Technically Speaking For March 26

Summary

- Brexit is still a potential car crash for the global economy.

- The yield curve has officially inverted.

- Although the indexes were up on the day, the daily charts are still trending modestly bearish.

Recessions are caused by economic shocks that are severe enough to disrupt the economy. Brexit continues to look like such an event. Recently, Prime Minister May went to the EU to ask for more time before the parties implemented Brexit. The EU gave the UK two choices. Either:

- Vote for the deal they negotiated with May and get an extension until May. Parliament has already voted this deal down twice. The votes were especially lopsided.

- Don't vote for the deal and get an extension to April 12 (two weeks from now).

As of now, the UK is headed for an April 12 "hard Brexit" withdrawal - a situation where the UK is a member of the union on day 1 and not a member on day 2. Yesterday, Parliament voted to seize Parliament's timetable in order to test several other options, including a new popular vote. Parliament's actions would be non-binding. This is a very unusual move in UK politics; it points to a decidedly weak Prime Minister and places the entire process in an even greater state of flux.

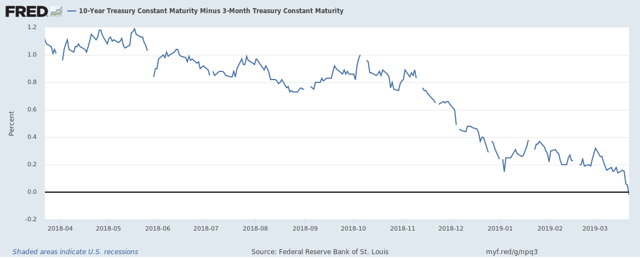

We have a yield curve inversion:

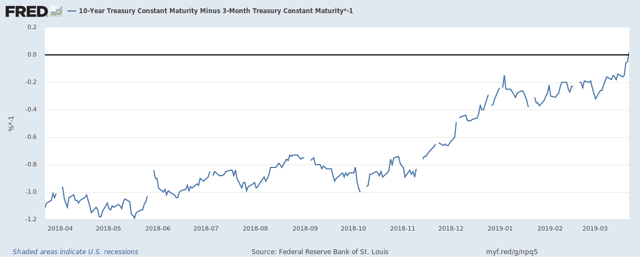

The St. Louis FRED system is usually a day or two behind for posting financial market data. But there you have it: an inverted yield curve. Here is a chart with the curve multiplied by -1:

Sometimes this chart is simply better at showing the move. Either way, a key recession predictor has been triggered. The flattening yield curve is a big reason why I have a 30% recession probability in the next 6-12 months.

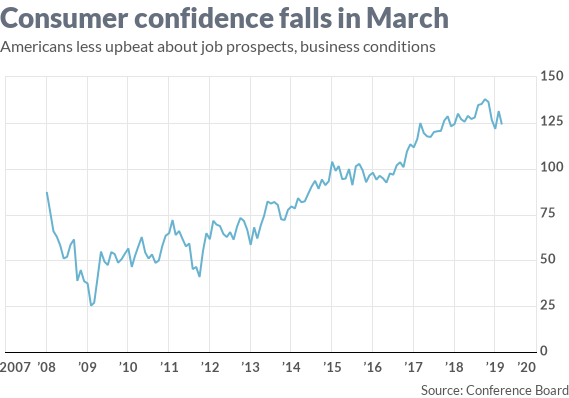

Consumer confidence was a bit lower in the latest report from the Conference Board (emphasis added):

The Conference Board Consumer Confidence Index® declined in March, after increasing in February. The Index now stands at 124.1 (1985=100), down from 131.4 in February. The Present Situation Index – based on consumers’ assessment of current business and labor market conditions – declined, from 172.8 to 160.6. The Expectations Index – based on consumers’ short-term outlook for income, business and labor market conditions – decreased from 103.8 last month to 99.8 this month.

Here's a chart of the data from MarketWatch:

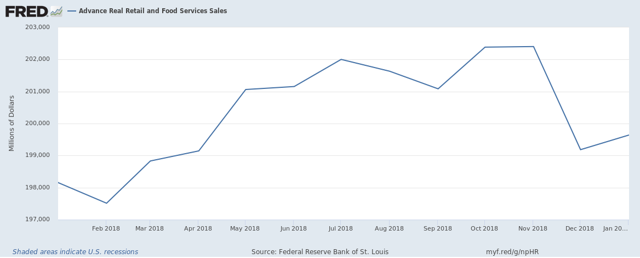

Confidence took a hit at the end of last year due to the market drop and the government shutdown. It rebounded in the previous report, probably because of the market rebound and resolution to the shutdown. But it's down again largely thanks to a drop in the current situation index. Let's add in retail sales' weak performance over the last year ...

.... and you get a slowing consumer, which is responsible for 70% of economic growth.

