Summary

- The markets were not affected by the rising trade tensions.

- The Beige Book said the economy was in good shape.

- Small caps are rallying; large caps, not so much.

If this week's European events had occurred six or seven years ago, global equity markets would have sold off mightily for fear of international contagion. Instead, markets are up modestly. You'll recall that the two winners in Italy's latest election could not form a coalition government, forcing the Italian president to nominate an ex-IMF technocrat to lead a "caretaker" government, which would hold power only until the country could hold snap elections. And in Spain, Prime Minister Rajoy was forced to resign after a no-confidence vote led to his ousting. While the markets took all of these events in stride, they do place the ECB in a modest policy bind. They had wanted to taper off their bond-buying program by September. This is probably still in on the table but rate hikes have definitely been pushed out a bit further.

And the international tension didn't end there. The Trump administration has stated it will levy tariffs on EU, Canadian, and Mexican goods, as well as certain Chinese imports. The EU had been trying to get the Trump administration to grant the trading block another extension but to no avail. And according to Canadian Prime Minister Trudeau, a new deal between the US and our neighbor to the north was scuttled when Vice President Pence demanded that a five-year sunset provision be included in the new deal -- a clause no sane trade negotiator would accept. As with the EU situation, the markets yawned, probably because they believe that Trump's imposition of tariffs isn't a current policy but is instead a negotiating tactic. Only time will tell if that analysis holds.

And the Federal Reserve released the latest Beige Book, which contained a positive assessment of the US economy.

Economic activity expanded moderately in late April and early May with few shifts in the pattern of growth. The Dallas District was an exception, where overall economic activity sped up to a solid pace. Manufacturing shifted into higher gear with more than half of the Districts reporting a pickup in industrial activity and a third of the Districts classifying activity as "strong." Fabricated metals, heavy industrial machinery, and electronics equipment were noted as areas of strength. Rising goods production led to higher freight volumes for transportation firms. By contrast, consumer spending was soft. Nonauto retail sales growth moderated somewhat and auto sales were flat, although there was considerable variation by District and vehicle type. In banking, demand for loans ticked higher and banks reported that increased competition had led to higher deposit rates. Delinquency rates were mostly stable at low levels. Homebuilding and home sales increased modestly, on net, and nonresidential construction continued at a moderate pace. Contacts noted some concern about the uncertainty of international trade policy. Still, outlooks for near term growth were generally upbeat.

This is a great assessment for an economy that is nearly eight years into an expansion.

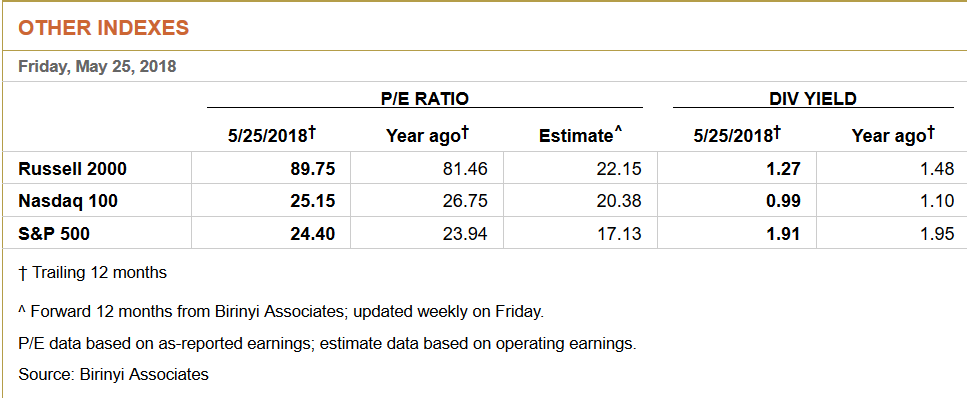

The markets remain expensive:

