Summary

- While the shutdown is over, some economic damage occurred.

- Markit Economics' EU PMIs showed more weakness.

- The markets ended the week continuing their consolidation.

The shutdown is over - at least for now. About a week ago, a colleague commented on Facebook that air travel problems would be the final straw, and he was right. The central question now is, "did this end soon enough to prevent damage from occurring?" Not likely. A large enough portion of the economy was stagnant for a long enough time that some negative impact occurred. And, with this only being a three-week reprieve, I would expect federal employees to be gun-shy about any spending that isn't absolutely essential. Still, it's far better it's over than not.

Markit released the latest PMIs for the EU, which showed continued weakness. The EU manufacturing PMI decreased .9 to 50.5; the service number was .4 lower at 50.8, and the composite decreased .4 to 50.7. The overall pace of new orders was at a 5-5 1/2 year low, while the pace of the decline was the worst since 2013. German manufacturing was in a mild contraction (PMI of 49.9), although France's rose 1.5 to 51.2. The results from Markit make this observation from the ECB press conference more prescient (emphasis added):

The risks surrounding the euro area growth outlook have moved to the downside on account of the persistence of uncertainties related to geopolitical factors and the threat of protectionism, vulnerabilities in emerging markets and financial market volatility.

British businesses are taking action to mitigate the effect of Brexit:

Businesses have been sounding the alarm over Britain's impending departure from the European Union ever since its approval in a 2016 referendum. But this week, with lawmakers unable to agree on any sort of orderly plan as the March deadline for a deal nears, their warnings rang louder - and some decided to act.

Airbus and Bentley called the prospect of Brexit without an agreement a "killer" and a "disgrace." Sony, concerned about Brexit-generated disruptions, said it would move its European headquarters from Surrey to the Netherlands. Other companies are furiously stockpiling supplies, while civil servants are scrambling to prepare for emergency arrangements.

While politicians may yet pull together a deal before March 29, analysts say businesses have run out of time. The precarious state of affairs is already damaging the economy.

March 29 still looms large on the calendar as the date when a period of disruption starts. This would be concerning at any time. But with EU economic data weakening, it is especially concerning now.