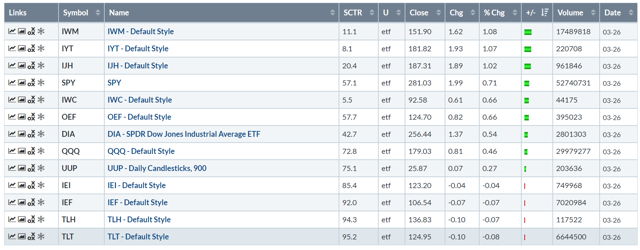

Let's turn to today's performance table:

This was a far more traditionally aligned bullish day, with equities rallying and the Treasury market selling off a bit. Moreover, the higher risk indexes (the IWM and IJH) led the market higher.

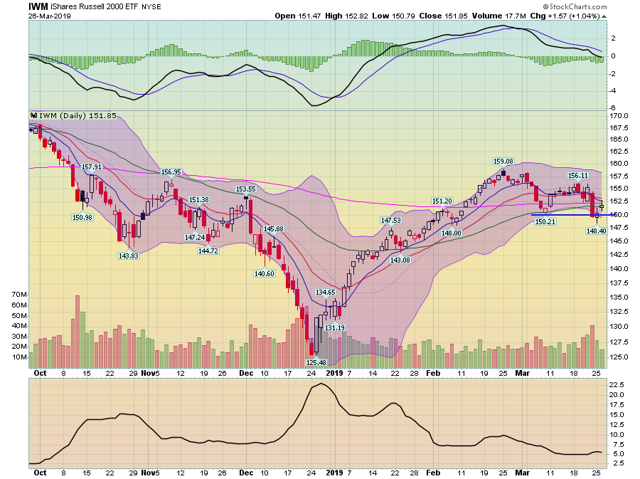

However, the daily charts continue to show a modestly bearish trending in the markets. Let's start with the IWM:

The IWM hit a high of 159 at the end of February. It has moved modestly lower since. Prices are trading right around the 200-day EMA while the shorter EMAs are trending lower. The MACD is declining and gave a sell signal at the end of February. If the markets were really happy about moving higher, the IWM would be rallying (this index represents risk-based capital).

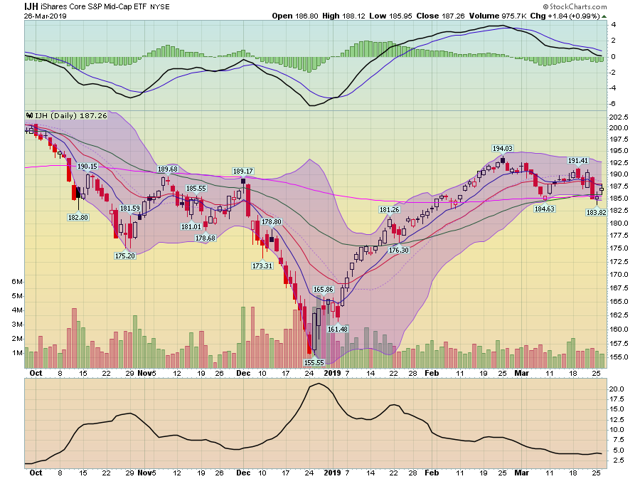

The IJH hit a high of 97.72 at the end of February and has since traded modestly lower. Prices are right above the 200-day EMA with the shorter EMAs trending sideways to modestly lower. The MACD is declining and has given a sell signal.

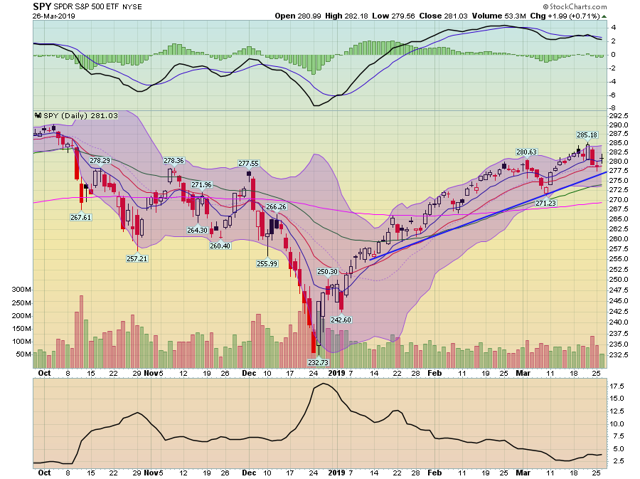

In comparison, we have the SPY...

which is still in a rally. But the MACE is declining modestly and has given several sell signals over the last few months.

The lack of any upside move for the IWM and IJH is concerning, indicating the bulls are not entirely confident in the underlying economic environment, which is not a good development for the market going forward.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.