- The latest durable goods numbers are soft.

- BOE head Carney said he'd probably cut rates in the event of a hard Brexit.

- The small-cap indexes are moving lower, meaning larger-caps will probably follow.

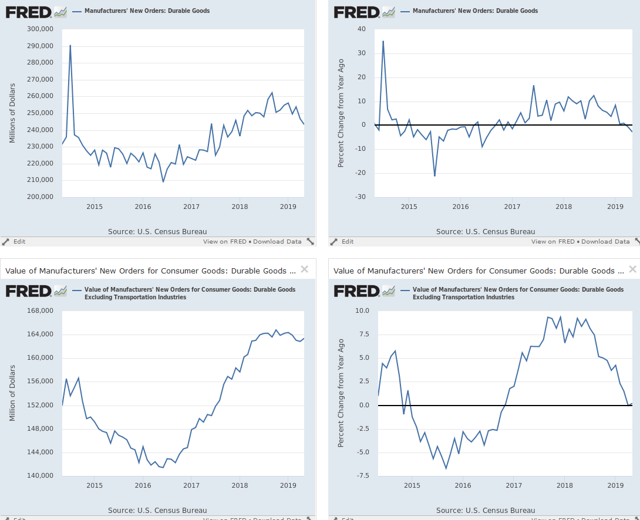

The latest durable goods numbers are soft. For the past three months, the M/M increases/decreases have been +1.7%/-2.8%/-1.3%; the numbers ex-transportation are a little better: -0.5%/-2.8%/+0.3%. Business orders are also soft: +0.3%/-1%/+0.4%. Here are the charts of the headline data:

The top charts show the total number; the bottom charts are ex-transportation; the left charts show the total number, while the right charts are Y/Y. The latter are concerning; the total number (top chart) is now negative, while the ex-transport number (bottom number) barely missed turning negative in the latest report. Tie this data in with the anecdotal comments from the latest Dallas Fed manufacturing report (which I noted yesterday) and you have more weakness than the headline numbers imply.

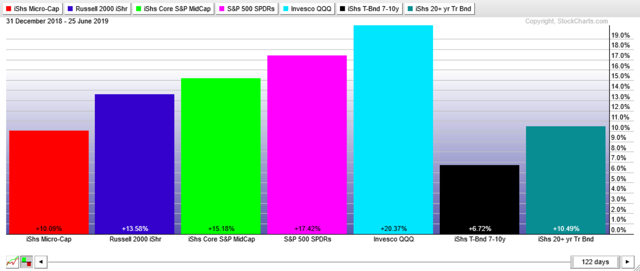

One of my main complaints about the Spring rally is the lack of confirmation from small caps. The following chart puts that into perspective:

Small caps are on the left; the equity indexes get progressively bigger until the IEF (second from right). Since the first of the year, the general trend has been: the larger the company in the underlying index, the bigger the overall performance. If traders thought the economy was about to grow strongly, the smaller-caps would outperform the larger-caps. Instead, the companies that are better poised to survive a slowdown are the better performers.

BOE head Carney has indicated the bank would be inclined to cut rates in the event of a no-deal Brexit (emphasis added):

Mark Carney has indicated that the Bank of England could have to cut interest rates should Britain crash out of the EU without a deal as he said the mounting risks of such a scenario were slowing down growth.

Answering questions from MPs on the Commons Treasury committee on Wednesday, the governor of the Bank said a no-deal Brexit would probably require economic stimulus.

“It’s more likely we would provide some stimulus” in the event of no-deal Brexit, he told the MPs. “We have said we would do what we could in the event of a no-deal scenario but there is no guarantee on that.”

The only problem the BOE has is that UK interest rates are only 0.75%, so there is only so much the bank can cut.

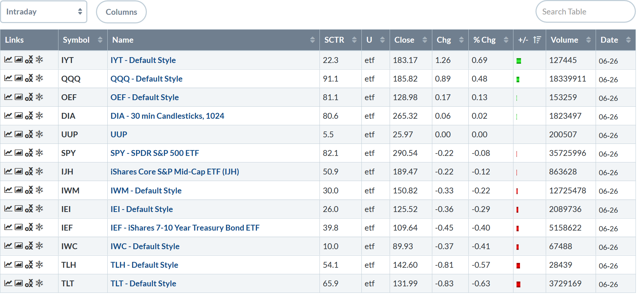

Let's turn to yesterday's performance table:

This is an odd table. Transports led the market higher, probably due to a trade deal rumor. QQQ was the next best performer. Then, the percentage increases drop to fractional levels—large-caps are right around 0%; small-caps are off marginally. The long end of the curve sold off a bit.

