Summary

- The Reserve Bank of India lowered interest rates 25 basis points.

- News from the automakers is pretty bearish.

- The markets had a down day, but the overall uptrend remains intact -- for now.

The Reserve Bank of India lowered rates 25 basis points. Here is a key statement from their policy announcement describing international developments:

Let me begin by setting out key developments that the MPC considered while arriving at the policy decision. The MPC noted that global growth is slowing down across key advanced economies ((AES)) and in some major emerging market economies ((EMES)) as well. World trade is also losing momentum. While international commodity prices, especially of crude, have recovered from their December lows, they remain soft. In consonance, inflation has edged down in major AEs and many EMEs. Global financial markets have regained poise from heightened turbulence in December, with equity markets paring earlier losses, bond yields easing and EME currencies appreciating, aided by a weaker U.S. dollar.

The bank notes that not only is global GDP declining, so are prices -- which, to use their term, act in "consonance" with growth. The RBA made the same observations in their policy announcement on Monday. So far, over the last few months, there is unanimous analysis regarding the slowing of the global economy.

News from the automakers is weakening. Landrover reported a £3.4 billion loss for Q4 2018. Despite an increase in sales, Volvo is reporting a drop in earnings caused by higher U.S. tariffs. The industry as a whole is predicting a very difficult 2019.

There are two reasons this should be concerning. First, consumers make two major durable goods purchases -- autos and houses. Because these purchases are financed, households must have confidence in their medium and long-term finances. Weak auto sales mean consumer confidence is weaker.

Second, these industries not only employ large numbers of people but also stand at the epicenter of numerous supply chains. When the big companies' sales slow, it sends negative ripple effects into the economy at large.

Larry Summers argues that no trade deal with China will have a meaningful impact on its relationship with the U.S.:

Technology for artificial intelligence in development today, however, can be operated on widely available equipment. And there are hundreds of thousands of Chinese citizens studying in the United States or working for U.S. companies that develop such technology. Keeping U.S. knowledge out of Chinese hands for substantial lengths of time is impracticable short of a massive breaking of economic ties.

Nor is it likely for the Chinese government to halt its support of technology development. How would the United States react if other countries demanded that we close down DARPA, the Defense Department’s advanced research agency, because it represented unfair competition? Or if trading partners argued that U.S. support for private clean-energy companies, such as the subsidies provided by the Obama administration, was an unfair trade practice?

Much of our current information technology and communications infrastructure comes directly or indirectly out of Bell Labs, which was financed out of the profits of a government-regulated and -protected monopoly. Would the United States have responded constructively to demands from other countries to dismantle the Bell system?

