Summary

While the trade war rhetoric is heating up, oil supplies are increasing.

It was an odd week from a performance perspective.

The overall market tenor is still positive.

Recessions are caused by shocks - events that are so large they gum up the natural flows of the underlying economy. Oil price spikes are the most common. Financial events - which caused the last two US recessions - also lead to downturns. A trade war would also do the trick, which is why the continued escalation in trade tensions is so scary for economists. This week, Trump stated he would tax an additional $200 billion in Chinese imports; the Chinese stated they'd retaliate. Then, on Friday, the NY Times reported that the EU has imposed tariffs on politically-sensitive items. We're now starting to hear stories about the negative ramifications of these developments. The reporting only focuses on individual companies so far. But expect the damage to begin spreading.

Thankfully, it looks like oil prices won't be a problem as OPEC has agreed to increase supplies:

OPEC meets Russia and other allies on Saturday to clinch a new deal raising oil output, a day after agreeing a production hike within the group itself but confusing the market as to how much more oil it will pump.

...

OPEC said in a statement that it would raise supply by returning to 100 percent compliance with previously agreed output cuts, but gave no concrete figures.

As I've noted several times before, oil price shocks were the primary causes of most recessions during the 1970s, '80s, and '90s (for more on this, please see the academic research of James Hamilton). But it looks like that won't happen this time around.

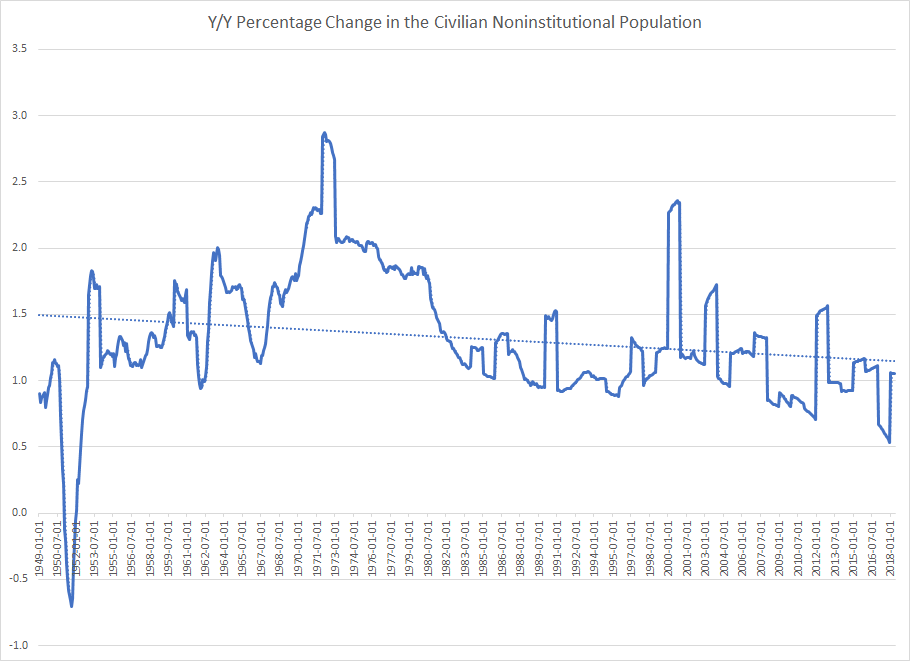

Believe it or not, the immigration debate has a strong economic component. Potential GDP is derived from two statistics: population growth and productivity increases. The more people a country has and the more productive its economy, the higher its potential economic growth. And the US has a population growth problem:

(Data from St. Louis FRED; author's calculations)

Above is a chart of the Y/Y percentage change in the noninstitutional civilian population from which the economy draws workers. The blue trend line is a linear regression of the trend, which is moving lower. We see the same trend with the longer moving averages:

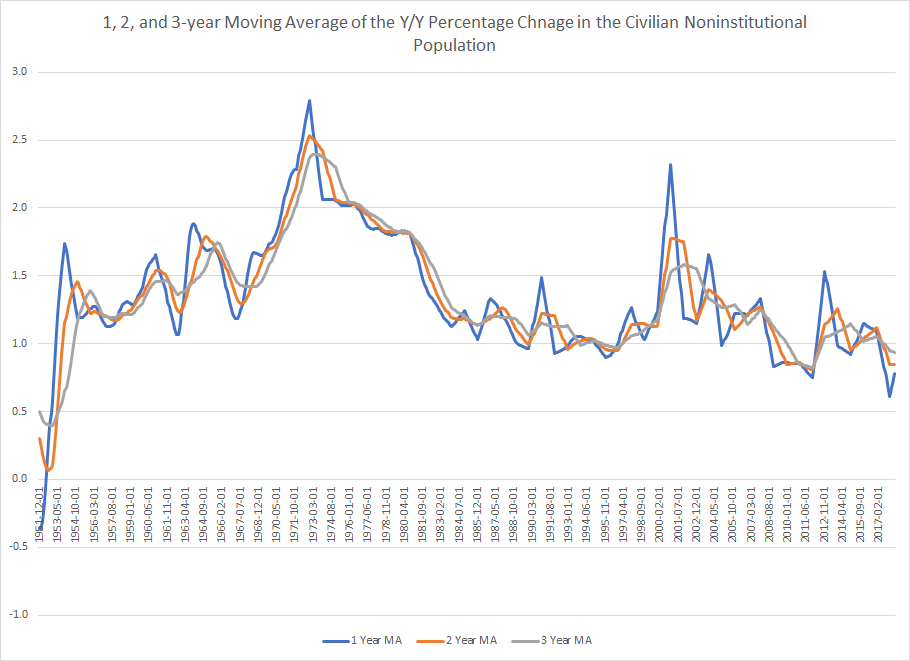

(Data from St. Louis FRED; author's calculations)

The 1-, 2-, and 3-year moving averages of the Y/Y percentage change in population growth are all moving lower. This partially explains why projected real GDP from any number of sources has been declining. Without an influx of new people, future US growth will be weaker.

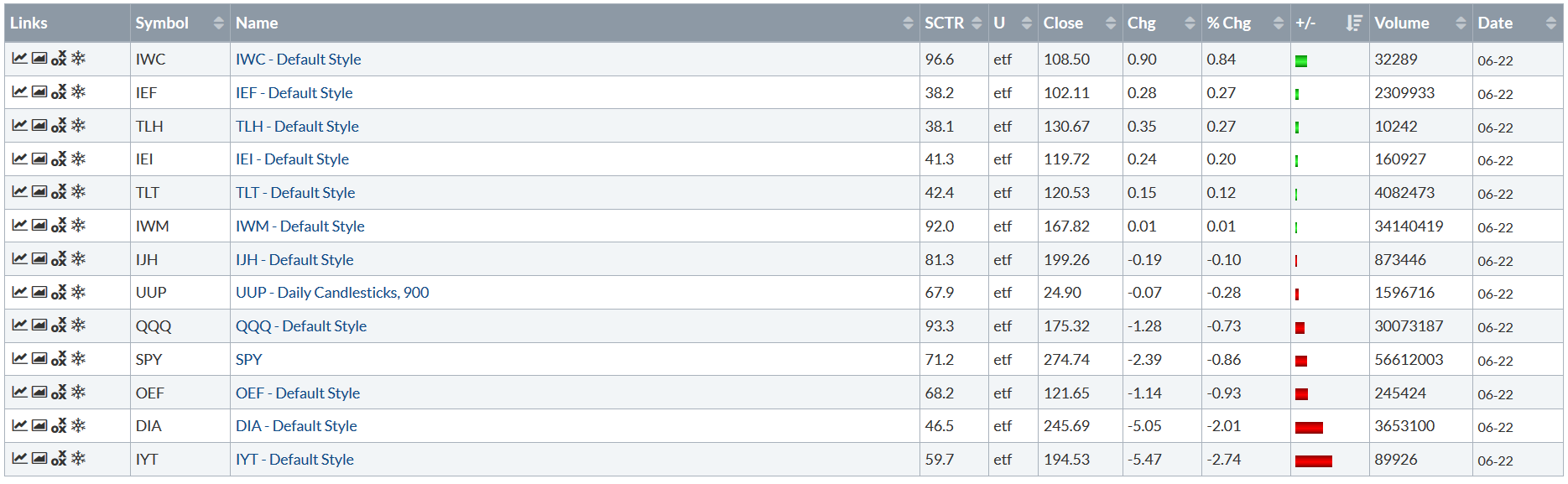

Turning to the indexes, this was an odd week:

Let's start with the obvious question: why is the iShares Micro-Cap (NYSE:IWC) up .84% when the iShares Russell 2000 (NYSE:IWM) - the other, large, small-cap ETF - has barely advanced? I have no answer for that. Aside from that odd development, the Treasury market outperformed stocks this week, with the major Treasury market ETFs up marginally. Transportation was the big loser this week largely due to ramped-up trade war rhetoric - increased tariffs translate into diminished trade and therefore fewer companies shipping goods from point A to point B. The DIA's weaker performance relative to the SPY shows the extreme disadvantage of having an index comprised of 30 stocks instead of 500.

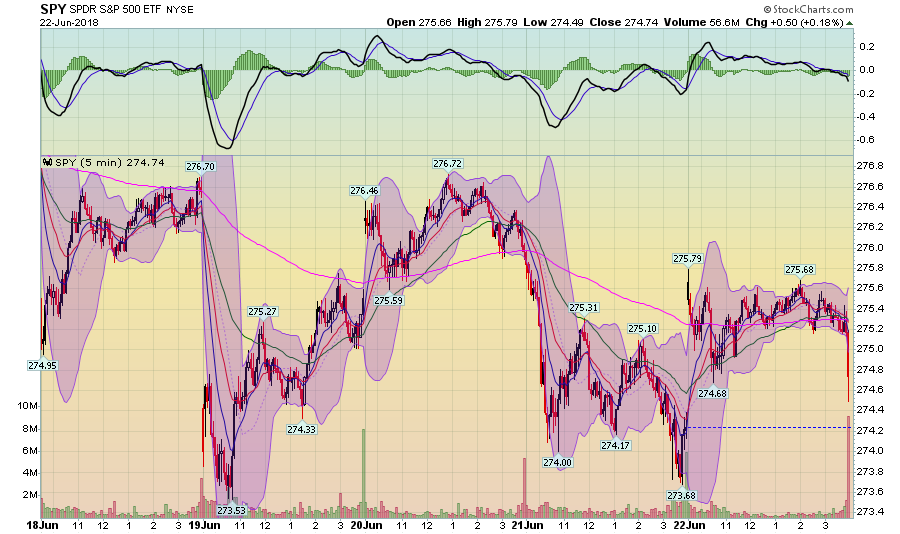

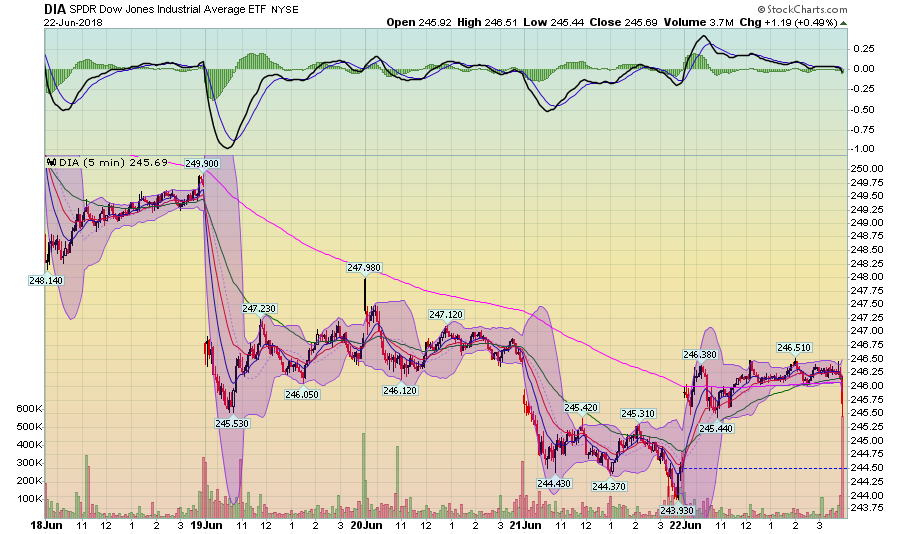

Let's turn to the charts, starting with this week's 5-minute time frame:

While there is a great deal of volatility in the chart, prices traded in a narrow 3-point range. The 200-minute EMA implies a slight downward bias, but only marginally.

