Summary

- Turkey's economy is in very bad shape.

- The diffusion index of the Chicago Fed's national activity index has been negative all year.

- The week started out poorly for the indexes.

The Turkish economy is in trouble (emphasis added):

Through the course of a 16-year run as Turkey’s supreme leader, Mr. Erdogan has time and again delivered on his promises of potent economic growth. Yet not unlike an athlete who puts up record-shattering numbers through performance-enhancing drugs, he has produced expansion by resorting aggressively to debt. He has unleashed credit to his cronies in the real estate and construction industries, who have filled the horizons with monumental infrastructure projects.

The bill has come due. Over the last two years, financiers have taken note of the staggering debt burdens confronting Turkey’s major companies and grown fearful of the increasingly dubious prospects for full repayment. Investors have yanked their money out of the country, sending the value of Turkey’s currency, the lira, plunging by more than 40 percent against the American dollar.

Turkey's economy contracted for the last three quarters of 2018, although it rebounded in 1Q19. Unemployment has risen to 14.1%; industrial production decreased 4% Y/Y in the latest report and and has contracted in 7 of the last 12 months; inflation is running at 18.7%; and retail sales are down 6.9% Y/Y in the latest report (they have also decreased in 7 of the last 12 months). There is no way to spin those numbers as anything but terrible.

How will Washington respond to Big Tech's rise? A new bill has a partial answer (emphasis added):

Sens. Mark Warner (D-Va.) and Josh Hawley (R-Mo.) will propose legislation today forcing the social media companies to tell users how they are monetizing their data. Their bipartisan bill would also require the companies to regularly disclose the ways consumers’ data is being used, as well as file an annual report on the total value of all the data they’ve collected.

Yes, there are obvious problems - the biggest of which is what exactly is the valuation methodology? Then there's the issue of some people's data being more valuable than others (for example, a person with an income of $250,000 would probably have more value than a person with an income of $50,000). However, this does get to a core issue with tech companies: a key input into their business model (personal data) is free, meaning the company has a massive profit margin. Frankly - I'd like to know what I'm worth, y'know?

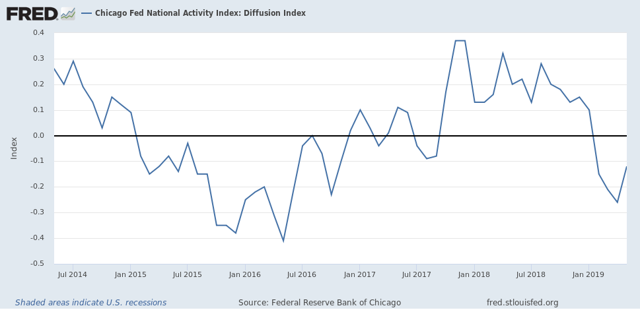

The Chicago Fed released the latest National Activity Index this morning. Here's a 5-year chart of the diffusion index:

It's been negative for the entire year. That's not fatal, but it does indicate a wider breadth of softness than implied by the macro-level numbers.

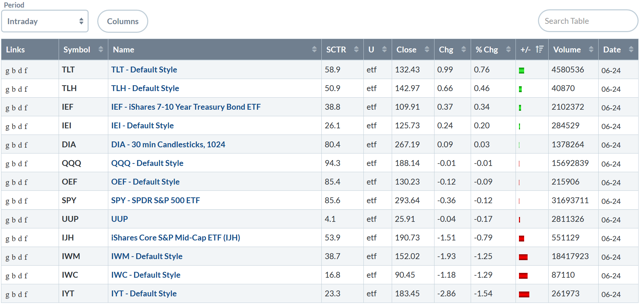

Let's turn to today's performance table:

Not the way you want to start the week. The long-end of the Treasury curve led the market higher followed by the belly of the curve. The large-cap indexes were more of less even. Smaller-caps lost ground: small and micro-caps each declined over 1%.

