Technically Speaking For March 19

Summary

- Alan Krueger, a great economist, died.

- Although somewhat softer, the housing market is in decent shape.

- The IWMs are still under-performing, raising questions about the strength of this rally.

The economic world has lost one of its titans:

Alan B. Krueger, who advised two presidents and helped lead economics toward a more scientific approach to research and policymaking, was found dead on Saturday at his home in Princeton, N.J. He was 58.

A labor economist by training, Mr. Krueger was part of a new wave of economists who pushed the field toward a more empirical mind-set, with an emphasis on data rather than theory. He applied that approach broadly: to education, health care, labor markets and terrorism, and even to more lighthearted subjects like the rising price of concert tickets. His latest book, due out in June, is on the economics of the music industry.

Krueger was one of the first economists to show that raising the minimum wage didn't lead to a decrease in employment (which has been confirmed by other studies). He will be missed.

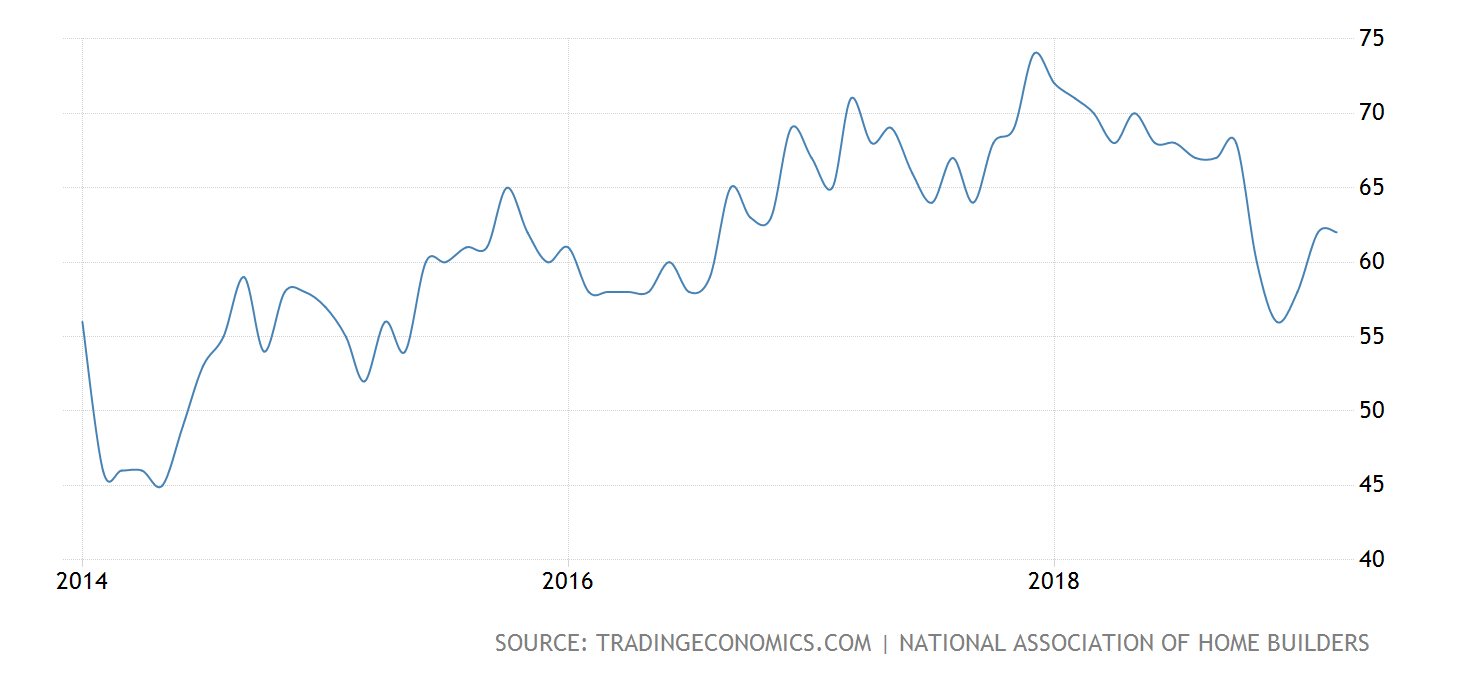

After dropping sharply last year, the National Association of Homebuilders sentiment index has rebounded modestly:

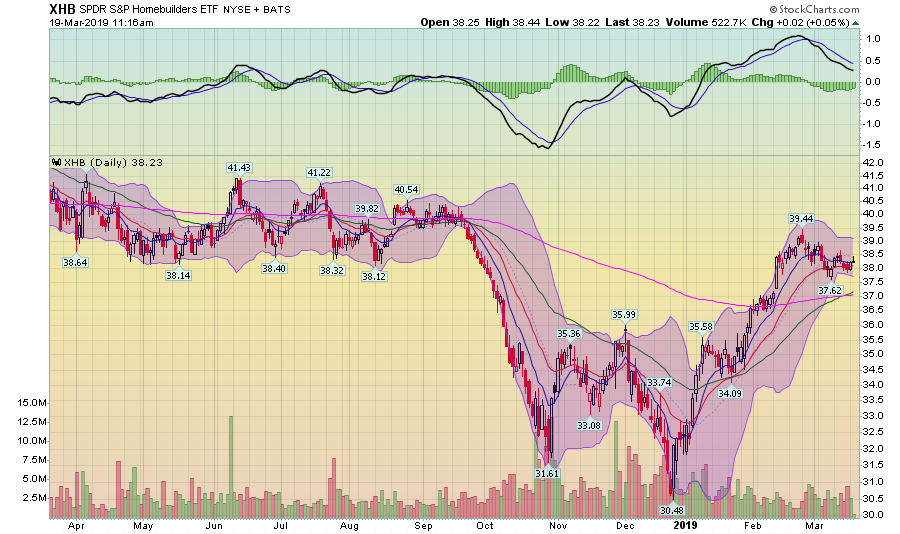

The index has declined since its highs at the end of 2017. Housing data points to a softer housing market. Existing home sales have declined from a 5.6 million/year sales pace a year ago to their current level of 4.950 million. New home sales have also declined from a 680,000/year pace at the end of 2017 to a 630,000 pace (they've been as low as 560,000 in the last few months). Prices are also declining. Over the last year, the median price for an existing home dropped from $276,000 to $249,000 while the median new home price dropped from $340,000 to $320,000. Still, this looks like a slowdown, not a crash. The homebuilding ETF (NYSEARCA:XHB) has rebounded with the rest of the market and is currently in a modest correction:

U.S. Representative David Cicilline has asked the FTC to open an anti-trust investigation into Facebook (NASDAQ:FB):

There is also mounting evidence of anticompetitive conduct by Facebook that may warrant scrutiny by federal antitrust enforcers. For example,the social media goliath has reportedly systematically spied on its rivals, giving it valuable information on how people used competitive products.

This will be interesting to see develop.

Today was a tale of two markets, with the indexes rallying in the morning but selling off on news that China was "pushing back" against some trade demands. The transports were the worst performer, down 1.33%. The mid-caps were next, declining .55% while the small caps were off .54%. Industry performance was varied, with health care up .75% and financials off .8%.

