Technically Speaking For March 12

Summary

- Once again, Teresa May's Brexit proposal has gone down in defeat. Badly.

- Germany is not doing well.

- Although the markets rallied again, I'm not convinced this rally is all that great.

Parliament has rejected May's Brexit deal:

Parliament rejected Prime Minister Theresa May’s withdrawal plan on Tuesday in a vote of 391 to 242. Last-minute negotiations with the E.U. were not enough to secure the support of hardliners in the prime minister’s own Conservative Party.

Parliament is expected to vote Wednesday on whether to leave the E.U. on schedule, on March 29, without a deal.

If lawmakers want to keep trying for a managed withdrawal, they would vote Thursday on whether to request a delay from E.U. leaders.

Let's hope they at least have the sense to ask for a delay.

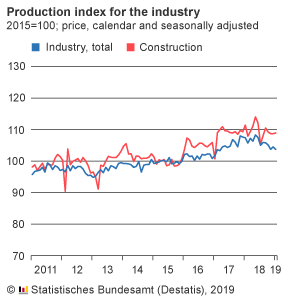

Germany is not doing well. Industrial production continues to decline:

From the latest report (emphasis added):

In January 2019, production in industry was down by 0.8% from the previous month on a price, seasonally and calendar adjusted basis according to provisional data of the Federal Statistical Office (Destatis). The revised figure shows an increase of 0.8% (primary -0.4%) from December 2018.

In January 2019, production in industry excluding energy and construction was down by 1.2%. Within industry, the production of capital goods decreased by 2.5% and the production of intermediate goods by 0.7%. The production of consumer goods showed an increase of 1.5%. Outside industry the energy production was up by 3.6% in January 2019 and the production in construction increased by 0.2%.

That's not all. The latest Markit Manufacturing PMI hit a 74-month low of 47.8. Output contracted for the first time in 6 years. And in another report issued today, German manufacturing sentiment was at its lowest since 2012.

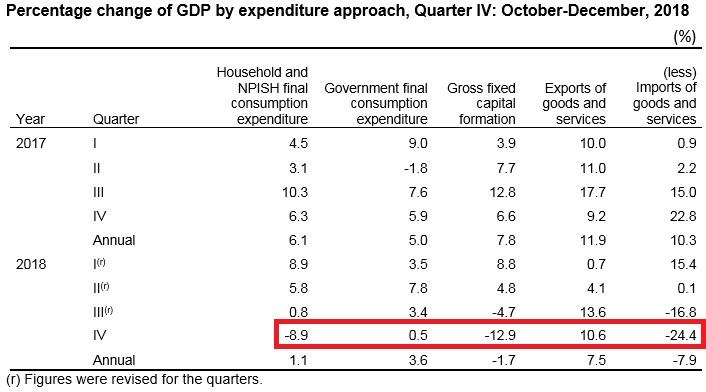

We can add Turkey to the countries that are slowing: In Q4 2018, GDP decreased by 3% Y/Y per the latest report. Household consumption was down 8.9% and investment cratered 12.9% (both numbers are Y/Y):

In Q4 2018, GDP decreased by 3% Y/Y per the latest report. Household consumption was down 8.9% and investment cratered 12.9% (both numbers are Y/Y):

And it looks like we have more bad news about Brexit. From the Washington Post (emphasis added):

Prime Minister Theresa May presented a tweaked Brexit deal with some new language to a skeptical Parliament for a landmark vote on Tuesday. But the British leader faced strong headwinds, as crucial blocs of lawmakers signaled they will not support her withdrawal agreement.

This shouldn't be surprising. Considering the massive defeat she suffered a few months ago, it seems highly unlikely that she'll be able to pass the agreed-to deal with the EU. That increases the possibility of a hard Brexit, where the UK is in the union on day 1 and out on day 2 - a situation that has "unintended consequences" written all over it.

