Summary- The Fed kept rates on hold today and stated they would be patient about future rate increases.

- Although she survived several key votes, PM May remains in a precarious political situation and the possibility of a hard Brexit remains high.

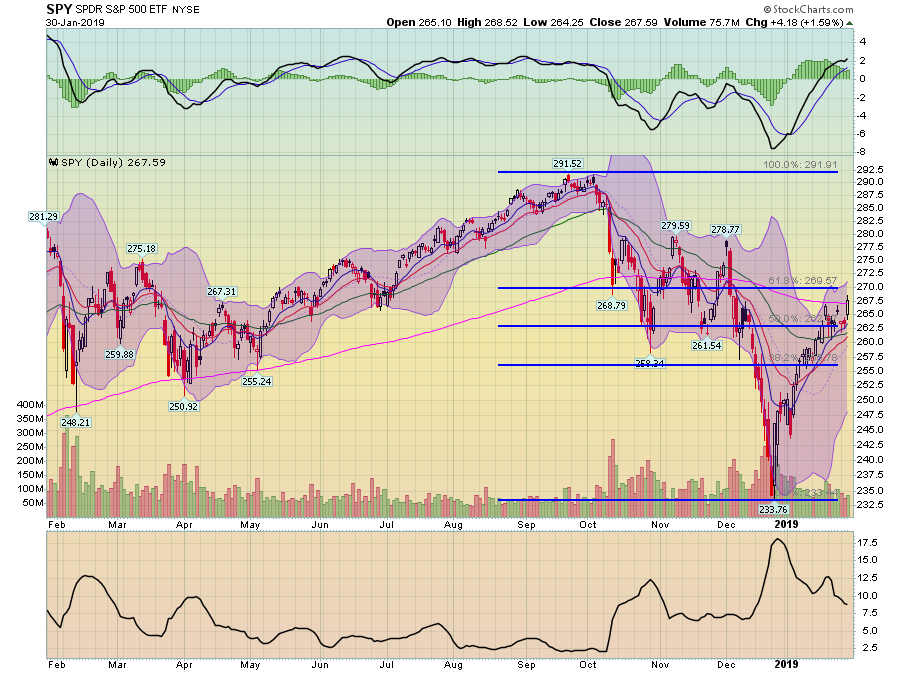

- Prices ended their consolidation and moved through the 200-day EMA on the SPY chart.

The Fed kept rates on hold today. Here's the key sentence from their policy statement (emphasis added):

In light of global economic and financial developments and muted inflation pressures, the Committee will be patient as it determines what future adjustments to the target range for the federal funds rate may be appropriate to support these outcomes.

The Fed operates from two perspectives. The first is based on their economic models while the second is based on "real world" data. The Fed has clearly shifted from the first to the second.

March 29 -- the formal date of a "hard Brexit" -- still looms large on the horizon. In the latest round of Parliamentary intrigue, Teresa May survived two key votes (emphasis added):

Mrs. May’s latest political escape came when lawmakers narrowly failed to approve an amendment giving Parliament the power to instruct her to seek a delay to avoid a disorderly, and possibly chaotic, exit that Britain faces on March 29 if there is no agreement.

However, she later lost a vote on a nonbinding amendment that said Britain should not leave the bloc without a deal, a sign of potential troubles ahead.

May continues to believe (at least publicly) that she can reopen negotiations with the EU and extract additional concessions. The EU has consistently rejected this option. The EU probably wants to send a very public signal that withdrawal would inflict such significant economic pain as to make it an unattractive option. It now appears that May is hoping to eventually present Parliament with two options: her already-negotiated agreement or no deal, thereby forcing approval of the former. This is a very dangerous political game of chicken that has "unintended consequences" written all over it.

