Summary

- The high-yield market's problems are continuing

- Retail stocks are selling off

- At a time when the bulls could really use some good news, they didn't get any

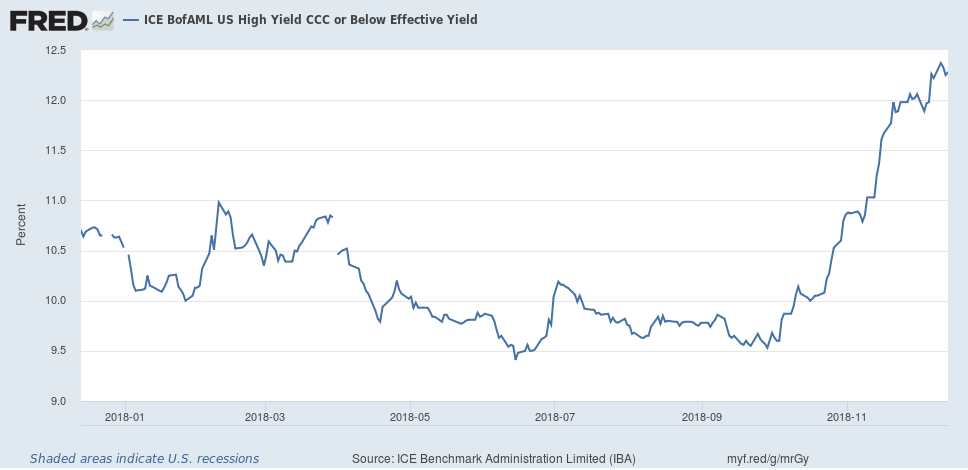

According to the Financial Times, the high-yield market is "drying up."

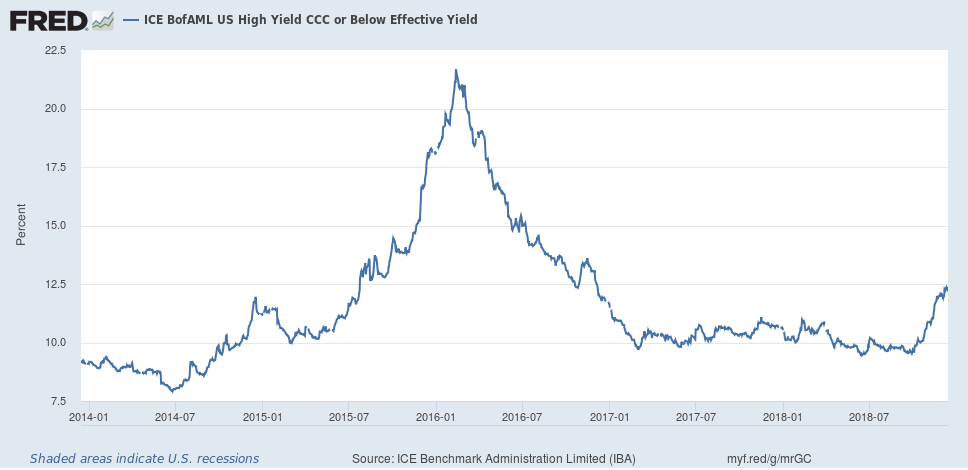

Investment banks are having a difficult time finding buyers for leveraged loans, leading to the postponement of a number of deals until after the first of the year. Yields in the high-yield market continue to move higher:

The CCC market rose over 200 basis points over the last few months. It looked like the market had crested in mid-November, but rates continued to climb in early December. Overall, rates are now at their highest level since the oil price-caused blow-out of 2015-2016:

This is a standard, end-of-the-economic-cycle development.

