Summary

The BEA released the third and final estimate of 2Q18 GDP:

Real gross domestic product (GDP) increased at an annual rate of 2.0 percent in the second quarter of 2019 (table 1), according to the "third" estimate released by the Bureau of Economic Analysis. In the first quarter, real GDP increased 3.1 percent.

There are three key areas of the report

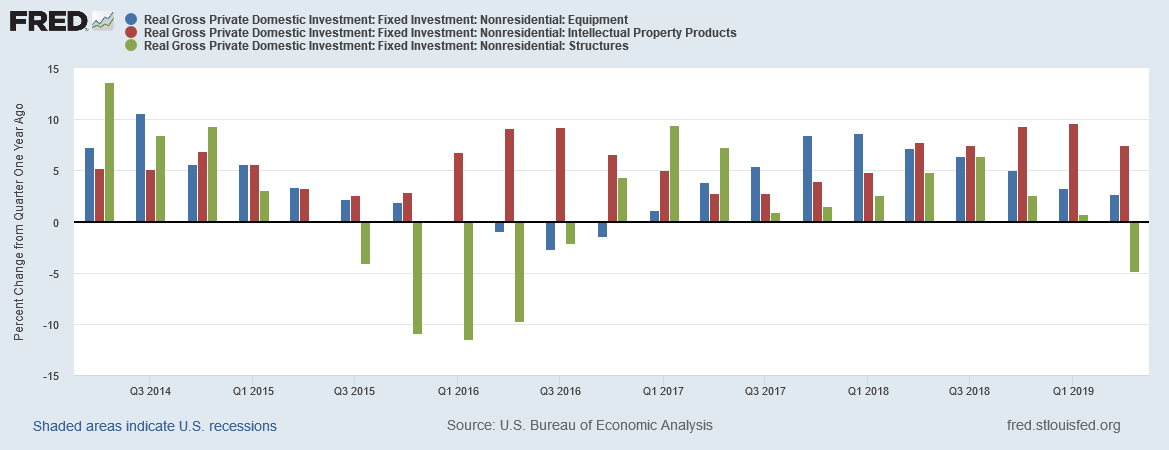

Of the three main sub-divisions of business investment, two are declining on a Y/Y basis: equipment (in blue) and non-residential structures (in green).

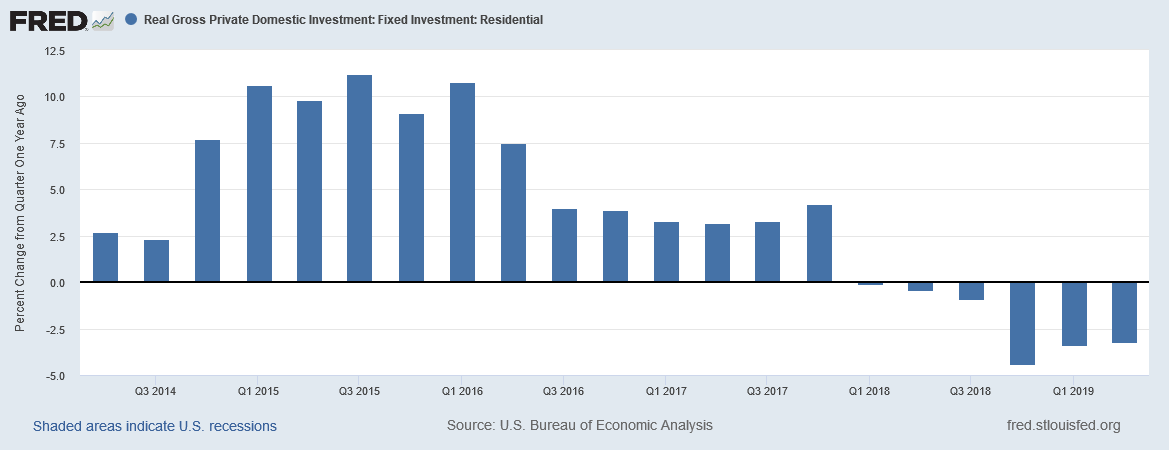

Residential investment has been declining on a Y/Y basis for the last six quarters.

