Summary

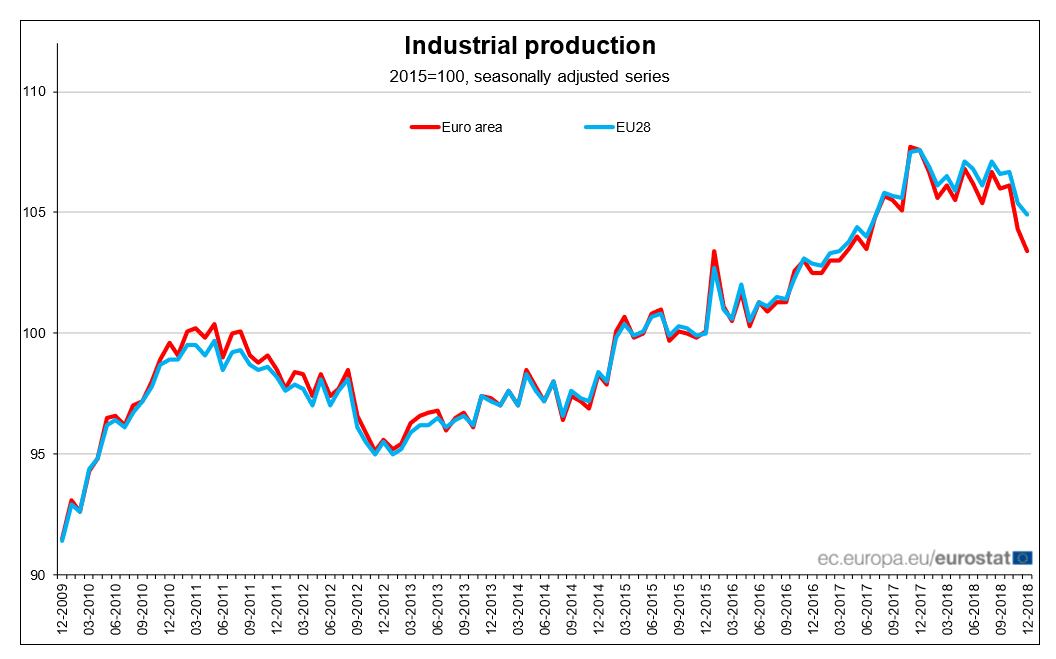

- EU industrial production has declined in four of the last six months, and is down sharply in the latest report.

- Auto delinquencies among lower-rated borrowers are at very high levels; Bank of England Governor Mark Carney warned about a global slowdown in his latest speech.

- The indexes were up modestly, but a late-in-the-day selloff put a big crimp in today's performance.

EU industrial production decreased .9% in the latest report. More concerning is the trend:

The data printed within the same range between Q4 2017 and Q4 2018. It has now moved convincingly lower, declining in four of the last six months. This report contained a 1.5% M/M decline in both capital and non-durable consumer goods, indicating weak business investment and consumer spending. While this data is usually given less weight when compared to other coincidental indicators, this decline should be no less concerning.

Auto delinquencies are rising. From the Washington Post (emphasis added):

A record 7 million Americans are 90 days or more behind on their auto loan payments, the Federal Reserve Bank of New York reported Tuesday, even more than during the wake of the financial crisis.

Economists warn that this is a red flag. Despite the strong economy and low unemployment rate, many Americans are struggling to pay their bills.

“The substantial and growing number of distressed borrowers suggests that not all Americans have benefited from the strong labor market,” economists at the New York Fed wrote in a blog post.

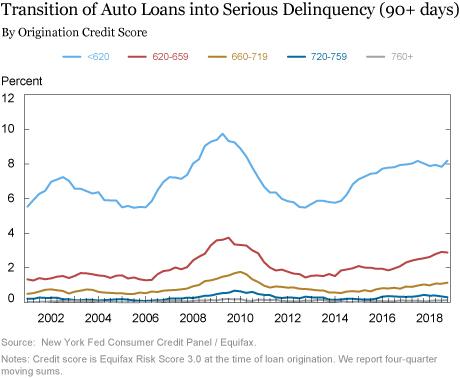

This data point has popped up several times over the last few years, only to be swept from the headlines by other, more prominent stories. This release has caught the non-financial press' attention, which usually means the problem is extreme. Here is a chart of the data from the NY Fed:

As they observe on their Liberty Street blog (emphasis added):

The flow into serious delinquency (that is, the share of balances that were current or in early delinquency that became 90+ days delinquent) in the fourth quarter of 2018 crept up to 2.4 percent, substantially above the low of 1.5 percent seen in 2012.