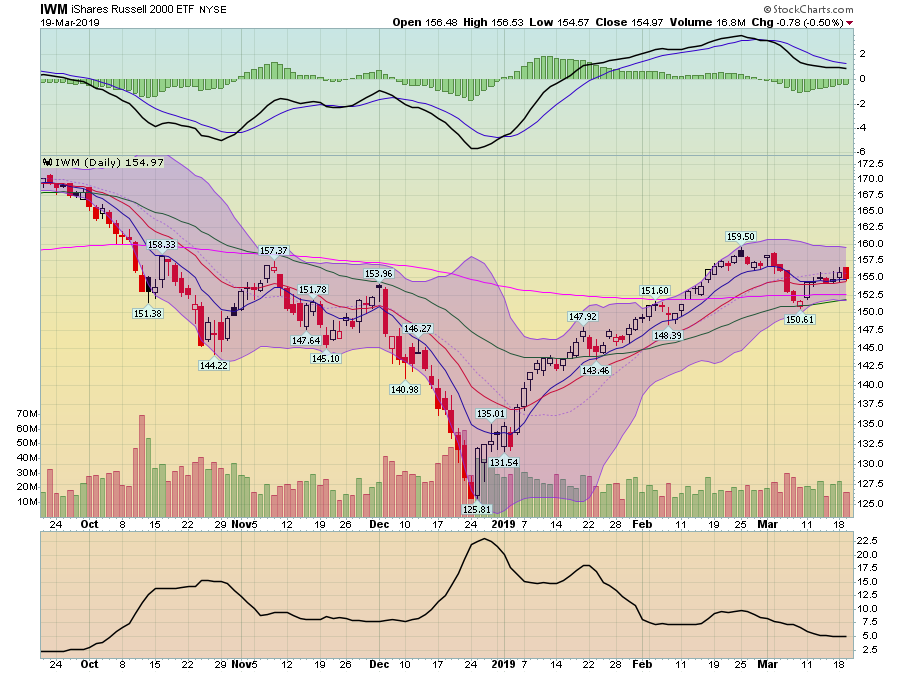

Before getting to the charts, let me explain how I view the indexes. They all are part of a larger, interrelated system. All don't have to rally at the same time. But if some indexes lag while others are rallying, there's a problem somewhere. We may not know what it is (and it could be multiple reasons). But rest assured, there's a reason for the under-performance - and it's probably not good.

This is why the under-performance of mid and small-caps over the last few weeks has been a big sticking point with me. These indexes represent risk-based capital; if they aren't rallying, it means traders are risk-averse. This, in turn, raises serious questions about the viability of the rally.

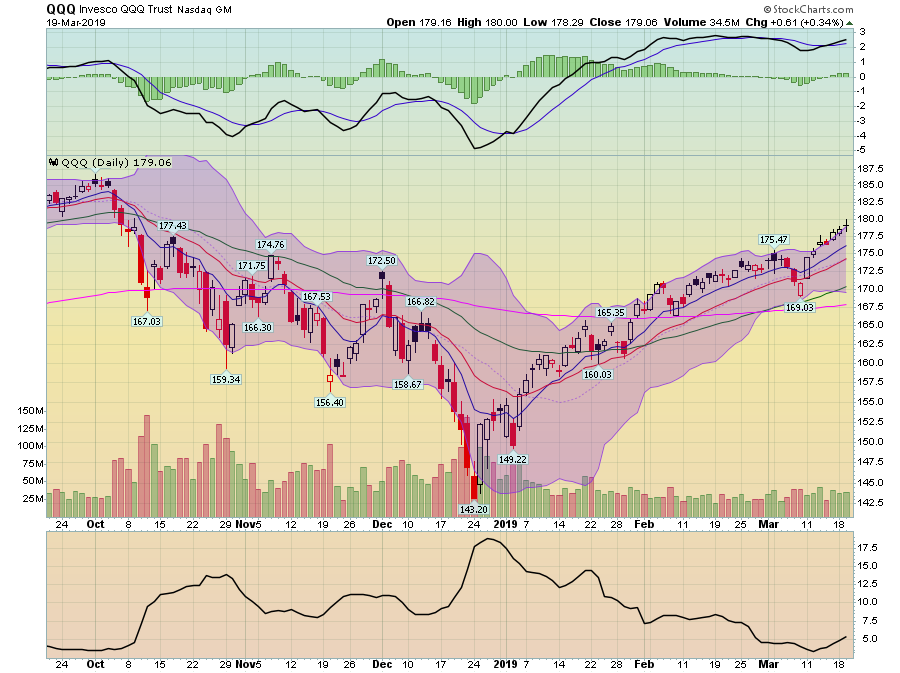

The following two charts illustrate the problem:

Despite the selloff at the beginning of March, the QQQ is in the middle of a nice rally. Prices are in a continual uptrend that started at the beginning of February. The shorter EMAs are all rising with the shorter above the longer. Eventually, the 200-day EMA will be pulled higher.

So far, so good. Then we have the IWM:

The IWM was also in a rally during February. It also sold off at the beginning of March. But it's been stuck with the small moving averages. It's moved a little higher but it's still a few points below February highs. Momentum is declining.

The rising QQQ says, "traders think earnings and the economy are growing". But the IWM say, "we're not willing to take on a lot of risk", which really undercuts the bullishness of the QQQ chart.

To a large extent, the markets continue to telegraph diametrically opposed opinions about the markets. And that's not a good thing.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.