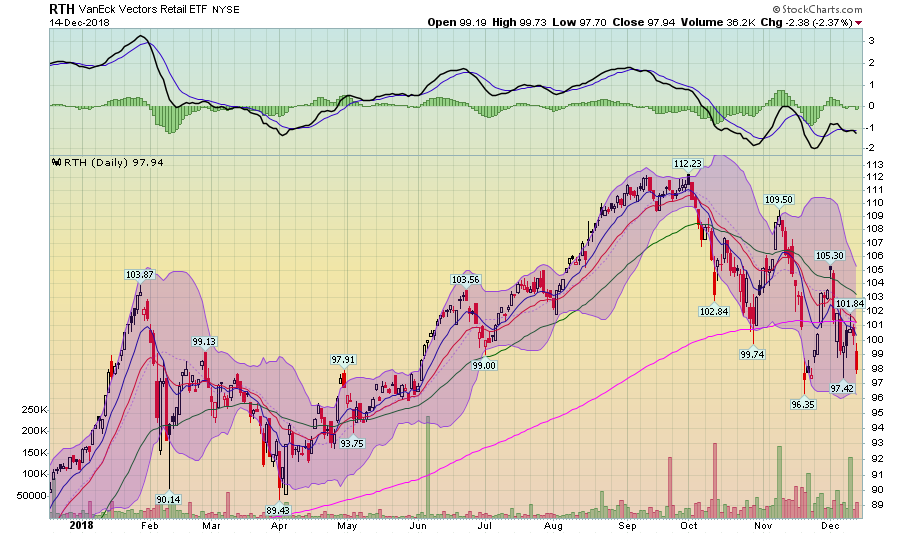

Despite a positive retail sales report on Friday, the market is selling retail stocks.

The Consumer Discretionary (NYSE:RXI) is trading near a 52-week low. Other retail stocks are also falling. The VanEck Vectors Retail ETF (NYSEARCA:RTH) -- the ETF that tracks retail stocks -- is in a clear downtrend:

The ETF peaked at 112.23 at the beginning of October. It has been moving consistently lower since printing a continuing series of lower lows and lower highs. Prices are now below all the EMAs. The 10-day EMA has moved below the 200-day EMA; the 20-day will soon follow. Department stores are also falling:

The six major stores are all technically weak. The timing of this sell-off -- at the height of the holiday shopping season -- is particularly telling.

The market's underlying technicals are deteriorating.

