Summary

- The employment report was about as good as you could ask for.

- The Fed appears open to pausing its rate hiking program.

- The markets had a great day.

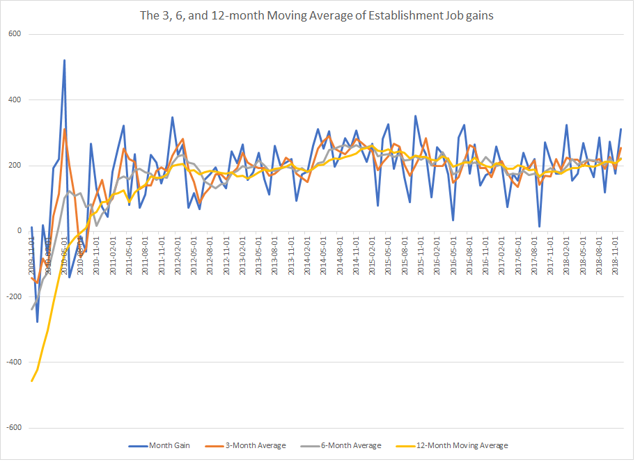

The employment report was a much-needed breath of fresh air for the markets. The headline number of 312,000 jobs added in December was more than enough to spark the market higher. But the report didn't stop there: The two previous months were revised 58,000 higher while wage gains increased 3.2% Y/Y. The 3, 6, and 12-month moving averages of establishment job growth are all above 200,000:

(Data from the FRED system; author's calculations).

You couldn't ask for a better employment report.

And the Federal Reserve added to the cheer. Fed Chairman Powell said (emphasis added):

... the U.S. central bank can now be patient about further monetary policy and wait to see how conflicting signals from the market and the economy resolve themselves. In a conversation at the American Economics Association meeting in Atlanta, Powell said the central bank was open to changing course on rate hikes and reducing its balance sheet depending on how the economy evolves.

He didn't say they would change course, only that the bank was open to that idea. But that statement was more than enough for markets, which were growing worried that the Fed was ignoring potential warning signs. Yesterday, Dallas Fed President Kaplan echoed Powell's statements in a Bloomberg interview.

Although he's not a voting member, Richmond Fed President noted that (emphasis added):

But as we enter 2019, I hear a lot of concern. Some is environmental, driven by trade or politics. Some is market driven, as volatility has increased and the yield curve has narrowed. Some is margin pressure. But overall, the question I hear most is, “How long can this growth continue?”

The rest of his speech noted that the U.S. economy has a low population and productivity growth that will keep growth low for the foreseeable future. I think we can put him into the "a pause might make sense" camp.

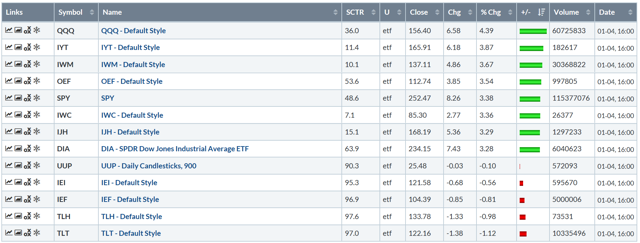

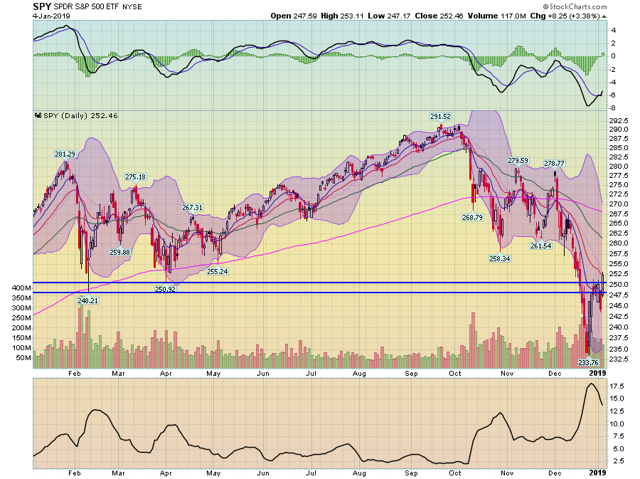

Let's turn to the markets because they had a great day:

It feels like forever since I've had a positive assessment of the markets. But today I most definitely do. The Treasury market sold-off, believing that Powell will be more dovish on interest rates. In contrast, the equity markets were up big: the Nasdaq rose 4.39%; small caps increased 3.67%; the SPY's were up 3.38%. The Dow was the worst performer, and it rose 3.28%. This was a great way to end the week.

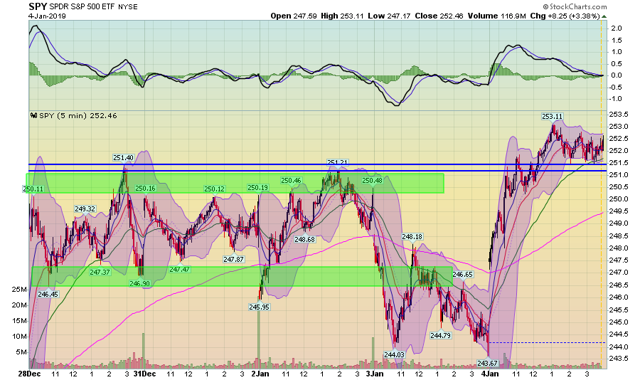

However, let's take a deeper look at the charts to see if we made any technical progress, starting with today's chart:

There are two basic trends: a rally in the morning (which is actually two rallies and a mid-morning consolidation) followed by consolidation in the afternoon. The best news is that the market didn't sell-off near the close, which means traders are comfortable holding positions over the weekend -- a very welcome development. Pay particular attention to the 251 level.

Over the new year, the SPY consolidated between the mid-240s and lower 250s. Today, the market used the lower 250s for technical support. This could support an additional move higher early next week.

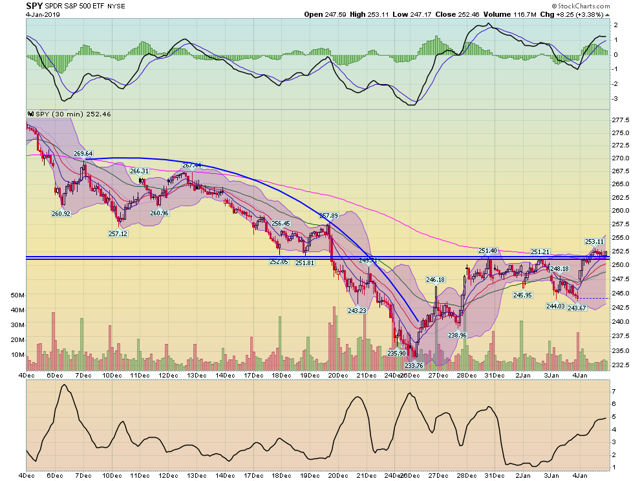

The good news continues on the 2-week chart:

After breaking through resistance in the lower 250s, prices consolidated gains near 2-week highs.

The 30-day chart shows continued improvement:

Prices are now over the 200-minute EMA, which they're using for technical support.

Finally, prices made important progress on the daily chart:

Today, prices printed a strong bar and moved through February 2018 lows. While still negative, the MACD has given a buy signal.

Considering how terrible the news has been of late, today's action was a welcome development. It appears the Fed may be more inclined to pause while the labor market is going strong. Markets reacted by rallying and making important technical progress. Hopefully, this trend continues next week.

Have a safe weekend. See you on Monday.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.