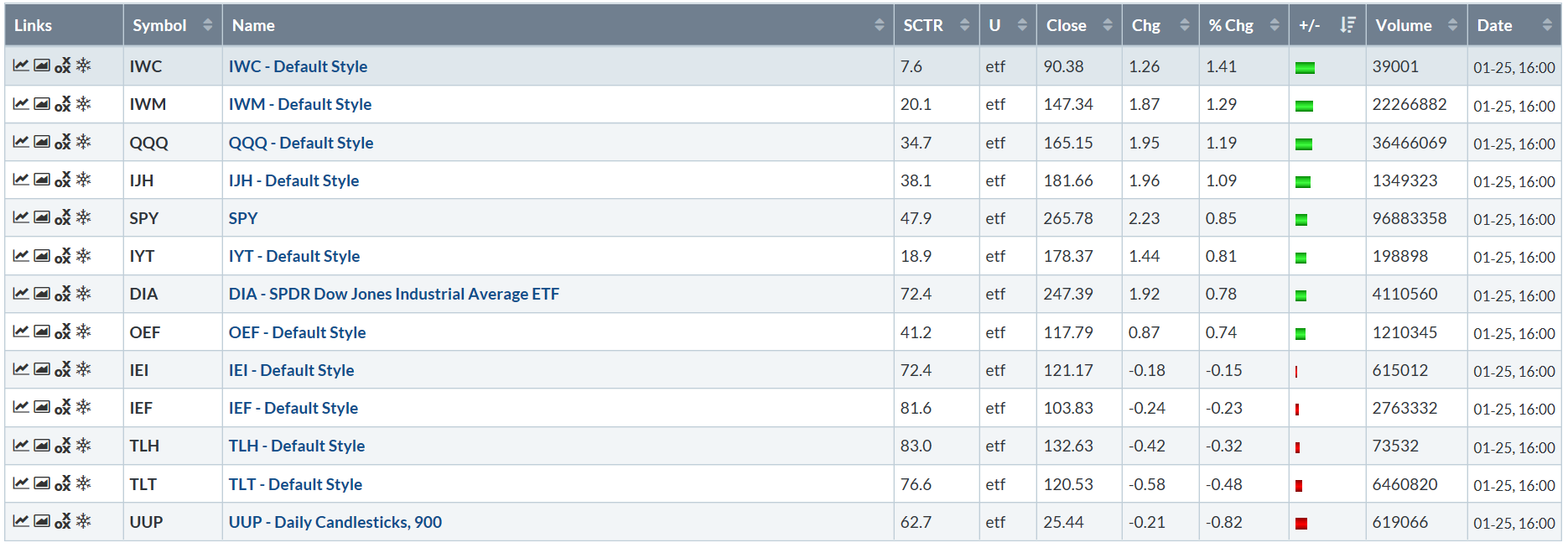

Let's turn to Friday's performance table:

The markets ended the week on a high note, with the equity indexes rising as we head into the weekend. Micro- and small-caps led the way, followed by QQQ. Large-cap indexes also rose, but less than 1%. Also, note that the marginal sell-off in the Treasury market continues.