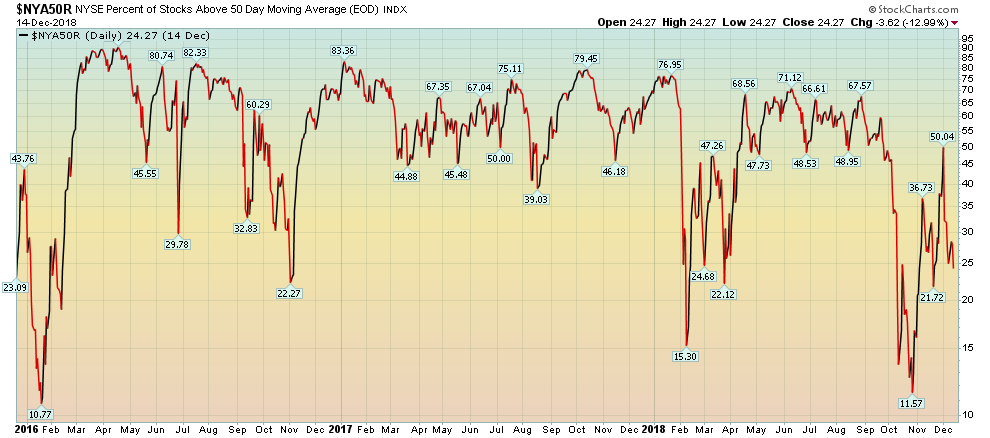

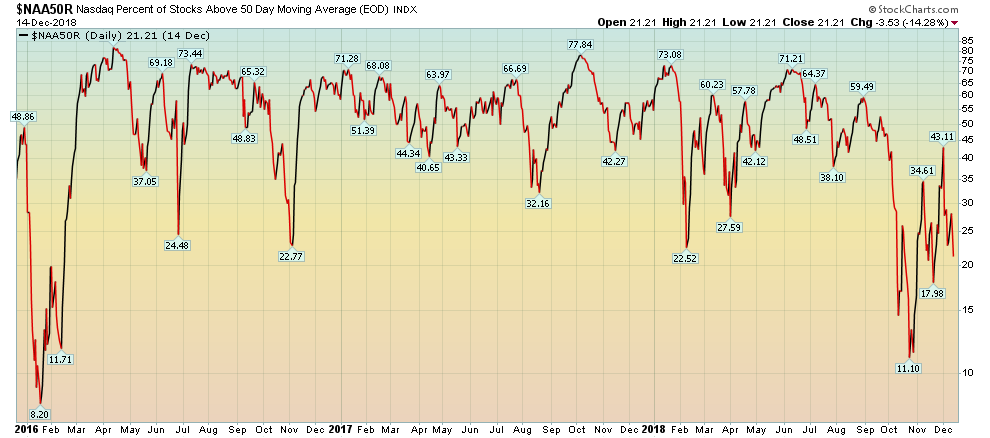

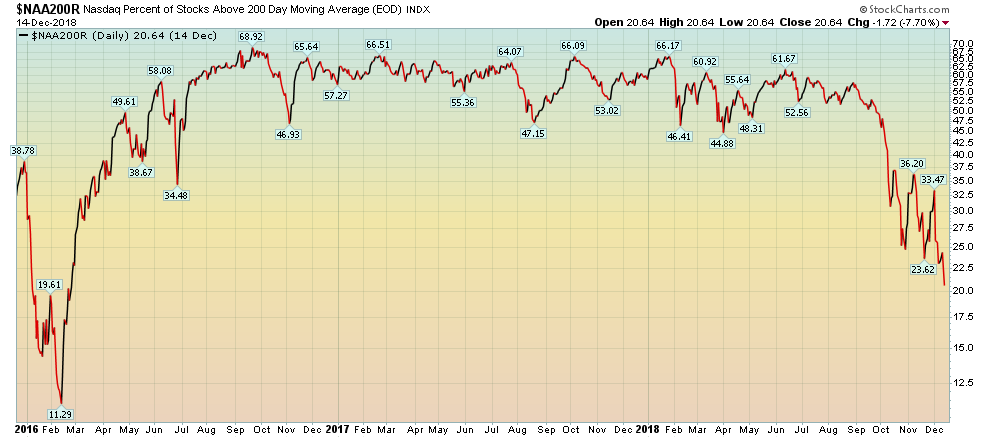

Let's start with the percentage of Nasdaq) stocks above their respective 50 and 200-day EMAs:

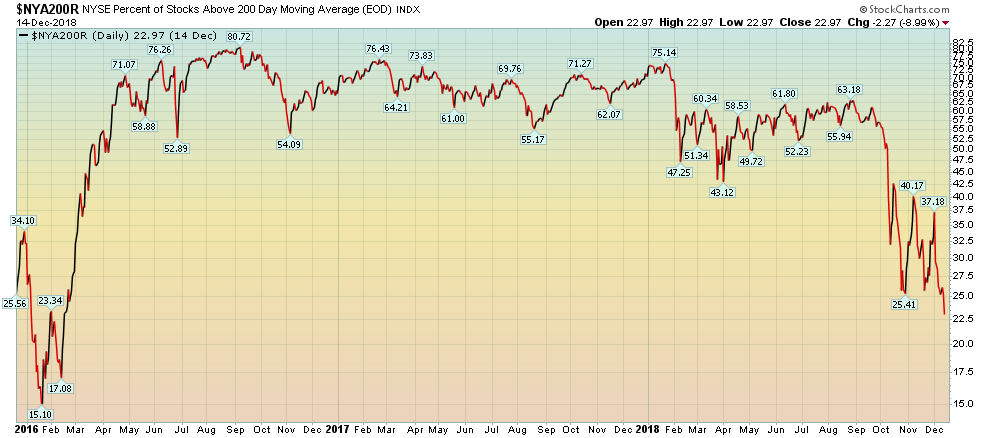

Both are right above 20% -- a very low level. We see the same thing for the NYSE:

Both are also in the low 20% range. In other times during this "most hated rally in history," we'd be in classic "buy the dip" territory. However, the current bearish state of the market means these are very worrying numbers.