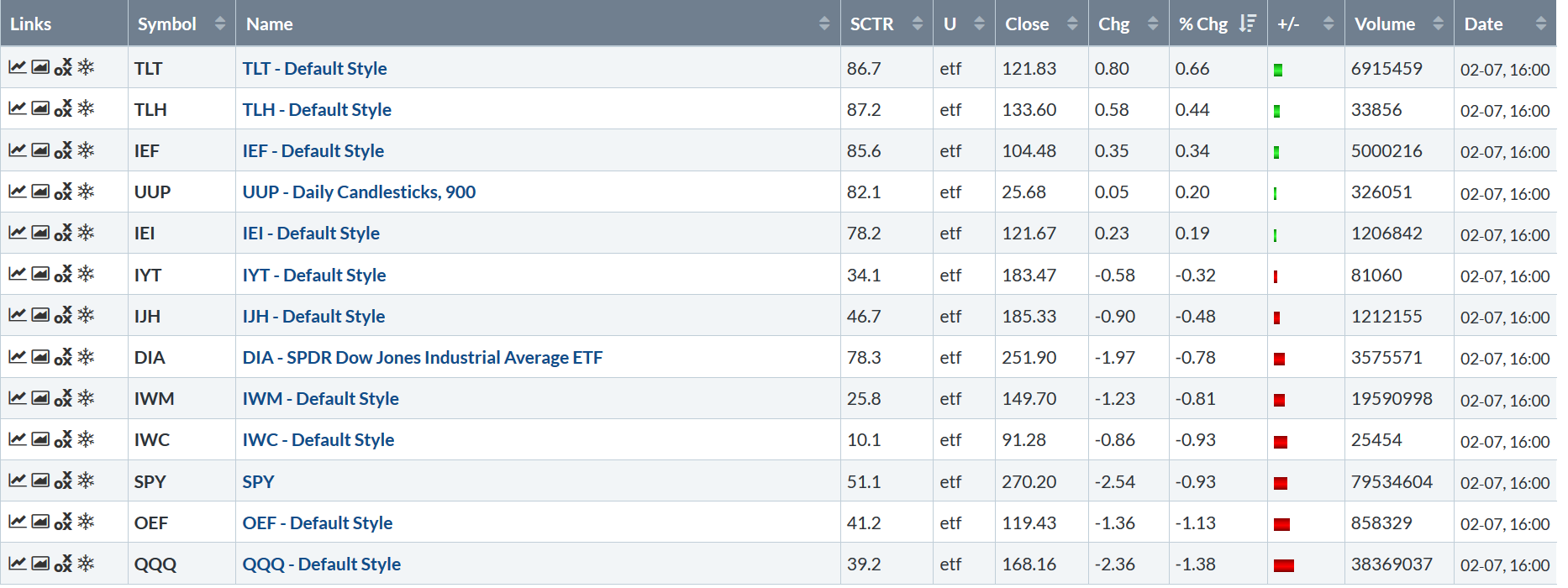

Let's take a look at today's performance table:

The markets dropped thanks to a news story from CNBC that Trump would not be meeting Chairman Xi before the March 2 deadline. Considering the importance of the topic, you'd think there'd be an effort to have the two leaders meet face-to-face. Be that as it may, the losses weren't that bad, with the worst performer only off 1.38%.