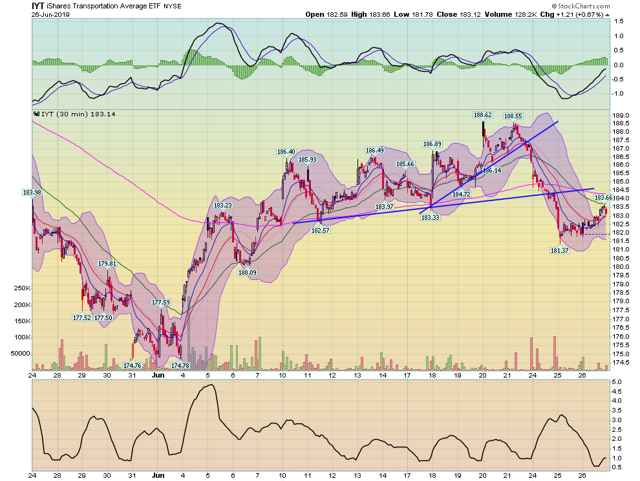

The 30-minute charts are pointing towards lower moves. Let's start with the transports:

IYT broke its trend at the end of trading on Monday. It's been inching higher since, but is still below its trend line. Prices are also below the 200-minute EMA.

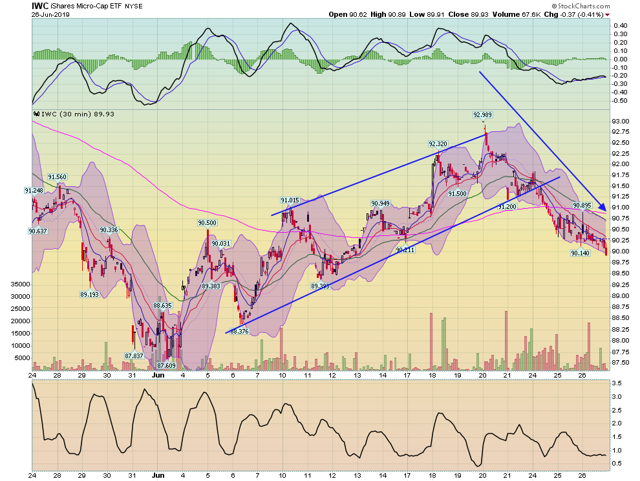

Micro-caps broke trend three days ago in the morning and have been heading lower since. They have yet to find a short-term bottom on this chart.

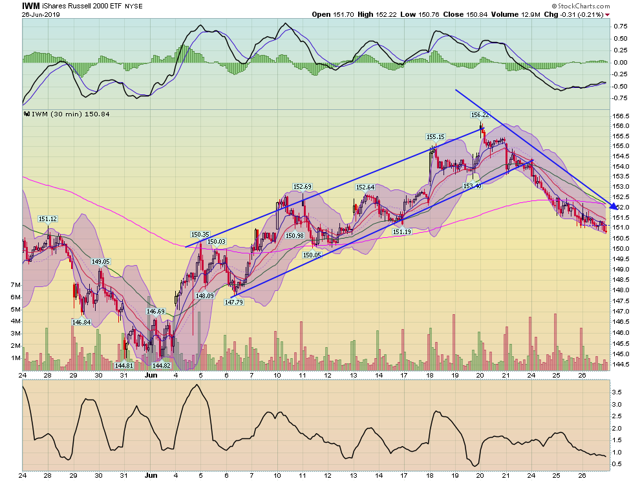

Small-caps also broke trend in the morning three days ago. Like the micro-cap index, prices are below the 200-minute EMA.

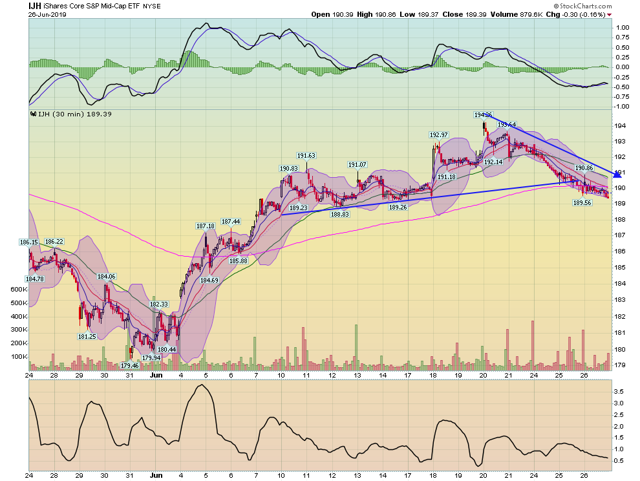

Mid-caps have also broken trend, although that didn't happen until Tuesday. Prices are now below the 200-minute EMA.

With the riskier averages now trending lower, it's likely the larger-cap indexes will follow.