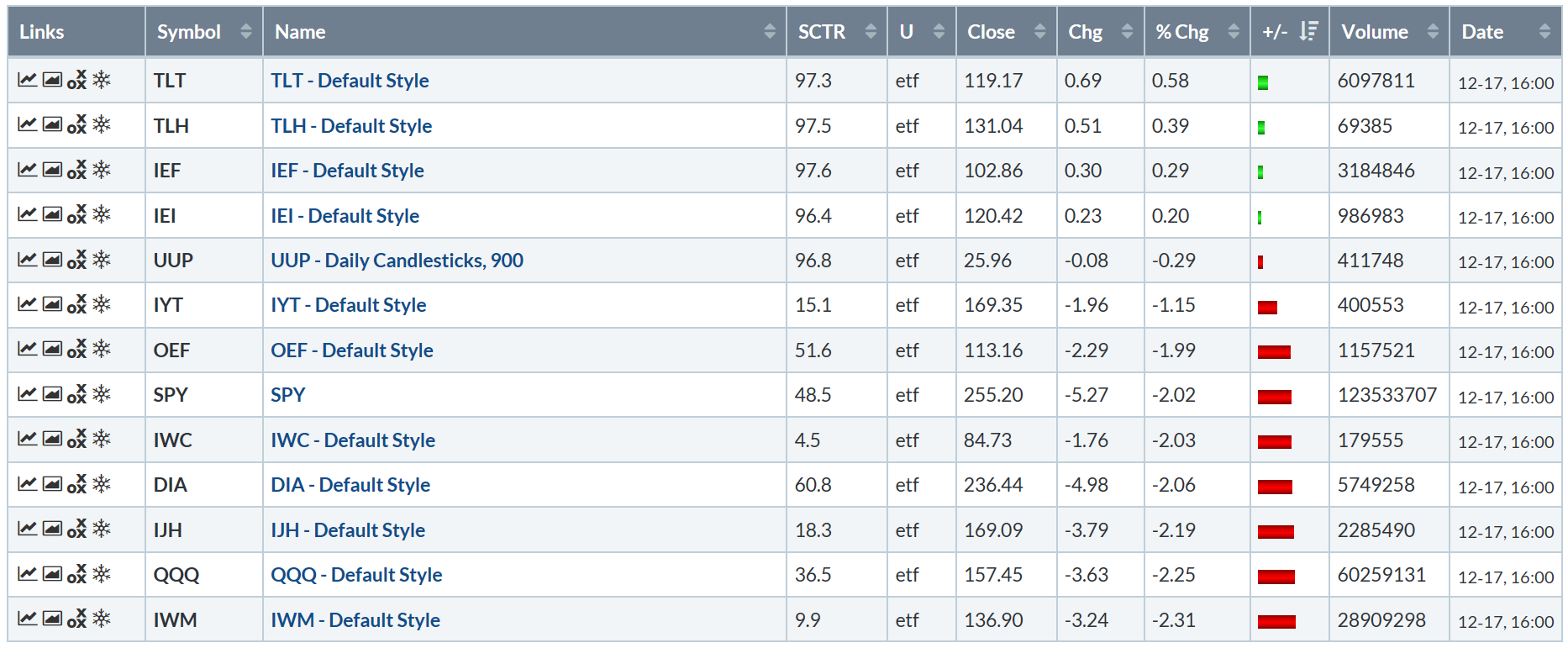

Let's check in on today's performance table:

There's a lot of red in that table. The IWM (NYSE:IWM) fell the most; it was off 2.3%. The QQQ (NASDAQ:QQQ) wasn't far behind; neither were the mid-caps or the Dow. The long-end of the Treasury curve continued to rally, which will send yields lower and further compress the curve.