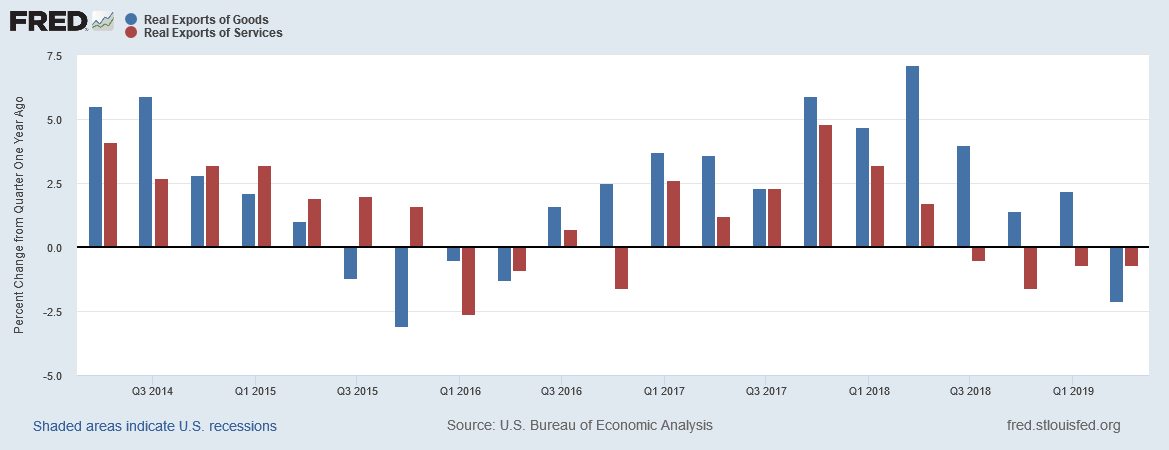

Service exports (in red) have declined for the last four quarters. Goods exports (in blue) have declined in the latest quarter.

What this means is that consumer spending is the primary driver of growth.

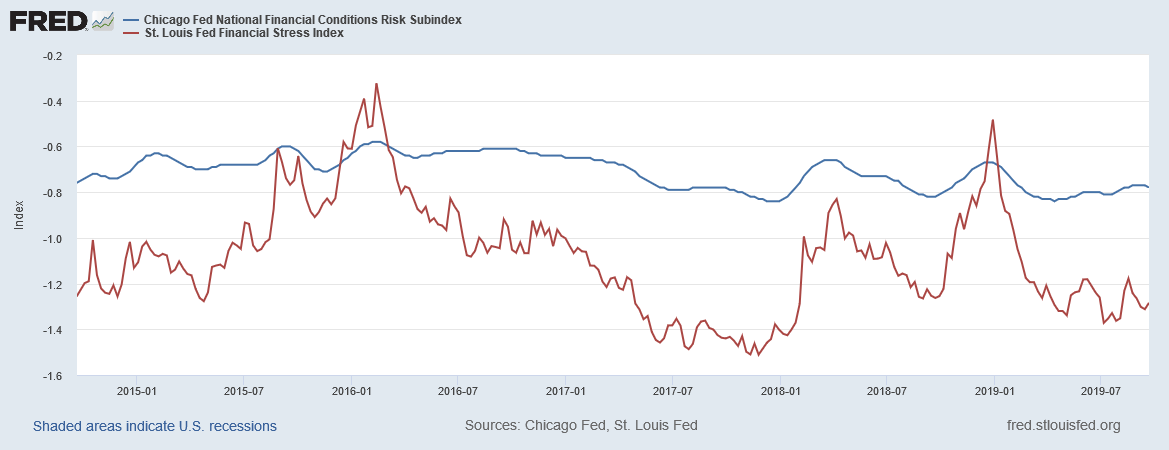

Last week, the credit markets were stressed, which caused the Fed to inject liquidity into the money markets. Thankfully, several measures of financial stress are still at very low levels:

The Chicago Fed's National Financial Conditions Index (in blue) and St. Louis Financial Stress Index Re were updated last Friday and are still at low levels.