Borrowers with credit scores less than 620 saw their transitions into delinquency exceed 8 percent in the fourth quarter (annualized as a moving sum), a development that is surprising during a strong economy and labor market

There's little to add to that point.

Bank of England Governor Mark Carney on the global economic environment (emphasis added):

In the past few quarters, however, these trends have largely reversed. After peaking a year ago around 4%, global momentum is now weakening in all major regions and downside risks have intensified. The proportion of the global economy growing above trend has fallen from four-fifths to one-third. Trade growth has slowed and the export outlook has dimmed. Capital goods orders are stagnating, investment growth has become more tepid, and business confidence is diminished

Potentially more seriously, the slowing in global momentum may also be the product of rising trade tensions and growing policy uncertainty. Global economic policy uncertainty is at record highs (Chart 3). And protectionist rhetoric is becoming reality, with the United States raising tariffs on a range of imports from its main trading partners, and some retaliating in kind (see Annex Table A1). If all measures contemplated are implemented, average US tariffs will reach rates not seen in half a century.

This line of thinking is now commonplace among global central bankers.

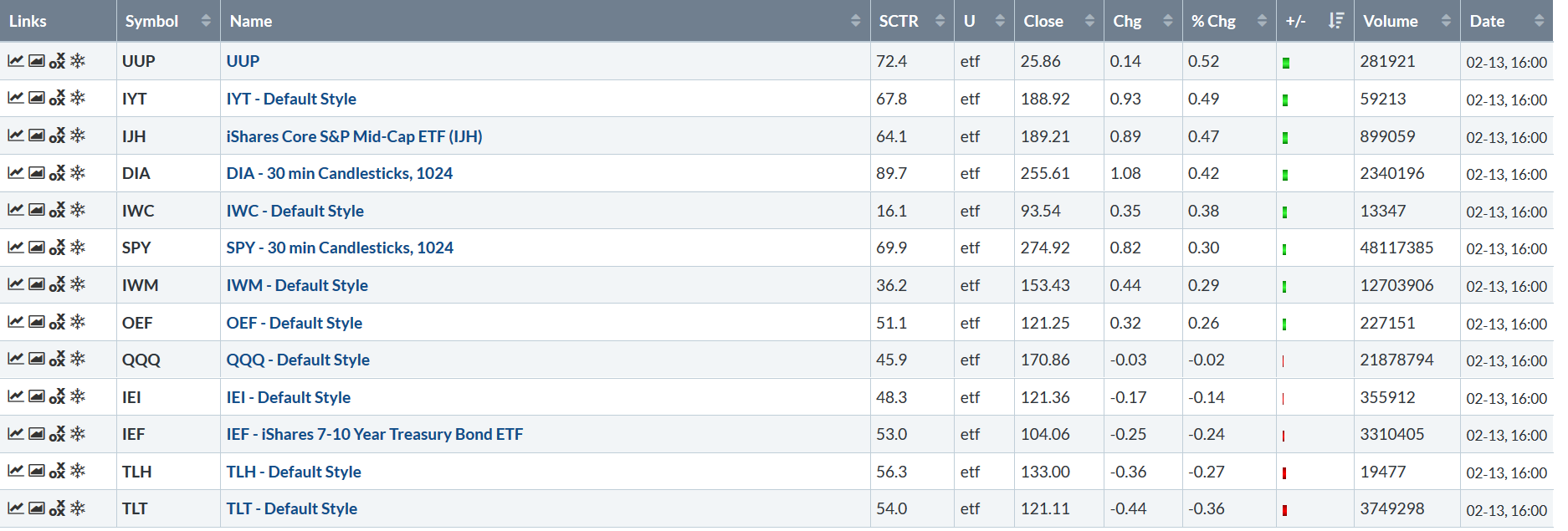

Let's take a look at today's performance tables:

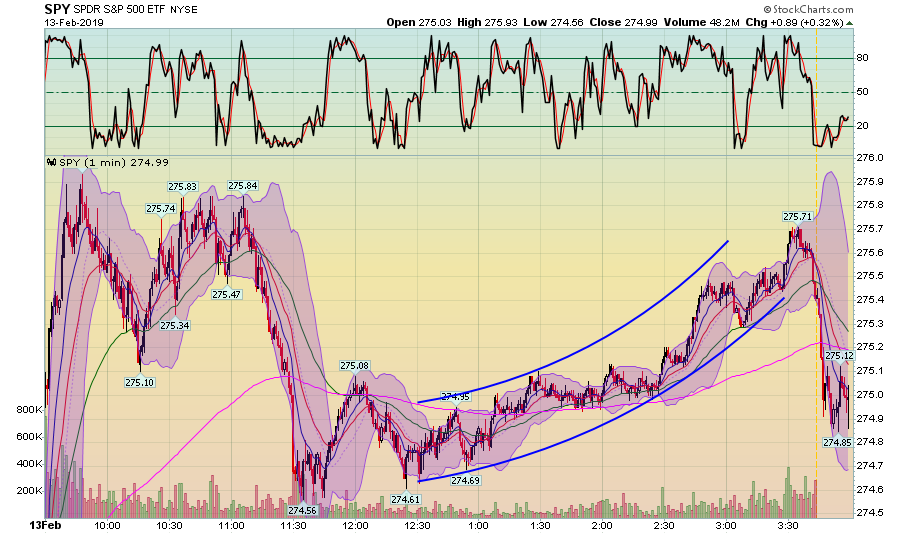

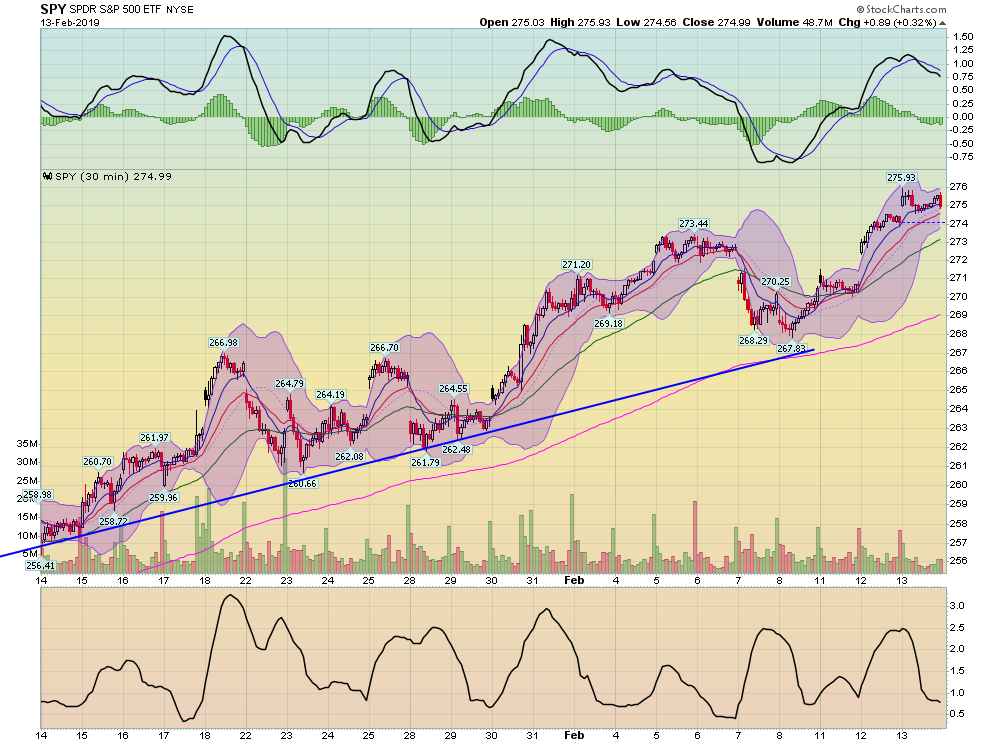

Overall, all the indexes were up modestly. But that stands in stark contrast to the numbers reported throughout the session, which were much stronger. Let's take a look at what happened in today's session, starting with the SPY (NYSE:SPY):

The market started with a strong upswing. Prices sold off a bit, then regained highs. This wound up being a double-top formation, which we only know in retrospect. After bottoming, prices rallied, forming an upward curving channel. But then they sold off sharply at the close.

