Technically Speaking For May 15

Summary

- Today's coincidental indicators releases were weak.

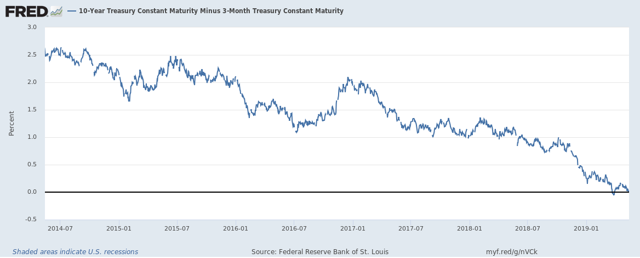

- Treasury yields have dropped pretty sharply over the last 3-4 months; the yield curve has again inverted moderately.

- The market had a good day, but weak volume numbers are a concern.

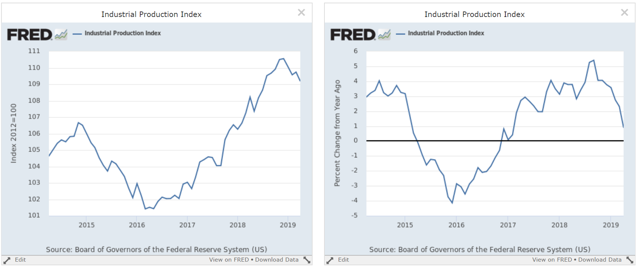

Weak coincidental indicator news. Retail sales were down .2% M/M but up .1% ex-auto sales. Remember that both numbers dropped sharply in December due to negative macroeconomic developments. Both are now higher so this month's modest increase/decline could be seen as a natural cooling off period after a decent rebound at the start of the year. Industrial production declined .5%, its third decline in the last four months. Industry group performance is weak: manufacturing and mining are down in three of the last four months. And the performance numbers for major market groups have been weak for the last four months. The IP chart is starting to cause concern:

The absolute number (left chart) and Y/Y percentage change (right chart) are clearly moving lower.

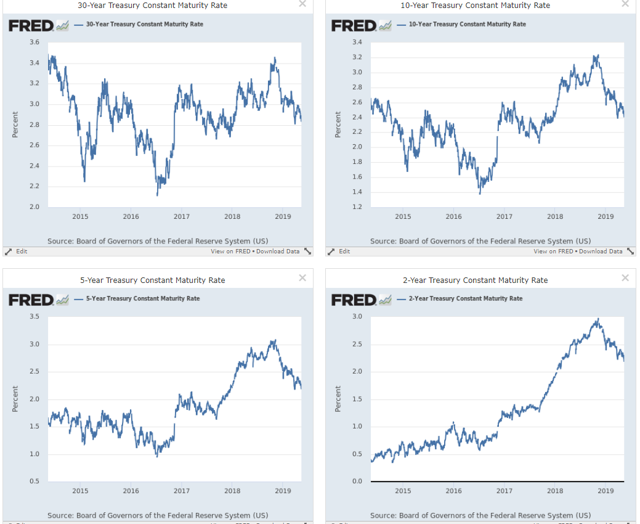

Treasury yields have moved lower:

30-Year yields (upper left) have declined from 3.46-2.83; 10-year yields (upper right) are down from 3.22-2.40; 5-year yields (lower left) have dropped from 3.09-2.18; 2-year yields (lower right) have moved from 2.98-2.18. This means that the bond traders see lower growth and weaker inflation. Finally, the yield curve is once again contracting mildly:

Last year, the U.S. economy enjoyed robust growth boosted by accommodative monetary and fiscal policies. As the stimulus from these policies wanes, and with slower foreign growth, I expect to see a slower pace of growth – somewhere in the neighborhood of the economy’s longer-run trend of roughly 2 percent

and risks to the economy (emphasis added)

As always, there are risks to the outlook, and this generally positive outlook has several prominent downside risks. Over the medium term, I see the biggest risks coming from trade policy uncertainty and slower growth abroad, particularly in China, the euro area, and the United Kingdom. To the extent slower foreign growth and waning fiscal and monetary stimulus represent a stronger headwind than I am building into my baseline forecast, we could see somewhat slower growth. Right now the data are noisy, and we need more time and evidence to judge whether this risk materializes.

At the core of the US economy are two slow-growth variables: slowing population growth and weak productivity growth. Until we reverse those variables, slower growth is here to stay.

Let's next turn to today's performance table:

The QQQs led the markets higher, rallying 1.38%. They were followed by the OEF and SPY. Small and mid caps also rose but not nearly as impressively. For those who read my daily recaps, you'll notice that we're back where we were a few weeks ago: rallying large caps, underperforming small caps.

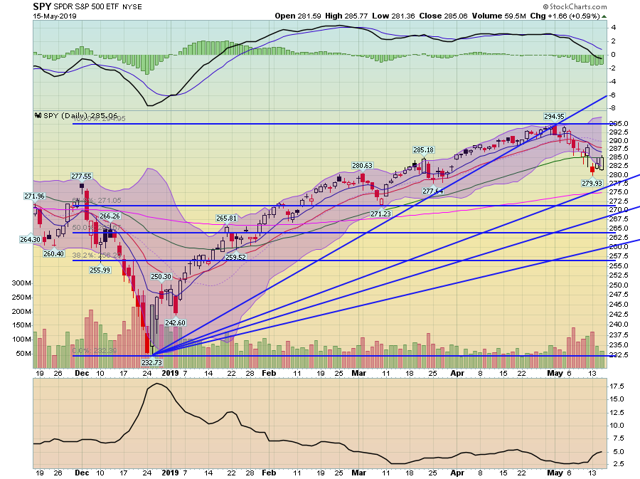

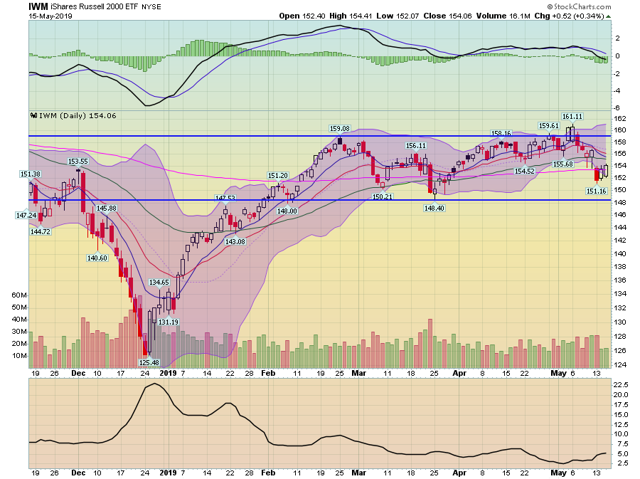

A look at the daily charts shows that the rally is ... unimpressive:

The IWM printed a strong bar today. But the volume totals were nearly half of those on the sell-off. Above, prices face resistance from the 10, 20, and 50-day EMAs, all of which are now moving lower, indicating a weakening trend.

The QQQ share most of the qualities with the IWM -- a strong bar on weak volume with overhead resistance form the shorter EMAs.

The SPY hit resistance at the 50-day EMA today. The shorter EMAs are moving lower and volume is weak.

Today's rally was a "news rally;" the administration said they would delay imposing tariffs on auto imports, which relieved a trade-war weary market. But we still have problems with China and weaker-than-desired coincidental numbers today. Combine that with the weak volume numbers and the rebound rally still looks a bit suspicious.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.