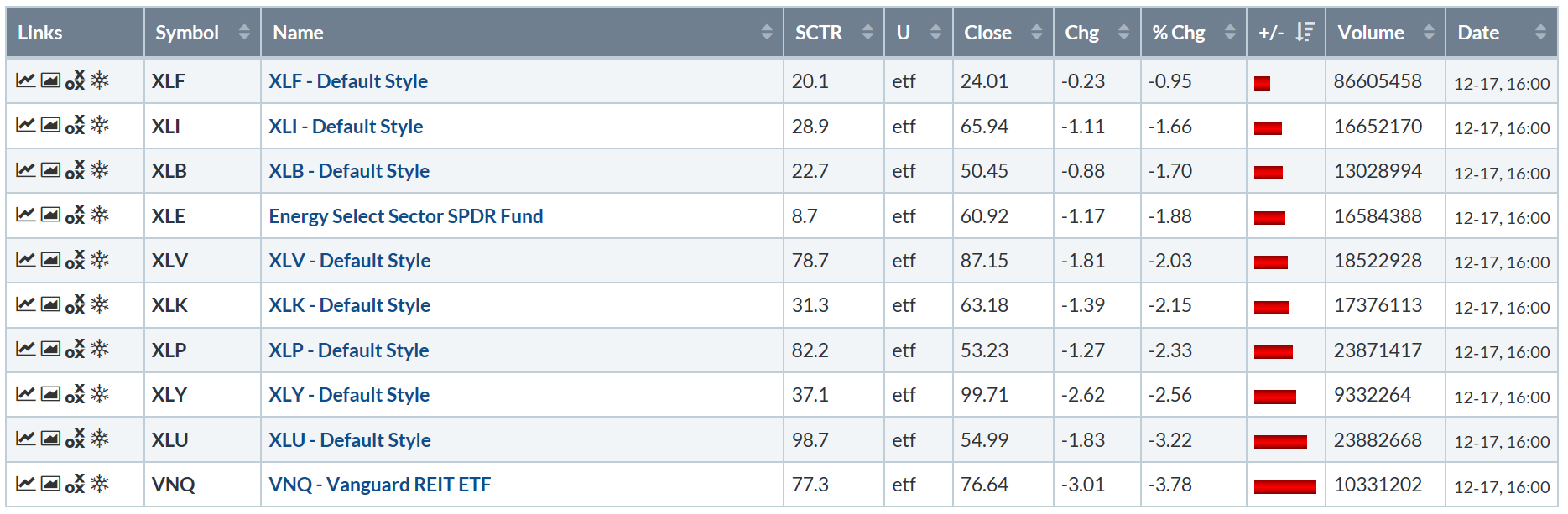

The industry table wasn't any better:

Everybody was down today -- even the defensive sectors: utilities were the second-worst performer; staples were the fourth-worst. Healthcare -- which has the Johnson & Johnson (NYSE:JNJ) handicap -- actually performed modestly well, only dropping slightly more than 2%.