Like the SPY, the DIA traded in a very narrow range - a mere 4 points. Here, prices dropped sharply at Tuesday's open and then traded sideways for the remainder of the week.

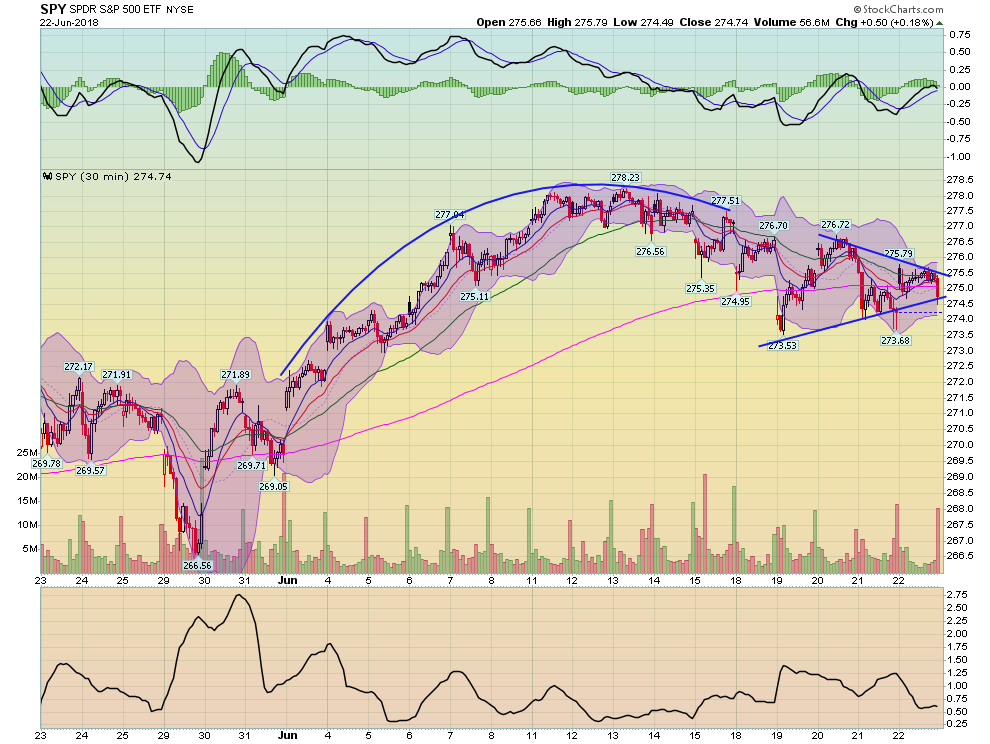

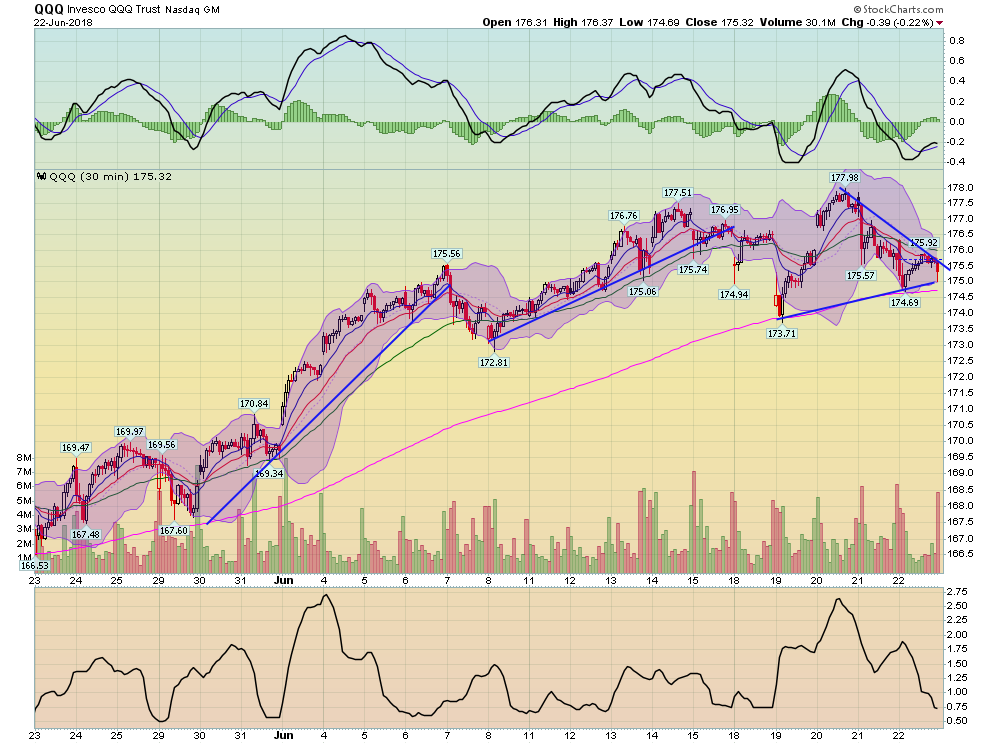

Next, let's look at the 30-minute charts:

The SPY formed an arc from late May through mid-June. Prices are now consolidating in a triangle pattern around the 200-minute EMA.

