Technically Speaking For March 27

Summary

- The San Francisco Federal Reserve is predicting modest growth in the medium term due to slowing population growth.

- The housing market is rebounding modestly.

- The overall tone of the markets remains modestly bearish.

The San Francisco Federal Reserve is projecting a somewhat slower pace of growth in 2019. Most importantly, due to slower working-age population growth, they are also predicting a slower pace of growth for the medium term (emphasis added):

Demographics are the most important reason to expect slow future growth relative to its historical pace. By the middle of the next decade, the working age population (16-to-64 year olds) will be growing at a historically low pace, reflecting the aging of the baby boom generation. Of course, the working-age population does not translate one-for-one into employment; for example, many people over 64 do work, and participation trends are changing for other groups. Going forward, the Congressional Budget Office projects that the potential U.S. labor force will grow at about a 0.5% pace. This is almost a percentage point below its average pace over the past half century.

Population and productivity growth form potential GDP. Both are growing slowly.

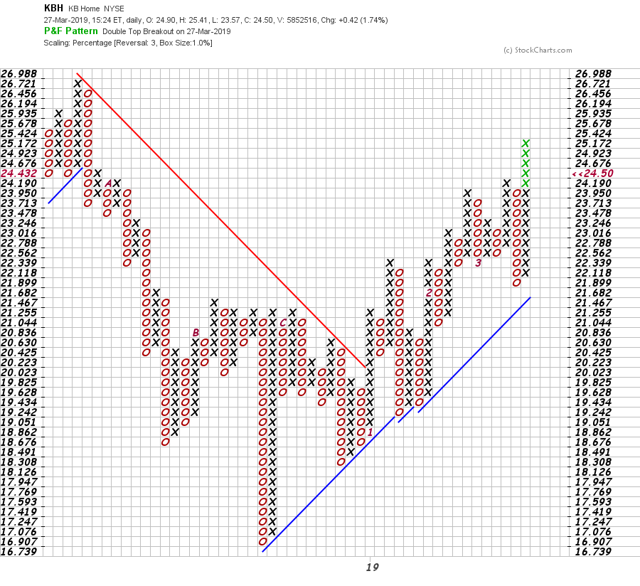

Homebuilding stocks are rebounding. On the latest earnings call, KB Home (NYSE:KBH) said it is seeing a pick-up in activity; other builders are seeing the same thing. There are strong fundamentals supporting this development: the unemployment rate is low, interest rates are coming down, despite some recent softness consumer sentiment is still at high levels, and home prices are starting to come down a bit. As a result, the homebuilding sector is rallying, which is clearly shown in the point and figure chart:

Theresa May has offered to step down as prime minister if Parliament passes the Brexit plan:

Prime Minister Theresa May of Britain told Conservative lawmakers on Wednesday that she would step down if Parliament approved her plan for withdrawal from the European Union.

“I have heard very clearly the mood of the parliamentary party,” Mrs. May told the lawmakers. “I know there is a desire for a new approach, and new leadership, in the second phase of the Brexit negotiations, and I won’t stand in the way of that.”

I have to wonder if anyone would be able to corral Parliament on this issue. It seems as though no one wants to make the hard decisions related to this separation of the countries. Still, the longer this is delayed the probability of a very messy no-deal Brexit increases, which will send shock waves through the UK and EU economies.

Let's turn to today's performance table:

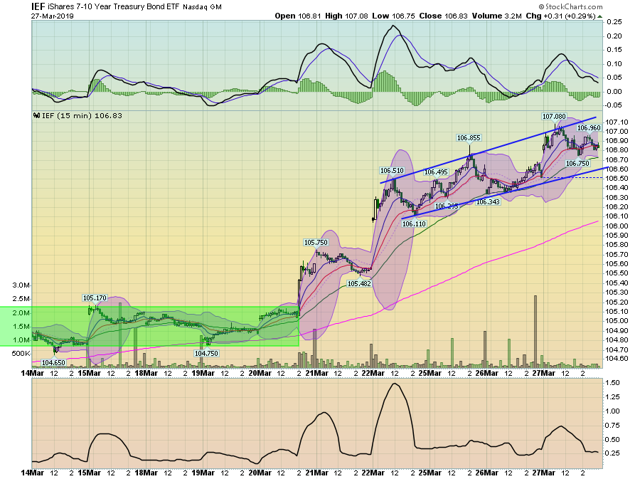

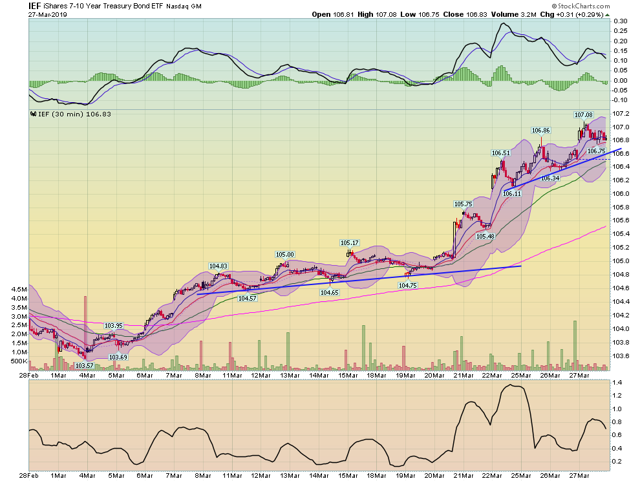

Even though the transports led the markets higher, this was really a Treasury market day, with the long end of the market providing the bulk of the moves higher. Meanwhile, equity indexes were off modestly.