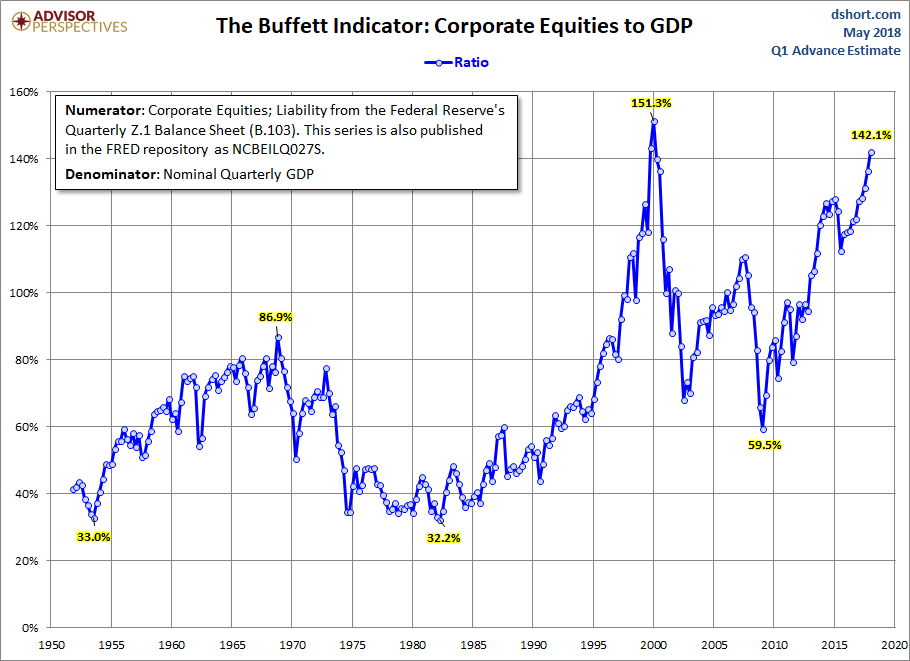

This isn't the only measure that shows an expensive market. Here's a graph of market cap to GDP from Adviser Perspectives:

Other valuation models show a similarly expensive market.

Despite their high costs, there are plenty of earnings to support prices. The 1Q18 earnings season was strong. The next few quarters also look bright:

- For the second quarter, companies are expected to report earnings growth of 18.9% and revenue growth of 8.6%.

- Analysts also currently expect earnings to grow at double-digit levels for the remainder 2018.

- For Q3 2018, analysts are projecting earnings growth of 21.1% and revenue growth of 7.5%.

- For Q4 2018, analysts are projecting earnings growth of 16.9% and revenue growth of 5.8%.

- For all of 2018, analysts are projecting earnings growth of 19.6% and revenue growth of 7.6%.

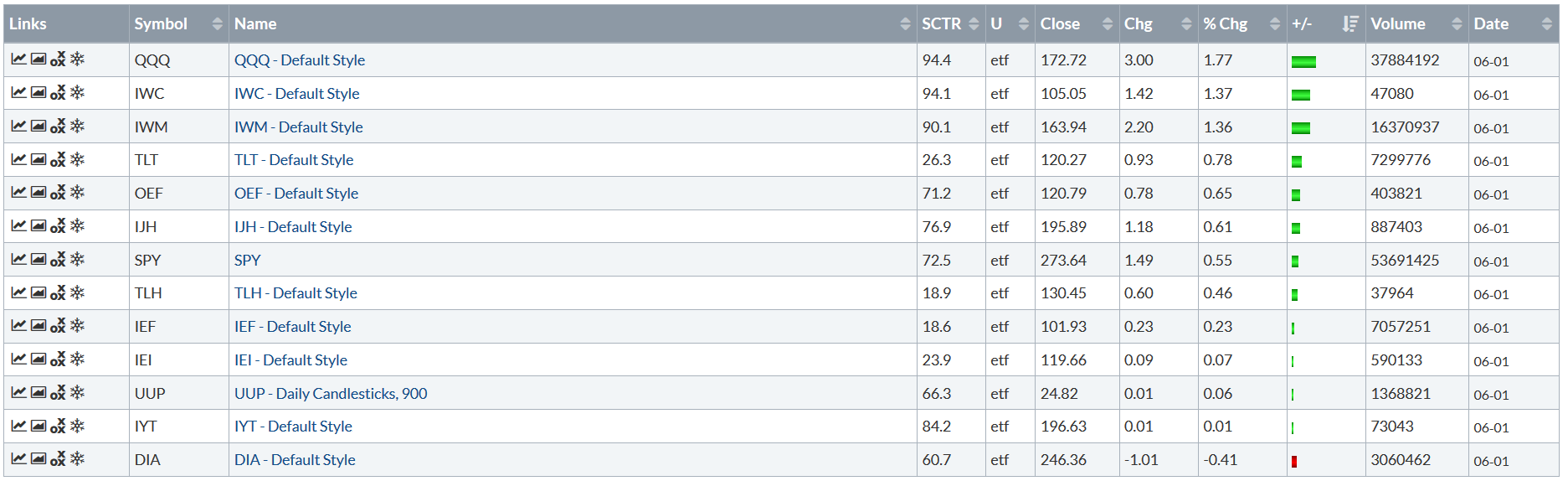

It was mostly a good week for the indexes:

The QQQs and the IWMs were the top two performers. The SPYs, while up for the week, were only mostly so. The Treasury market caught a safety bid from the EU situation.