The QQQ have a somewhat stronger rally than the SPY. But prices are now consolidating as well.

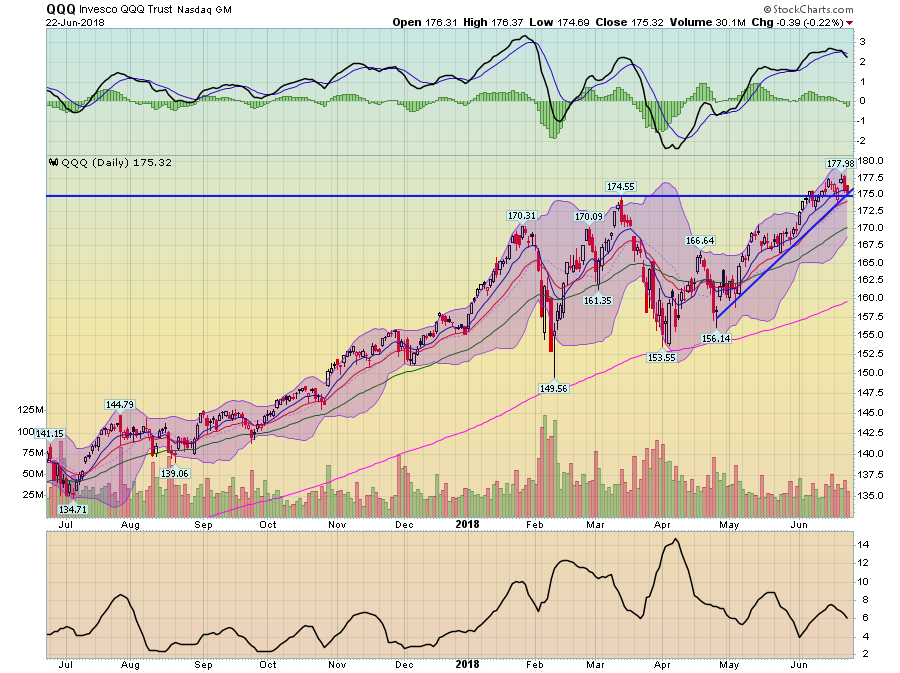

And finally, here are the daily charts:

After breaking through the 174.5 level, prices for QQQ are now falling back to the 10-day EMA. They're also using the trend-line connecting the early and late May lows. However, the MACD has given a short-term sell signal.

