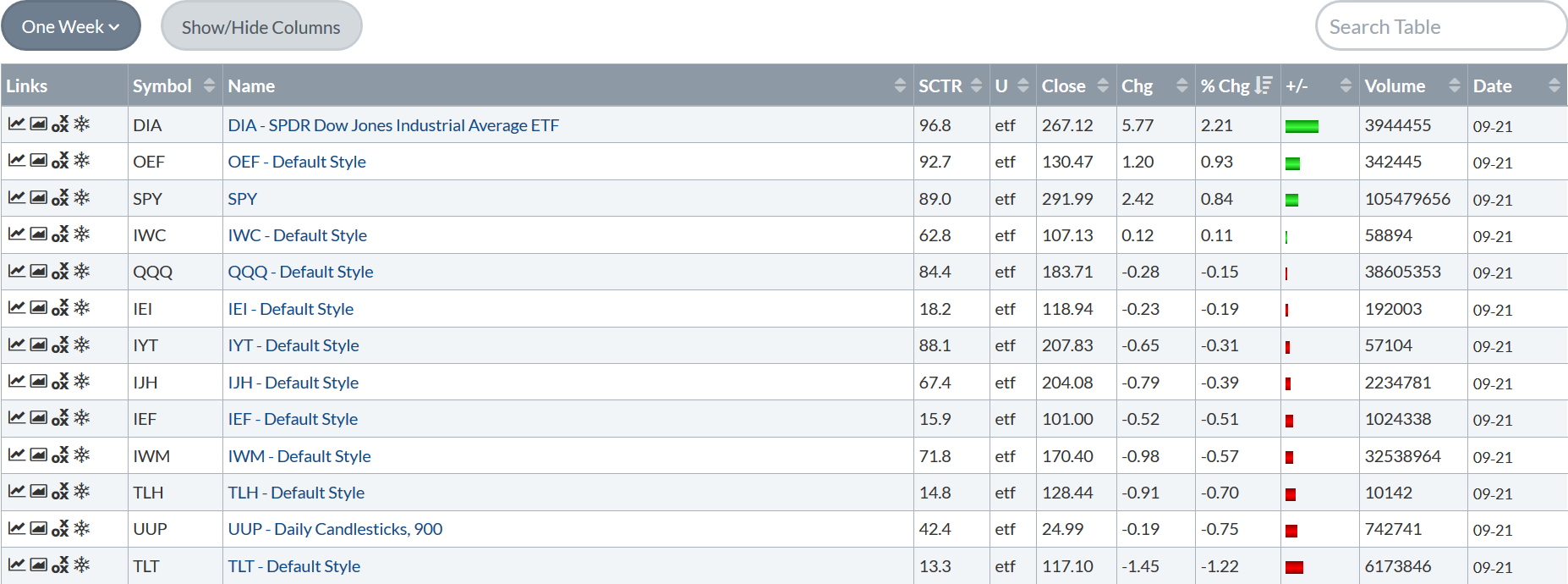

Turning to the markets, let's look at an end-of-the-week performance table.

Was this a good week? Sort of. The DIAs were up 2.21% - a solid performance. But that's about where it ends. The OEFs - another large-cap index - had the second best performance. But that was over 1% lower than the DIAs. And the SPYs were even lower. The QQQs? They were off marginally while the IWMs were down almost .6%. The best way to categorize this is "mixed." Let's look at the daily charts in order of weekly performance mentioned above:

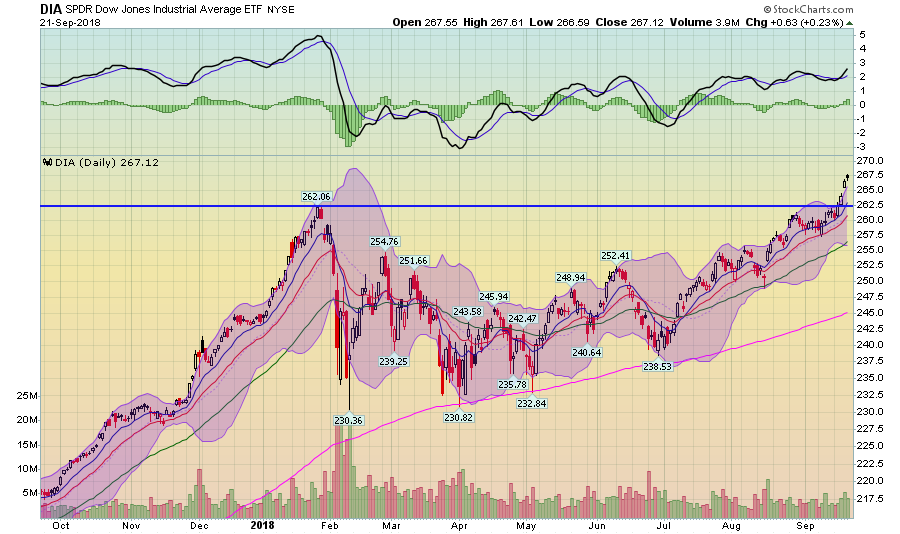

Let me begin with this: I hate the Dow. It's a dinosaur from a by-gone era that we should do away with yesterday. That being said, it's still reported. And, it also has a very bullish chart. Prices are over the highs from late January. The EMAs are bullishly aligned, prices are using the EMAs for technical support, and momentum is moving higher.