Overall, I remain modestly bearish on the markets. As I noted yesterday, the riskier averages are moving modestly lower while the Treasury market is rallying. The bigger cap indexes are trading sideways. For this to change, we, at a minimum, need to see a stronger move from the IWM and IJH. While I'd also like to see a Treasury market selloff to accompany an equity move higher, that's probably not going to happen.

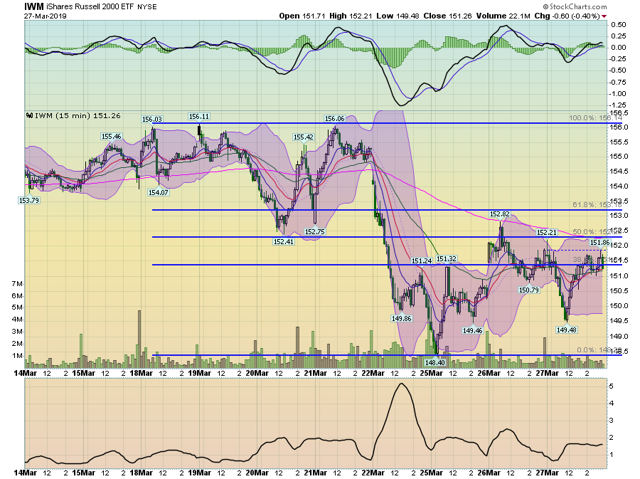

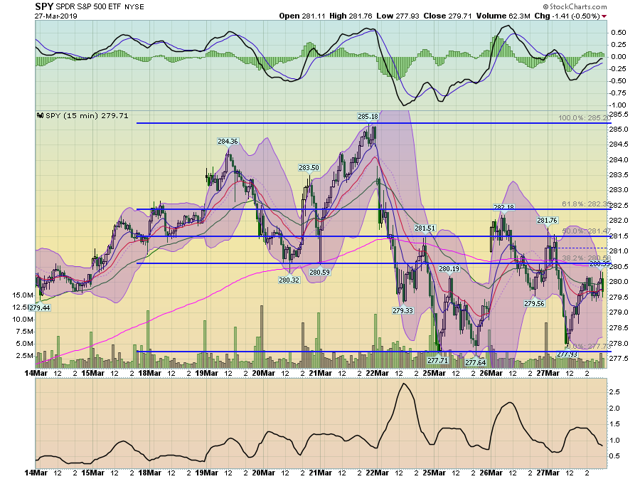

None of that is happening right now. Let's start with charts from the two-week time frame:

The IWM is trading in the lower half of its two-week chart. Prices are below the 200-day EMA, as are the shorter EMAs.

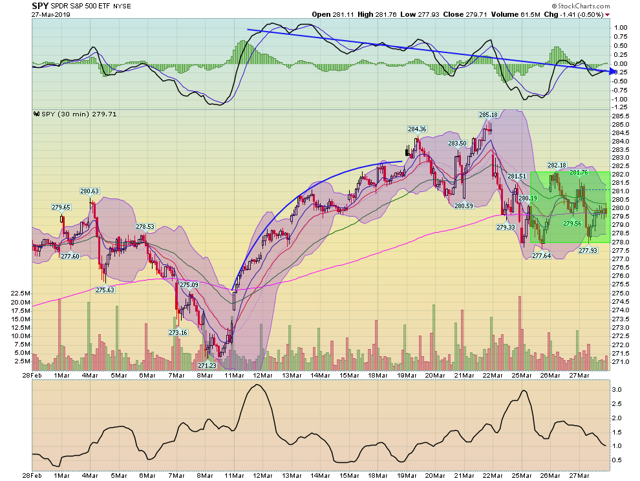

The SPY is also in the lower half of its chart with prices below the 200-day EMA.

Meanwhile, the IEF is rallying. It consolidated between March 14 and March 20. It then started to move higher and has been in an uptrend for the last three-and-a-half days.

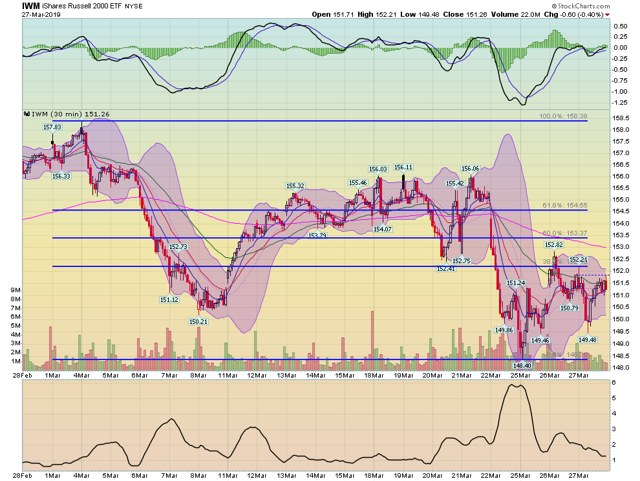

We see the same situation in the 30-minute time frame:

The IWM is in the lower half of its 30-day chart. Prices are below the 200-day EMA.

The SPY is in a somewhat better position. Prices arced higher from March 11-19. But they've been trending modestly lower since. Right now, prices are consolidated right around the 200-minute EMA.

Meanwhile, the IEF is in the middle of a rally.

Right now, my basic call is modestly bearish. The Treasury market rally and underperformance of the IWMs and IJHs indicate traders are modestly concerned about future growth. But the underlying fundamentals are still good, which should continue to support the markets.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.