Technically Speaking For June 12

Summary

- CEO confidence is a touch lower.

- There is remarkably little stress in the financial markets.

- Longer-term charts support the idea that we're in the middle of a topping formation.

CEO confidence is down for the fifth consecutive month (emphasis added):

Overall economic confidence of the CEOs of some of the country's top companies has dipped another leg lower, according to the latest survey by the Business Roundtable of 127 chief executives. This barometer of CEO optimism hasn't seen a quarter-over-quarter increase since it hit a record high over a year ago.

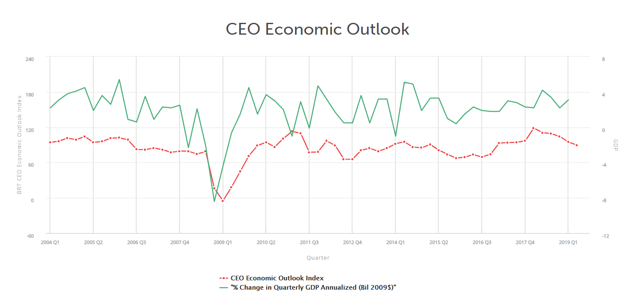

Here's a chart of the data:

The data is still at high levels, so we shouldn't view the decline as alarming. It is obvious, however, that macro-level events are having a negative impact. One of the implications of this data is weaker capital spending expectations:

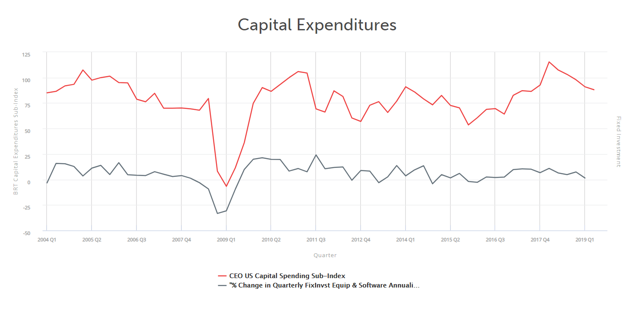

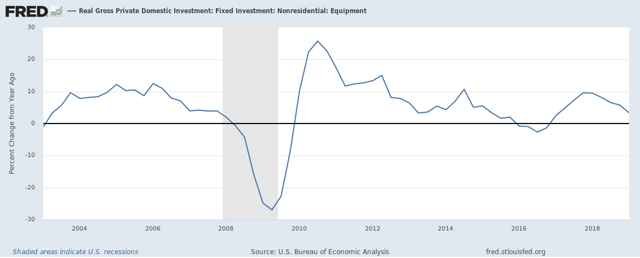

These peaked in the first quarter of 2018 in reaction to the passage of the TCJA but have been trending lower since. This corresponds with a decrease in capital spending:

It's reasonable to expect a continued decline in this metric as a result of declining investment expectations.