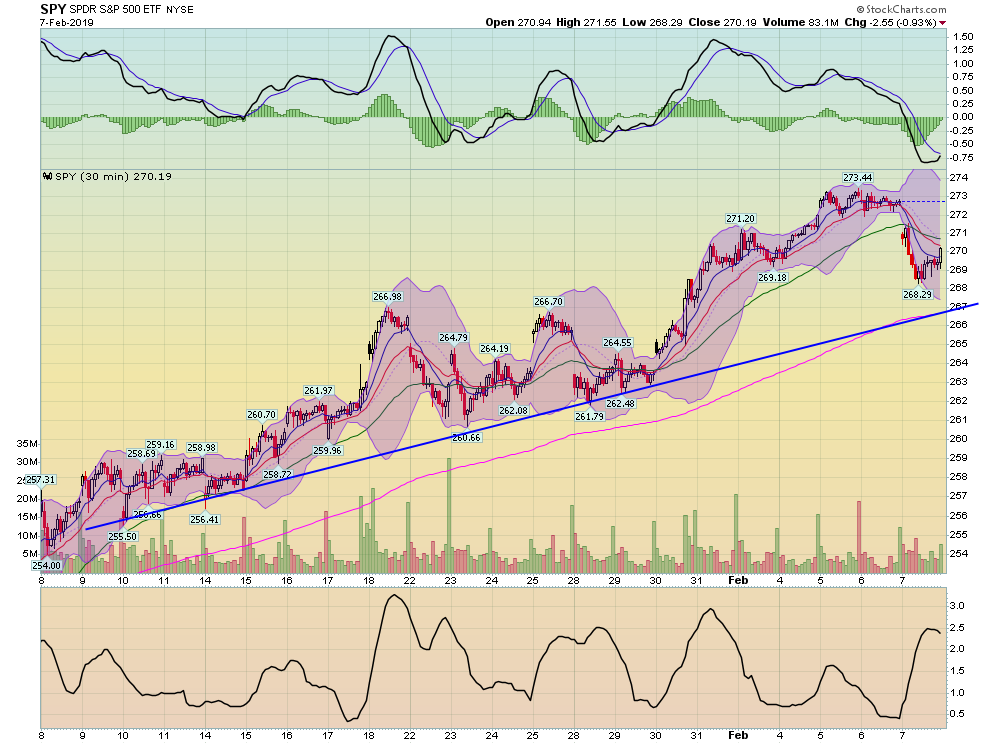

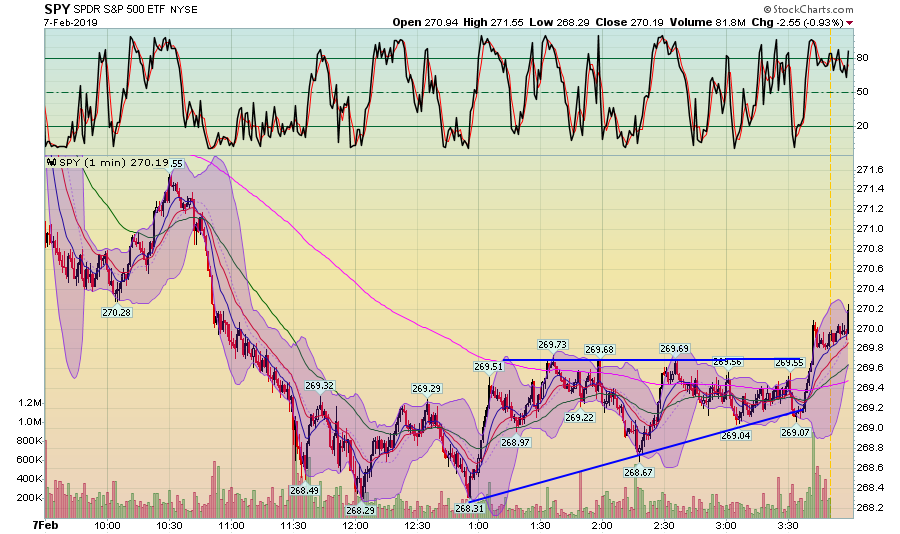

The SPY (NYSE:SPY) gapped lower at the open. The market quickly caught a bid but fell under the weight of the above-referenced CNBC story. Prices did consolidate losses in the afternoon. The rising bottoms are encouraging, as is the end-of-the-session rally sending prices above resistance around the 269 level.

