Technically Speaking For The Week Of March 4-8Summary

- Although the jobs report was downright bad, the longer averages are still strong.

- The ECB publicly acknowledged that the EU economy is weakening.

- The markets are clearly in a correction.

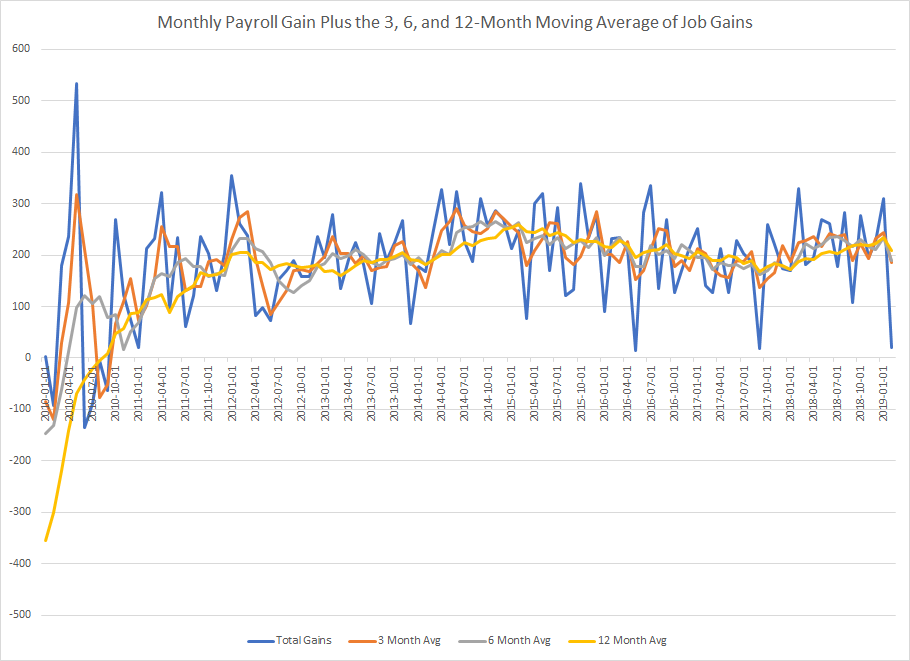

Despite the weak jobs report, the 3, 6, and 12-month moving averages of establishment job gains are still clustered around 200,000:

The 3, 6, and 12-month moving averages are 186,000, 190,000, and 209,000 respectively. That doesn't mean this report isn't concerning - in fact, it's the third weak report for a coincidental indicator released in the last month. However, the establishment job data can be very noisy, which is why I prefer moving averages, which smooth out the volatility.

The ECB announced additional stimulus measures due to weaker economic data. From the press conference on Thursday (emphasis added):

Euro area real GDP increased by 0.2%, quarter on quarter, in the fourth quarter of 2018, following growth of 0.1% in the third quarter. Incoming data have continued to be weak, in particular in the manufacturing sector, reflecting the slowdown in external demand compounded by some country and sector-specific factors. The impact of these factors is turning out to be somewhat longer-lasting, which suggests that the near-term growth outlook will be weaker than previously anticipated.

Central banks are notoriously circumspect with their public statements. When they do admit to weaker data, it's important to take notice.