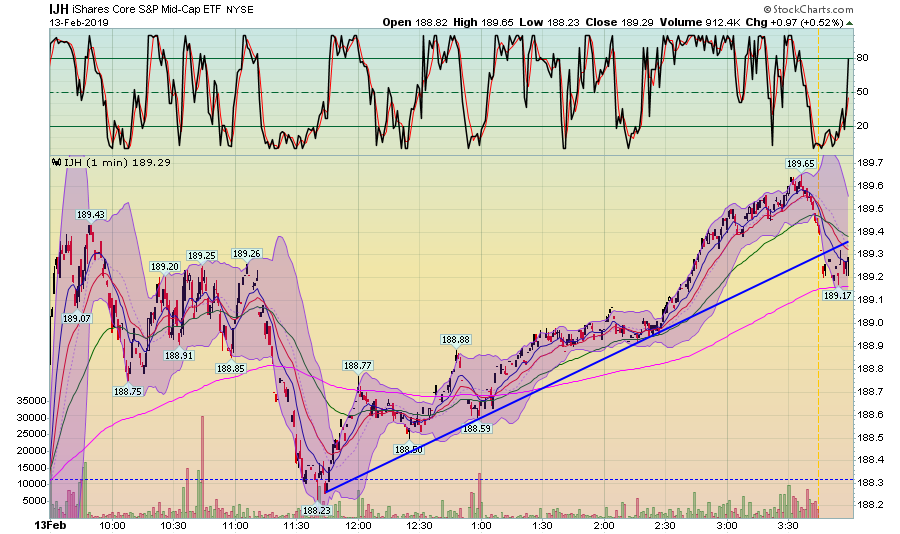

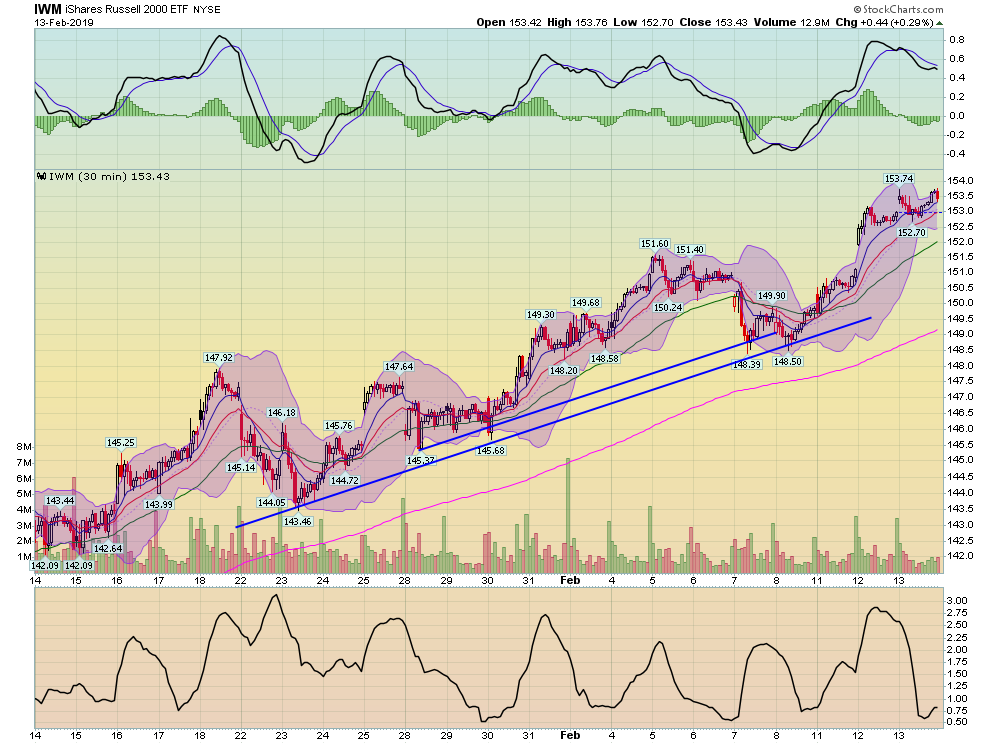

In comparison, the mid-caps didn't sell off nearly as sharply. They instead remained near their highs for the day and closed above the 200-day EMA. While not shown, the iShares Russell 2000 (NYSE:IWM) has similar performance characteristics.