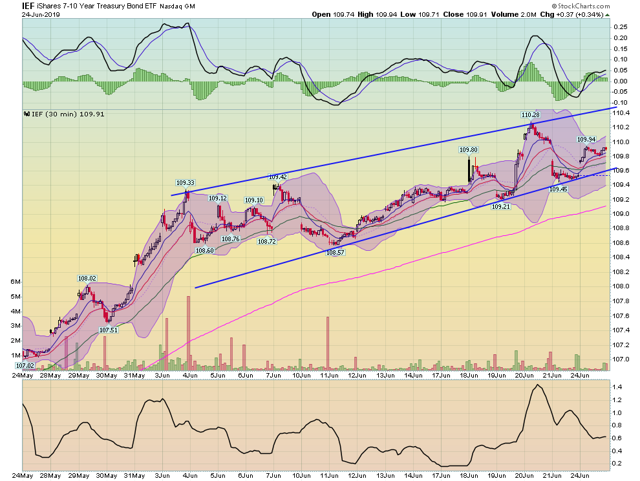

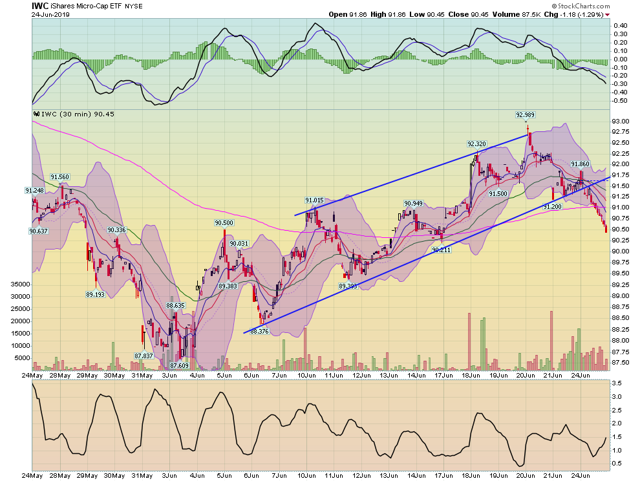

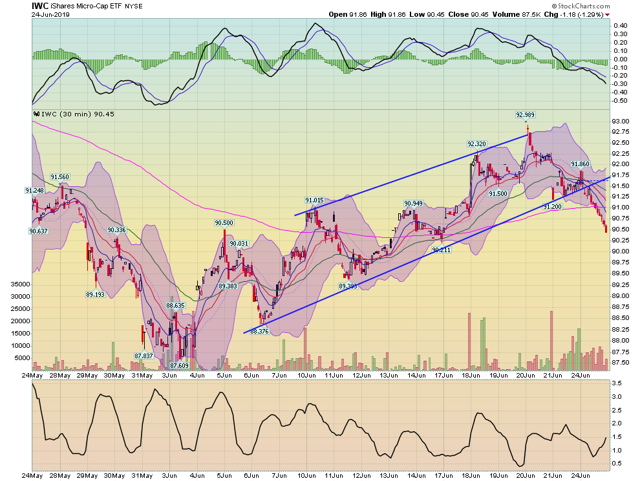

The 30-minute charts show that we could be seeing a modest breakdown. Let's start with the Treasury market:

The iShares 7-10 Year Treasury Bond (NASDAQ:IEF) continues to move higher in an upward sloping channel. Remember that the 10-year Treasury is yielding a little over 2% - which is barely positive after accounting for inflation.

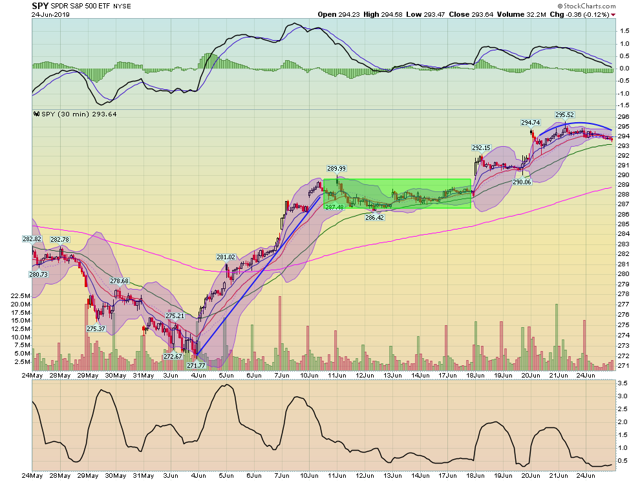

While the SPY (NYSE:SPY) is still in an upward rally, it has formed a rounding top - a topping pattern - over the last three days. Momentum is trending lower.

And then we have the small-caps:

Small-caps clearly broke trend today. They are now below the 200-minute EMA on much weaker momentum.

The iShares Micro-Cap (NYSE:IWC) exhibits the same pattern.

So, the Treasury market continues to rally, small-caps are selling off, and large-caps are forming topping patterns. With four days left in the trading week - and a holiday-shortened week next week - it's not looking that positive.