The Mexican Central Bank lowered rates 25 basis points to 7.75%. Here is how they described the economy:

Although economic activity in the previous quarters and in July remained stagnant, it is expected to recover slightly over the rest of the year. Slack conditions in the economy during the early part of the quarter remained at levels similar to those of the previous one, with a persistent negative output gap. In an environment of significant uncertainty, the balance of risks for growth remains biased to the downside

The Mexican economy is slowing. GDP has declined from 2.6% in 1Q18 to a .8% decline in 2Q19. Although unemployment is trending higher, it is still a very low 3.4%. This is supporting a 2.1% Y/Y increase in retail sales. However, manufacturing is weak: the manufacturing PMI has been below 50 in four of the last six months, while industrial production has declined on a Y/Y basis in eight of the last nine months.

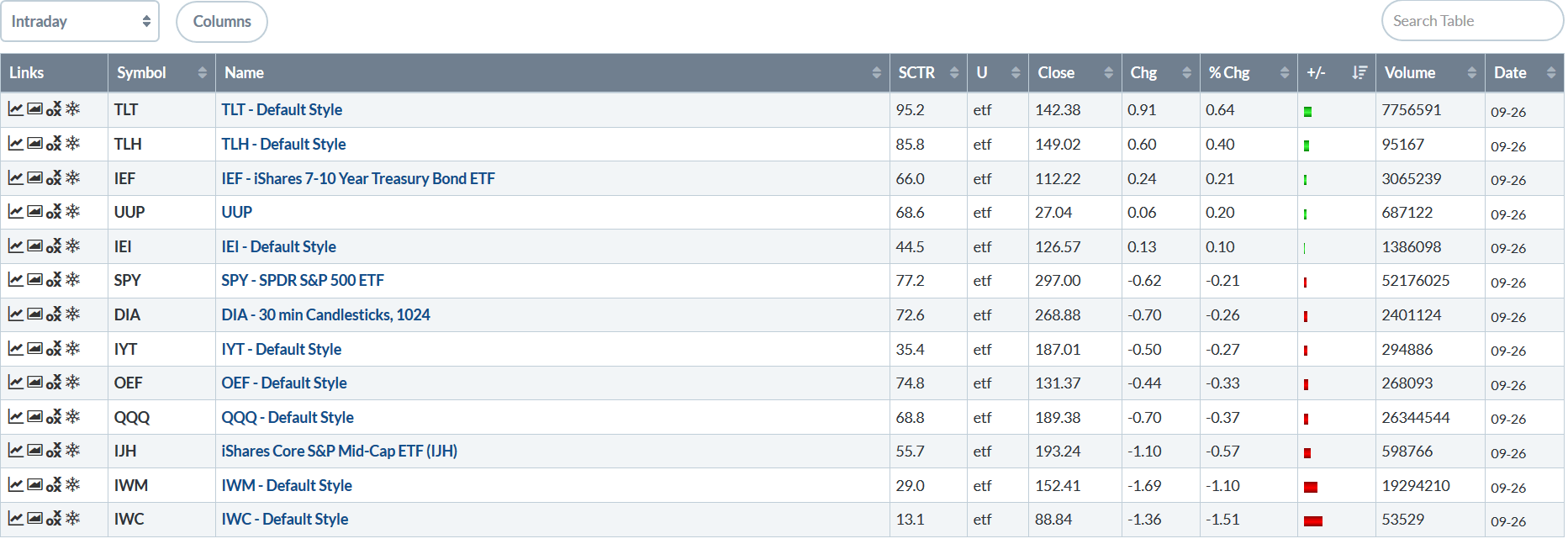

Let's turn to today's performance table:

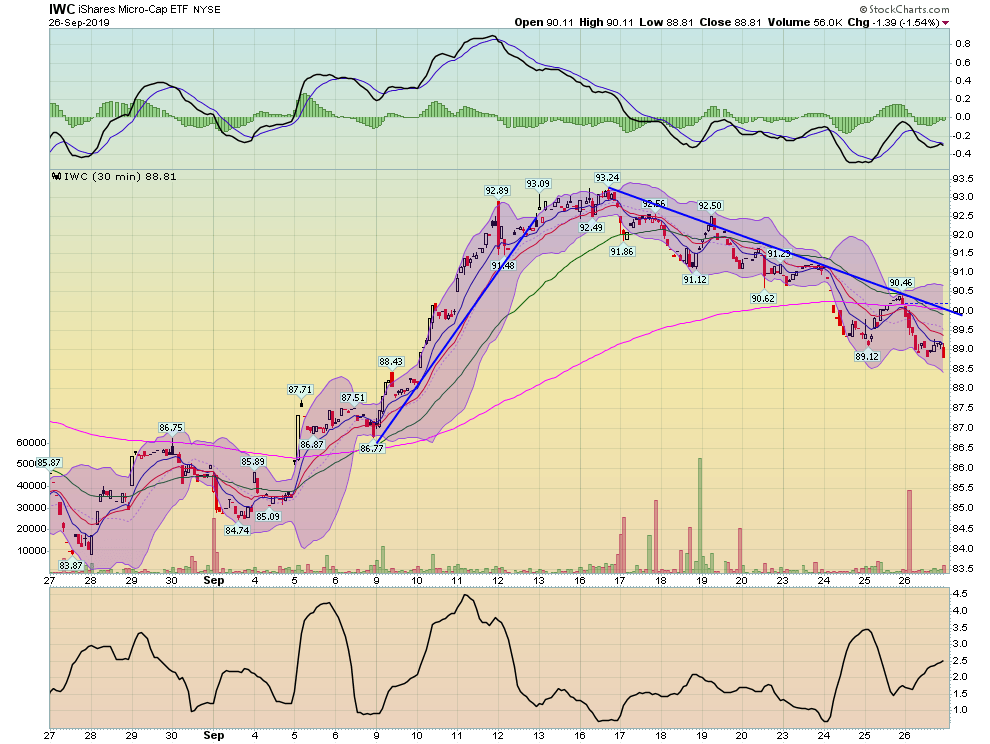

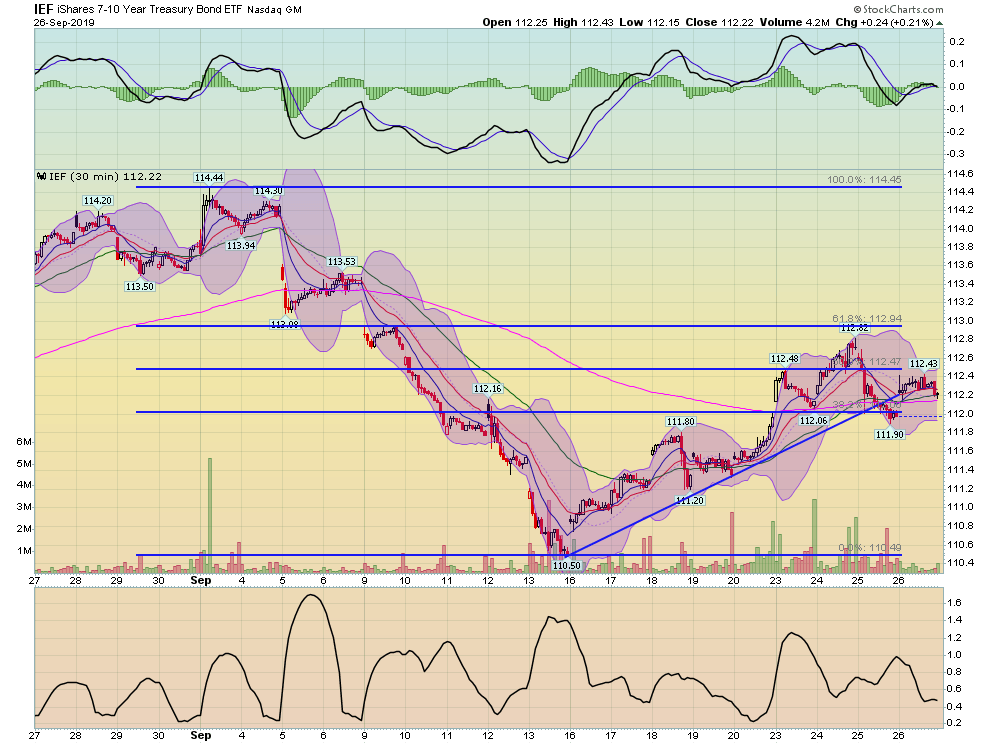

Once again, the treasury market led the way higher, with the long-end of the market gaining .64%. Other sections of the market were also higher. On the other end of the table are smaller-caps, with micro-caps dropping 1.51% and small caps down 1.1%. The larger-cap equities were down less, almost marginally.