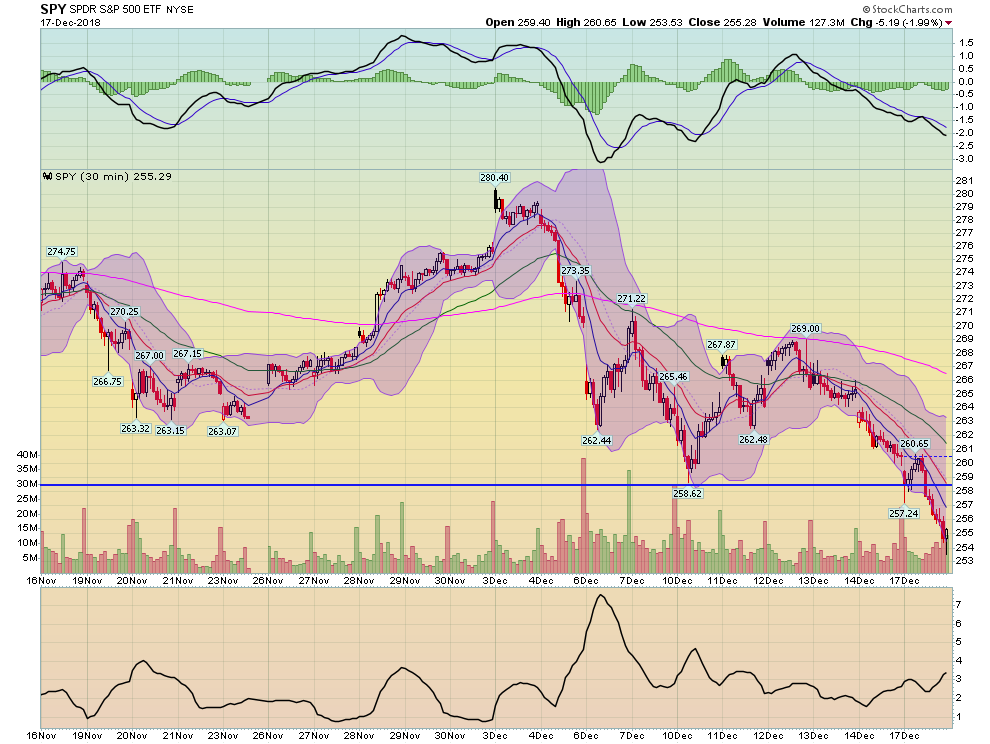

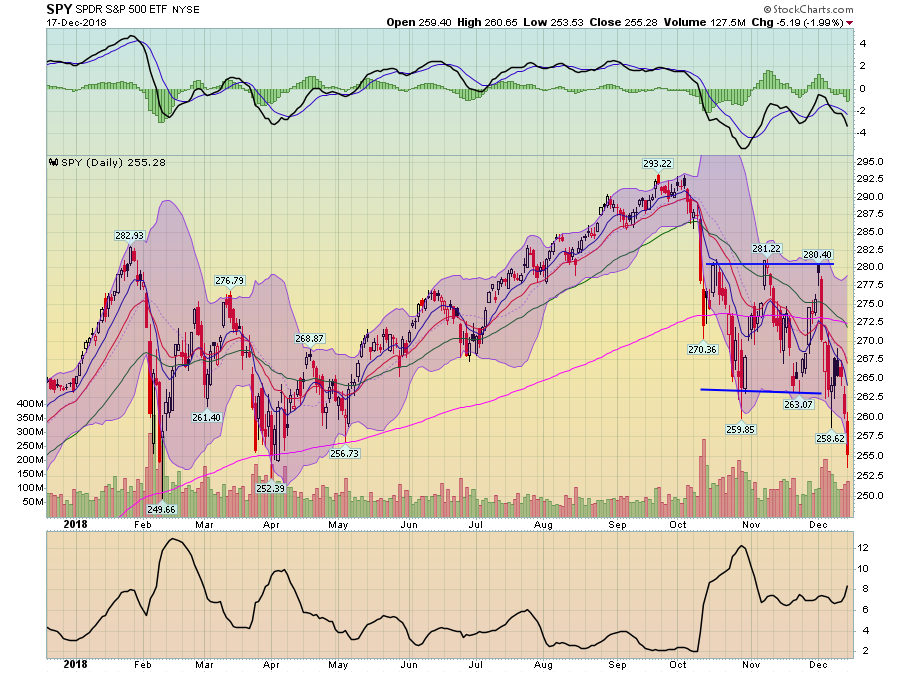

Before looking at the charts, let's remember where we left off last week. A lot of indexes are at or near 52-week lows. All the charts have a number of bearish indicators such as declining EMAs, shorter EMAs below longer EMAs, and negative momentum. This is also the Fed week; it would not be unheard of for the markets to tread water until the Fed announcement Wednesday afternoon.