However, today's sharp selloff didn't dampen the overall uptrend in the market:

The SPY remains in an uptrend, as does ...

... the IWM.

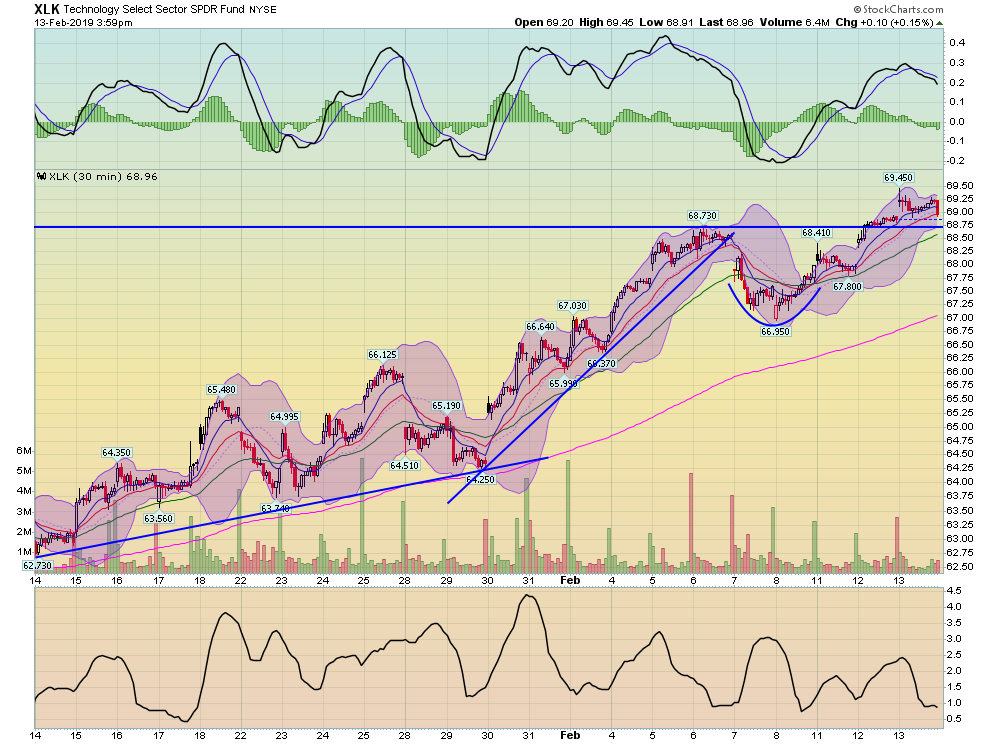

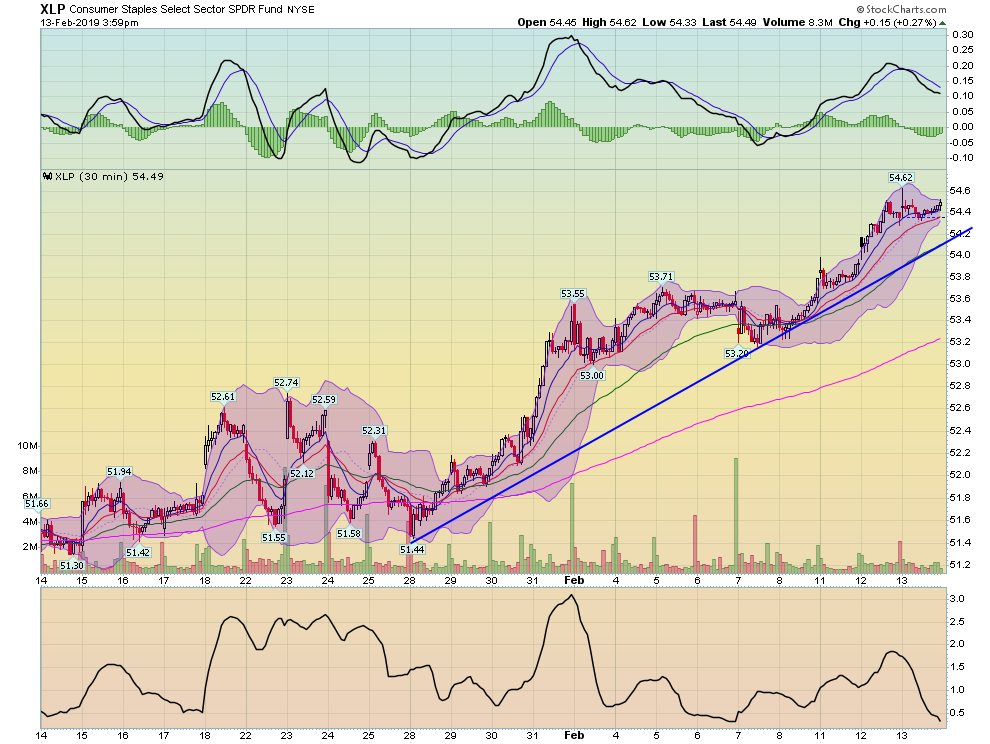

In addition, several of the major ETFs also have solid uptrends on their charts:

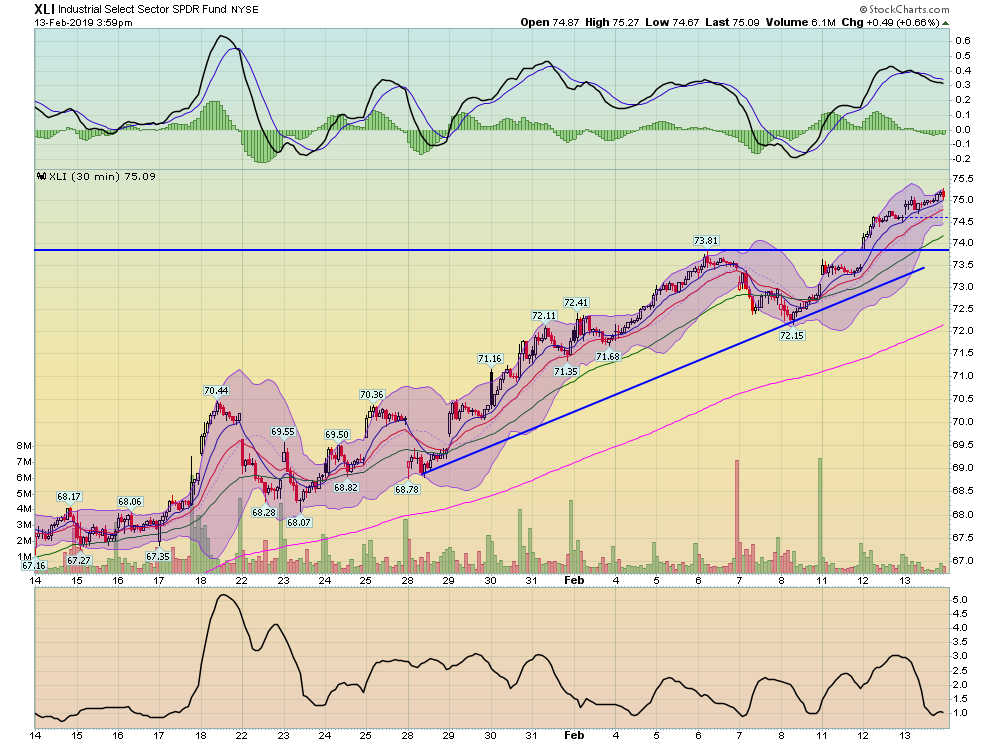

The Industrials ETF (NYSE:EXI) has been moving higher for most of the past 30 days. It's prices have moved through the last printed high of 71.81.

The technology ETF (NYSE:IYW) has several uptrends over the last 30-days. Like the XLI, the XLK has moved through recent highs and is near 30-day highs.

The consumer staples sector ETF (NYSE:KXI) has been moving higher since January 26.