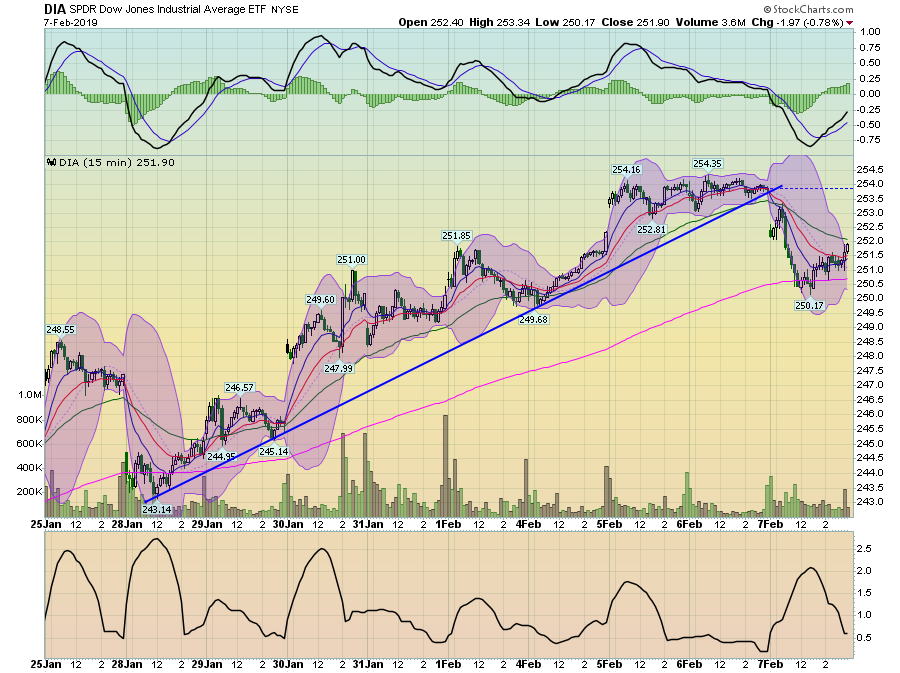

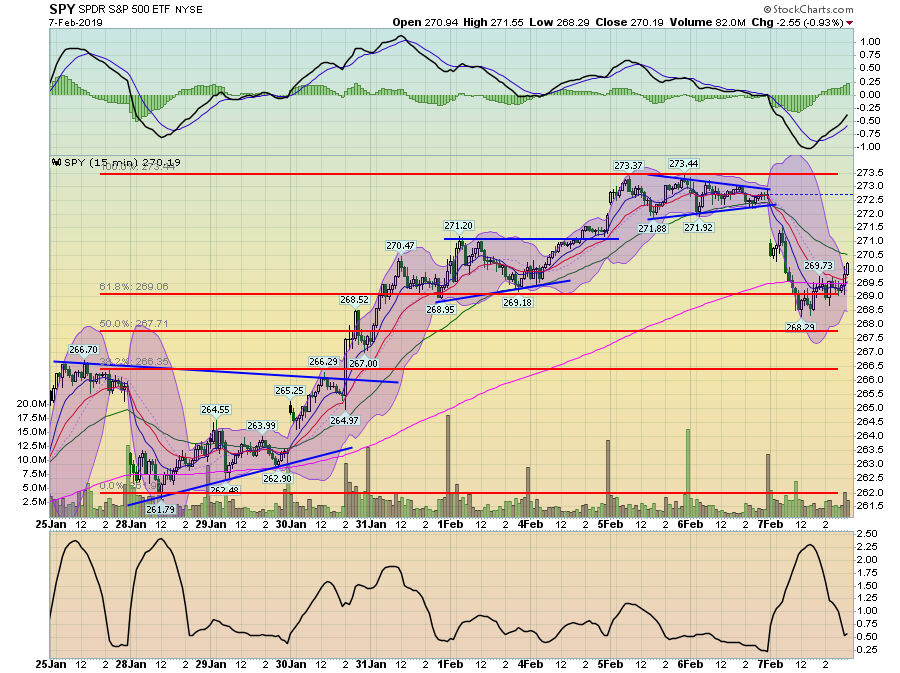

There are several 2-week charts that broke trends today:

The DIA clearly broke a trend that connects four lows from the last two weeks. Prices fell to natural support at the 200-minute EMA.

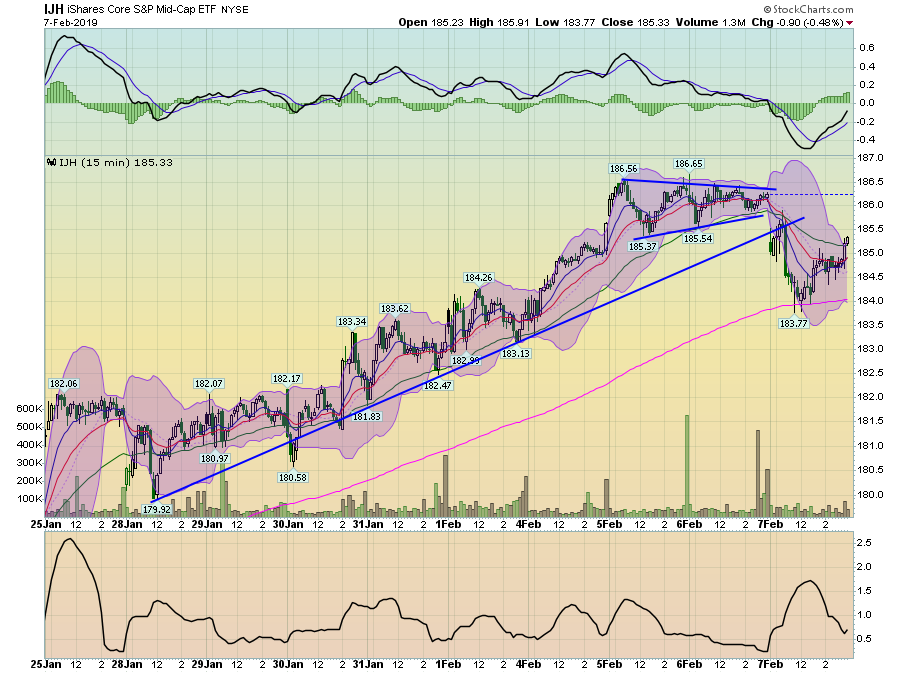

The mid-caps also broke the trend and hit support at the same technical level.

