Technically Speaking For June 3

Summary

- The U.S.-China trade war is heating up.

- The last PMI reports contain a lot of weak new orders information.

- The market started the week on a very bad note.

The trade wars are heating up. China is preparing a blacklist of companies (emphasis added):

China’s Ministry of Commerce said the list would contain foreign companies, individuals and organizations that “do not follow market rules, violate the spirit of contracts, blockade and stop supplying Chinese companies for noncommercial reasons, and seriously damage the legitimate rights and interests of Chinese companies.”

The Chinese government also issued a white paper over the weekend that struck a very defiant tone regarding future trade negotiations. Now trade tensions are escalating: the U.S. removed India from a special status while also threatening to impose tariffs on Mexican imports if the country doesn't stop the flow of illegal immigrants coming to the U.S. Expect these developments to further depress business sentiment, which will lead to a slowdown in private sector spending.

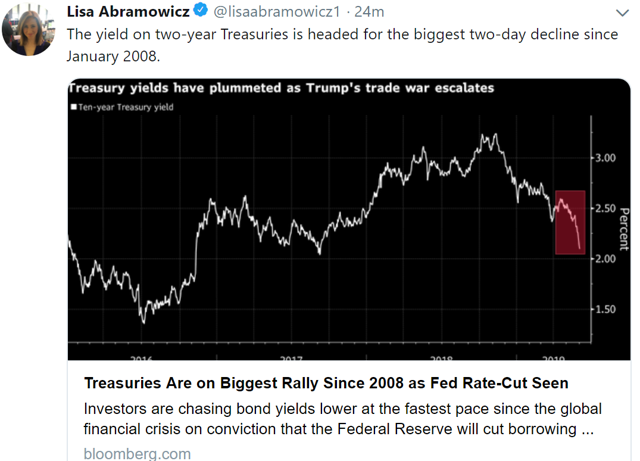

From my Twitter feed:

This is not a good development. As I noted in my weekly summary, the bond market is signaling a recession. This large drop in the 2-year yield bolsters that argument.

Markit released the latest round of PMI reports, most of which contained discussion of weak demand, which is occurring on a global scale.

- South Korea: export orders have declined for 10 months; new domestic orders have also decreased.

- Japan: new orders are down for five months; export orders are down for six months;

- Taiwan: new orders are down for nine months

- Russia: soft demand for new orders

- EU: new orders are down for eight months;

- Germany: new orders and exports are down

- France: new orders are off fractionally

- Italy: new orders still show contraction

Notice the breadth of the decline; it's not just China - which has been the locus of the trade conflict. Chinese weakness has encompassed Asian countries too. And EU weakness is entering its third quarter - a very unhealthy development. Here's how the global report characterized the situation (emphasis added):

Global PMI surveys signalled that manufacturing downshifted into contraction during May. Business conditions deteriorated to the greatest extent in over six-and-a-half years, as production volumes stagnated and new orders declined at the fastest pace since October 2012.

The trend in international trade continued to weigh on the sector, with new export business contracting for the ninth month running. Business optimism fell for the second month in a row and to its lowest level since future activity data were first collected in July 2012.

Those two paragraphs are very bearish.

Let's turn to today's performance table:

The week is starting on a very bearish note. The long-end of the Treasury market led the way higher, bolstered by comments from St. Louis Fed President Bullard that the Fed might have to cut rates. On the plus side, the IWM and IJH both moved higher - a welcome development considering their overall underperformance during the spring rally. But the QQQ sank over 2% thanks to news that the FANG stocks were the subject of anti-trust oversight.

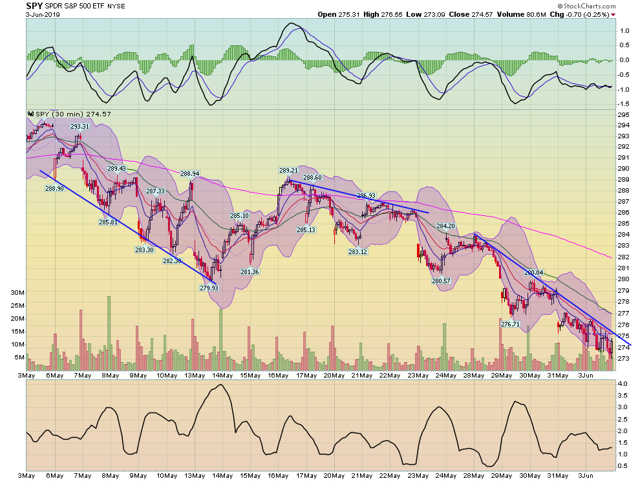

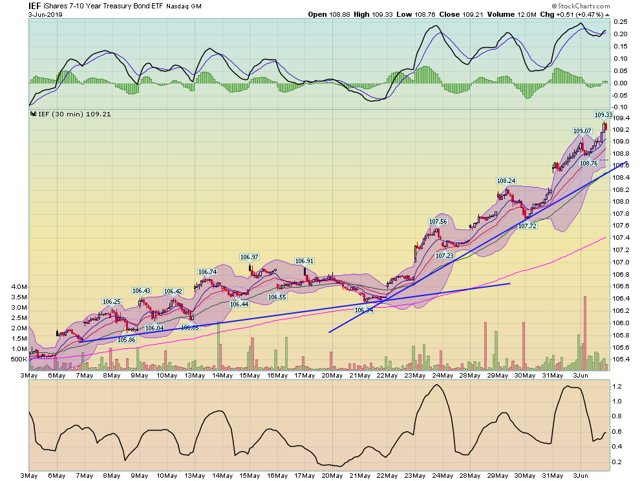

Turning to the charts, there is a fair amount of bearishness all around, starting with the 30-day SPY and IEF charts:

While there are technically three movements - a down/up/down pattern - the general trend is down with a slight interruption in Mid-May. The 200-minute EMA is clearly moving lower on a continual basis.

Meanwhile, the IEF is rallying; it has formed two distinct legs up. The first is from May 6-May 20 when its overall angle is modest. But starting on May 22, the IEF really starts to rally.

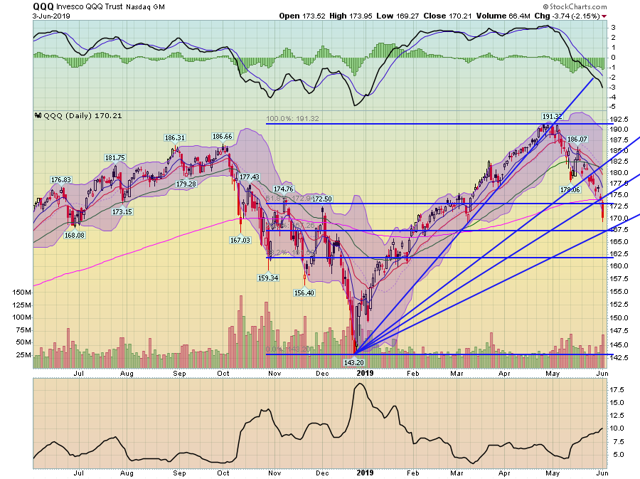

The daily QQQ chart, however, should really add to the bearish tone:

The QQQ was the solid performer during the spring rally. Today, it printed a solid down bar on higher volume. Prices are now below the 200-day EMA and momentum continues to wane.

Right now, it feels as though the bearishness is accelerating. The Trump administration has opened up trade wars on three fronts; anti-trust regulators are looking into some of the largest and most successful companies - which, coincidentally, are also some of the primary drivers of the QQQ rally. The Treasury market is rallying like the stock market. And, thanks to bad news at the beginning of the week, there are now four more days for the market to move lower.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.