Investing.com’s stocks of the week

Summary

The rapid and radical changes to global politics continues.

An increase in government spending was a big reason for the stronger economic numbers in the 3Q.

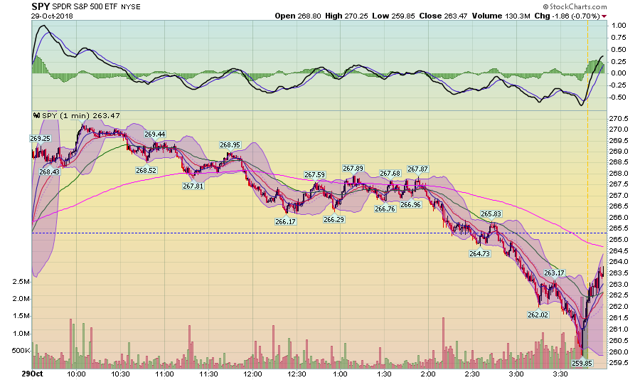

Despite gapping higher at the open, prices couldn't maintain upward momentum.

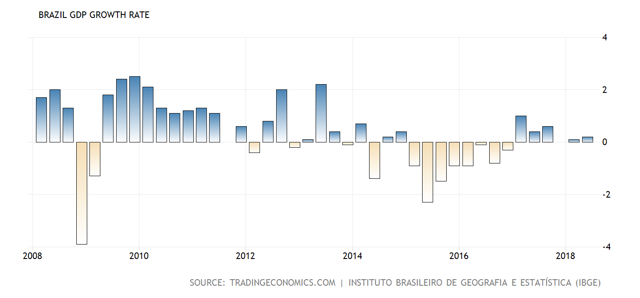

The sea-change in global politics continues. Brazil elected a far-right political candidate whose style and method of communication (he primarily used social media) mirrors Trump's. The country has experienced a modest economic malaise for the last five years:

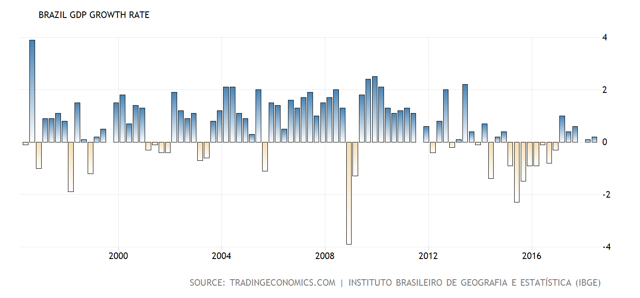

This stands in stark contrast to Brazil's economic heyday from the mid-1990s to the GFC when growth was strong.

In the EU, Angela Merkel has announced that she will step down as leader of the CDU when her term expires in a few years. Merkel has been a driving force in EU politics for a number of years, which was supported by Germany's economic prominence. The global move away from international coalitions such as GATT and trade treaties will most likely continue (I've recently seen the word "re-nationalization" to describe this change).

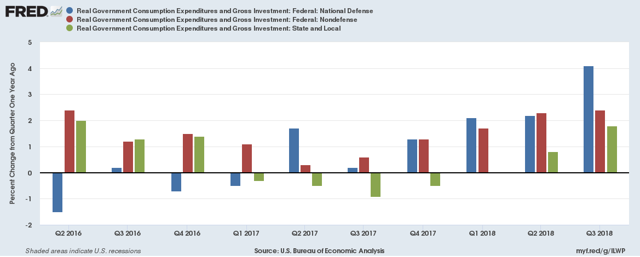

I made this point in my weekly Turning Points newsletter, but it bears repeating. There is often a huge debate between the political right and left and the stimulative effect of government spending on the economy. The latest BEA GDP report should put some of that debate to rest:

The type of preferred spending is different: the blue bar represents national defense spending, a key component of the political right's beliefs. A left-leaning political spending pattern would have shown an increase in social program expenditures. Regardless, this noticeable increase in government expenditures undoubtedly contributed to growth in the second and third quarter.