However, most of the charts continue to contain a number of very bearish indicators

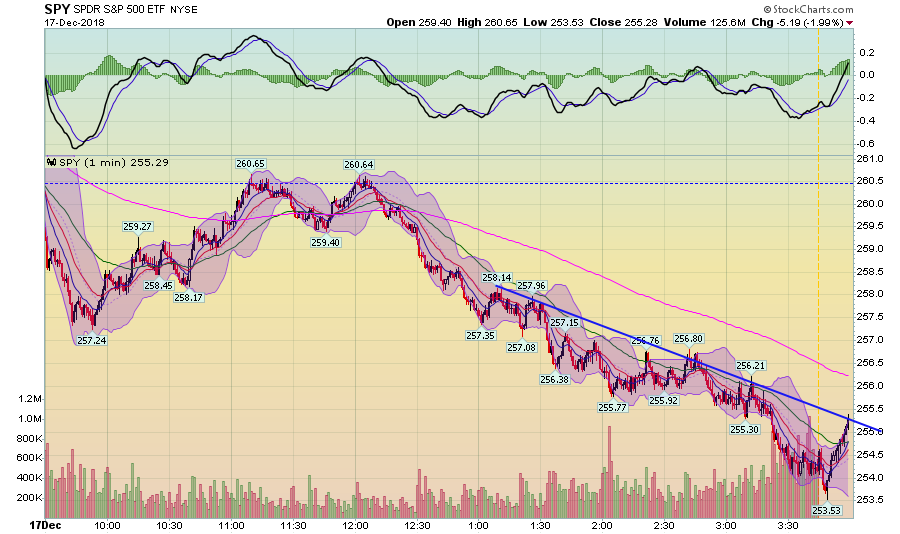

The markets opened lower. They tried to rally in the morning, twice attempting to move through last week's closing price. After forming a double top, prices moved lower for the remainder of the session, printing a series of lower lows and lower highs.

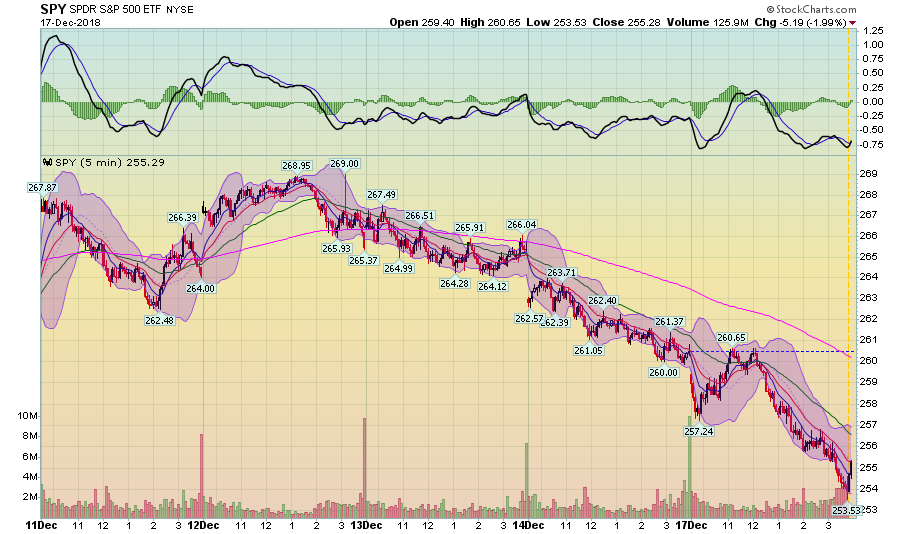

The bearishness continues on the 5-day chart:

Prices are in a solid and continual three-day downtrend.

The 30-day chart is also bearish:

Prices have moved through the last technical support level and are now near a 30-day low.

And, yes, the daily chart is also bearish:

Prices have broken the lower support line of the sideways consolidation pattern.

The next logical technical support level is the 52-week low. And that's never a good place to be.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.