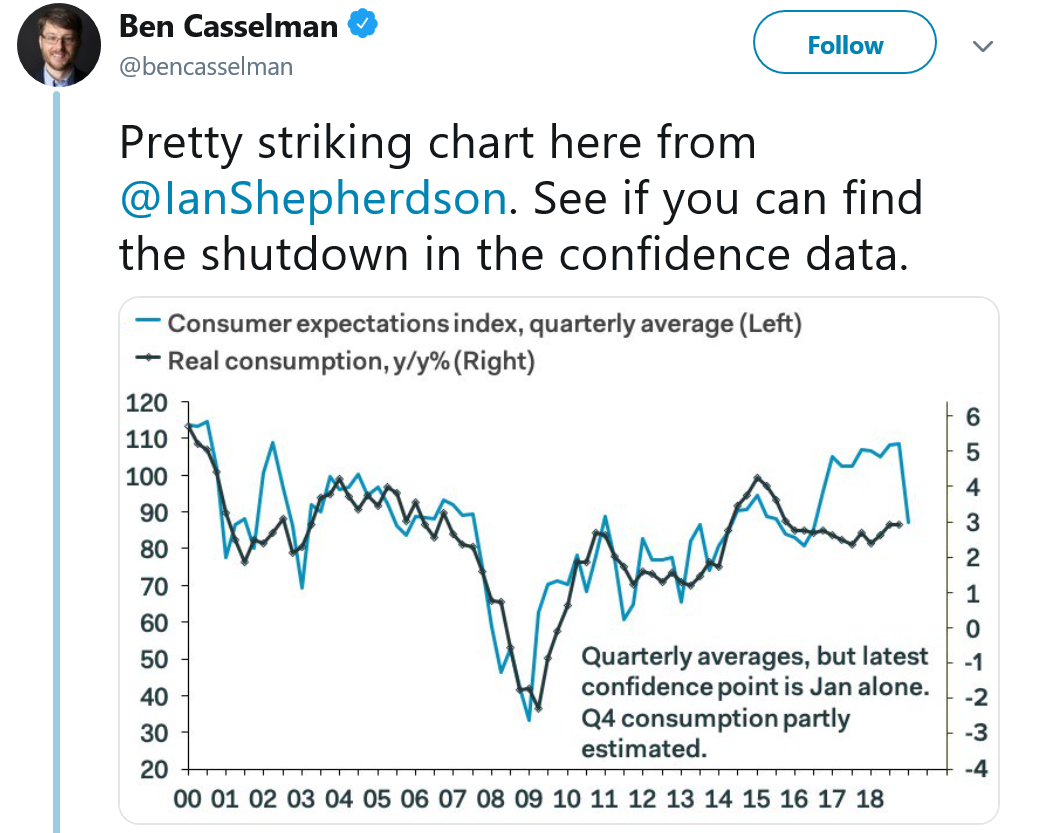

The University of Michigan's consumer confidence number dropped sharply last month, which could have a negative impact on consumer spending. From my Twitter feed:

Hopefully, the shutdown caused the decline, meaning the successful re-opening of the government will lead to a rebound. Even so, don't be surprised to see weaker-than-expected consumer spending for the late December-late January period in the upcoming data releases.