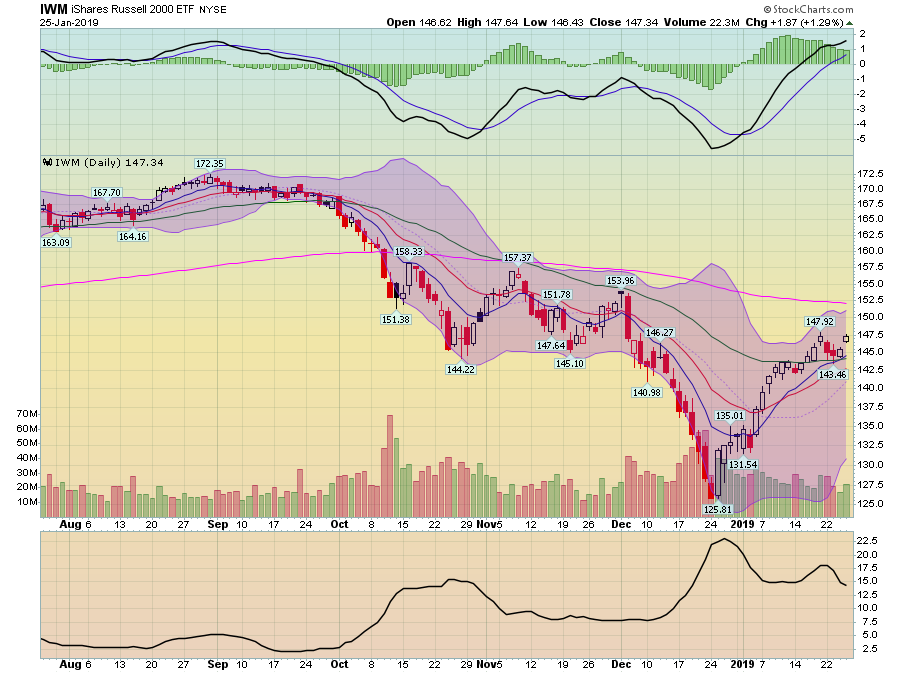

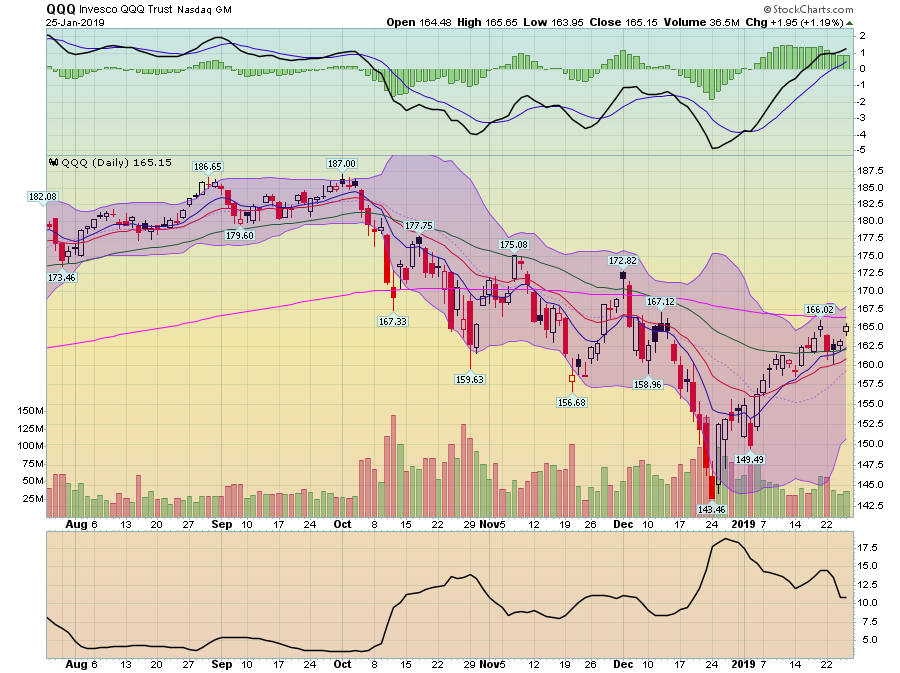

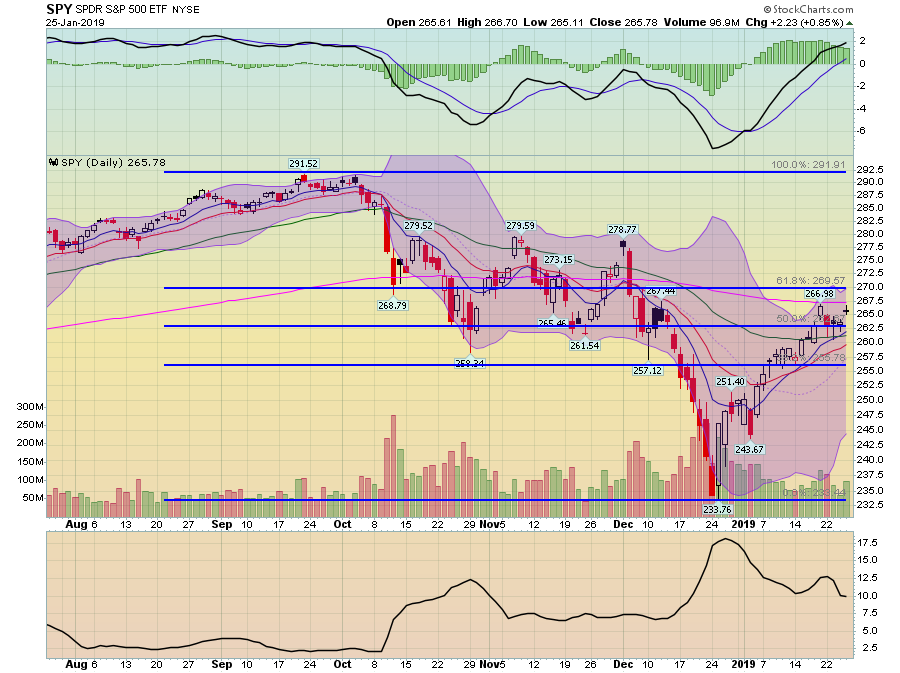

All week long, I've observed that the markets have been consolidating. Today, let's take a look at the daily charts of IWM, QQQ, and SPDR S&P 500 (NYSE:SPY) to see exactly what that means:

IWM has rallied about 18% since it hit a low in late December. Prices have been above the 50-day EMA for seven days and have been consolidating between 144 and 147.5 all week. Momentum is for a move higher: the 10-day EMA has risen above the 50-day EMA, and the 20-day EMA should crossover soon. Momentum continues to rise.

QQQ is up about 16% since its late December low. Prices crossed over the 50-day EMA eight days ago and have traded between the 50- and 200-day EMA since. All indications are for a move higher soon. Although the 10- and 20-day EMAs are still below the 50-day EMA, each is rising and should cross higher soon. The MACD is also moving higher.

SPY has risen about 16% from its late December low. Prices moved through the 50-day EMA seven days ago and have been consolidating between 260 and 267 since. All indications are for a continued move higher: the shorter EMAs are rising, the 10-day EMA has crossed over the 50-day EMA, the 20-day EMA will soon, and the MACD is rising.

Consolidation is healthy; it indicates that traders are pausing without selling. My primary concern right now is that uncertainty caused by trade tensions, the upcoming budget negotiations, and the ever-present Brexit, will eventually hit sentiment and send the markets lower.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.