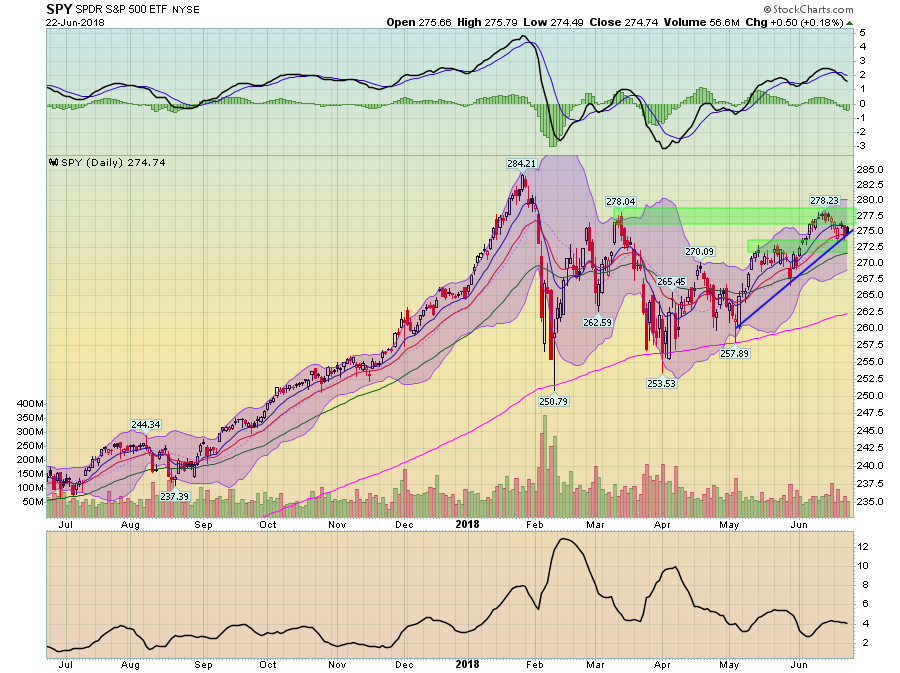

The SPY pattern is similar to the QQ.

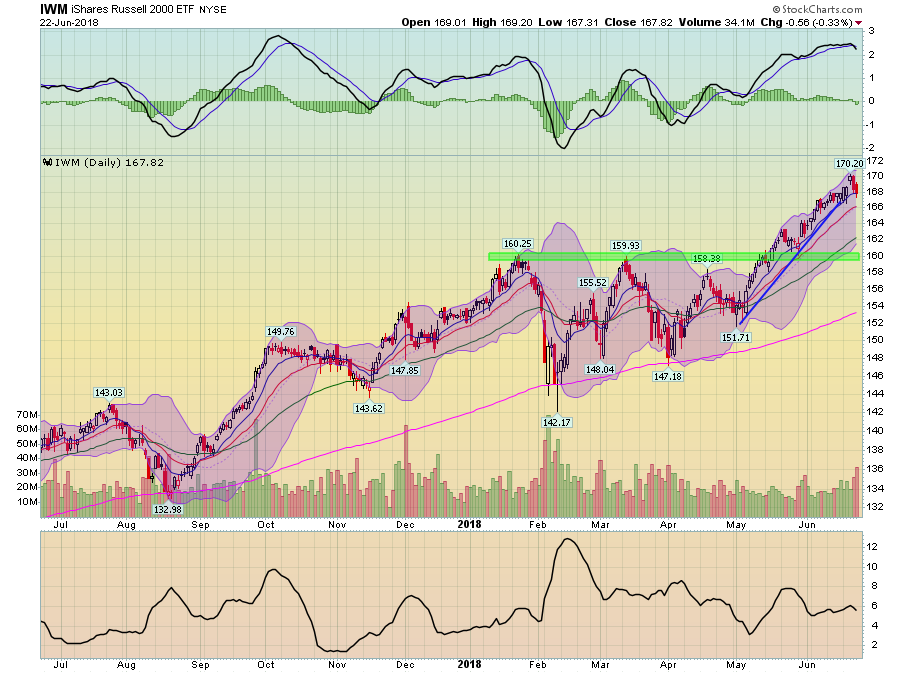

The real winner for the last month is clearly IWM. It moved through resistance in mid-May and has continued to move higher. But prices have broken the trendline and the MACD has also given a sell-signal.

So, where does that leave us in the week ahead? I'd say the probability for a modest decline. The IWM - which have led the market higher - appear as if they want to do a bit of profit taking. And the DIA and QQQ MACDs have both given a sell signal. But also remember that the underlying economic and earnings environment is very strong, so any drop will be limited.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.