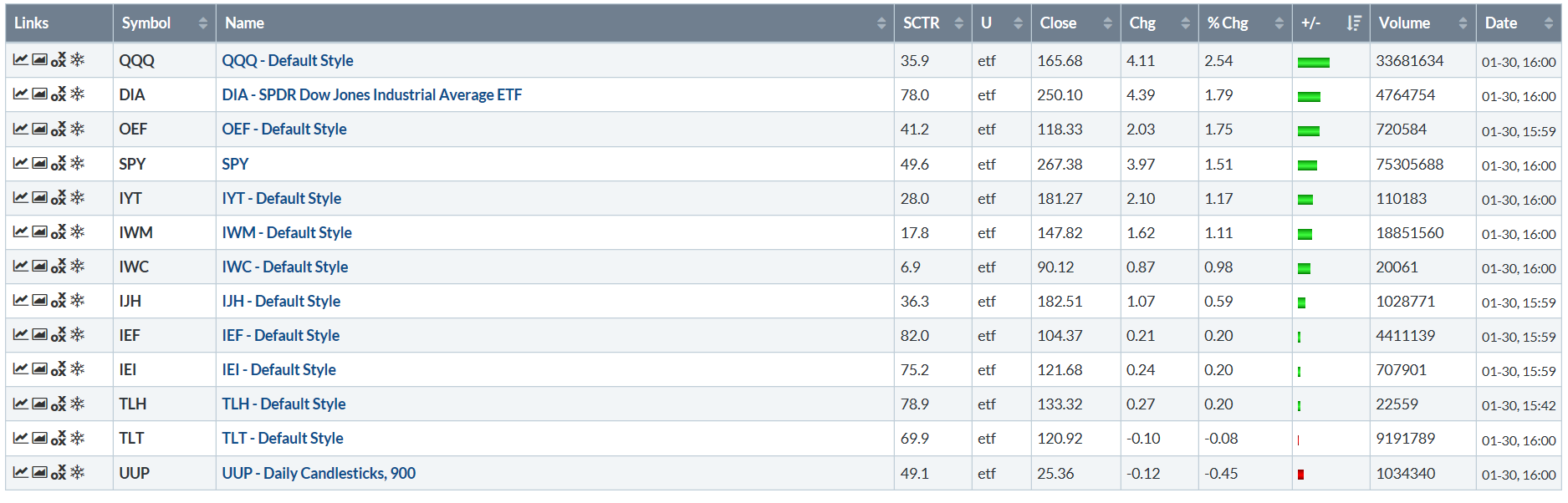

Let's take a look at today's performance table: Considering some of the losses over the last few days -- especially in the QQQ -- today's move higher is welcome. And, the QQQ made a strong advance, rising 2.5%. But everybody did well.

Considering some of the losses over the last few days -- especially in the QQQ -- today's move higher is welcome. And, the QQQ made a strong advance, rising 2.5%. But everybody did well.

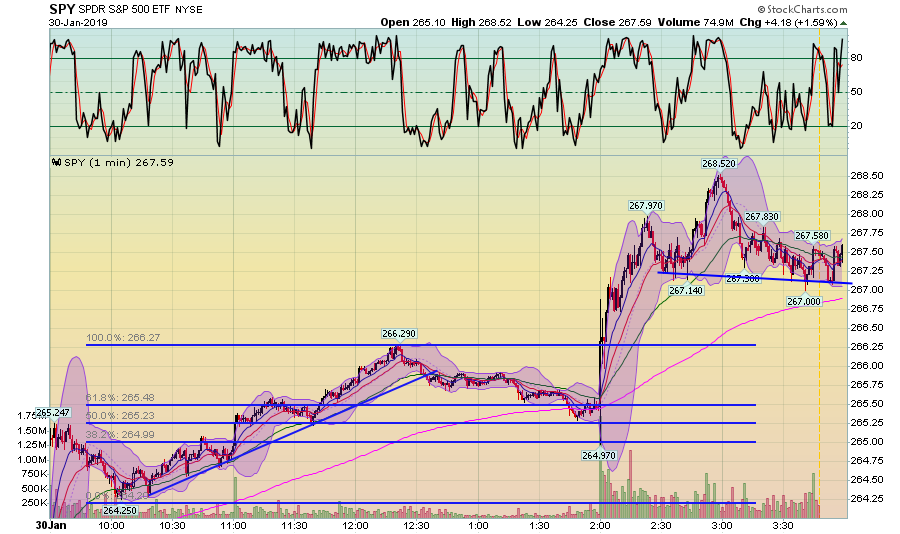

Over the last few days, I've grown a bit tired of trying to come up with new ways of writing about "consolidation". Thankfully, today's price action eliminates that problem. Let's start with today's chart:

There are four movements:

- A rally that started at the open and continued until right afternoon

- A move lower until 2:00 PM, when prices found support at the 200-minute EMA and 61.8% Fib level

- A sharp move higher thanks to a dovish Fed

- Consolidation for the remainder of the day, with prices using the lower 267 handle for support.

This chart shows the bulls are still very much in control of the market; every time the market sold off, the bulls started buying.

The 2-week chart shows the consolidation in more detail. We see a series of rising lows and lower highs. 266.90 was the absolute high, which fell after prices rallied thanks to the dovish Fed commentary.

Finally, on the daily chart, we have a strong bar higher with the body moving through the 200-day EMA.

So, is the consolidation over? Yes. The main question now is will prices continue to move higher. For that answer, we need a few more trading sessions.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.