Over the last two weeks, we've seen a reversal of the markets, with the treasury market rallying and the equity markets moving lower.

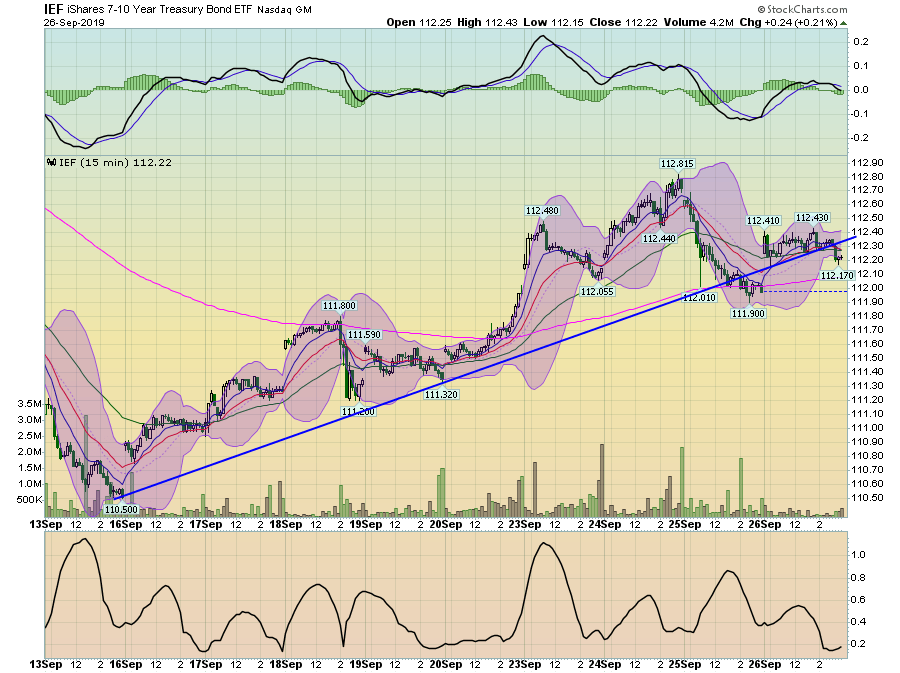

The IEF is trending higher. It started at the beginning of last week and has continued since. The gain is only a few points, but it's a gain, nonetheless.

