Technically Speaking For May 20

Summary

- The internals of the latest Japanese GDP report were concerning.

- Weakness in industrial production may be slowing growth.

- The indexes were mostly lower; the charts are not shaping up well.

The FT was very happy with Japan's latest GDP report. Me, not so much. The 2.1% annual growth rate was impressive. But two large Q/Q increases were responsible: residential investment rose 1.1% while public investment advanced 1.5%. Other internals were weak: private consumption was down 0.1% and non-residential investment moved 0.3% lower. Most concerning was the 2.4% quarterly decline in exports. However, GDI was up 3.8% while GNI increased a healthy 3% (remember that the BOJ is more sensitive to national income numbers). The Y/Y numbers were better: household spending rose 0.3% and non-residential investment advanced 1.6%. But once again exports were down this time by 2.7% from the previous year.

Once again, the zombie of Brexit rears its ugly head. Parliament will vote on May's Brexit deal (again) in June. May has tried to form a coalition with some members of the Labour Party to no avail. She has also started to make plans for a transition out of the Prime Minister role, indicating she knows her time as leader is at best very weak. For reasons that defy logic, Euro-skeptic Tories are still agitating for a no-deal outcome. Ultimately, we still have the same problem: Brexit stands to be an event that disrupts the economic order to such a degree as to cause a slowdown at best and a recession at worst.

Weakness in industrial production could be starting to hurt. In the latest Turning Points, I noted that industrial production is now in a solid downtrend. It's possible we're starting to see the negative ramifications of weak industrial growth. Today, Ford announced they would lay off 7,000 white color employee. The latest National Activity Index from the Chicago Federal Reserve declined, largely due to the drop in industrial production. And the latest reading from the NY Fed's GDP Nowcast took a hit, largely due to weaker manufacturing. While manufacturing is a smaller component of U.S. growth, it's still important and has a wide-ranging overall impact, especially in the Industrial Midwest.

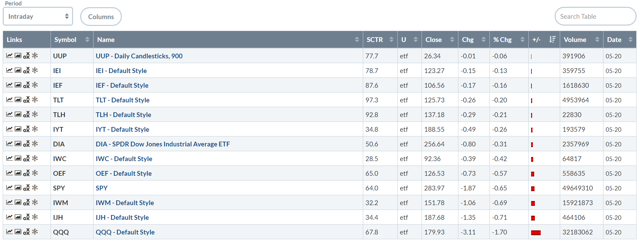

Let's turn to today's performance table:

The day started with news that Chinese tech giant Huawei was placed on an "entity list" which was followed by news that Google (NASDAQ:GOOGL) had effectively cut the Chinese company off from anything more than a standard relationship. That sent the tech sector lower, which took the QQQ down 1.70%. But tech also represents slightly over 20% of the SPY, which sent that index lower as well.

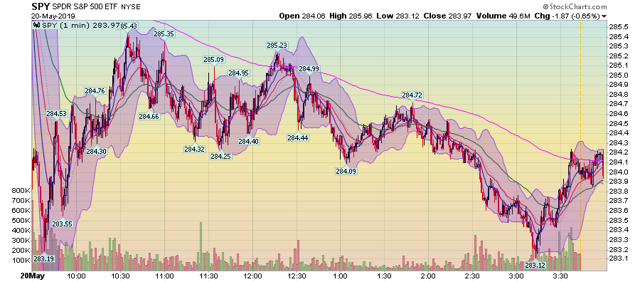

There's a fair amount of bearishness in the shorter SPY charts, starting with today.

Prices opened lower and then tried to stage a rally. But that ended mid-morning. The index continued lower for the rest of the day. Several rallies fizzled.

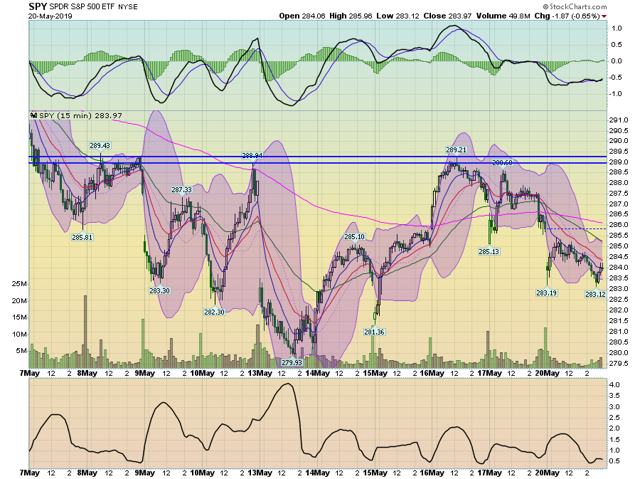

The overall trend in the 2-week chart is also lower. There's a general move lower from May 7-May 13. Prices rose for the next three days but have been coming down since. Momentum has been negative most of the time.

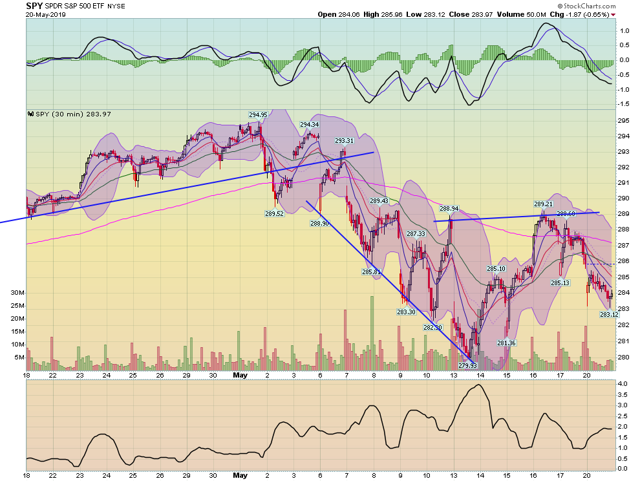

On the 30-day chart, prices seem to be forming an up-down-up-down pattern. Just like the 2-week chart, momentum has been negative for most of the last two weeks as prices have spent more of the time below the 200-minute EMA.

Let's add in the daily charts of the small-cap indexes, starting with the IWC:

Prices are once-again below the 200-day EMA. But now the shorter EMAs are below that indicator as well with weaker momentum. Prices are now right around key resistance levels from earlier in the year.

The IWM is right below the 200-day EMA with the shorter EMAs moving lower. Momentum continues to decline.

The IJH is right at the 200-day EMA on declining momentum.

The week has started with bad news which negatively impacted the most important sector in the market, which, in turn, sent the larger-cap indexes lower. Smaller-cap indexes are now hanging right at key support levels. Overall, things could be better.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.