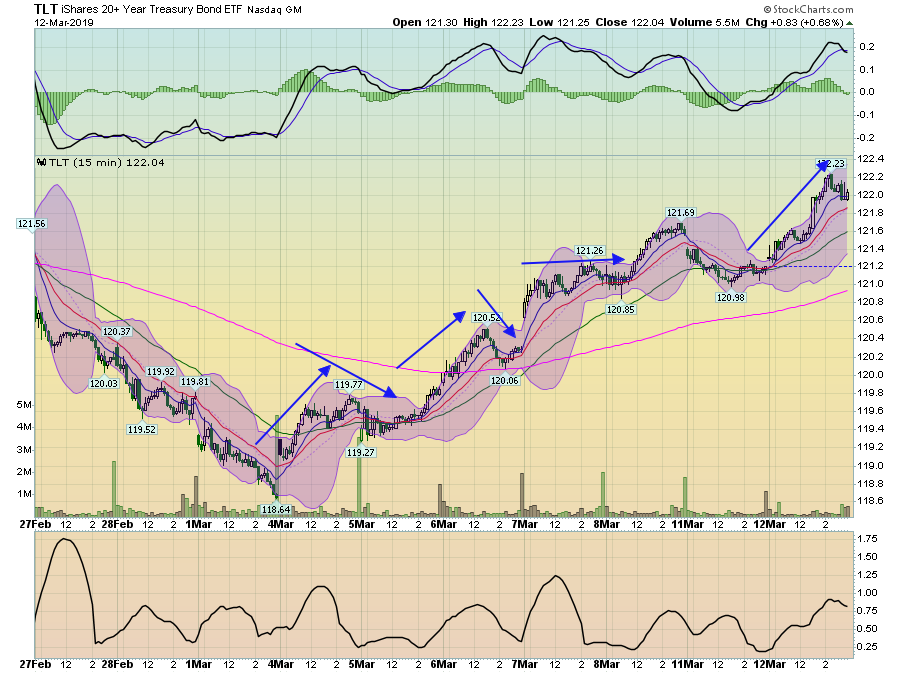

Today's numbers were a bit odd. The TLT was the best performer, gaining .7. Next best was the Nasdaq which was up .52. The TLH - which rose .48, was third. The industry performers were decidedly defensive: Utilities and health care were the two best performers (up .65 and .61, respectively).