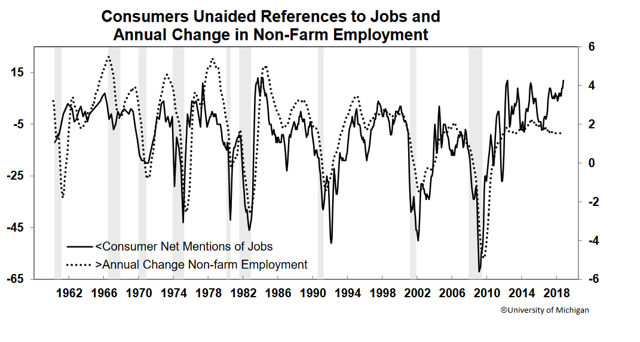

Consumer sentiment remains at high levels:

From the University of Michigan [edited and with emphasis added]:

The Consumer Sentiment Index has been higher thus far in 2018 (98.5) than in any prior year since 2000, which was the last year of the longest expansion since the mid-1800s. Importantly, stock price declines, rising inflation and interest rates, and the negative mid-term election campaigns, have not acted to undermine consumer confidence. Needless to say, consumers are not immune to these negative factors. The data only indicate that the tipping point toward escalating pessimism has not been reached. This resilience was primarily due to the prevailing belief that the economy would produce robust job growth during the year ahead, even if overall wage growth remained dismal. Consumers now place a higher value on job security compared with wage growth due to job losses in the Great Recession as well as the aging of the labor force.

Here is the accompanying chart:

What's most interesting is the observation that the GFC has tamped-down the desire for wage hikes; instead, consumers want their job to be around. That's a very important development that goes a fairly long way to explaining why weak wage growth hasn't been countered yet.

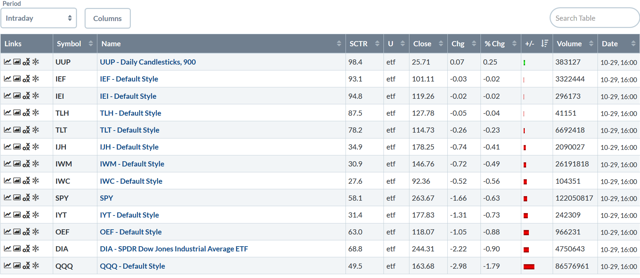

Turning to the markets, here is today's performance table:

This is a classic bearish table: treasuries are up, equities are down. However, the charts tell a less than happy tale:

Prices gapped higher at the open. Then, they trended modestly lower throughout the trading session but remained around Friday's close until the last few hours of trading, when they sold-off. There was a decent buying surge at the end, but it was insufficient to rally the market above Friday's close.

And the bearishness continues on the weekly 5-minute chart and the monthly 30-minute chart:

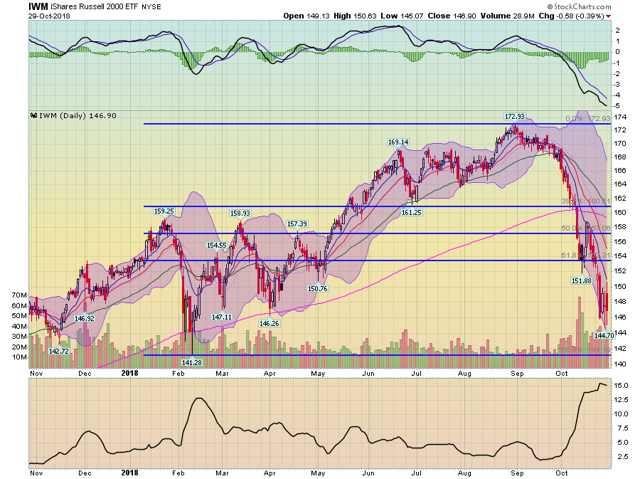

Sometime last week, I noted that the iShares Russell 2000 (NYSE:IWM) was the most important chart of the major indexes. It had already moved through most of its key support levels and was next looking to make a complete "round-trip," targeting its 52-week low.

It is still a very bearish chart. Prices are sitting in the mid-140s, where the index printed a few lows in early 2018. These are technically weak levels that hold little sway over current prices. There is still a large amount of downward pull on this chart; prices really want to move to the lower 140s. Don't be surprised if we hit that level in the near-future.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.