Summary

Australia has changed Prime Ministers (again).

Student debt is taking a toll on the economy.

Indexes were higher, but this was really a big company day.

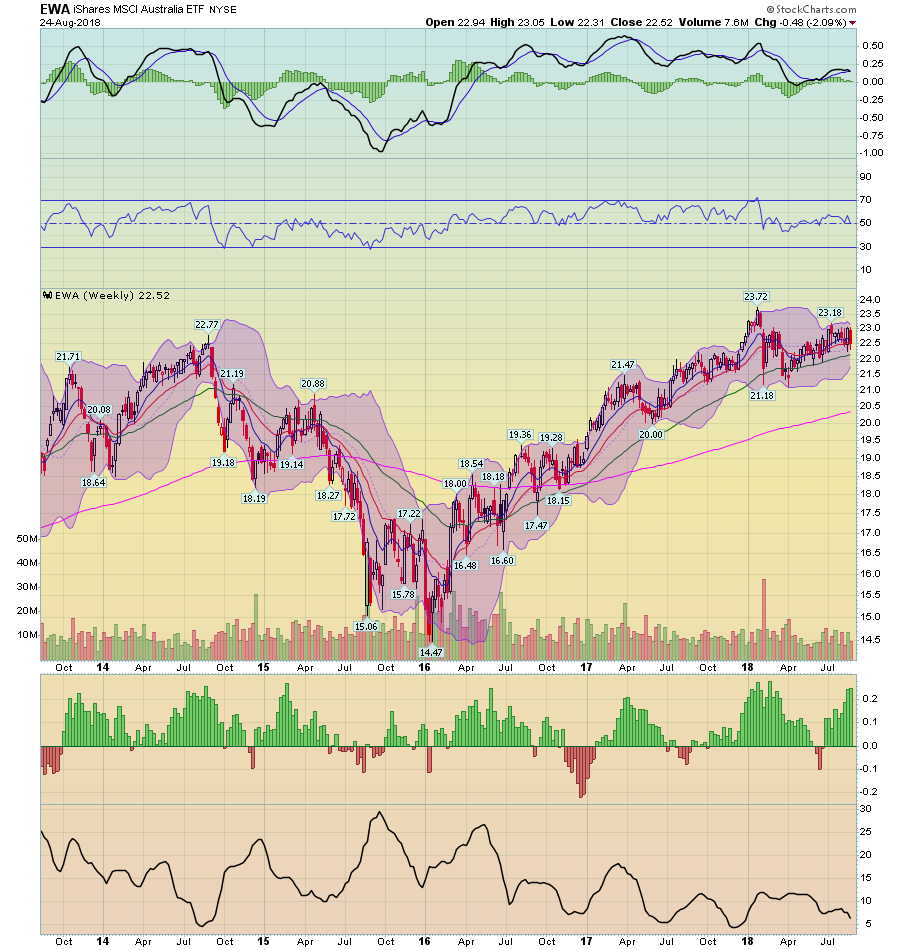

Australia has another new Prime Minister: Malcolm Turnbull is out; Peter Dutton is in. The press has been reporting about disillusionment with Turnbull for the last few weeks, which means the political discontent has been brewing for at least a few months (international stories are usually a few months later than local developments). Dutton's tenure could be brief; elections are scheduled for next Spring. The Australian economy is doing well despite the near-constant turnover of Australian Prime Ministers. There hasn't been a recession in over 20 years. The RBA's latest assessment was largely positive. And the market is near a multi-year high:

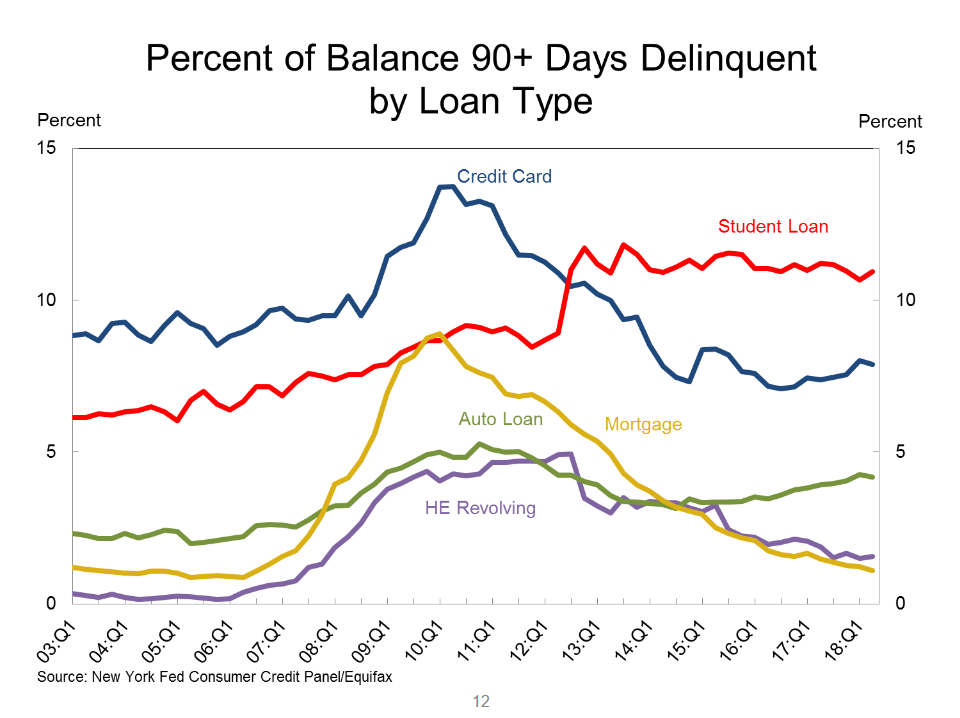

A very brief history of funding for state colleges: It used to be that states would pay the vast majority of state college expenses. That started to end in the early 1990s as states slowly transferred more of the cost of education to students. Fast forward to today, and we now have a situation where student debt is the fastest growing area of the debt market. As a result, student debt is now the area with the highest delinquency rate:

This has tremendous negative implications for the economy. After students graduate from college, they have to allocate payments to their creditors, preventing younger people from buying houses or starting businesses. This could partially explain why we're seeing a smaller number of start-ups. It's also why we're seeing the rise of "democratic socialism" among younger voters.

It looks like we have an agreement to agree with Mexico on Nafta: From the NY Times:

President Trump said Monday that the United States and Mexico had reached agreement to revise key portions of the North American Free Trade Agreement and would finalize it within days, suggesting he was ready to jettison Canada from the trilateral trade pact if the country did not get on board quickly.

According to the report, the countries have changed issues related to auto production. The US structured the treaty in a manner they hope will lead to increased U.S. production. According to the same report:

To qualify for zero tariffs under Nafta, car companies would be required to manufacture at least 75 percent of an automobile’s value in North America under the new rules, up from 62.5 percent previously. They will also be required to use more local steel, aluminum and auto parts, and have 40 percent to 45 percent of the car made by workers earning at least $16 an hour, a boon to both the United States and Canada.

Canadians are savvier trade negotiators, so I wouldn't be surprised if they waited a bit longer to deal. I also think they are agitated with the U.S. using "Canada is a threat to the U.S." justification for raising tariffs.

Turning to the markets: the main issue of late has been whether or not the markets could make a strong advance through recent resistance. The answer at the end of today's trading session is, "it depends."

