Technically Speaking For July 24Summary

- The government has opened an antitrust investigation into the tech sector.

- Things might be heading in a very bad direction in Hong Kong.

- The markets had a solid move higher today.

The government has formally opened a probe into the tech sector:

The Justice Department said on Tuesday that it would start an antitrust review into how internet giants had accumulated market power and whether they had acted to reduce competition. Similar inquiries are underway in Congress and at the Federal Trade Commission, which shares antitrust oversight responsibilities with the Justice Department.

After losing the Microsoft (NASDAQ:MSFT) case in the 1990s, the government-backed off of high profile antitrust cases. This occurred at the same time that the Democrats embraced a more Wall Street-friendly attitude during the Clinton administration. Antitrust law has evolved a great deal since then, meaning the government will probably be advancing new and novel theories going forward. This should be very interesting to watch.

Boris Johnson doubled down on the UK leaving the EU on October 31:

"The people who bet against Britain are going to loose their shirts," Johnson says, adding Britain will leave the EU in October, "no ifs, no buts."

This isn't a surprising statement. Johnson was one of the earliest Brexit proponents while also making it a key part of his platform as he pursued the Prime Ministership. That, of course, doesn't mean this is going to end well. As I noted yesterday, the EU has offered the UK a more or less final decision on the issue, making a hard Brexit the most likely outcome. To that point, remember that recessions are caused by shock economic events that disrupt fundamental economic operations, which Brexit could easily do.

Events in Hong Kong could be taking a turn for the worse (emphasis added):

China on Wednesday warned that it would not tolerate protesters’ efforts to threaten the central government’s authority in Hong Kong and suggested that it could, if asked, mobilize troops in the People’s Liberation Army garrison there to maintain order.

.....

“The behavior of some radical protesters challenges the central government’s authority, touching on the bottom line principle of ‘one country, two systems,’” Colonel Wu said during a news conference in Beijing unveiling the new strategy. “That absolutely cannot be tolerated.”

One could argue there are three fundamentally important international cities of finance: Hong Kong, New York, and London. A Chinese military action against Hong Kong protesters would have the same effect as the Tiananmen Square (NYSE:SQ) crackdown. It could potentially have a very negative impact on US-China trade talks.