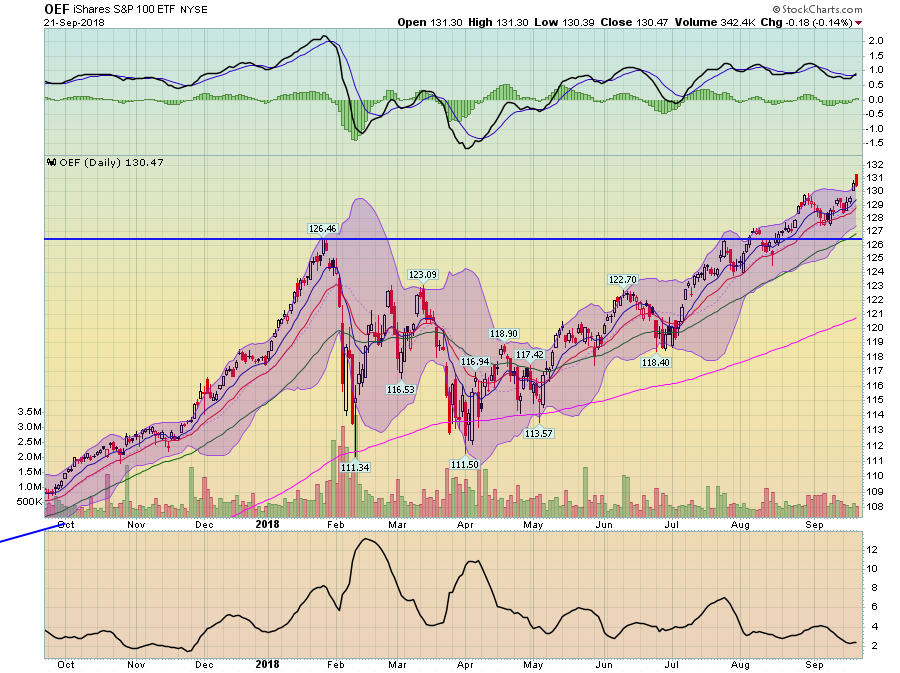

Next, here is the OEF:

Because this is a larger Dow-type average, its performance mirrors the Dow to a large degree. Notice, however, the volume has been low these last few days. This isn't a good development.

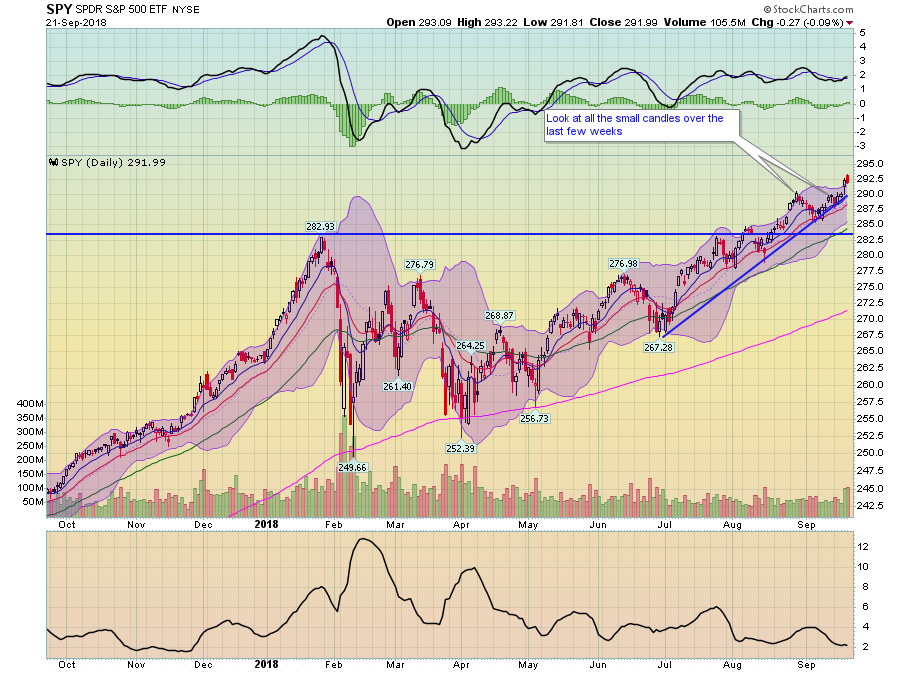

Above are the SPYs, which are also a lot like the Dow. Unlike the OEFs, the SPYs had a nice volume increase Thursday and Friday.