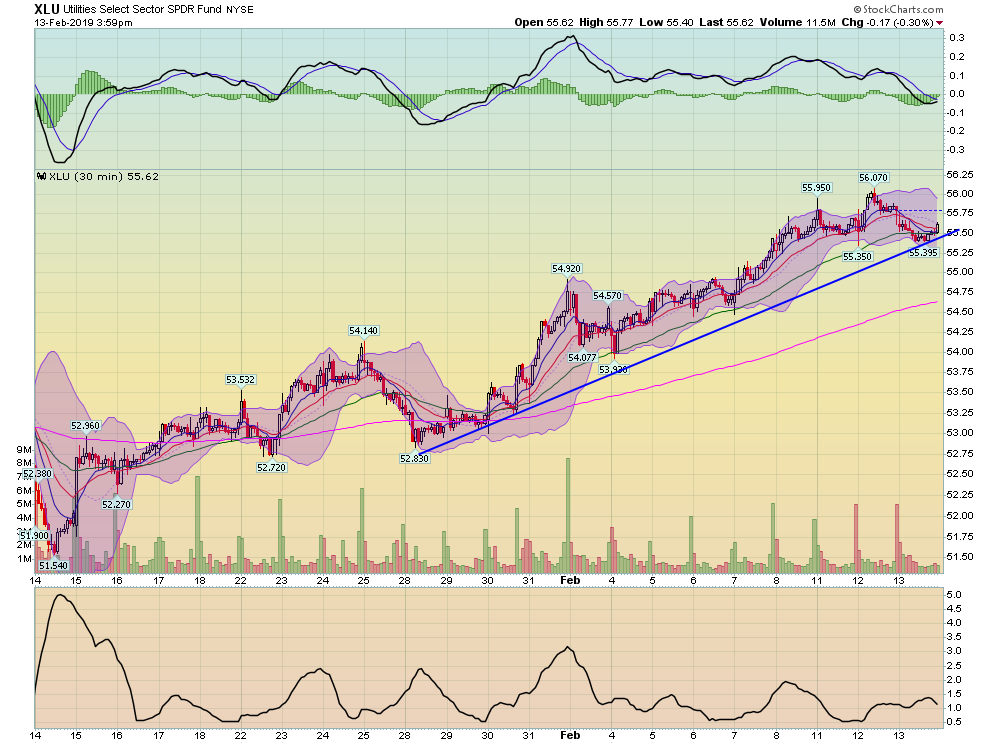

The utility ETF is also in a solid uptrend, as is ...

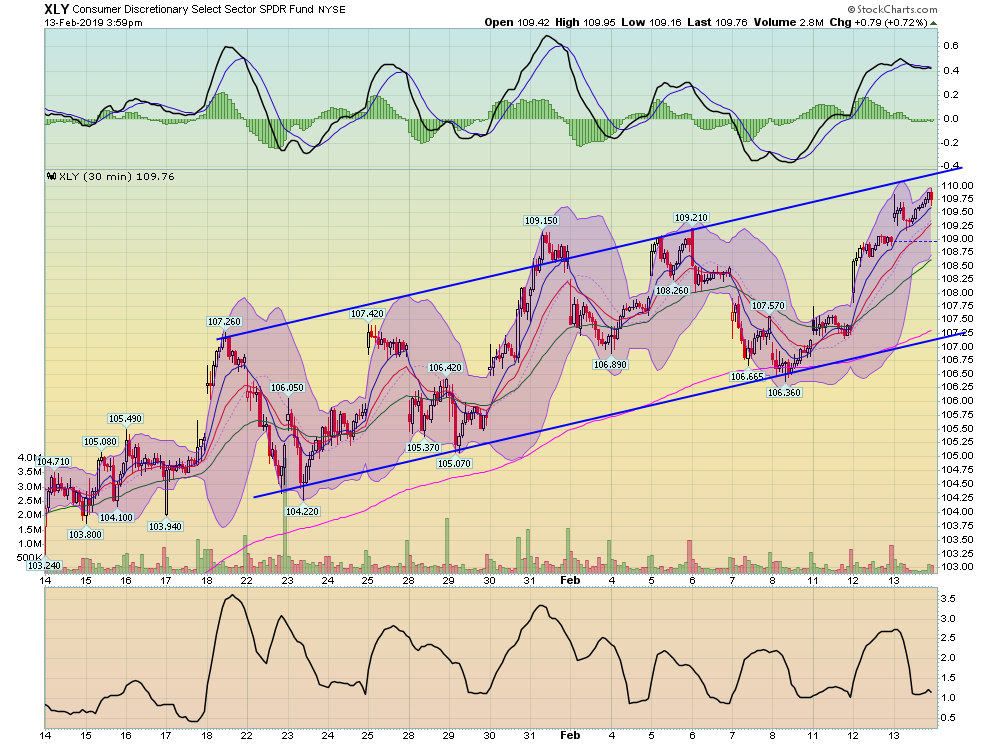

... the consumer discretionary sector.

Right now, the market is looking very good.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.