The SPYs also hit support at their 200-minute EMA, which corresponds to the 61.8% Fib level.

Because these trend breaks occurred in the 2-week time frame, they're not that alarming. We should, however, keep them in mind.

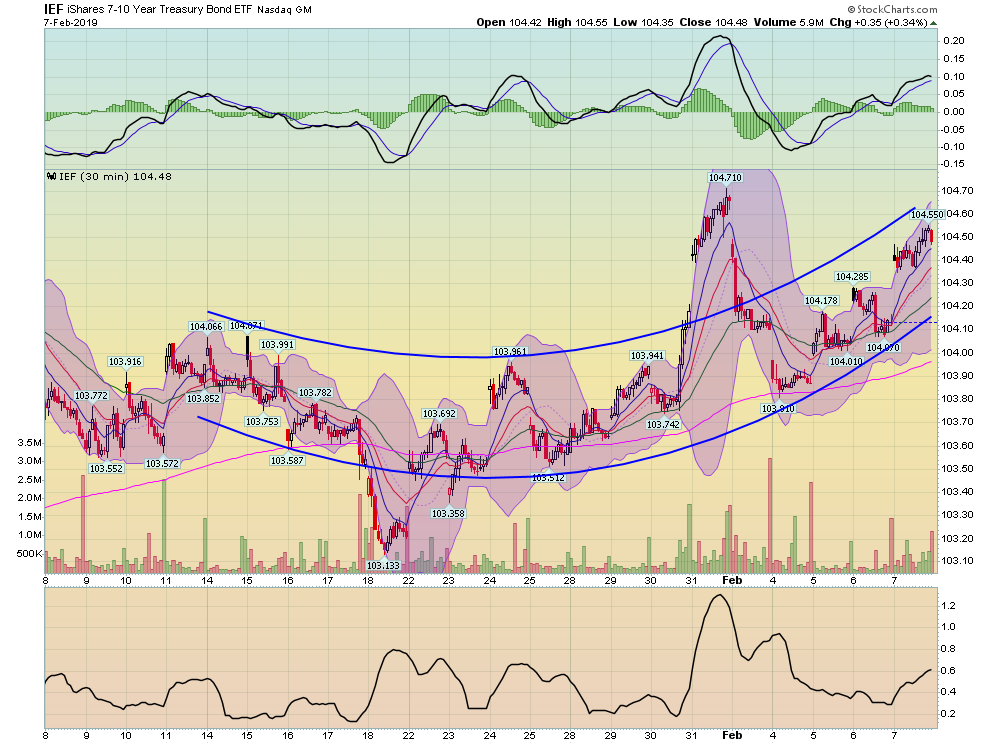

There are a few 30-minute charts of note as well:

Although the trend lines don't connect to price points, there is a clear upward sweeping channel in the IEF.

The SPY is still moving higher in the 30-minute time frame ...

