Summary

- The yield curve continues signaling recession.

- Defensive stocks are the top-performing sectors over the last 12 months.

- The markets are continuing to "roll over."

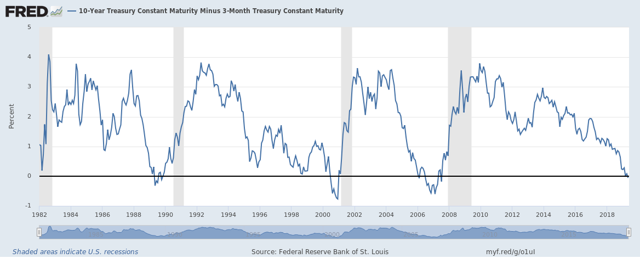

The yield curve continues to signal a recession. As I noted in my weekly Turning Points Newsletter:

My recession probability for the next six to 12 months is still at 15%, largely due to the yield curve's near inversion.

Lisa Abramowicz made the same observation on Twitter this AM:

Here's a chart of the data from the St. Louis FRED system:

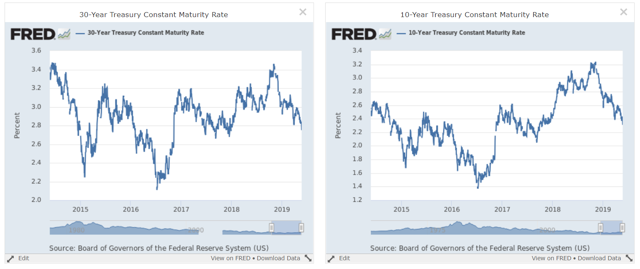

A big reason for this is the long end of the curve has dropped significantly since the start of the year:

The 30-year has dropped 60 basis points while the 10-year has declined 80. This tells us that bond traders see slower growth which leads to weak inflation.

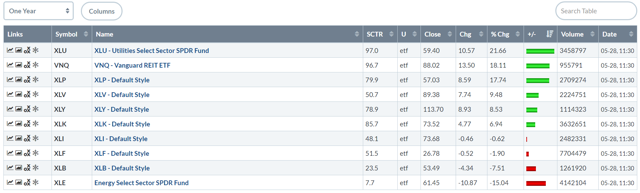

Over the last year, defensive sectors have rallied:

Utilities were the top-performing industry, gaining 21.66%. This was followed by real estate, consumer staples, and healthcare. Combined, these four sectors account for 28% of the SPY (NYSE:SPY), so even when they rally, they may lack the ability to move the market higher. Notice the large increase in the top three sectors - which rose an average of 19% - and then the large drop-off in performance for the next three groups, which increased 8.31% on average.

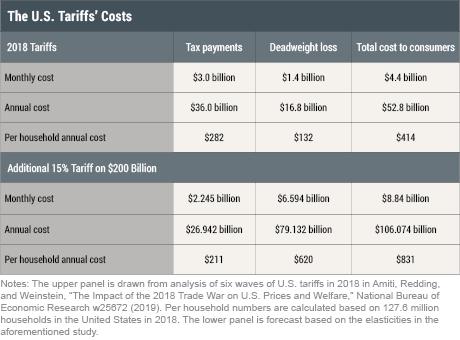

How much will the new round of tariffs cost U.S. households? Liberty Street Economics at the NY Fed blog crunched the numbers:

Most troubling is that the new round of tariffs leads to increased deadweight economic losses, which the post explains thusly:

Some firms may also reorganize their supply chains in order to purchase their products from other, cheaper sources. For example, the 10 percent tariffs on Chinese imports might cause some firms to switch their sourcing of products from a Chinese firm offering goods for $100 a unit to a less efficient Vietnamese firm offering the product for $109. In this case, the cost to the importer has risen by nine dollars, but there is no offsetting tariff revenue being paid to the government. This tariff-induced shift in supply chains is therefore called a deadweight or efficiency loss.