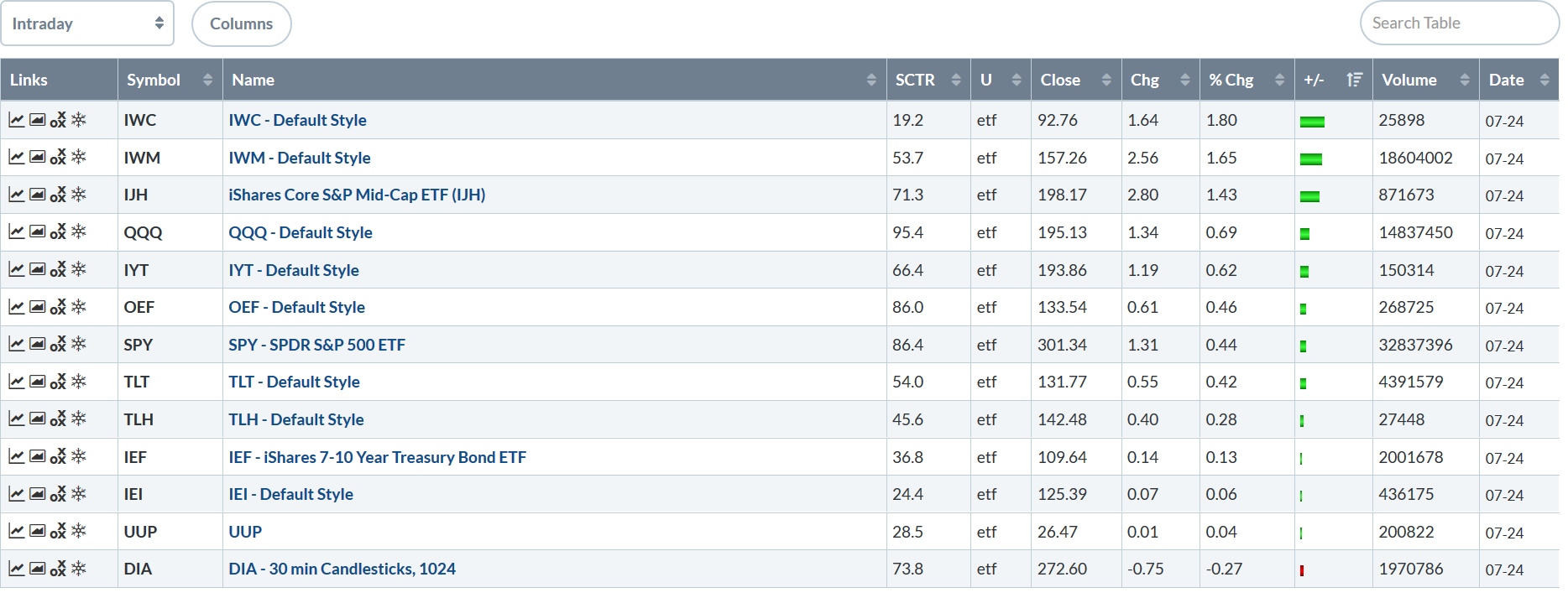

Let's take a look at today's performance table:

This was a solid day for the markets. The best news is that micro, small, and mid-caps led the market higher, with all three gaining over 1.4%. But the larger-cap indexes also did well.

Before looking at the charts, I'd like to clarify some confusion I created in yesterday's post, where I changed my bias from bearish to bullish. However, I was very lax in clarifying my point of reference. My bullish bias is short-term -- 1-2 weeks. My long-term bias (3-6 months minimum) is still bearish, based on a combination of technical and fundamental analysis. Going forward, I'll use the following format:

- Short term bias (1-2 weeks): bullish

- Long-term bias (3-6 months minimum): bearish

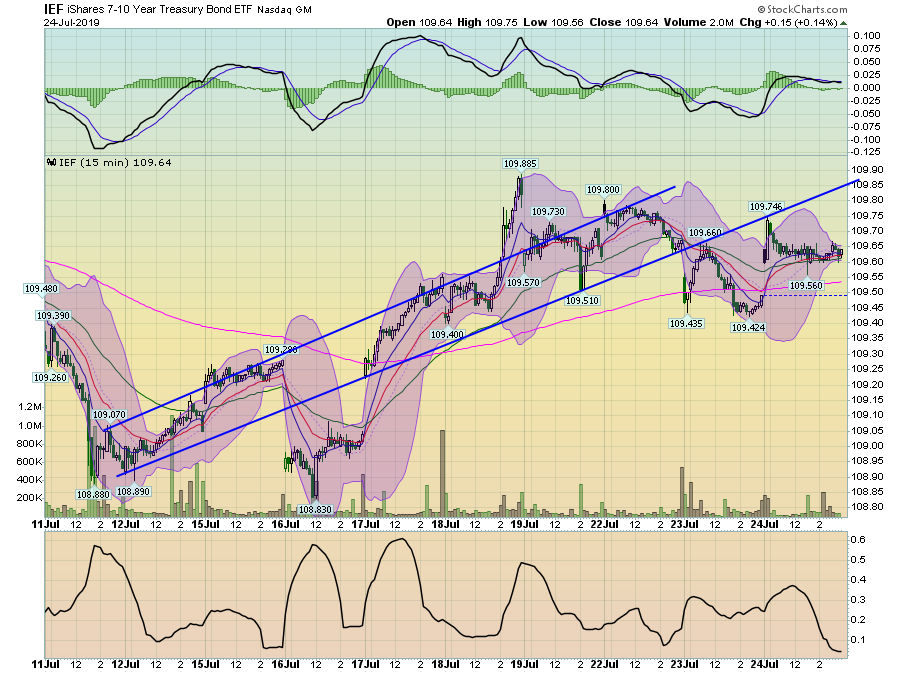

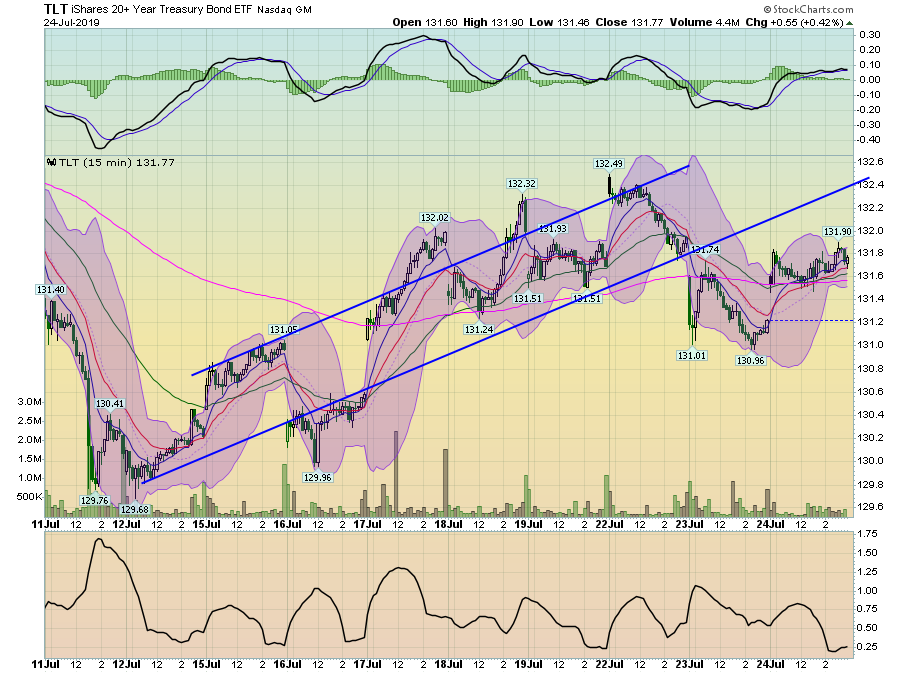

Yesterday when I changed my short-term bias, I did so based on two factors: a trend break by the Treasury market ETFs and rising short-term charts. Both of those trends continued today.

The IEF gapped higher at the open and hit resistance at the upward sloping trend line.

The TLT chart is the exact same.