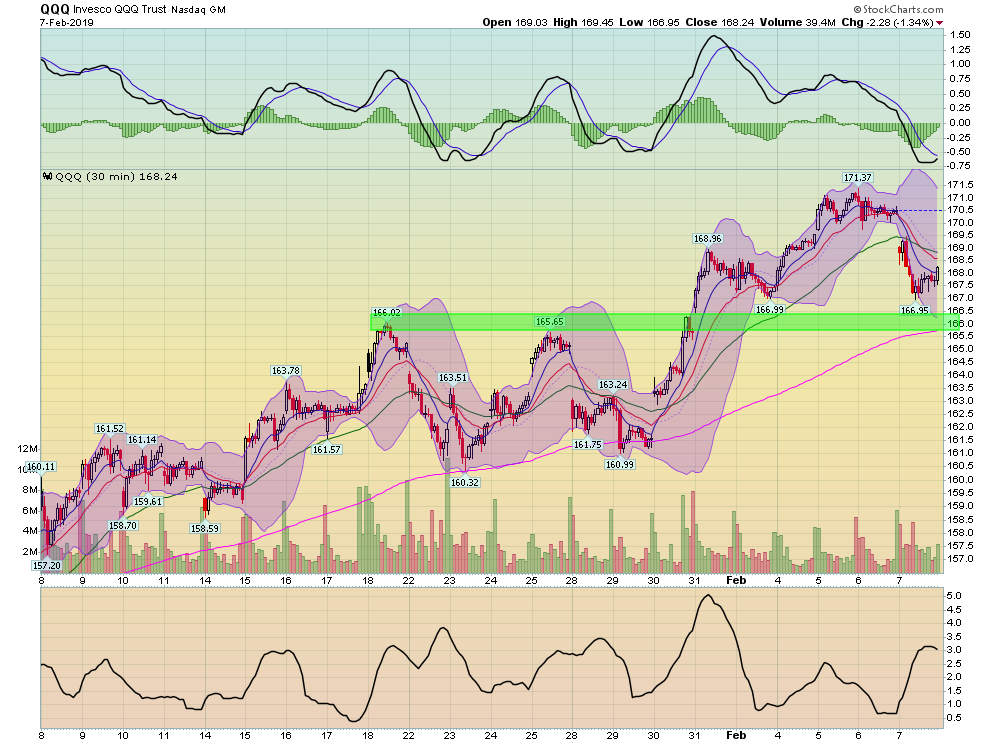

... as is the QQQ ...

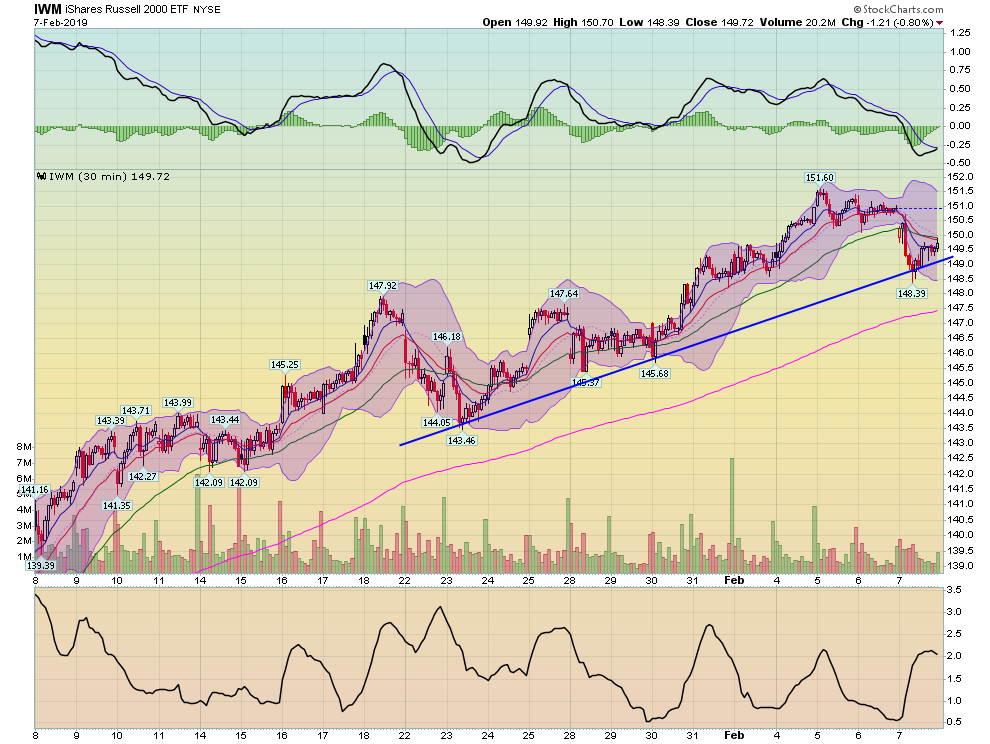

... and the IWM.

This is just one day, so we shouldn't read much into the price movements.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.