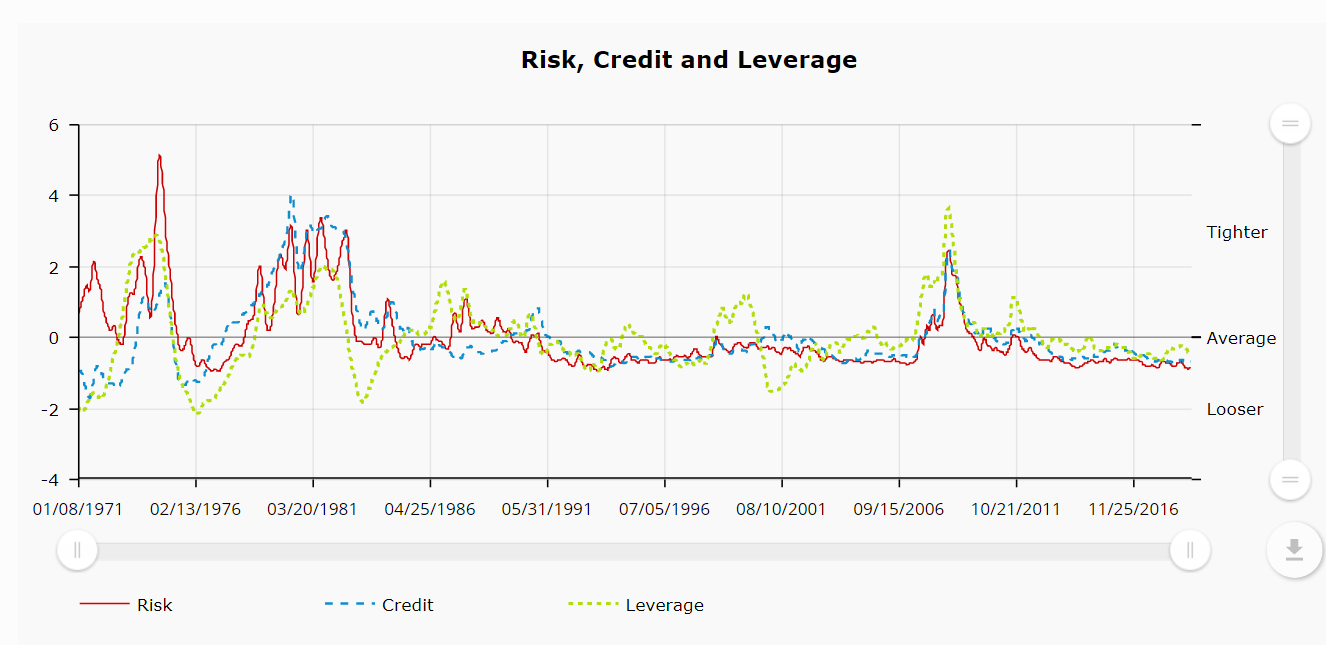

The Chicago Fed released the latest Financial Conditions Index, which shows a financial system in good shape:

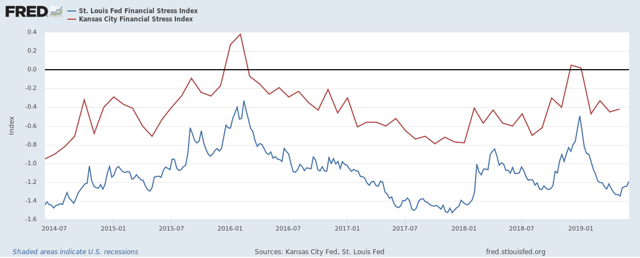

The Kansas City and St. Louis Federal Reserve Financial Stress Indexes confirm the above data:

Both indexes use most of the same inputs, which explains why they closely track each other. The Kansas City number (in red) is released monthly while the St. Louis number (in blue) is released weekly.

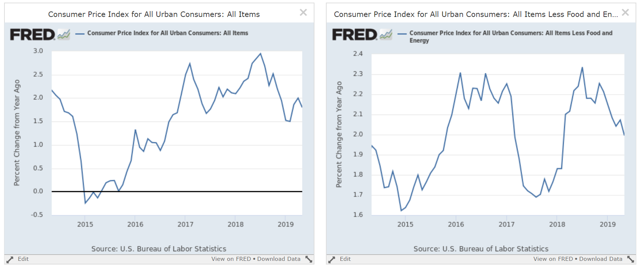

CPI data is weaker (emphasis added):

The Consumer Price Index for All Urban Consumers (CPI-U) increased 0.1 percent in May on a seasonally adjusted basis after rising 0.3 percent in April, the U.S. Bureau of Labor Statistics reported today. Over the last 12 months, the all items index increased 1.8 percent before seasonal adjustment.

Here's a chart of the data:

The left chart depicts the Y/Y percentage change in overall CPI while the right chart shows core CPI. The former is just below 2% while the latter is right at 2%. While some have argued that weak inflation is a problem, Kansas City Fed President George argues differently. In a recent speech, she argued that there are two different inflation expectations: those of traditional consumers, who are more influenced by gas prices and modestly higher prices for "food, energy, rents, and health care," and those of financial market participants who are more focused on the future CPI as measured by the difference between Treasury bonds and their corresponding TIPs. She implies that the "main street" expectation is for higher inflation. She also argues for a target inflation range rather than a hard target.

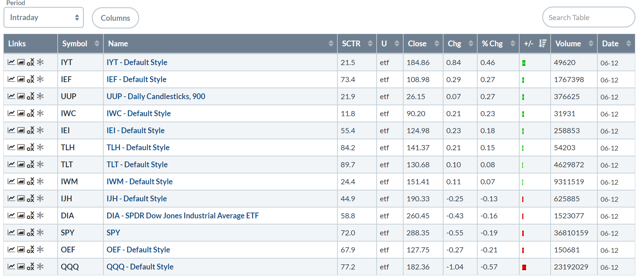

Let's turn to today's performance table

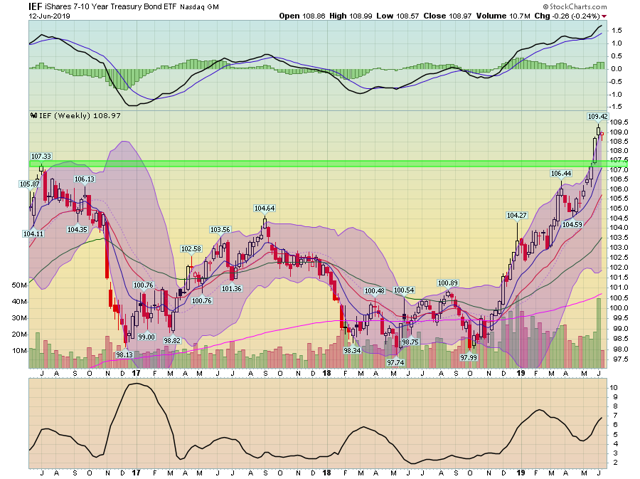

This is one of the stranger performance tables I've seen. Transports are leading the pack - which should be bullish. But the 7-10 year Treasury ETF is the second-best performer - which is followed by the dollar and micro-caps. As if that weren't strange enough, the larger-cap indexes all moved slightly lower on the day.