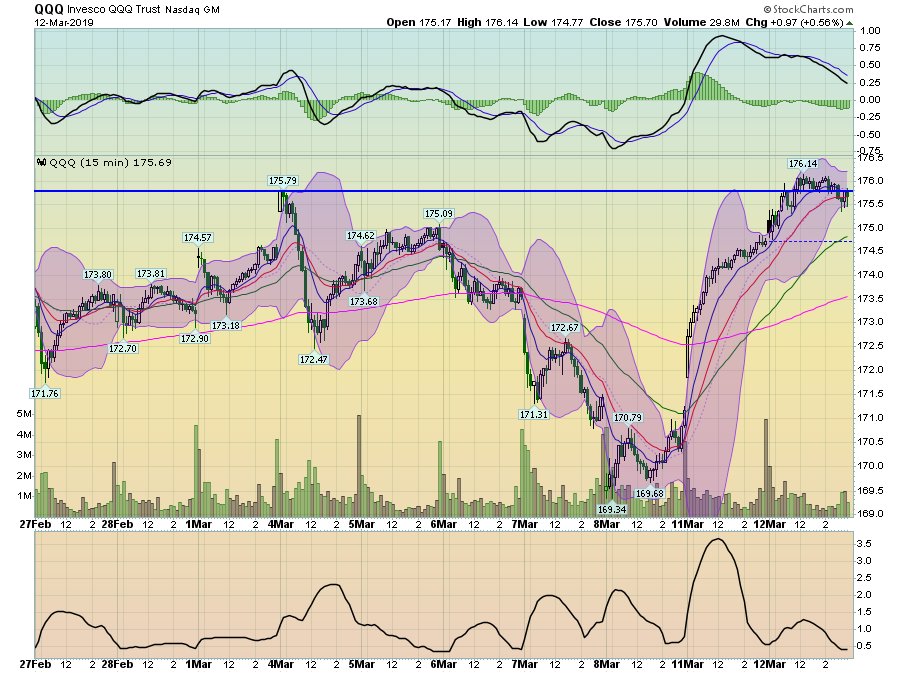

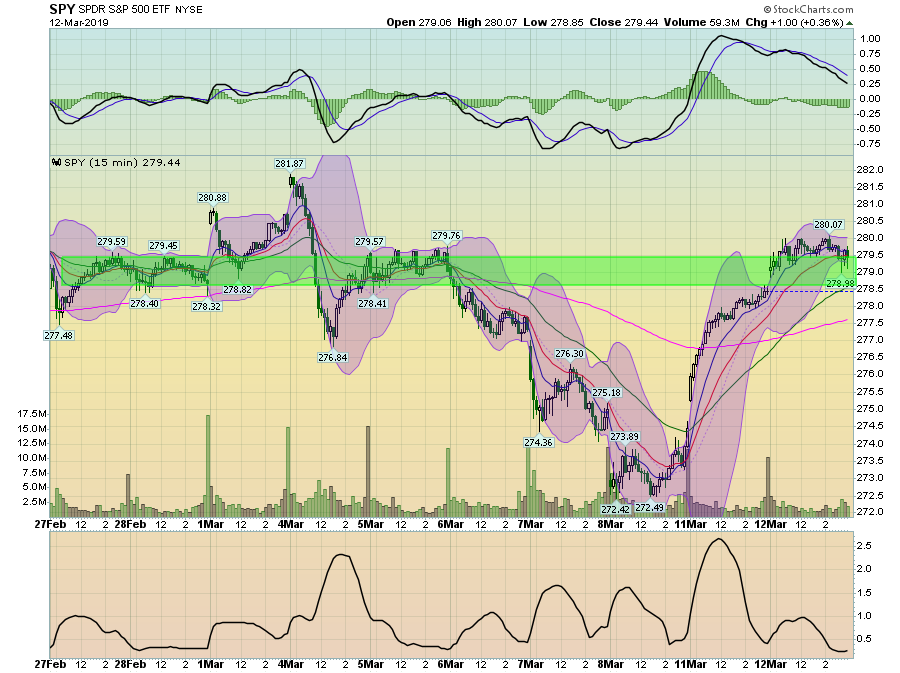

Despite the positive numbers, I'm not that impressed with this week's rally so far. Let's start with the 5-day charts of the SPY and QQQ:

The SPY is currently trading near a 1-week high. But prices moved sideways today.

And a careful look of the QQQ shows that it formed a rounding top today - a topping pattern.

Looking at the 2-week charts highlights additional areas of weakness:

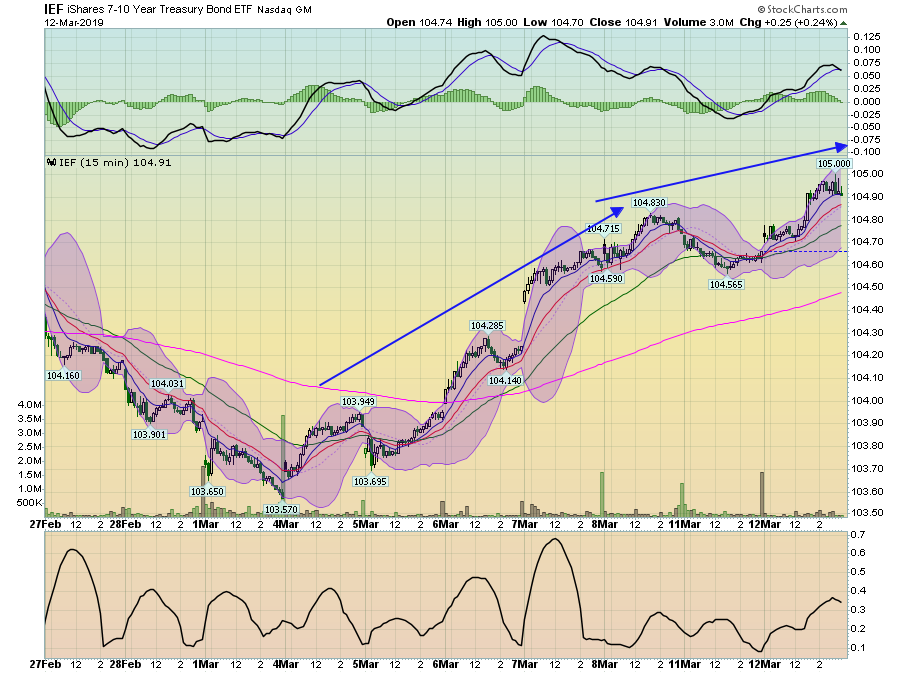

The IEF has rallied 1.4% since March 4. There are two overall trends: the first, which lasted from March 4-8, is a fairly strong rally. The second started on March 8 and is a lower increase.

The TLT is in the middle of a solid rally. Notice the natural progression of advances and selloffs that have the makings of a solid move higher.