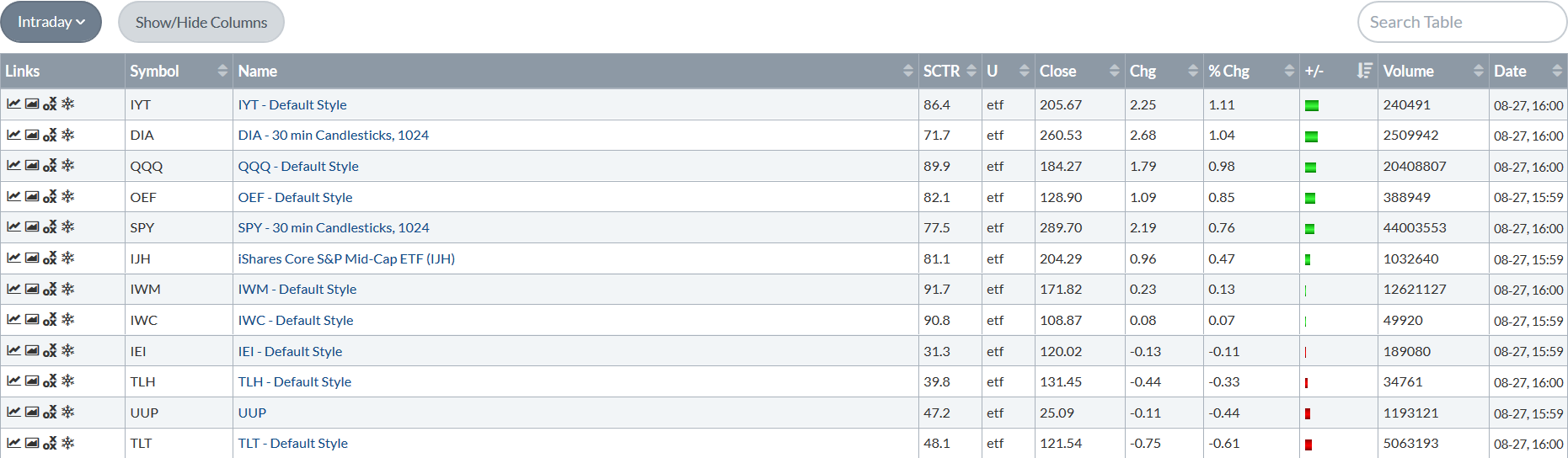

Let's start with a table of today's performance:

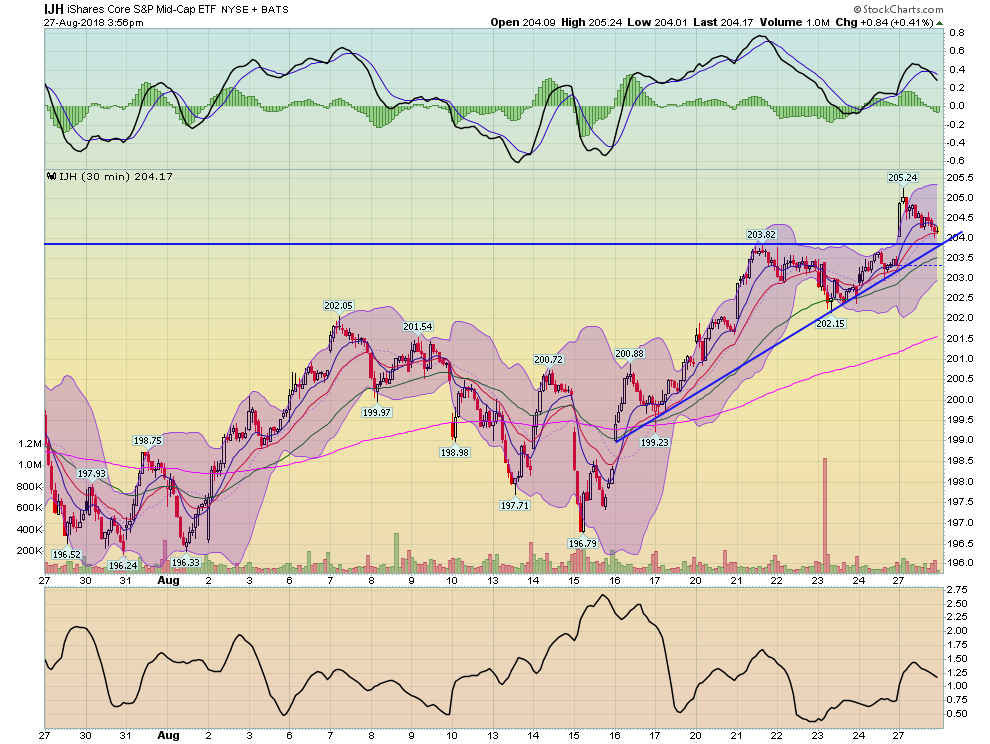

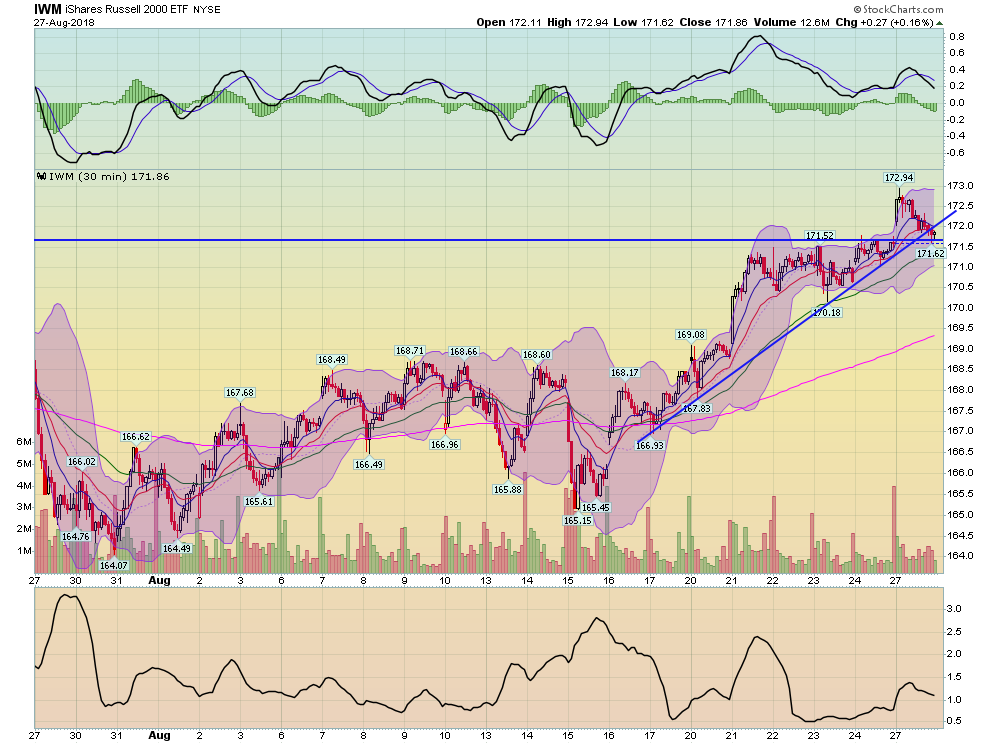

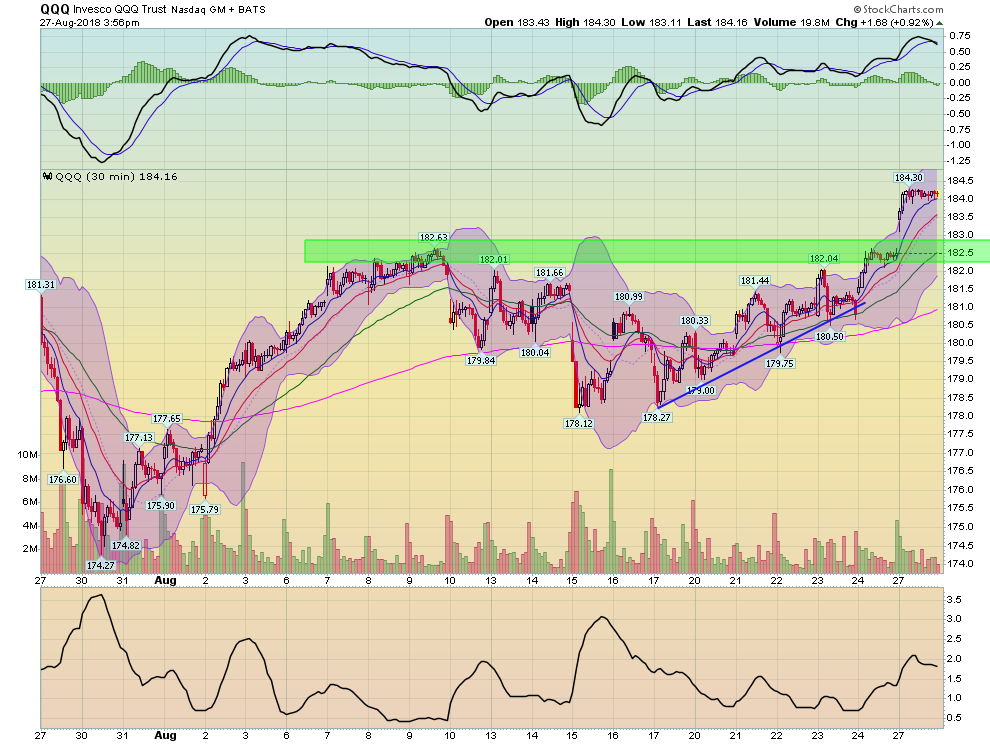

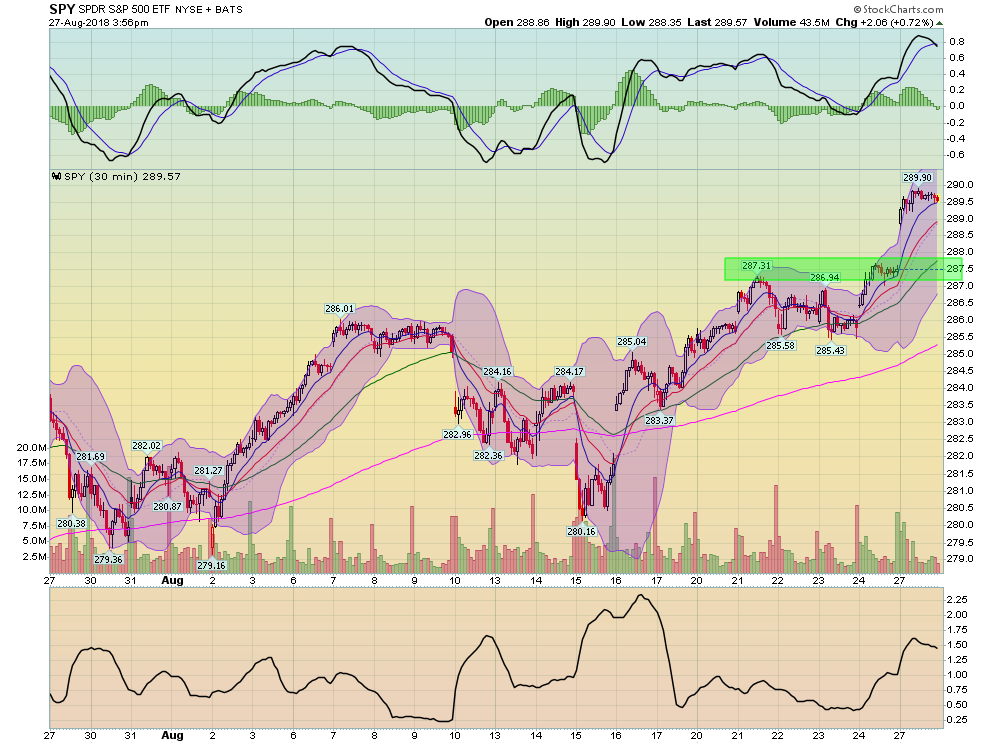

Indexes comprised of larger issues SPDR Dow Jones Industrial Average (NYSE:DIA), Invesco QQQ Trust Series 1 (NASDAQ:QQQ), iShares S&P 100 (NYSE:OEF) and SPDR S&P 500 (NYSE:SPY) were up fairly impressively. However, indexes with smaller issues iShares S&P Midcap 400 (NYSE:IJH) and iShares Russell 2000 (NYSE:IWM) were up much less. Here are the 30-day charts to shed more light:

The QQQs gapped through the lower 180s at the open, and then moved higher. They traded sideways for the remainder of the day.

The SPYs have the exact same pattern, although with different levels.

But the mid-caps and small caps sold-off continually throughout the trading day. Yes, they were still up, but they each had far more technical damage by the end of the trading sessions.

What's going on? The NAFTA news indicates that trade issues might be simmering down a bit, which is beneficial to all multi-nationals. Small and mid-cap companies are far more domestically oriented, which explains their underperformance on the day.

Is this divergence fatal? I don't think so. What's really important is the underlying news about the U.S.-Mexico trade talks. Trade issues have been hampering sentiment for the last few months. We've seen concerns pop up in the ISM and Markit Economics reports; Atlanta Fed President Bostic commented on it in his latest speech. While it hasn't hampered current spending plans, the possibility was increasing that we'd see problems down the line. Today's report helps to lower the stress caused by trade issues, which should help the markets move higher.

Disclosure:I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.