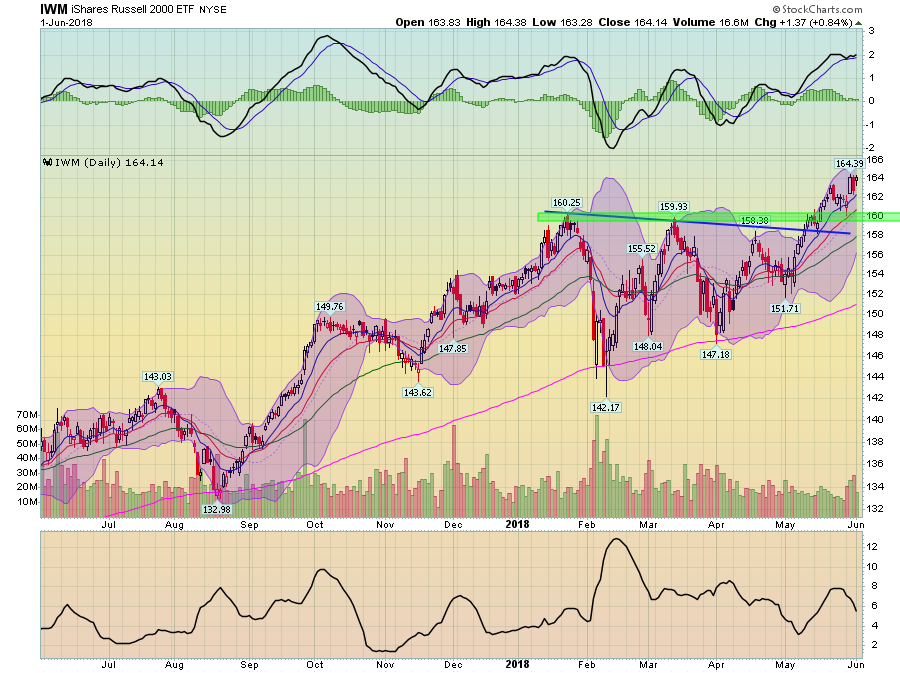

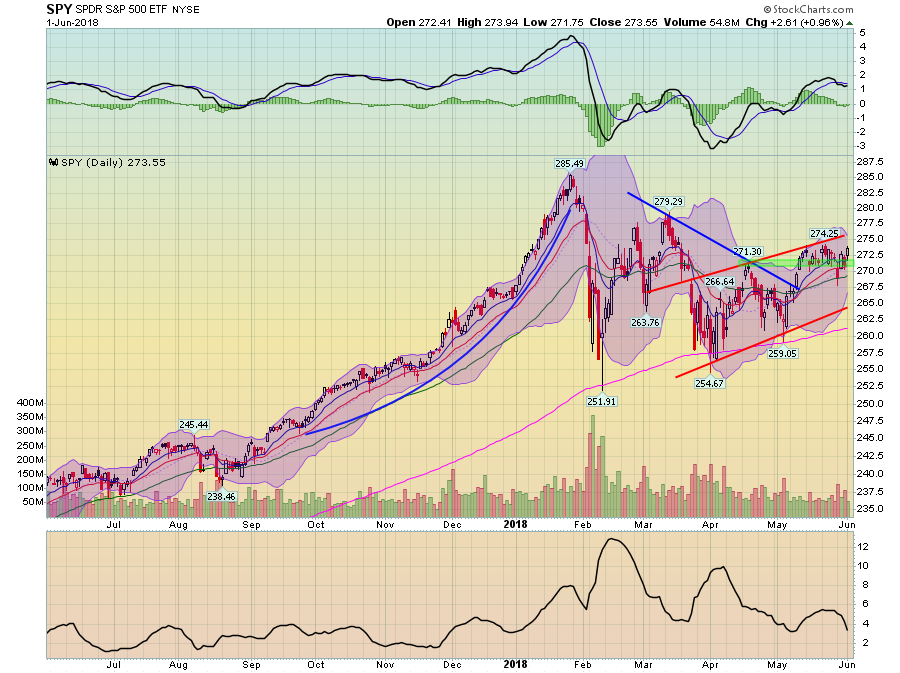

Turning to the charts, we actually have two different markets right now:

The IWMs are rallying. Since the beginning of May, they're increased 8.5%. Prices have moved through resistance at the 160 level and are using the 10-day EMA for technical support on the rally up.

In contrast, we have the SPYs, which are meandering. They remain below their end-of-the-year highs. And since the sell-off earlier this year, they just haven't seen a lot of upside action.

So, why the difference in performance? The big reason is trade. Russell 2000 companies derive a smaller percentage of their income from international sales, so the heightened trade tensions have less of an impact. The SPYs have companies with a much higher international exposure, so they'll be more exposed to higher trade tensions.

So, what's in store for next week? At this point, who knows? While the US economic news has been positive, growing trade tensions and the potential for political instability greatly complicate the mix.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.