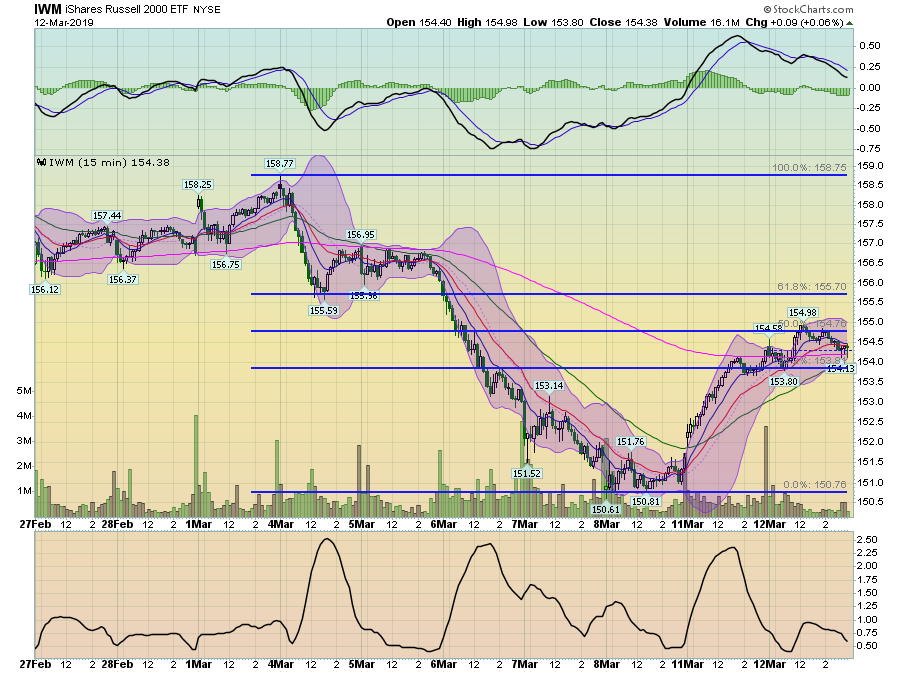

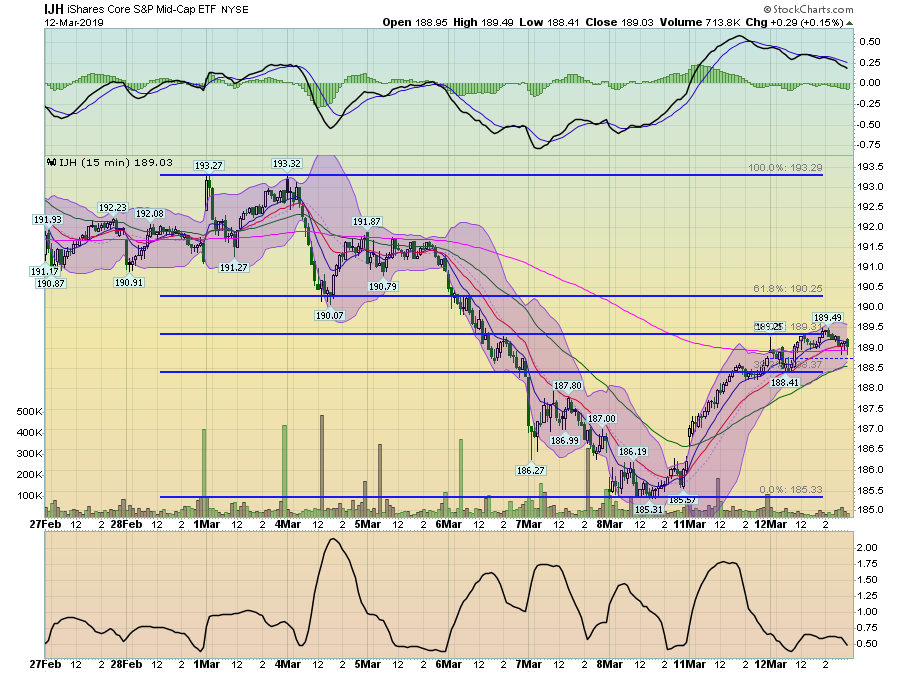

At the same time, riskier capital indexes have advanced, but not as much as the larger cap indexes.

The mid-caps have rallied to their respective 50% Fibonacci level.

The Russell 2000 is currently trading between its 38.2% and 50% Fibonacci level.

In contrast, we have the QQQ ...

... which is just shy of its 2-week high.

The SPY is currently trapped in the 278-279 area, which has a lot of resistance from trading last week.

The combination of the rallying Treasury market and the weaker performance in the riskier equity indexes is not that inspiring. That could change, however, depending on how we do in the next few sessions.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.