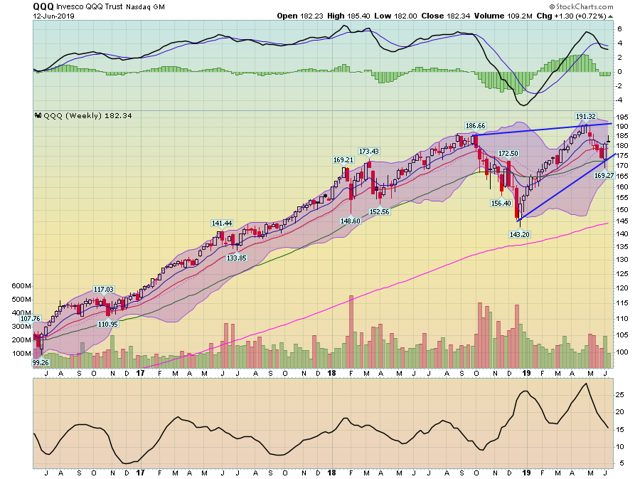

Today, let's take a look at the weekly charts. This helps to put recent price action into a longer-term perspective. And, I think it shows that an argument can be made that the markets are topping.

The QQQ is forming a rising wedge pattern - a bearish reversal pattern.

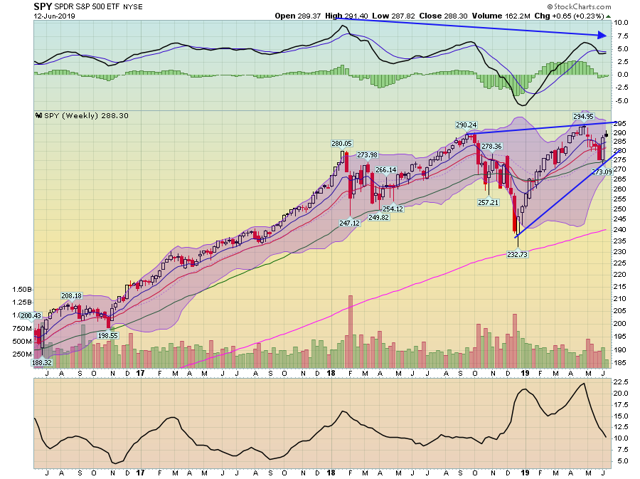

The SPY is as well.

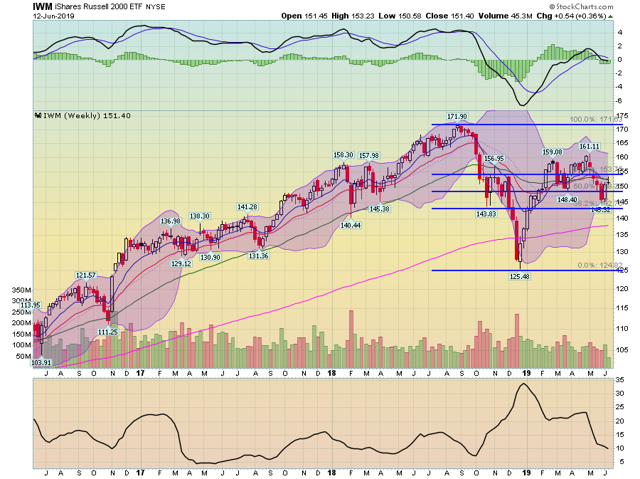

The IWM broke its uptrend last fall. The Spring rally sent prices to slightly above the 61.8% Fibonacci level but the index has had a difficult time keeping momentum above that level.

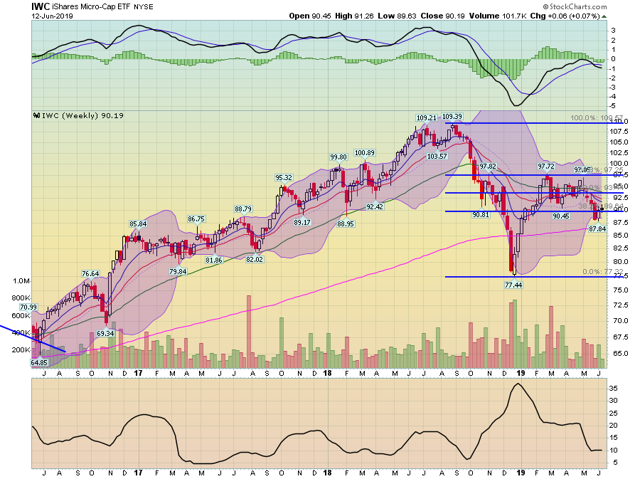

The IWC (micro-caps) has the same pattern as the IWM.

All this is happening while the Treasury market is making one of its highest levels in the last five years.

So - there's been an exodus from micro and small-caps. Large-caps could be forming a rising wedge pattern and the Treasury market is rallying strongly. All this supports the idea that the market is in the middle of a slow-motion topping formation.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.