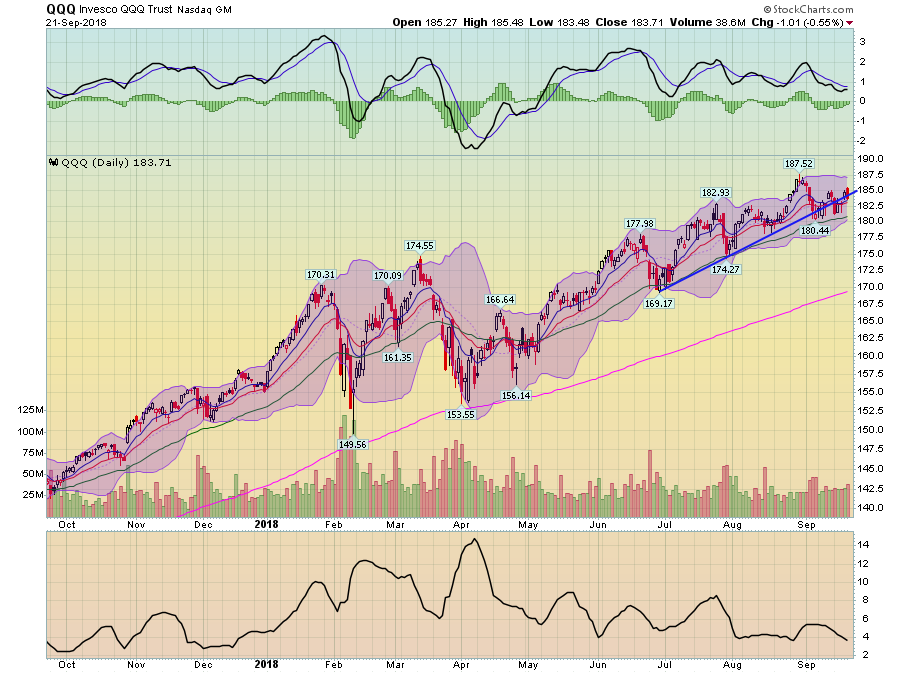

And then we have the QQQs:

This is not nearly as bullish. Prices are struggling to say about the trendline that connects the lows of late June, late July, and early September. While bullish, the EMAs are a little less so. Momentum is decidedly weaker.

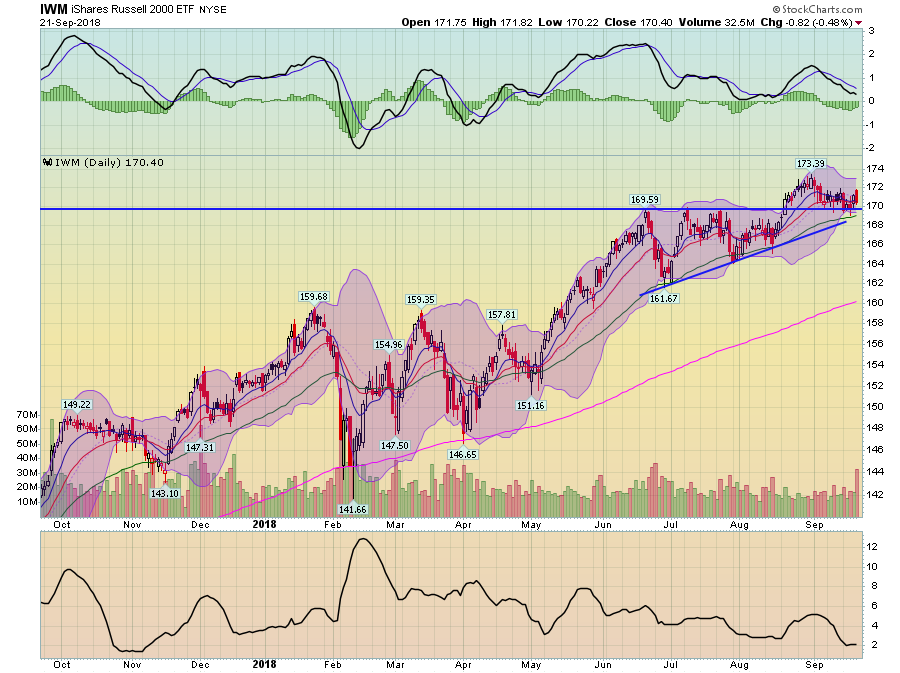

And then we have the IWMs...

...which are even more negative. The shorter EMAs are moving lower, as is momentum. Prices are in a short-term downtrend. And on Friday, they just couldn't keep the positive momentum going, despite a nice spike in volume.

This split between large, more-established companies and the more aggressive, growth-oriented market segments is a problem that the markets have to overcome to make a convincing bid higher.

Disclosure:I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.