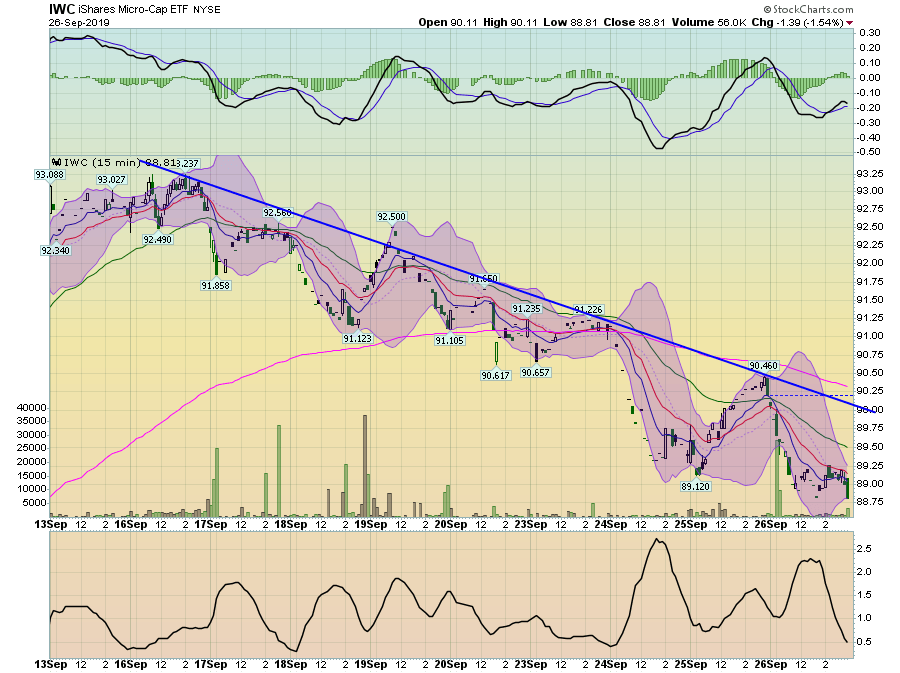

Micro caps started to move lower a week ago Monday and has been continuing lower since. The small and mid caps are moving lower as well.

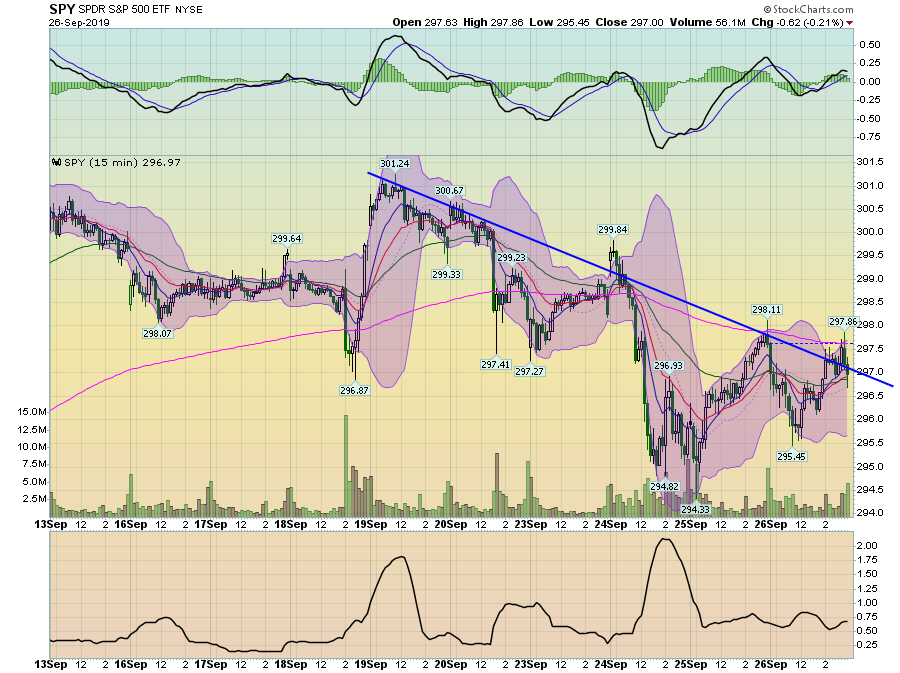

The SPY (NYSE:SPY) has been moving lower but in a far less disciplined manner. It gained sharply on the 19th but has been moving lower since.

The 30-day charts show this is not a major sell-off but could instead be classified as profit-taking.

Micro caps are modestly lower; they're selling-off in a disciplined manner.

Meanwhile, the treasury market has rebounded somewhat.

So, where does this leave us as we near the end of the trading week? The most logical answer is this is a simple counter-trend to the solid gains we saw a few weeks ago.