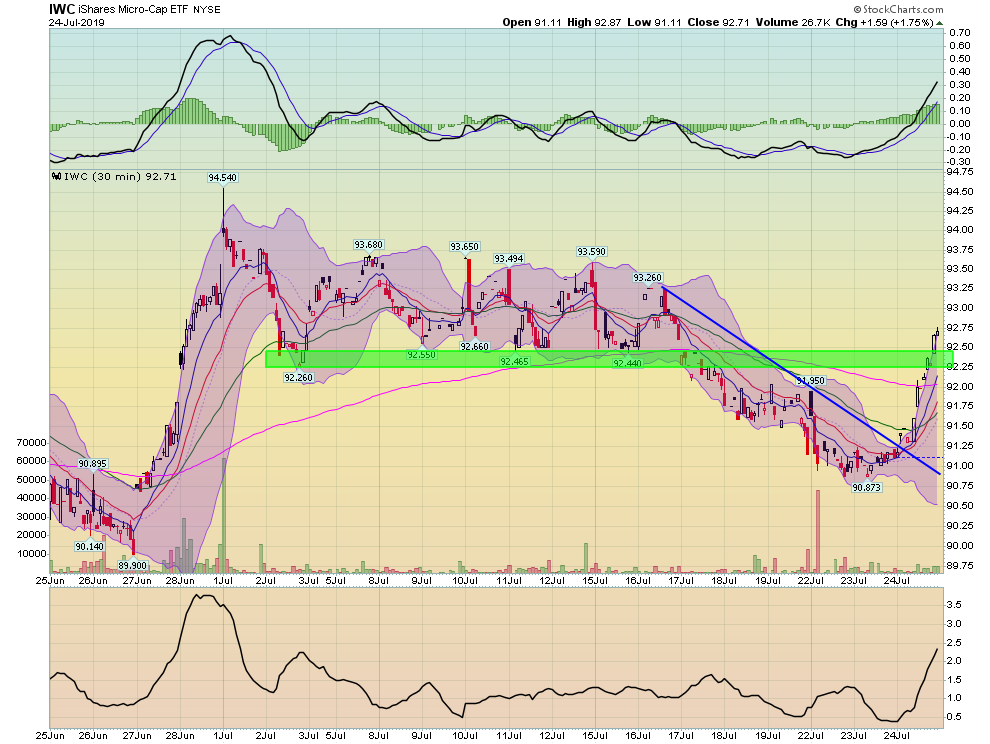

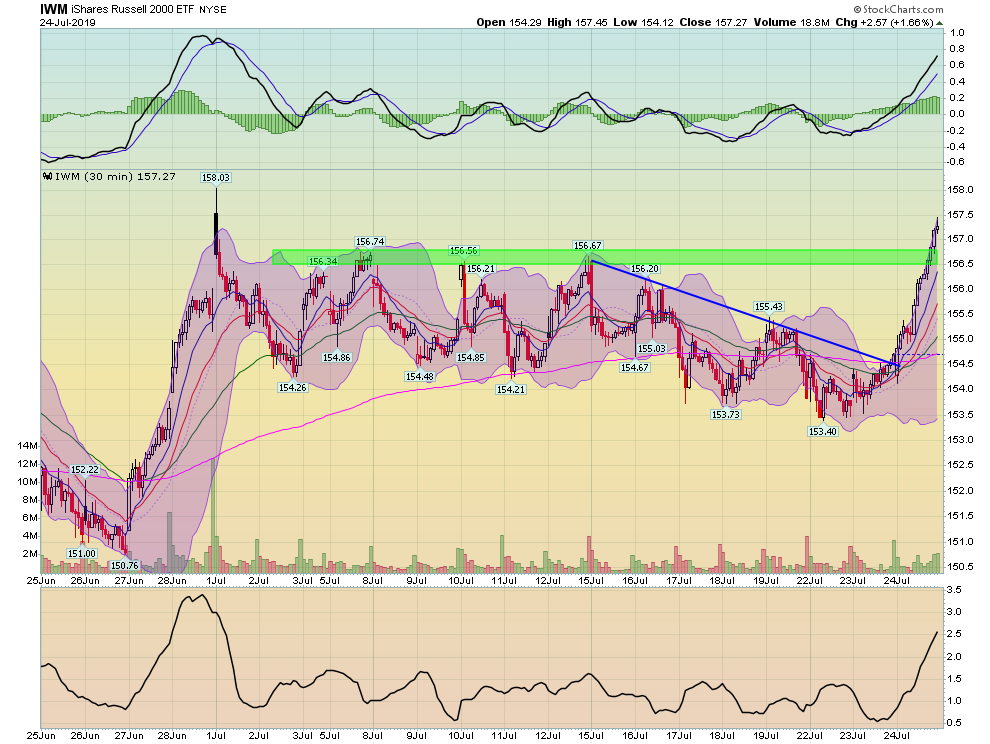

The short-term charts of the small-cap indexes moved higher.

Micro-caps broke the downward sloping trend line connecting highs from July 16 and July 22. Prices also broke through resistance in the lower 90s.

Small-caps broke through resistance in the mid-150s.

Mid-caps also broke through resistance.

All three have made solid moves today, making their respective trend breaks more important.

The charts above are solid and support a continued move higher.