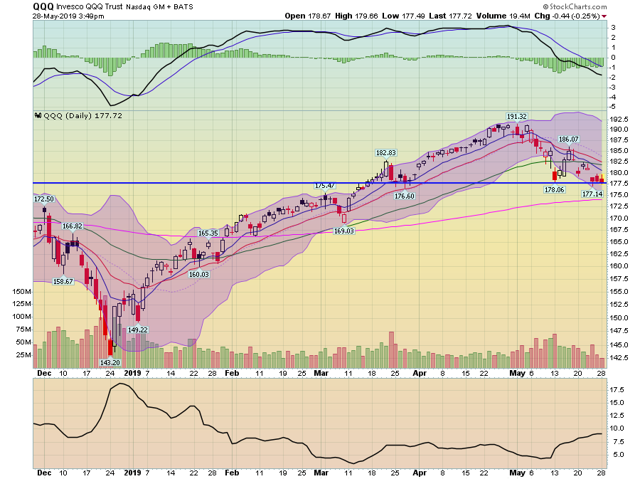

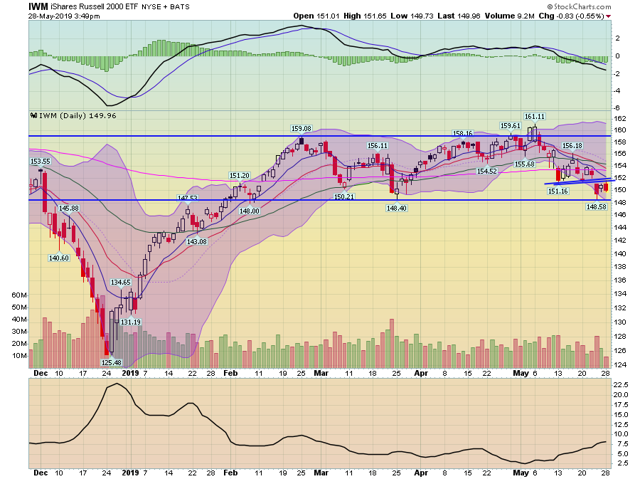

Markets rarely change direction on a dime. Instead, they build up momentum in one direction, reaching either a buying or selling climax which is followed by a slow change of direction. I call the process "rolling over." It's a process the markets are currently in the middle of. It's best shown on several daily charts:

The QQQs rallied for most of the spring. During the rally, the MACD was pegged at a very high level. Prices started to fall at the beginning of May and have been trending lower since. After falling through the 50-day EMA, they tried to rally but hit resistance at the 10- and 20-day EMAs. They are again trending lower and have found support at the 177-178 level. Now, however, the shorter EMAs have moved lower and are below the 50-day EMA which will slowly bring that average down.

Small-caps didn't rally during the spring; they instead moved sideways. They are once again below the 200-day EMA but now the shorter EMAs are moving lower at a steeper angle.

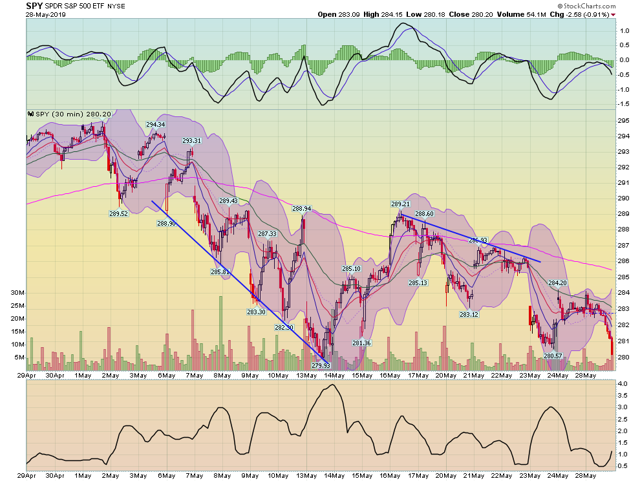

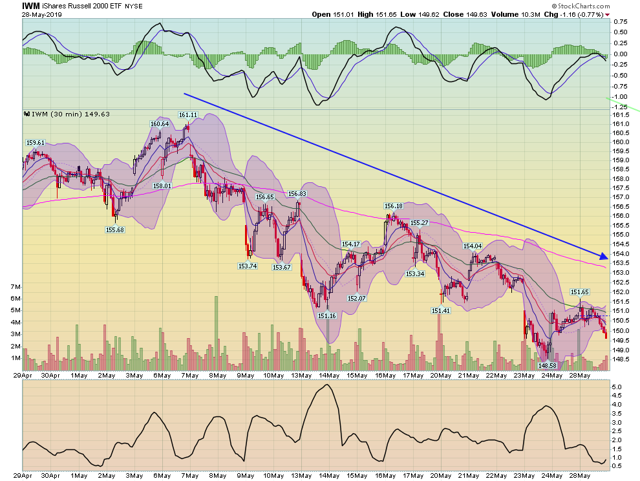

There is additional bad news in the shorter time frames.

The SPYs have made two solid moves lower; they attempted to rally above their respective 200-minute EMAs but failed.

The IWMs are moving consistently and solidly lower.

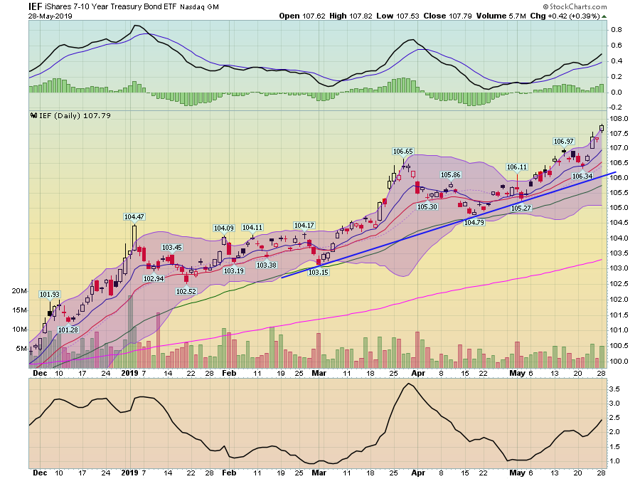

And then we have the Treasury market ...

... which is in a solid rally.

Right now, the downward pressure continues to mount. Prices are continuing to pull the shorter EMAs lower. Key crossovers - the 10 below the 20, the 10 below the 50 - are occurring. Momentum is falling and Treasuries are rallying. From a technical perspective, the one question I have is, "will there be one event that creates a significant shock to send the markets sharply lower?" Only time will tell.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.